Ch. 7: Accounts Receivable 1

Chapter 7 Accounts Receivable

In this chapter you will learn how accounts receivable affect businesses, how they are controlled, accounted for, and reported in financial statements.

What Are Accounts Receivable?

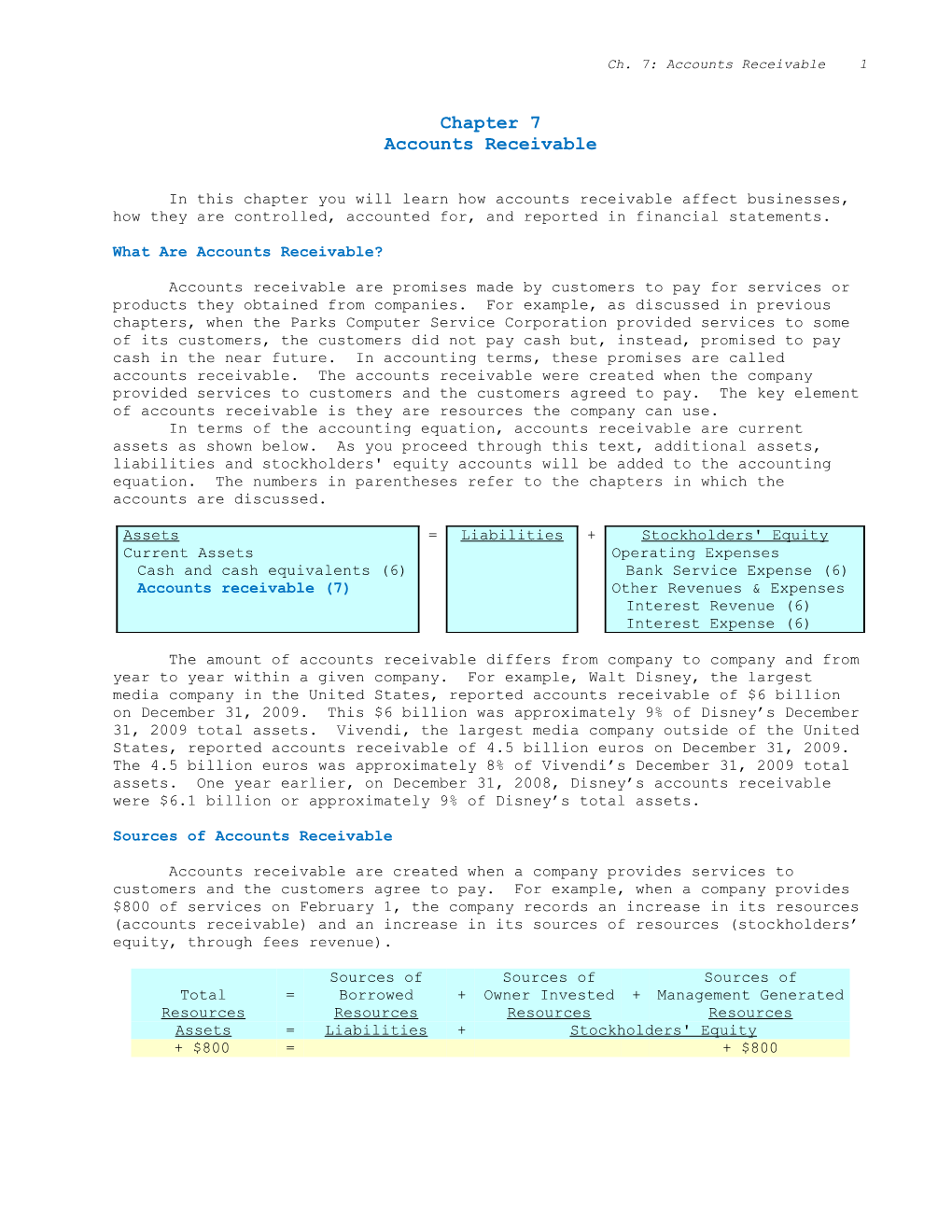

Accounts receivable are promises made by customers to pay for services or products they obtained from companies. For example, as discussed in previous chapters, when the Parks Computer Service Corporation provided services to some of its customers, the customers did not pay cash but, instead, promised to pay cash in the near future. In accounting terms, these promises are called accounts receivable. The accounts receivable were created when the company provided services to customers and the customers agreed to pay. The key element of accounts receivable is they are resources the company can use. In terms of the accounting equation, accounts receivable are current assets as shown below. As you proceed through this text, additional assets, liabilities and stockholders' equity accounts will be added to the accounting equation. The numbers in parentheses refer to the chapters in which the accounts are discussed.

Assets = Liabilities + Stockholders' Equity Current Assets Operating Expenses Cash and cash equivalents (6) Bank Service Expense (6) Accounts receivable (7) Other Revenues & Expenses Interest Revenue (6) Interest Expense (6)

The amount of accounts receivable differs from company to company and from year to year within a given company. For example, Walt Disney, the largest media company in the United States, reported accounts receivable of $6 billion on December 31, 2009. This $6 billion was approximately 9% of Disney’s December 31, 2009 total assets. Vivendi, the largest media company outside of the United States, reported accounts receivable of 4.5 billion euros on December 31, 2009. The 4.5 billion euros was approximately 8% of Vivendi’s December 31, 2009 total assets. One year earlier, on December 31, 2008, Disney’s accounts receivable were $6.1 billion or approximately 9% of Disney’s total assets.

Sources of Accounts Receivable

Accounts receivable are created when a company provides services to customers and the customers agree to pay. For example, when a company provides $800 of services on February 1, the company records an increase in its resources (accounts receivable) and an increase in its sources of resources (stockholders’ equity, through fees revenue).

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity + $800 = + $800 2 Ch. 7: Accounts Receivable

If you remember assets increase with debits and a journal entry must have debits equal to credits, the process of recording the transaction is quite simple, as shown below.

