December 19, 2012

Marathon Petroleum Corporation (MPC-NYSE)

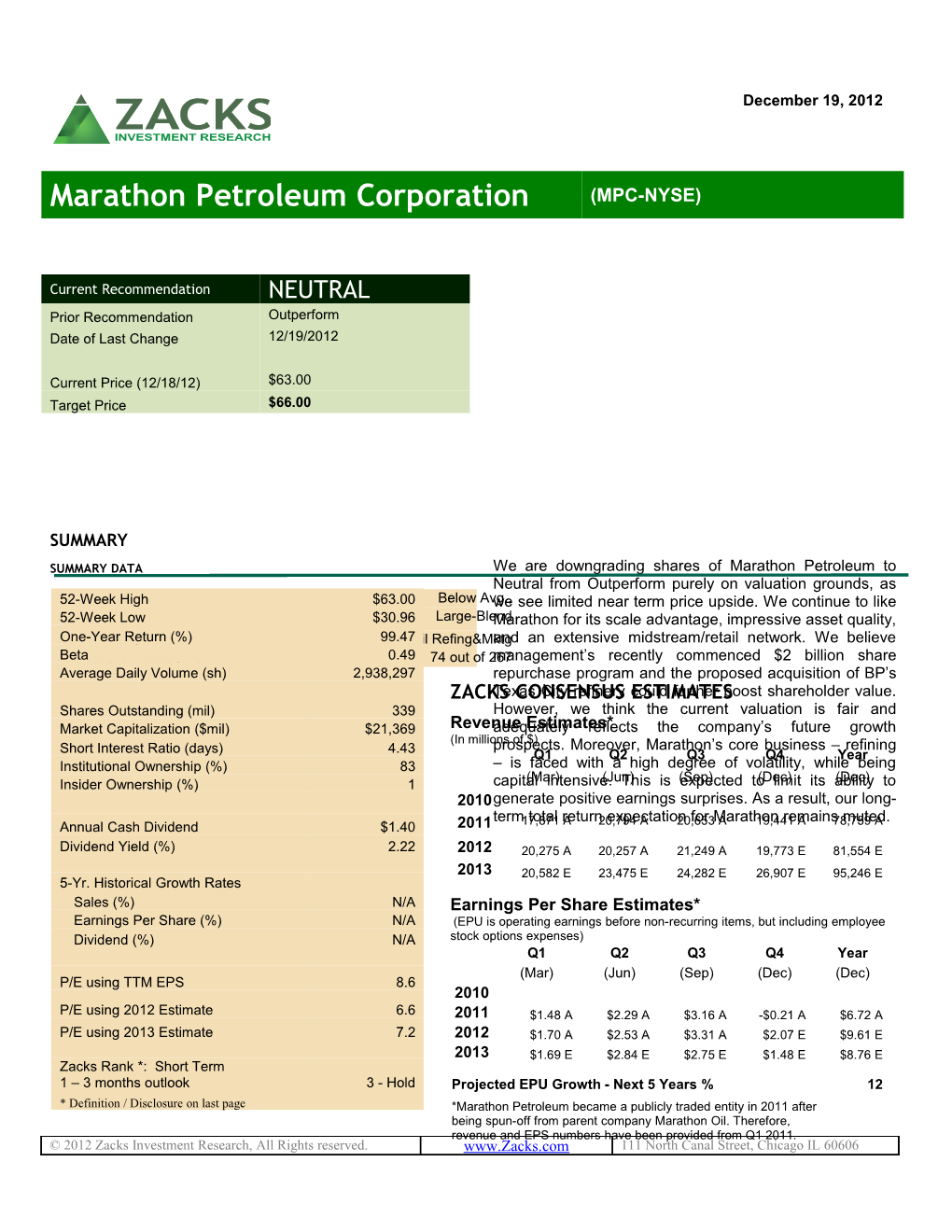

Current Recommendation NEUTRAL Prior Recommendation Outperform Date of Last Change 12/19/2012

