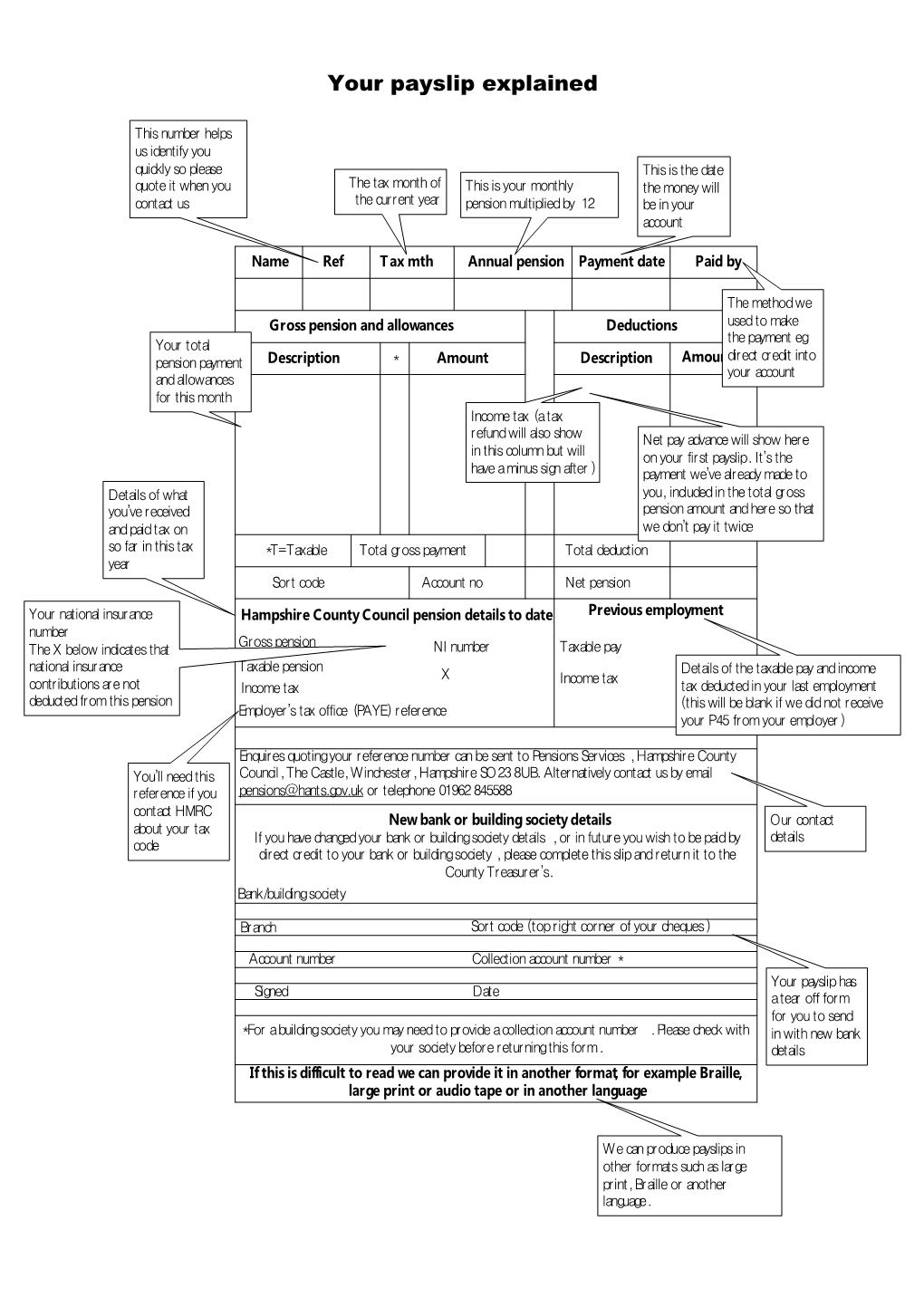

Your payslip explained

This number helps us identify you quickly so please This is the date quote it when you The tax month of This is your monthly the money will contact us the current year pension multiplied by 12 be in your account