Posting Date Description Ref. Debits Credits Feb. 1 Accounts Receivable 121 800 Fees Revenue 411 800 Customer services

In business, many companies exist primarily to provide customers with products rather than services. For example, Wal-Mart's main revenues result from prices it charges its customers for the products they buy when they shop at Wal-Mart stores. Companies like Wal-Mart, that buy their products from other companies and sell them to individuals and other companies, are called retailers or merchandisers. The products Wal-Mart sells include home goods, food, garden supplies, office supplies, and many other items. On the other hand, General Motors is an example of a manufacturing company. Manufacturers take items, called materials, and employ people to combine the materials with other items and convert them into different items, called products, and sell them to customers. Similar to Wal-Mart, however, General Motors’ main revenues result from prices it charges its customers for its products, which consist primarily of automobiles, trucks, and parts and accessories. From an accounting standpoint, whether a company is a retailer or manufacturer, accounts receivable result when the company sells its products to customers and, in turn, receives promises of payment from them. However, while a service company would record revenues in a fees revenue account, a retailer or manufacturer would record revenues in a revenue account called sales. This could be done as follows.

Posting Date Description Ref. Debits Credits Feb. 1 Accounts Receivable 121 2,500 Sales 415 2,500 February sales

Similar to the fees revenue account, the sales revenue account would appear as revenue on the income statement of a retail or manufacturing company. As you proceed through this text, you will learn much more about retailers or merchandisers. In fact, this and the following chapters relate the many accounting topics examined primarily to merchandising businesses, although references will frequently be made to service and manufacturing businesses as well. Manufacturing companies are usually examined in much greater depth in Managerial Accounting texts. One common policy practiced by merchandising companies is allowing customers to return products within a reasonable time period. Even though you may not have given much thought to this policy, you are probably well aware of why merchandisers follow it. This policy is based on the idea that if customers are encouraged to try products, they will often buy them. Furthermore, many customers, especially parents, often find it much more convenient to buy products, take them home, allow other family members to examine them and possibly try them on, keep the products they want, and return the rest. If customers are not allowed to return items, some merchandising companies, especially those specializing in clothing, would find it much more difficult to sell as many items as they do. One result of customers returning products to merchandising companies is the resource (accounts receivable) resulting from the original sale of products (shown in the previous journal entry) must be reduced Ch. 7: Accounts Receivable 3 by the amount of the sales prices of products returned. The resource must be reduced because once the items are returned the customer no longer owes the company for the products. Stockholders’ equity must also be reduced because management was responsible for allowing the products to be returned. Thus, the company's resources and sources of resources both decrease by the sales prices of the products returned, $50 for example.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity - $50 = - $50

Remembering accounts receivable are assets and assets are reduced by credits, accounts receivable would be reduced by a credit for the amount of the sales prices of the products returned ($50). But what account should be debited? A review of the previous journal entry suggests it would be reasonable to debit the sales account, inasmuch as the customer's return of the merchandise implies the sale was canceled by the customer. Although a debit to the sales account is reasonable, in practice an account called sales returns and allowances is often used to record customers' returns. The sales returns and allowances account is used because information about customers' returns is important for business managers. For example, consider what action you might explore if you were a manager and you learned customers had returned almost every one of a certain type of sweater they purchased. It would be reasonable for you to investigate reasons sweaters were returned. If you discovered sweaters were returned because they had flaws in them, you might consider not buying such sweaters again or possibly changing companies supplying you sweaters. Because managers are often interested in customers' returns, such sales returns are recorded in the sales returns and allowances account as follows.

Posting Date Description Ref. Debits Credits Feb. 7 Sales Returns and Allowances 416 50 Accounts Receivable 121 50 February sales returns

Similar to sales returns for items returned by customers, sometimes customers are encouraged to keep items they are not completely satisfied with. For example, a customer who bought a $120 pair of shoes and returns them because they have a flaw on the leather heel might be offered a $20 reduction in the sales price. This price reduction is called a sales allowance. Companies grant sales allowances in order to satisfy customers and, also, to avoid having to process some returned merchandise that may be difficult to sell to other customers. Sales allowances are recorded through a journal entry identical to sales returns, as shown above. Sales and sales returns and allowances not only affect accounts receivable, but are also reported in the revenue section of the income statement as shown below.

Sales $150,000 Less: Sales Returns and Allowances $3,000 Net Sales $147,000

The above revenue section of the income statement reports the company charged its customers $150,000 for products sold to them this period. Of this amount, 4 Ch. 7: Accounts Receivable in effect, sales of $3,000 were canceled for products returned by customers or for allowances granted to them for products they would have returned if allowances were not granted. The resulting $147,000, called net sales, represents the dollar amount of sales prices of products sold to customers and kept by them. The reporting of sales revenue ($150,000) separate from sales returns and allowances ($3,000) provides more information to managers than simply reporting the sales prices customers agreed to pay for products they kept ($147,000).

Uses of Accounts Receivable

By far the most important use of accounts receivable is to collect cash from customers. It is primarily the ability to be converted into cash that gives accounts receivable value. The collection of accounts receivable does not affect the accounting equation. It is simply the conversion of one resource (accounts receivable) into another resource (cash). For example, the collection of $400 of accounts receivable would result in the following.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity + $400 - $400

As presented several times in earlier chapters, the collection of accounts receivable results in the following journal entry.

Posting Date Description Ref. Debits Credits Feb. 3 Cash 111 400 Accounts Receivable 121 400 A/R collection

The fact that accounts receivable are not the same as cash seems to create a major roadblock for some students accepting accounts receivable as resources (assets). If most accounts receivable will become cash in 30 to 60 days, why are they considered to be resources at the time a company provides a service or product to a customer and the customer agrees to pay? Why not wait until the cash is collected to record the increase in resources (cash)? The answer to these questions is that even though accounts receivable are not the same as cash, they are valuable. One important use of accounts receivable is as collateral for loans. It is possible for companies to pledge their accounts receivable to financial institutions in return for cash loans. By pledging their accounts receivable, companies agree to use cash they receive from collecting accounts receivable to repay the loans. Another way companies can obtain cash is through sale of their accounts receivable. This process of selling accounts receivable is called factoring. When a company factors its accounts receivable, it transfers all rights to them to a financial institution, called a factor, in return for cash. Since the factor now owns the accounts receivable, all credit customers must be informed to pay the factor, not the company from which they received the products or services. Even though it is probably easier to understand accounts receivable are valuable because they can be immediately converted into cash by being pledged or factored, managers believe accounts receivable are most valuable because they will soon result in cash through the collection process. Most accounts Ch. 7: Accounts Receivable 5 receivable are neither pledged nor factored; they are held and collected. Similar to other resources, accounts receivable are resources because they are useful.