Current Price (12/18/12) $63.00 Target Price $66.00

SUMMARY

SUMMARY DATA We are downgrading shares of Marathon Petroleum to Neutral from Outperform purely on valuation grounds, as 52-WeekRisk HighLevel * $63.00 Below Avg.,we see limited near term price upside. We continue to like 52-WeekType Low of Stock $30.96 Large-BlendMarathon for its scale advantage, impressive asset quality, One-YearIndustry Return (%) 99.47Oil Refing&Mktgand an extensive midstream/retail network. We believe Beta Zacks Industry Rank * 0.49 74 out of 267management’s recently commenced $2 billion share Average Daily Volume (sh) 2,938,297 repurchase program and the proposed acquisition of BP’s ZACKSTexas CONSENSUS City refinery couldESTIMATES further boost shareholder value. Shares Outstanding (mil) 339 However, we think the current valuation is fair and Market Capitalization ($mil) $21,369 Revenueadequately Estimates* reflects the company’s future growth (In millionsprospects. of $) Moreover, Marathon’s core business – refining Short Interest Ratio (days) 4.43 Q1 Q2 Q3 Q4 Year Institutional Ownership (%) 83 – is faced with a high degree of volatility, while being (Mar) (Jun) (Sep) (Dec) (Dec) Insider Ownership (%) 1 capital intensive. This is expected to limit its ability to 2010generate positive earnings surprises. As a result, our long- term total return expectation for Marathon remains muted. Annual Cash Dividend $1.40 2011 17,871 A 20,794 A 20,653 A 19,441 A 78,759 A Dividend Yield (%) 2.22 2012 20,275 A 20,257 A 21,249 A 19,773 E 81,554 E 2013 20,582 E 23,475 E 24,282 E 26,907 E 95,246 E 5-Yr. Historical Growth Rates Sales (%) N/A Earnings Per Share Estimates* Earnings Per Share (%) N/A (EPU is operating earnings before non-recurring items, but including employee Dividend (%) N/A stock options expenses) Q1 Q2 Q3 Q4 Year (Mar) (Jun) (Sep) (Dec) (Dec) P/E using TTM EPS 8.6 2010 P/E using 2012 Estimate 6.6 2011 $1.48 A $2.29 A $3.16 A -$0.21 A $6.72 A P/E using 2013 Estimate 7.2 2012 $1.70 A $2.53 A $3.31 A $2.07 E $9.61 E 2013 $1.69 E $2.84 E $2.75 E $1.48 E $8.76 E Zacks Rank *: Short Term 1 – 3 months outlook 3 - Hold Projected EPU Growth - Next 5 Years % 12 * Definition / Disclosure on last page *Marathon Petroleum became a publicly traded entity in 2011 after being spun-off from parent company Marathon Oil. Therefore, revenue and EPS numbers have been provided from Q1 2011. © 2012 Zacks Investment Research, All Rights reserved. www.Zacks.com 111 North Canal Street, Chicago IL 60606 OVERVIEW REASONS TO BUY Findlay, Ohio-based Marathon Petroleum Corporation (MPC) is a leading independent refiner, transporter and marketer of petroleum Marathon Petroleum is the fifth largest products. The company, in its current form, domestic refiner with a combined crude oil came into existence following the 2011 spin-off processing capacity of approximately of Houston, Texas-based Marathon Oil 1,193,000 barrels per day through its Corporation’s refining/sales business into a portfolio of six refineries. A major separate, independent and publicly traded advantage for the company is its entity. Marathon Petroleum operates in three proprietary access to pipelines, which segments: Refining and Marketing, Speedway inhibits lower-cost competitors from (Retail), and Pipeline Transportation. supplying Marathon Petroleum's key markets. Refining and Marketing: The unit’s operations include six refineries having a Marathon Petroleum’s proposed purchase combined crude processing capacity of of BP Plc's Texas City refinery – one of the 1,193,000 barrels per day (or approximately largest and most complex in the country – 7% of the total refining capacity in the U.S.), will help the company to solidify its position concentrated primarily in the Midwest, Gulf in the fuel export business, apart from Coast and Southeast regions of the country. improving production flexibility. Additionally, Marathon Petroleum – through its marketing organization – sells Marathon Petroleum is almost through with transportation fuels, asphalt and specialty its $2.2 billion Detroit Heavy Oil Upgrading products throughout the country to support Project. Ongoing since 2008, the initiative commercial, industrial and retail operations. – on budget and on schedule – is expected This segment contributed bulk of the to finish later this year. The completion of company’s 2011 earnings (approximately the project will not only deliver an extra 88%). 80,000 barrels a day of heavy oil processing capacity but also free up capital Speedway (Retail): Marathon Petroleum expenditures and boost the company’s free also possesses a profitable retail footprint cash flow. headquartered in Enon, Ohio. Known as Speedway LLC, it is the fourth biggest chain The company’s financial flexibility and of company-owned and -operated gasoline strong balance sheet are real assets in this and convenience stations in the U.S. highly-uncertain period for the economy. Speedway consists of some 1,350 stores in Marathon Petroleum remains in excellent seven states, catering to approximately 2 financial health, with more than $3 billion in million customers daily. cash/cash equivalents and an investment- grade credit rating with a debt-to- Pipeline Transportation: The company’s capitalization ratio of 23%. Furthermore, an ‘Pipeline Transportation’ segment – which attractive dividend yield and the $2 billion oversees one of the biggest petroleum share buyback program – that commenced pipeline networks in the U.S. based on total recently – highlight the company’s volume delivered – owns, operates, leases commitment to create value for or has an ownership interest in about 9,600 shareholders. miles of pipeline, consisting of 68 systems spread over 15 states and federal waters. Marathon Petroleum transports more than 2.8 million barrels of crude oil and petroleum products daily through these pipelines.