Name Ref T ax mth Annual pension Payment date Paid by

The method we Gross pension and allowances Deductions used to make the payment eg Your total direct credit into pension payment Description * Amount Description Amount your account and allowances for this month Income tax (a tax refund will also show Net pay advance will show here in this column but will on your first payslip. It’s the have a minus sign after ) payment we’ve already made to Details of what you, included in the total gross you’ve received pension amount and here so that and paid tax on we don’t pay it twice so far in this tax *T=Taxable Total gross payment Total deduction year Sort code Account no Net pension

Your national insurance Hampshire County Council pension details to date Previous employment number Gross pension The X below indicates that NI number Taxable pay national insurance Taxable pension Details of the taxable pay and income X Income tax contributions are not Income tax tax deducted in your last employment deducted from this pension (this will be blank if we did not receive Employer’s tax office (PAYE) reference your P45 from your employer )

Enquires quoting your reference number can be sent to Pensions Services , Hampshire County You’ll need this Council, The Castle, Winchester, Hampshire SO23 8UB. Alternatively contact us by email reference if you [email protected] or telephone 01962 845588 contact HMRC Our contact about your tax New bank or building society details If you have changed your bank or building society details , or in future you wish to be paid by details code direct credit to your bank or building society , please complete this slip and return it to the County Treasurer’s. Bank/building society

Branch Sort code (top right corner of your cheques)

Account number Collection account number * Your payslip has Signed Date a tear off form for you to send *For a building society you may need to provide a collection account number . Please check with in with new bank your society before returning this form. details If this is difficult to read we can provide it in another format, for example Braille, large print or audio tape or in another language.

We can produce payslips in other formats such as large print, Braille or another language. Some of the terms you might see on your payslip

Gross pension and allowances Basic pension This is your basic monthly pension payment. GMP, Pre 6/4/88 The Guaranteed Minimum Pension (GMP) is the minimum pension which we have to provide for members who were contracted out of SERPS (the top up state pension scheme) GMP, Post 5/4/88 between 6 April 1978 and 5 April 1997. The amount is broadly equivalent to the amount the member would have received had they not been contracted out. The GMP is split into two elements, pre 6 April 1988 and post 6 April 1988 because different cost of living adjustments are applied to each part. Pre 6/4/88 GMP Inc GMP is calculated at age 60 (for women) and age 65 (for men). If Post 6/4/88 GMP Inc you worked beyond this age, you get an increment on the GMP up until your actual leaving date. The increment is again split into two elements because different cost of living adjustments are applied to each part.

Deductions Income tax This is the tax that has been deducted from your pension. If it is followed by a minus sign (-) then it is a tax refund. Net pay advance You will have received the net pay advance payment into your bank account shortly after your retirement. On your first payslip, the amount of the payment is included in both the basic pension figure and as a deduction so that it is not paid again with your second pension payment. Charitable donation If you take part in the Give As You Earn scheme, the donation will appear here. HSA Crown Plan If you contribute to a Hospital Simplyhealth plan, your insurance HSA Individual Plan contributions will appear here.

Tax codes BR This stands for Basic rate i.e. 20% tax is deducted from your benefits. Suffix codes e.g. 647L The number part of the tax code indicates how much is allowed against your pension before calculating income tax. For example, 647 means that your tax-free pay for the tax year is £6,479. K codes e.g. K375 The K code is a negative tax code and is applied if you owe extra tax. NT This code is an abbreviation of No Tax or Nil Tax and is applied if you do not have to pay tax on your pension. D0 This code is applied by HMRC if you are liable to pay income tax at the higher rate, i.e. 40%. You may be given this tax code if you use your personal allowances on another employment or pension. Wk 1 This means your tax code is being applied on a week one basis and no account is taken of previous tax you’ve paid in the year. You get an equal amount of tax free pension each month but because changes that happened earlier in the year are not taken into account, your tax might not be exactly right at the end of the year.