Controlling Accounts Receivable

Accounts receivable are controlled in business in many ways, two of which will be briefly discussed in this chapter: (1) analyzing potential credit customers, and (2) maintaining detailed customer records. Two other ways in which accounts receivable are controlled are discussed in the Appendix to Chapter 7: (3) preparing an accounts receivable aging schedule, and (4) calculating financial ratios.

Analyzing potential credit customers Accounts receivable are valuable primarily because they result in cash from customers. In most cases, accounts receivable result in cash being paid by customers to the company from which the services or products were received. Unfortunately, all customers who buy services or products on account do not pay what they owe. Some customers move from their homes and businesses and simply forget to pay. Some customers go bankrupt and cannot pay their bills. Some customers simply are dishonest and refuse to pay. As a result, companies who provide services or sell products on account must consider the fact that some of their accounts receivable may never result in cash from customers. An important way in which businesses control their accounts receivable is through an analysis of potential credit customers. The analysis is designed to avoid, as much as possible, providing services or products to customers who will not pay. As a simple example of an analysis of potential credit customers, consider the Matthew Sporting Goods Company. The company sells baseball, basketball, football, and soccer equipment. Currently, it is the company's policy to sell only to city and town youth organizations, such as baseball programs for 7-12 year old children or soccer programs for teenagers. As a result of its sales policy, the Matthew Sporting Goods Company has always been able to collect all its accounts receivable. A monthly income statement for the company is as follows.

Matthew Sporting Goods Company Income Statement For the Month Ended June 30

Sales $120,000 Cost of Goods Sold $54,000 Gross Profit $66,000 Operating Expenses Salaries Expense $15,800 Wages Expense $24,000 Supplies Expense $1,200 Utilities Expense $10,800 Rent and Insurance Expense $5,150 Total Operating Expenses $56,950 Income from Operations $9,050 Other Revenues and (Expenses) ($50) Income Before Taxes $9,000 Income Taxes Expense $3,000 Net Income $6,000

Before continuing with the example of the analysis of potential credit customers, notice how the Matthew Sporting Goods Company's income statement 6 Ch. 7: Accounts Receivable above differs from the income statements presented in previous chapters. Note the Matthew Sporting Goods Company's income statement has several major categories, including sales, cost of goods sold, operating expenses, other revenues and expenses, and income taxes expense. As discussed in Chapter 6, this form of the income statement is known as a classified income statement. Each major category or classification is the result of the accounting profession's response to information needs of users of financial statements. From previous chapters you are somewhat familiar with the category of income taxes expense and the category of other revenues and expenses (remember interest revenue and interest expense in chapter 6?). In addition, it is common for financial statement users to want to know how much it cost a company for the products the company sold to its customers and the cost of operating the company so the products could be sold. As a result, the income statement reports product costs separately as the cost of goods sold and operating costs separately as operating expenses. As we proceed through other chapters, you will learn more about the financial statements categories as well as other changes in the statements. Continuing with the example of the analysis of potential credit customers, the Matthew Sporting Goods Company is considering trying to increase its net income by selling to individual customers in addition to city and town youth organizations. The company expects this new policy will generate an additional $5,000 sales revenue per month. From discussions with managers of other businesses in the area, the company also expects 1% of accounts receivable from individual customers will prove to be worthless. That is, the company expects 1% of its new accounts receivable to be uncollectible because some customers will not pay their bills. Based on its estimates, the company's projected July income statement could be as follows.

Matthew Sporting Goods Company Income Statement For the Month Ended July 31

Sales $125,000 Cost of Goods Sold $56,250 Gross Profit $68,750 Operating Expenses Salaries Expense $15,800 Wages Expense $25,000 Supplies Expense $1,250 Utilities Expense $11,250 Rent and Insurance Expense $5,150 Uncollectible Accounts Expense $50 Total Operating Expenses $58,500 Income from Operations $10,250 Other Revenues and (Expenses) ($50) Income Before Taxes $10,200 Income Taxes Expense $3,400 Net Income $6,800

A review of the two income statements presented above reveals the following main points. First, based on its analysis of potential credit customers, the Matthew Sporting Goods Company would adopt a policy of selling to individual customers because its monthly net income would increase by $800 ($6,800 - $6,000). Second, an additional operating expense, uncollectible accounts expense, appears on the projected income statement for July. This $50 uncollectible accounts expense is the dollar amount of the new accounts receivable the company expects will never be collected (1% of $5,000). Third, Ch. 7: Accounts Receivable 7 the $5,000 increase in revenues (sales) resulted in increases in some expenses but not in others. For example, selling to more customers resulted in increases in the cost of goods sold, wages expense, supplies expense, and utilities expense. These expense increases were expected because more sports equipment, labor, supplies, and electricity were needed to service the additional customers. On the other hand, the additional revenues did not result in increased salaries expense or rent and insurance expense because additional managers did not need to be hired, additional space did not need to be rented, and additional insurance was not needed. Once again, at this point in your career you are not expected to be able to make these predictions. As you become more familiar with business and accounting, however, these ideas will become much clearer. The uncollectible accounts expense introduced in the above example is often a difficult expense for students to accept. However, consider the business world. It is a fact of life that some customers simply never pay their bills. The fact that some customers do not pay is accounted for as uncollectible accounts expense. A logical question then becomes, why would a company provide services or products to customers who will not pay for them? The answer is, of course, companies do not provide services or products to customers who they know will not pay. As the Matthew Sporting Goods Company example above showed, however, a company can increase its net income by extending credit to some customers who may not pay if, in the process, enough customers who receive credit do pay. Again, in the Matthew Sporting Goods Company example, although 1 percent of new customers may not pay, 99 percent will pay. As long as the Matthew Sporting Goods Company can charge this 99 percent of its customers enough to more than cover the total cost of the products sold to the 1 percent who will not pay, the company will increase its net income. As the projected July income statement showed, the Matthew Sporting Goods Company expects to be able to receive from the 99 percent of its customers who will pay enough to cover for the 1 percent who will not pay and, as a result, increase the company's net income by $800. In actual business practice, companies accept the risk of providing services and products to some customers who may not pay because the vast majority of customers do pay, with the result being increased net income. From the standpoint of controlling accounts receivable, it is necessary for companies to project the income effects of providing services and products to customers who may not pay, as illustrated above. If, as a result of providing services and products to such customers, net income does not increase, companies should reconsider doing business with them. For example, if the Matthew Sporting Goods Company’s projections indicated net income would decrease, the company should not expand by selling to individual customers, but should continue to sell only to city and town youth organizations.