Equity Research MPC | Page 2 REASONS TO SELL quarter of 2012, ahead of the Zacks Consensus Estimate of $3.29.

The refining segment – which contributes Compared with the year-ago period, Marathon the bulk of Marathon Petroleum’s revenues Petroleum’s earnings per share improved by and earnings – is the major driver to the 4.70% – from $3.16 to $3.31 – on the back of company’s results. However, with refiners strong refining margins. being buyers of crude, an increase in oil prices can squeeze their profitability. Revenues at $21,249.0 million were up 2.9% year over year and surpassed the Zacks The inherent volatility of the refining Consensus Estimate of $19,653.0 million. business reduces the accuracy and reliability of long-term earnings and Segmental Performance revenue estimates. Additionally, results are exposed to unplanned shut-downs that Refining & Marketing: Margins in the refining may have a lingering impact. business (in Chicago and the U.S. Gulf Coast) increased from the year-earlier levels. Marathon Petroleum has pegged its 2012 capital budget at $1.4 billion, up 17% from Marathon Petroleum’s refining and marketing the amount it invested in 2011 and some unit earned $1,691.0 million during the quarter, $150 million more than previous compared with profits of $1,711.0 million in the announcement – quite high by industry year-ago period– reflecting higher crude oil standards. This may adversely affect the costs. company’s leverage and deteriorate its credit metrics. Additionally, the increasing The company's realized gross refining and capital intensity of its operations may result marketing margin of $13.12 per barrel was a bit in reduced returns going forward. down from the year-ago period's margin of $13.18 per barrel. Total refined product sales The requirement of policies to reformulate volumes decreased marginally (by 0.3%) from fuel and lower emission from refinery the year-earlier level to 1,605 thousand barrels operations make the industry a highly per day, while throughput dipped 1.7% year regulated one. As a result, companies like over year to 1,345 thousand barrels per day. Marathon Petroleum are often forced to divert cash flows to ensure regulatory Speedway: Income from the Speedway retail compliance, which can adversely impact stations totaled $76 million during the quarter, profitability. down from $85 million in the year-ago period. The negative comparison was driven by decreased gasoline and distillate gross margin & high expenses, partially offset by higher RECENT NEWS merchandise gross margin. Same-store fuel sales decreased 3.9% year over year.

Pipeline Transportation: Segment profitability Third Quarter 2012 Results for the most recent quarter was $52 million, declining 7.1% from the third quarter of 2011, On November 1, 2012, Ultra Petroleum adversely affected by lower pipeline affiliate reported slightly better-than-expected third earnings. quarter 2012 profits attributable to favorable market conditions and high refining margins in Capital Expenditure & Balance Sheet Chicago and the U.S. Gulf Coast. During the quarter, Marathon Petroleum spent The company came out with earnings per share $360 million on capital programs (50.60% on (adjusted for special items) of $3.31 in the third Refining). As of September 30, 2012, the

Equity Research MPC | Page 3 company had cash and cash equivalents of $3,387.0 million and total debt of $3,349.0 million, with a debt-to-capitalization ratio of 23%.

