DUNDEE TOWNSHIP ASSESSING SUMMARY

Dundee Township is a 48 square mile general law township located in northwest Monroe County. The Village of Dundee, a general law village, is an overlapping jurisdiction situated on approximately 6 square miles at the intersection of M-50 and US-23. Assessing duties include the Village of Dundee, which is presently experiencing growth in the commercial, industrial, and residential classifications.

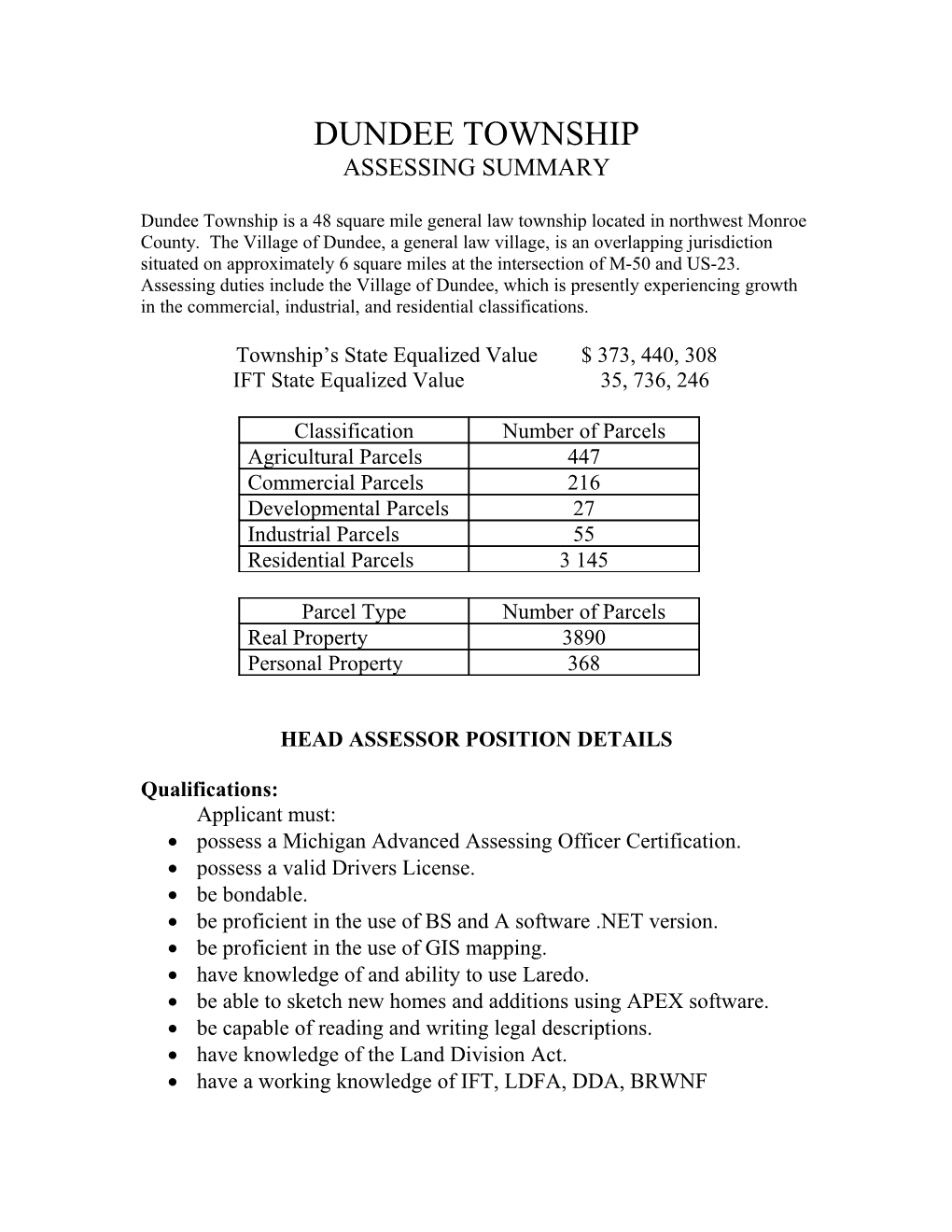

Township’s State Equalized Value $ 373, 440, 308 IFT State Equalized Value 35, 736, 246

Classification Number of Parcels Agricultural Parcels 447 Commercial Parcels 216 Developmental Parcels 27 Industrial Parcels 55 Residential Parcels 3 145

Parcel Type Number of Parcels Real Property 3890 Personal Property 368

HEAD ASSESSOR POSITION DETAILS

Qualifications: Applicant must: possess a Michigan Advanced Assessing Officer Certification. possess a valid Drivers License. be bondable. be proficient in the use of BS and A software .NET version. be proficient in the use of GIS mapping. have knowledge of and ability to use Laredo. be able to sketch new homes and additions using APEX software. be capable of reading and writing legal descriptions. have knowledge of the Land Division Act. have a working knowledge of IFT, LDFA, DDA, BRWNF Continuing Education Requirements: Must complete 20 hours of continuing education annually.

Duties/Responsibilities: A. Serve as Department Head for the Assessing Department. Chair monthly staff meetings. Attend one Township Board meeting per month or provide written report. Supervise department staff. B. Serve as Head Assessor. Sign the Assessment Roll. Prepare land studies and Economic Condition Factor analysis. Act as liaison with Monroe County Equalization Department, Michigan Tax Tribunal and State Tax Commission. Complete state mandated commercial and industrial property field review. Complete AMAR as required. File annual reports required by the STC. File IFT and Treasurer’s Warrant. Place Valuations on residential, agricultural, commercial, and industrial property. Negotiate with property owners. Defend Township in Assessment appeals. Review deeds. Process Personal Property Statements including Eligible Manufacturing Personal Property Statements. Maintain a working understanding of all current mandates. C. Oversee the timely completion of all assessing functions including: Assessment Roll Maintenance Assessment Change Notices Board of Review Maintaining and providing access to Property Cards Maintaining up-to-date Land Value, ECF, and Tax Maps D. Coordinate with other Township Departments in the completion of: Building Permits Variances and Special Use requests Property splits PA 116 tax bill proration PREs

.