** You now have the background to do exercise 7.1.

Detailed customer records A second way companies control accounts receivable is by maintaining detailed records of dollar amounts owed to them by each customer. These detailed records are called the accounts receivable subsidiary ledger. As you probably remember from the previous chapter's discussion of the customer deposits subsidiary ledger maintained by banks, a subsidiary ledger records the detailed information relating to one specific general ledger account. The accounts receivable subsidiary ledger consists of all customer accounts, the total of which agrees with the accounts receivable account balance in the general ledger. An example of a simplified accounts receivable subsidiary ledger page for the Matthew Sporting Goods Company is shown below.

Customer: R. Molinaro Customer Number: 74409 8 Ch. 7: Accounts Receivable

Date Description Debits Credits Balance 3/1 Balance 600.00 3/12 Sales invoice 1012 900.00 1,500.00 3/25 Payment received 500.00 1,000.00

From the accounts receivable subsidiary ledger it can be determined that R. Molinaro owed the Matthew Sporting Goods Company $600 at the beginning of March. The company provided Molinaro with $900 of additional products during March (3/12) and received $500 in cash payments from him (3/25). At the end of March, Molinaro owes $1,000 to the company. The accounts receivable subsidiary ledger has several uses, two of which are discussed here. First, the information in the accounts receivable subsidiary ledger can be used for billing customers. For example, at the end of March the Matthew Sporting Goods Company would send a statement of account to R. Molinaro reminding him of the transactions he had with the company in March and requesting payment of $1,000. A statement of account is a summary of a customer’s recent credit purchases and cash payment activity with a company and a reminder of the dollar amount owed by the customer. A statement of account is usually prepared and distributed to all customers each month. If companies want to collect cash from customers, customers must be billed and they must be periodically reminded of the amounts they owe. An example of a statement of account is shown below.

Statement of Account Matthew Sporting Goods Company 10 Cy Tenney Park Hamilton, MA 02080 R. Molinaro 589 Meehan's Way Lowell, MA 01854 March 31 Date Item Charges Payments Balance 3/1 Balance $600.00 3/12 Sales invoice 1012 $900.00 $1,500.00 3/25 Payment received $500.00 $1,000.00

Please pay the last amount shown in the balance column.

A second use of the accounts receivable subsidiary ledger is in evaluating current customers who request additional services or products. Again, using the information for R. Molinaro, the Matthew Sporting Goods Company may decide not to provide him with additional products until he pays a large part of his current balance. It may not be wise for the company to continue to sell to customers who have not paid for products sold to them previously. In summary, then, the detailed records maintained in the accounts receivable subsidiary ledger help control accounts receivable by enabling companies to accurately and promptly bill their customers and by providing companies with information useful in determining if additional services or products should be supplied to current customers.

** You now have the background to do exercise 7.2.

Accounting for Uncollectible Accounts Receivable

The accounting for uncollectible accounts receivable is often more difficult to understand than are the more important issues of why accounts receivable are valuable and how they are controlled. The following sections Ch. 7: Accounts Receivable 9 examine some of the major issues of accounting for uncollectible accounts receivable.

Recording uncollectible accounts receivable and the uncollectible accounts expense As discussed previously, even though companies know all customers will not pay their bills, it is often possible to increase income by taking chances and selling products to many customers. Remember the logic behind this strategy is there are more than enough good customers who will pay their bills to make up for the small number of customers who will not pay. With this in mind, how do companies account for the fact that some of their customers will not pay? Consider the problem facing a company selling products on credit. First, when they sell the products, they do not know which customers will not pay, otherwise there would be no reason to sell to such customers. Second, they know the total accounts receivable will never be collected in cash. Some customers will not pay. As a result, the company's problem is twofold: (1) how to report the accounts receivable resource (asset) on the balance sheet and (2) how to record the uncollectible accounts expense associated with selling to customers who will not pay. Since the total accounts receivable will not be collected because some customers will never pay, the company must find a way to report on its balance sheet the amount of cash the company does expect to collect from its accounts receivable. Remember, accounts receivable are resources primarily because they will be converted into cash. If accounts receivable will never be converted into cash, they are not resources. With regard to reporting uncollectible accounts expense on the company's income statement, since the names of customers who will not pay will be known only when the customers fail to pay, the exact amount of the uncollectible accounts expense cannot be determined until that time. It could be several months after sales are made to customers until the company determines the specific customers who will not pay. The solution to this problem of reporting the accounts receivable asset on the balance sheet and the uncollectible accounts expense on the income statement is, at the time sales are made to customers on credit, to estimate the dollar amount of the accounts receivable that will never be collected and reduce resources and sources of resources by that amount, for example $150.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity - $150 = - $150

Since $150 of accounts receivable are not expected to be converted into cash, the $150 of accounts receivable should not be resources. This $150 of accounts receivable that will not be collected should be recorded as a reduction in resources (accounts receivable?). The $150 is the expense of selling to customers who are not expected to pay and, similar to all other expenses, decreases sources of resources (through the increase in uncollectible accounts expense). The journal entry required is as follows.

Posting Date Description Ref. Debits Credits March 31 Uncollectible Accounts Expense 522 150 Allow. for Uncollectible Accts. 122 150 Uncollectible Accts. Rec. 10 Ch. 7: Accounts Receivable

There are several important points to note in the above journal entry. First, and often the most difficult for students to accept, is the fact the $150 is an estimate. Remember, the exact amount of the uncollectible accounts receivable cannot be determined until customers fail to pay. However, since the company knows some customers will not pay, it is better to estimate the uncollectible accounts receivable than to wait several months to determine the exact amount. You should note, however, an estimate is not simply a wild guess. There are industry statistics available to assist companies in making such estimates. Furthermore, companies who have been operating for several years have their own historical data to use in making such estimates. A second major point in the above journal entry is the credit to the allowance for uncollectible accounts rather than to accounts receivable. The purpose of the journal entry was to record the uncollectible accounts expense and to reduce assets (accounts receivable?) by the amount the company expects to be unable to collect. Remember, however, the company maintains an accounts receivable subsidiary ledger detailing each customer's activity with the company. The total owed by all customers, as shown in the accounts receivable subsidiary ledger, should always equal the amount in the accounts receivable account in the general ledger. Since, at the time the sales are made to customers, it is not known which customers will not pay, the company cannot reduce accounts in the subsidiary ledger because it would not know which specific customers' accounts to reduce. If accounts receivable in the general ledger were reduced through a credit to accounts receivable but accounts receivable in the subsidiary ledger were not reduced because the specific customers were not known, the two ledgers would not agree with one another. The general ledger’s accounts receivable would be less than the total in the accounts receivable subsidiary ledger. The solution to this problem is to make use of the allowance for uncollectible accounts to record those accounts receivable the company expects to be unable to collect. This allowance for uncollectible accounts is an unusual account. It is an asset account that normally has a credit balance. Such accounts are called contra asset accounts because most assets have debit balances. An example of the balance sheet reporting of accounts receivable is as follows.