VALUATION

One of the leading downstream operators in the U.S., we like Marathon Petroleum’s strong six- plant refining portfolio and its diversification into retail/midstream business lines, which make the stock potentially more stable. Additionally, the company possesses one of the healthiest balance sheets among peers and a robust free cash flow generating ability. The recent commencement of the $2 billion buyback program highlights Marathon Petroleum’s commitment to create value for shareholders.

However, due to the volatile nature of the refining business, we do not see any significant price upside for Marathon Petroleum shares in the next few quarters. We expect the company to grow at a somewhat more conservative and sustainable pace.

This is reflected in our new Neutral recommendation and the $66 price objective, which is based on a multiple of 7.1X trailing twelve-month cash flow.

Equity Research MPC | Page 4 Key Indicators

P/E P/E 5-Yr 5-Yr P/E P/E Est. 5-Yr P/CF P/E High Low F1 F2 EPU Gr% (TTM) (TTM) (TTM) (TTM) Marathon Petroleum Corp. (MPC) 6.6 7.2 12.0 6.8 8.6 8.5 3.6

Industry Average 16.5 13.1 16.5 9.4 24.6 104.4 10.7 S&P 500 14.1 13.2 10.7 12.0 14.6 27.7 12.0

Valero Energy Corp. (VLO) 7.1 7.0 6.3 5.0 9.7 199.8 3.4 Phillips 66 (PSX) 6.7 8.1 9.0 6.9 6.8 4.6 World Fuel Services Corp. (INT) 14.8 13.1 3.8 11.3 13.6 17.1 6.4 Tesoro Corp. (TSO) 6.4 7.6 12.4 6.2 10.1 68.7 4.2 TTM is trailing 12 months; F1 is 2012 and F2 is 2013, CF is operating cash flow

P/B Last P/B P/B ROE D/E Div Yield EV/EBITDA Qtr. 5-Yr High 5-Yr Low (TTM) Last Qtr. Last Qtr. (TTM) Marathon Petroleum Corp. (MPC) 1.8 1.8 1.0 24.8 0.3 2.2 4.6

Industry Average 2.6 2.6 2.6 11.5 -0.2 3.4 8.6 S&P 500 3.8 9.8 2.9 23.1 2.2

Equity Research MPC | Page 5 Earnings Surprise and Estimate Revision History

StockResearchWiki.com – The Online Stock Research Community

Discover what other investors are saying about Marathon Petrol (MPC) at StockResearchWiki.com:

http://www.stockresearchwiki.com/tiki- index.php?page=MPC/Ticker

DISCLOSURES & DEFINITIONS

The analysts contributing to this report do not hold any shares of MPC. The EPS and revenue forecasts are the Zacks Consensus estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts’ personal views as to the subject securities and issuers. Zacks certifies that no part of the analysts’ compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next six to twelve months. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next six to twelve months. Underperform- Zacks expects the company will under perform the broader U.S. Equity market over the next six to twelve months. The current distribution of Zacks Ratings is as follows on the 1001 companies covered: Outperform - 13.4%, Neutral - 78.9%, Underperform – 6.9%. Data is as of midnight on the business day immediately prior to this publication.

Our recommendation for each stock is closely linked to the Zacks Rank, which results from a proprietary quantitative model using trends in earnings estimate revisions. This model is proven most effective for judging the timeliness of a stock over the next 1 to 3 months. The model assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank 2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each company which provides an idea of the near-term attractiveness of a company’s industry group. We have 264 industry groups in total. Thus, the

Equity Research MPC | Page 6 Zacks Industry Rank is a number between 1 and 264. In terms of investment attractiveness, the higher the rank the better. Historically, the top half of the industries has outperformed the general market. In determining Risk Level, we rely on a proprietary quantitative model that divides the entire universe of stocks into five groups, based on each stock’s historical price volatility. The first group has stocks with the lowest values and are deemed Low Risk, while the 5th group has the highest values and are designated High Risk. Designations of Below-Average Risk, Average Risk, and Above-Average Risk correspond to the second, third, and fourth groups of stocks, respectively.

Analyst Nilanjan Choudhury QCA Nilanjan Choudhury Lead Analyst Nilanjan Choudhury Reasons for Update 3Q’12 Results & Recommendation Change

Equity Research MPC | Page 7