Tax Form 1120-H

DARCO 2/01

Homeowner associations are required to file tax returns, even when no taxes are due. Most qualify to use Form 1120-H. They may also use Form 1120 which could result in lower taxes when interest income is greater than $1500. The audit activity for Forms1120 is almost nonexistent; however 15 associations in San Diego and 12 in Florida were audited a few years ago. All of these Associations filed Form 1120 and were found to have erred. They paid more in IRS penalties plus taxes than they would have paid in taxes using Form 1120-H with reasonable deductions.

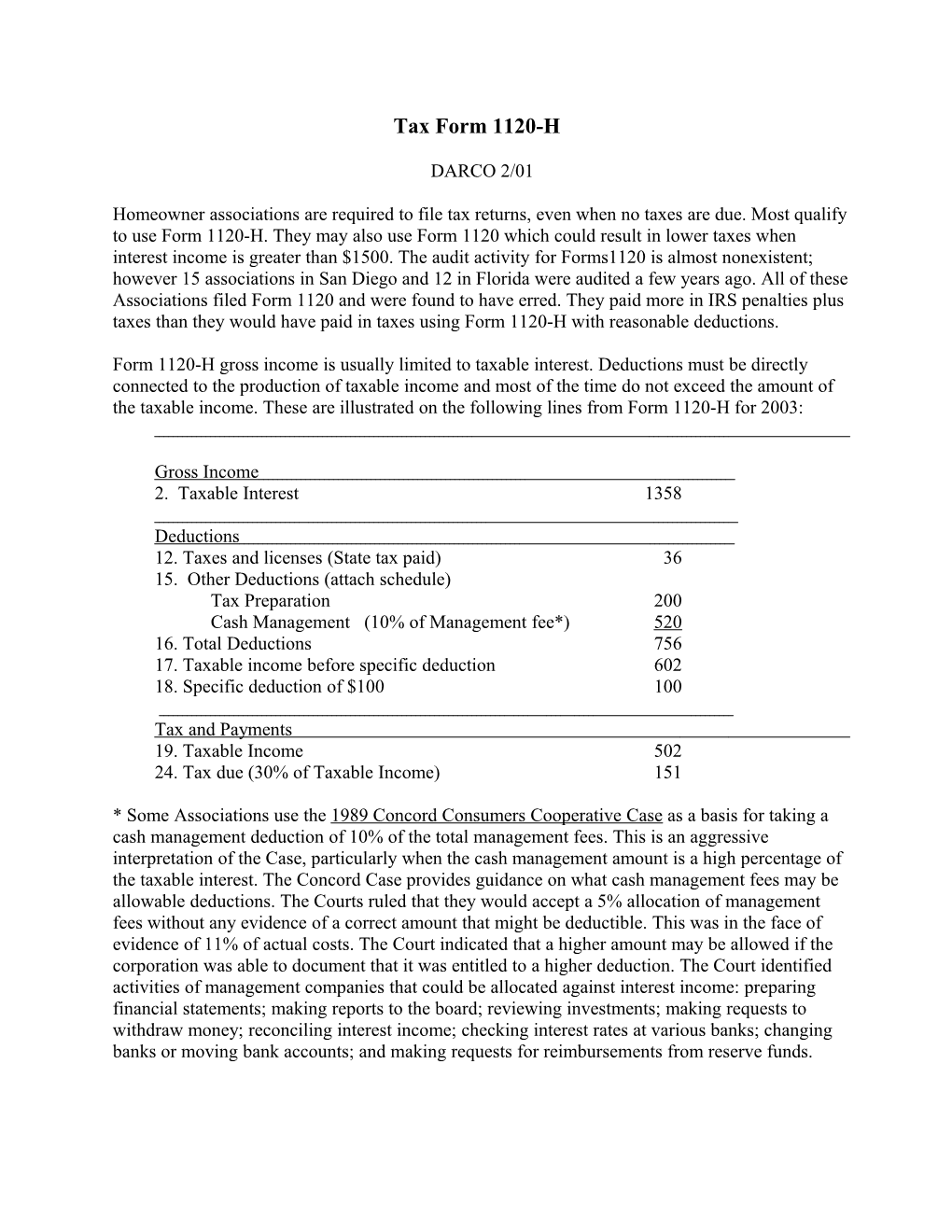

Form 1120-H gross income is usually limited to taxable interest. Deductions must be directly connected to the production of taxable income and most of the time do not exceed the amount of the taxable income. These are illustrated on the following lines from Form 1120-H for 2003:

Gross Income 2. Taxable Interest 1358

Deductions 12. Taxes and licenses (State tax paid) 36 15. Other Deductions (attach schedule) Tax Preparation 200 Cash Management (10% of Management fee*) 520 16. Total Deductions 756 17. Taxable income before specific deduction 602 18. Specific deduction of $100 100

Tax and Payments 19. Taxable Income 502 24. Tax due (30% of Taxable Income) 151

* Some Associations use the 1989 Concord Consumers Cooperative Case as a basis for taking a cash management deduction of 10% of the total management fees. This is an aggressive interpretation of the Case, particularly when the cash management amount is a high percentage of the taxable interest. The Concord Case provides guidance on what cash management fees may be allowable deductions. The Courts ruled that they would accept a 5% allocation of management fees without any evidence of a correct amount that might be deductible. This was in the face of evidence of 11% of actual costs. The Court indicated that a higher amount may be allowed if the corporation was able to document that it was entitled to a higher deduction. The Court identified activities of management companies that could be allocated against interest income: preparing financial statements; making reports to the board; reviewing investments; making requests to withdraw money; reconciling interest income; checking interest rates at various banks; changing banks or moving bank accounts; and making requests for reimbursements from reserve funds. Reference: CAI Ledger Quarterly, Fall 2000 issue