Assets Current Assets Cash $9,230 Accounts Receivable $5,000 Less: Allowance for Uncollectible Accounts $150 $4,850

From the above balance sheet information you can see the company's customers owe it $5,000. Of this amount, the balance in the allowance for uncollectible accounts shows $150 are expected to be uncollectible. Thus, the company expects to be able to collect in the near future $4,850 from its customers. Knowledge of this $4,850 is important for management's cash planning needs. The $4,850, not $5,000, will be available for management to do such things as pay employees, buy supplies, pay taxes, and pay owners dividends. The dollar amounts of accounts receivable and allowance for uncollectible accounts differ from company to company. For example, on January 31, 2010, Target’s allowance for uncollectible accounts was approximately 13% of its accounts receivable. On the other hand, Wal-Mart’s allowance for uncollectible accounts was approximately 7% of its accounts receivable.

Estimating uncollectible accounts receivable There are two common methods used for estimating uncollectible accounts receivable, one method is based on revenues and the other is based on the accounts receivable resource (asset). Ch. 7: Accounts Receivable 11

One method is examined in the following paragraphs and the second method is examined in the Appendix to Chapter 7. As you examine these methods, remember their purpose is simply to generate the dollar amounts of the uncollectible accounts expense (the reduction of sources of resources) and the related increase in the allowance for uncollectible accounts (the reduction of resources). Both methods result in the same journal entry, a debit to uncollectible accounts expense and a credit to the allowance for uncollectible accounts. However, because the methods are different, they usually result in different dollar amounts for the journal entry. The percentage of sales method (or the percentage of revenues method) estimates uncollectible accounts expense by relating the expense to the revenues that generated the accounts receivable. For example, in the case of the Matthew Sporting Goods Company, the company could estimate its uncollectible accounts expense by relating prior uncollectible accounts receivable to prior credit sales, as follows.

Accounts Receivable Uncollectible Year Credit Sales Judged Uncollectible Percentage 1 $102,000 $1,220 1.20 2 $107,000 $1,260 1.18 3 $113,000 $1,320 1.17 4 $120,000 $1,390 1.16 Totals $442,000 $5,190 1.17

The Matthew Sporting Goods Company could have fairly easily gathered the above information from its accounting records. The credit sales could have come from an analysis of the company’s general ledger accounts receivable account or its sales account. For example, the total debits to accounts receivable during a year would represent the company’s total credit sales. Remember, credit sales are recorded as a debit to accounts receivable and a credit to sales. The accounts receivable judged uncollectible could be obtained through an analysis of the company’s accounts receivable subsidiary ledger. The items identified would be those accounts receivable recorded in a given year that proved to be uncollectible. For example, in year 1 the company had credit sales of $102,000. Of this $102,000, customers owing $1,220 failed to pay their bills at any time during years 1-4. The uncollectible percentages shown above were calculated by dividing the accounts receivable judged uncollectible by credit sales. For example, in year 1 the uncollectible percentage was $1,220 / $102,000 = 1.20%. For the four years examined, the Matthew Sporting Goods Company’s uncollectible accounts receivable averaged 1.17% of credit sales. The company could use this 1.17% to estimate its uncollectible accounts expense for year 5. However, because the uncollectible percentages decreased during the four years, as shown in the above data, the company may prefer to use 1.15% in its estimate. Whichever percentage is used, however, remember accounting is more concerned with reasonable numbers than it is with accuracy. The company would probably not spend a great deal of time, money, and effort trying to refine its calculations to determine if 1.15% is better to use than 1.17%. For financial statement purposes, either percentage would probably be reasonable enough. Using 1.15% in its estimate of uncollectible accounts receivable, the Matthew Sporting Goods Company would prepare the following journal entry to record uncollectible accounts expense for June, assuming the company recorded credit sales of $12,000 for the month.

Posting Date Description Ref. Debits Credits June 30 Uncollectible Accounts Expense 522 138 12 Ch. 7: Accounts Receivable

Allow. for Uncollectible Accts. 122 138 Uncollectible Accts. Rec.

The $138 uncollectible accounts expense was calculated as follows:

Uncollectible Uncollectible Credit Sales Percentage Accounts Expense $12,000 x .0115 = $138

Once the Matthew Sporting Goods Company posts its uncollectible accounts expense journal entry to its general ledger, the balances in three of its related accounts could appear as follows. Ch. 7: Accounts Receivable 13

Accounts Receivable June 1 balance 5,390 June credit sales 12,000 11,400 June accounts receivable collections June 30 balance 5,990

The accounts receivable account shows the company started the month of June with a balance of $5,390. During June the company had $12,000 of sales on account and collected $11,400 from customers. Note some of these collections were probably from customers who owed the company at the beginning of June and some of the collections were from customers to whom sales were made in June. At the end of June the company’s customers owed it $5,990.

Allowance for Uncollectible Accounts 71 June 1 balance 138 June uncollectible accounts expense 209 June 30 balance

The company’s allowance for uncollectible accounts account shows the company started the month of June with a balance of $71. This means, of the $5,390 balance in the accounts receivable account at the beginning of June, the company expected to be unable to collect $71. During June the company recorded an uncollectible accounts expense of $138. At the end of June, of its $5,990 accounts receivable, the company expects customers who owe it $209 will never pay.

Uncollectible Accounts Expense June 1 balance 0 June uncollectible 138 138 June closing entry accounts expense June 30 balance 0

The company’s uncollectible accounts expense account shows the company’s expense was $138 in June. The account’s beginning and ending balances were zero because all expenses are closed to income summary at the end of each accounting period. Remember, income summary is closed to retained earnings at the end of the accounting period.

** You now have the background to do exercise 7.3.

What if a customer does not pay? If it is determined a customer is not going to pay, the accounts receivable for the customer will definitely not result in cash to the company. Since accounts receivable have value because they will result in cash, accounts receivable that will not result in cash do not have value. Accounts receivable not having value should be eliminated from the accounting system. Remembering accounts receivable are assets having debit balances makes their elimination quite easy: simply credit accounts receivable for the amount the customer owes. The more difficult question is: what account should be debited? The correct answer is the allowance for uncollectible accounts. Consider the Matthew Sporting Goods Company. On June 30, the company had the following account balances. 14 Ch. 7: Accounts Receivable

Assets Current Assets Cash $3,550 Accounts Receivable $5,990 Less: Allowance for Uncollectible Accounts $209 $5,781

Assume included in the company’s $5,990 accounts receivable were $136 owed by R. Willis. On July 3, the company was informed Willis was bankrupt and would be unable to pay. Because the receivable from Willis is now valueless, the Matthew Sporting Goods Company should eliminate the Willis accounts receivable. Remember, also, the allowance for uncollectible accounts represents those receivables expected not to be collected. Once the Willis uncollectible account receivable is eliminated, there is no need for such a large balance in the allowance for uncollectible accounts. Thus, the contra asset account, allowance for uncollectible accounts, should be reduced by the same amount, $136, as the asset account, accounts receivable, was reduced. Since both accounts receivable and allowance for uncollectible accounts are reported as resources, the elimination of uncollectible accounts receivable does not change the company's total resources or sources of resources. Total resources increase and decrease by the same amount.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity + $136 - $136

To eliminate the Willis account receivable, the company would simply credit accounts receivable for $136. To reduce the allowance for uncollectible accounts for the same amount, it is necessary to remember the allowance account is a contra asset, that is, it normally has a credit balance. To reduce an account with a credit balance, it is necessary to debit the account. The resulting journal entry to eliminate the Willis $136 account receivable would be as follows.

Posting Date Description Ref. Debits Credits July 3 Allowance for Uncollectible Accts. 122 136 Accounts Receivable 121 136 Uncollectible R. Willis

Once the above journal entry is posted to the general ledger, the company’s balances would appear as follows.

Assets Current Assets Cash $3,550 Accounts Receivable $5,854 Less: Allowance for Uncollectible Accounts $73 $5,781

Notice in the above, while the elimination of uncollectible accounts receivable changed the accounts receivable balance and the allowance for uncollectible accounts balance, it did not change the dollar amount of accounts receivable expected to be collected. The company still expects to collect Ch. 7: Accounts Receivable 15

$5,781 from its customers, but R. Willis is not one of those customers who is expected to pay. As you would expect, the R. Willis account which was eliminated from the general ledger would also be eliminated from the accounts receivable subsidiary ledger.

Payment received from uncollectible receivables Occasionally, but not very often, customers whose accounts receivable were judged to be uncollectible and eliminated from the accounting system will pay their bills. When this happens, the entry shown in the previous section, when the accounts receivable were eliminated, is incorrect and must be corrected. In addition, the collection of cash for the accounts receivable must be recorded. Continuing the example of the Matthew Sporting Goods Company, assume on July 21, customer R. Willis informs the company he is still in business and sends the company $136 as full payment of the amount he owes. Upon receipt of payment the Matthew Sporting Goods Company would first reinstate the account receivable of R. Willis and then record the cash receipt through the following two journal entries.

Posting Date Description Ref. Debits Credits July 21 Accounts Receivable 121 136 Allow. for Uncollectible Accts. 122 136 R. Willis Rec. Correction

July 21 Cash 111 136 Accounts Receivable 121 136 Collection from R. Willis

You should note the first entry above must be made in order to correct the Willis account in the accounts receivable subsidiary ledger. This subsidiary ledger must be corrected so the company can have an accurate record of activity with its customers. It is important to know customers who behave responsibly by paying their bills, especially if the customers request services or products on credit from the company in the future. As a result of the two journal entries, the accounting equation remains unchanged. All affected accounts are assets (resources). The net effect on the business is the resource cash increased by $136 and the contra asset, allowance for uncollectible accounts, increased by $136. The need to increase the cash account is obvious because the company now has $136 more cash. The need to increase the allowance for uncollectible accounts may not be so obvious, however. One way to understand this increase is to view it as a correction for the entry made when the Willis account receivable was incorrectly eliminated. As a result of the $136 increase in the allowance for uncollectible accounts, the company still expects to be unable to collect $209 from it credit customers ($73 + $136). R. Willis is not one of the customers who the company predicts will not pay, because Willis has already paid the full amount owed. Thus, the $209 represents the amount the company expects to be unable to collect from its other customers.

Summary of accounting for accounts receivable By far the two most important points in accounting for accounts receivable are (1) they are created by providing products or services to customers in return for their promises of cash and (2) because some customers will never pay, there is a cost involved in providing products or services on credit. Providing products or services to customers on credit results in an increase in resources (accounts receivable) and an increase in stockholders’ equity (sales or fees revenue). The cost of 16 Ch. 7: Accounts Receivable providing products or services to customers who do not pay is called uncollectible accounts expense. Although the uncollectible accounts expense must be estimated, it is similar to many other expenses because it results in a reduction of resources (through an increase in the contra asset allowance for uncollectible accounts) and a reduction in stockholders’ equity (through an increase in uncollectible accounts expense). The other transactions related to accounts receivable do not affect total resources or their sources. These transactions merely change the composition of resources, usually from accounts receivable to cash. The proper recording of such transactions is important, however, in order to arrive at reasonable balances in general ledger accounts and the accounts receivable subsidiary ledger accounts.

** You now have the background to do exercise 7.4.

Financial Statement Reporting of Accounts Receivable

Sales made on credit directly affect the balance sheet and the income statement. Accounts receivable are reported in two asset accounts on the balance sheet as shown below.

Assets Current Assets Cash $18,330 Accounts Receivable $75,000 Less: Allowance for Uncollectible Accounts $1,500 73,500

The accounts receivable account reports the total dollar amount owed by customers, which in the above case is $75,000. This is the amount the company will bill its customers and periodically remind them they owe to the company. The allowance for uncollectible accounts reports the dollar amount of accounts receivable the company does not expect to collect. This is the amount the company predicts customers will not pay, which in the above case is $1,500. The difference between accounts receivable and the allowance for uncollectible accounts represents the dollar amount of cash the company expects to collect from its credit customers. Based on the above, even though its customers owe $75,000, the company expects to receive cash of only $73,500 because customers owing $1,500 are not expected to pay. If management is planning future cash needs, it would predict $73,500 of cash would be coming soon to the company as it collects its accounts receivable. This $73,500 cash should soon be available to management for such purposes as buying supplies, paying rent, and paying employees. Credit sales are combined with cash sales and reported as revenues on the income statement. The cost of selling products to customers who do not pay for such products is accounted for as uncollectible accounts expense, which is reported on the income statement as an operating expense. Those companies separating operating expenses into selling expenses and administrative expenses report uncollectible accounts expense as a selling expense. Uncollectible accounts expense is a selling expense because it results from companies expanding sales to include customers who may not pay, as opposed to limiting sales to only customers who are certain to pay. Ch. 7: Accounts Receivable 17

Sales $400,000 Cost of Goods Sold $160,000 Gross Profit $240,000 Operating Expenses Salaries Expense $73,000 Wages Expense $40,000 Supplies Expense $3,000 Utilities Expense $9,000 Rent and Insurance Expense $14,000 Uncollectible Accounts Expense $1,000 Total Operating Expenses $140,000 Income from Operations $100,000 Other Revenues and (Expenses) ($1,000) Income Before Taxes $99,000 Income Taxes Expense $34,650 Net Income $64,350

** You now have the background to do exercise 7.5 and problems 7.1 and 7.2.

Chapter 7 Critical Points

• Accounts receivable are promises made by customers to pay for services or products they received. • Accounts receivable are created when a company provides a product or service to a customer who agrees to pay cash at a later date. • The most important use of accounts receivable is the collection of cash when the customers pay for the products or services they received earlier. • Accounts receivable are also valuable because they can be used as collateral for loans or sold (factored). • Analyzing potential credit customers is one way to control accounts receivable. • Maintaining detailed records (accounts receivable subsidiary ledger), preparing an aging schedule, and calculating ratios are other common methods of controlling accounts receivable. • The cost of providing products or services to customers who do not pay is called the uncollectible accounts expense. • The uncollectible accounts expense is estimated either as a percentage of sales (or revenues) or through the use of the aging method. • The uncollectible accounts expense is reported on the income statement as an operating (selling) expense. • Accounts receivable are reported in two asset accounts on the balance sheet: accounts receivable and the allowance for uncollectible accounts. • The accounts receivable account reports the total dollar amount owed by customers. • The allowance for uncollectible accounts reports the dollar amount of accounts receivable the company does not expect to collect from customers. • The difference between accounts receivable and the allowance for uncollectible accounts is the dollar amount of cash the company expects to collect from its credit customers. 18 Ch. 7: Accounts Receivable

• The following major topics have been examined so far. The number in parentheses refer to the chapters in which the accounts are discussed.

Assets = Liabilities + Stockholders' Equity Current Assets Revenues Cash and cash equivalents (6 Sales (7) Accounts Receivable (7) Sales Returns and Allowance for Uncollectible Allowances (7) Accounts (7) Operating Expenses Uncollectible Accounts Expense (7) Bank Service Expense (6) Other Revenues & Expenses Interest Revenue (6) Interest Expense (6)

Chapter Seven Questions

1. Define the term accounts receivable.

2. What are the main sources of resources for retail or merchandising companies? Give two examples of merchandising companies.

3. What are the main sources of resources for manufacturing companies? Give two examples of manufacturing companies.

4. What is the name of the account in which service companies record revenues?

5. What is the name of the account in which merchandising companies and manufacturing companies record revenues?

6. Why do merchandising companies allow customers to return products?

7. What is the name of the account in which the sales prices of returned products are recorded?

8. What is a sales allowance and why do merchandising companies grant them to customers?

9. What is the name of the account in which sales allowances are recorded?

10. Define the term net sales. Ch. 7: Accounts Receivable 19

11. What is the most important use of accounts receivable?

12. Why do companies pledge their accounts receivable?

13. What does it mean when a company factors its accounts receivable?

14. Define the term uncollectible accounts expense.

15. Describe the contents of an accounts receivable subsidiary ledger.

16. List two uses of an accounts receivable subsidiary ledger.

17. Define the term contra asset account and give an example of one.

Chapter Seven Exercises

Exercise 7.1: Analyzing Potential Customers

Since it was founded 15 years ago, the Blair Corporation has not offered any credit to customers, but has sold its products for cash. For the last five years, the Blair Corporation sales averaged $60,000 per year. Its cost of goods sold was approximately 40% of sales, its operating expenses were 35% of sales, and its income taxes expense averaged 35% of income before taxes. The Blair Corporation is considering expanding sales by $20,000 per year by selling on credit. The company predicts its cost and expense percentages will remain the same, but only 95% of the credit sales will be able to be collected.

1. Determine the company's expected total sales for the coming year.

2. Determine the company's expected cost of goods sold for the coming year.

3. Determine the company's expected gross profit.

4. Determine the company's expected uncollectible accounts expense.

5. Determine the company's expected total operating expenses (including its uncollectible accounts expense). 20 Ch. 7: Accounts Receivable

6. Determine the company's expected income before taxes.

7. Determine the company's expected income taxes expense.

8. Determine the company's expected net income.

9. Determine the dollar amount by which the company's net income is expected to increase through the $20,000 credit sales.

Exercise 7.2: Accounts Receivable Subsidiary Ledger

The Vincent Corporation maintains an accounts receivable subsidiary ledger from which the following information was obtained.

Customer: Shah Customer Number: 6785 Date Description Debits Credits Balance 8/1 Balance 3,233.04 8/12 Sales invoice 710 1,358.92 4,591.96 8/24 Payment received 2,500.00 2,091.96

During September, the Vincent Corporation engaged in the following transactions with Shah. September 7, credit sales of $945.78 (invoice number 985), September 15, cash received $1,500, and September 27, credit sales of $1,322.84 (invoice number 1049).

1. Update customer Shah's account in the Vincent Corporation's accounts receivable subsidiary ledger.

Customer: Shah Customer Number: 6785 Date Description Debits Credits Balance 8/1 Balance 3,233.04 8/12 Sales invoice 710 1,358.92 4,591.96 8/24 Payment received 2,500.00 2,091.96

2. If on September 30, the Vincent Corporation were to send statements of account to its customers requesting payment of the dollar amounts owed to the Vincent Corporation, determine the dollar amount Shah would be requested to pay. Ch. 7: Accounts Receivable 21

Exercise 7.3: Uncollectible Accounts Expense

The Hovanasian Corporation uses the percentage of sales method to estimate its uncollectible accounts expense. An analysis of its accounts receivable revealed the following.

Accounts Receivable Year Credit Sales Judged Uncollectible 5 $2,400,000 $108,000 4 2,250,000 87,750 3 2,100,000 88,200 2 2,000,000 80,000 1 1,950,000 74,750

1. Determine the percentage of credit sales the Hovanasian was unable to collect over the 5-year time period.

2. Using the percentage calculated in part 1, determine the uncollectible accounts expense the company's would record in year 6 if credit sales are $2,700,000.

3. Prepare the journal entry to record the company's year 6 uncollectible accounts expense. Before you prepare the journal entry, determine the transaction's effects on the company's resources and sources of resources.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity

Posting Date Description Ref. Debits Credits Dec. 31

Exercise 7.4: Accounts Receivable Transactions

Prepare the journal entries required to record the following May transactions of the Khakeo Corporation. Before you prepare each journal entry, determine the transaction's effects on the company's resources and sources of resources.

May 15: Cash sales for the first half of May totaled $365,000.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity 22 Ch. 7: Accounts Receivable

Posting Date Description Ref. Debits Credits May 15

May 15: Credit sales for the first half of May totaled $290,000.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity

Posting Date Description Ref. Debits Credits May 15

May 15: $185,000 cash was received from customers who purchased products from the company prior to May 16.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity

Posting Date Description Ref. Debits Credits May 15

May 15: Credit customers returned for credit products sold to them for $4,000.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity

Posting Date Description Ref. Debits Credits May 15 Ch. 7: Accounts Receivable 23 24 Ch. 7: Accounts Receivable

May 20: R. Kaberle paid the company $1,800 for products sold to him in two years ago. The company had considered the receivable to be uncollectible and had eliminated it last year.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity

Posting Date Description Ref. Debits Credits May 20

May 31: Cash sales for the second half of May totaled $390,000.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity

Posting Date Description Ref. Debits Credits May 31

May 31: Credit sales for the second half of May totaled $310,000.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity

Posting Date Description Ref. Debits Credits May 31 Ch. 7: Accounts Receivable 25

May 31: $205,000 cash was received from customers who purchased products from the company prior to May 31.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity

Posting Date Description Ref. Debits Credits May 31

May 31: Credit customers returned for credit products sold to them for $6,000.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity

Posting Date Description Ref. Debits Credits May 31

May 31: The company estimates the 4% of credit sales will be uncollectible.

Sources of Sources of Sources of Total = Borrowed + Owner Invested + Management Generated Resources Resources Resources Resources Assets = Liabilities + Stockholders' Equity

Posting Date Description Ref. Debits Credits May 31 26 Ch. 7: Accounts Receivable

Exercise 7.5: Balance Sheet Reporting of Accounts Receivable

The following information was obtained from the El-Halaby Corporation's March 31 post-closing trial balance: accounts payable = $38,000, accounts receivable = $42,500, allowance for uncollectible accounts = $3,500, bonds payable, 4-years = $44,000, buildings = $87,000, cash = $8,000, common stock = $68,000, equipment = $29,000, income taxes payable = $6,000, merchandise inventory = $29,000, land = $6,000, prepaid insurance = $3,000, prepaid rent = $2,000, retained earnings = $57,000, trucks = $12,000, and wages payable = $2,000.

1. Prepare the current assets section of the El-Halaby Corporation's March 31 balance sheet.

2. Determine the total dollar amount of March 31 statements of account the company would send to its customers.

3. Determine the dollar amount of cash the company expects to eventually collect from those customers who owed the company as of March 31.

Chapter Seven Problem

Problem 7.1: Accounts Receivable and Uncollectible Accounts Expense

The Pappastergion Merchandising Company is considering expanding sales by selling through catalogs. Currently the company sells products through its one store in Lowell, MA. The company’s income statement for October is presented below.

Pappastergion Merchandising Company Income Statement For the Month Ended October 31

Sales $312,500 Cost of Goods Sold $187,500 Gross Profit $125,000 Operating Expenses $87,500 Income from Operations $37,500 Other Revenues and (Expenses) $2,500 Income Before Taxes $40,000 Income Taxes Expense $14,000 Net Income $26,000 Ch. 7: Accounts Receivable 27

The company expects catalog monthly sales of $25,000. The company’s gross profit percentage averages 40%. Store operating expenses average 28% of store sales. Catalog operating expenses, other than uncollectible accounts expense, are expected to be 19% of catalog sales. The company’s income tax rate averages 35%. Although the company collects all its accounts receivable resulting from store sales, it expects to collect only 97% of catalog sales.

1. Prepare the company’s income statement for November as if the company had store sales of $350,000, other revenues of $2,600 (store operations only), and began its catalog operations on November 1.

Pappastergion Merchandising Company Income Statement For the Month Ended November 30

Store Catalog Total Sales $______$______$______Cost of Goods Sold $______$______$______Gross Profit $______$______$______Operating Expenses $______$______$______Income from Operations $______$______$______Other Revenues and (Expenses) $______$ 0 $______Income Before Taxes $ 44,600 $______$______Income Taxes Expense $______$______$______Net Income $______$______$ 31,915

2. Would you advise the Pappastergion Merchandising Company to expand sales by selling through catalogs? $______. Why or why not?

The Pappastergion Merchandising Company’s December 31 balance sheet contained the following information.

Assets Current Assets Cash $10,000 Accounts Receivable $27,500 Allowance for Uncollectible Accounts $1,500 $26,000 Merchandise Inventory $45,000 Supplies $1,125 Prepaid Insurance $2,250

3. If the Pappastergion Merchandising Company were to send invoices to its December 31 customers, what is the total dollar amount of invoices the company would send? $______.

4. If the Pappastergion Merchandising Company were to predict the dollar amount of cash it would receive from collecting its December 31 accounts receivable, what is the total dollar amount of cash the company would predict it would receive? $______.