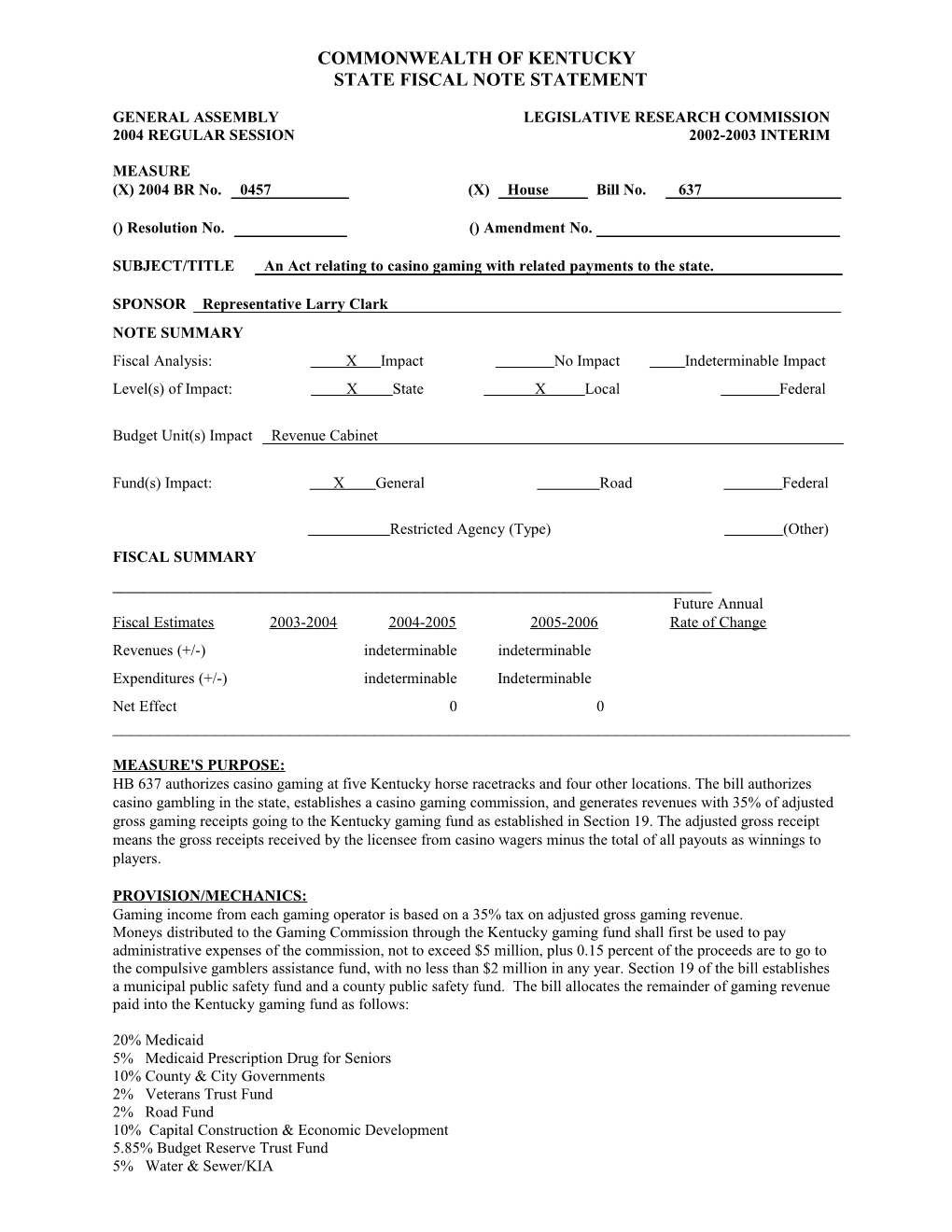

COMMONWEALTH OF KENTUCKY STATE FISCAL NOTE STATEMENT

GENERAL ASSEMBLY LEGISLATIVE RESEARCH COMMISSION 2004 REGULAR SESSION 2002-2003 INTERIM

MEASURE (X) 2004 BR No. 0457 (X) House Bill No. 637

() Resolution No. () Amendment No.

SUBJECT/TITLE An Act relating to casino gaming with related payments to the state.

SPONSOR Representative Larry Clark NOTE SUMMARY Fiscal Analysis: X Impact No Impact Indeterminable Impact Level(s) of Impact: X State X Local Federal

Budget Unit(s) Impact Revenue Cabinet

Fund(s) Impact: X General Road Federal

Restricted Agency (Type) (Other) FISCAL SUMMARY ______Future Annual Fiscal Estimates 2003-2004 2004-2005 2005-2006 Rate of Change Revenues (+/-) indeterminable indeterminable Expenditures (+/-) indeterminable Indeterminable Net Effect 0 0 ______

MEASURE'S PURPOSE: HB 637 authorizes casino gaming at five Kentucky horse racetracks and four other locations. The bill authorizes casino gambling in the state, establishes a casino gaming commission, and generates revenues with 35% of adjusted gross gaming receipts going to the Kentucky gaming fund as established in Section 19. The adjusted gross receipt means the gross receipts received by the licensee from casino wagers minus the total of all payouts as winnings to players.

PROVISION/MECHANICS: Gaming income from each gaming operator is based on a 35% tax on adjusted gross gaming revenue. Moneys distributed to the Gaming Commission through the Kentucky gaming fund shall first be used to pay administrative expenses of the commission, not to exceed $5 million, plus 0.15 percent of the proceeds are to go to the compulsive gamblers assistance fund, with no less than $2 million in any year. Section 19 of the bill establishes a municipal public safety fund and a county public safety fund. The bill allocates the remainder of gaming revenue paid into the Kentucky gaming fund as follows:

20% Medicaid 5% Medicaid Prescription Drug for Seniors 10% County & City Governments 2% Veterans Trust Fund 2% Road Fund 10% Capital Construction & Economic Development 5.85% Budget Reserve Trust Fund 5% Water & Sewer/KIA 2004 RS-BR0457-HB637 March 5, 2004 Page 2 of 3

0.15% UofL Equine Program 40% Primary, Secondary, & Postsecondary Education

Moneys retained by the casino gaming licensees shall be used for purses and the thoroughbred and standard bred development funds. Racing associations holding a license shall set aside 13% of adjusted gross receipts for racing industry improvements including purse supplements. Casino license holders are to set aside 10% of adjusted gross receipts payable to the Kentucky Revenue Cabinet for deposit in the Kentucky horse racing equity fund.

FISCAL EXPLANATION: The bill requires the passage of a constitutional amendment. The provisions of the bill shall be void without passage of the amendment. Thus, no action on the bill is expected unless the amendment passes in November, 2004. The bill allows for the issuance of temporary licenses by the Gaming Commission for approved applicants. These temporary licenses will allow some applicants to establish temporary gaming facilities until sufficient time (no more than 2 years) have past in constructing permanent gambling facilities. The temporary license allows applicants to begin small scale operations until the capital construction of permanent facilities are completed, which is estimated to occur 12 to 18 months after a temporary license has been granted. Because it is not known how long it will take for the Governor to appoint the Gaming Commission, nor how long it will take for applicants to submit an application and receive approval from the commission, nor how much adjusted gross receipts will be generated by temporary operations the fiscal estimates for 2004-05 and 2005-06 are indeterminable.

The table below indicates the expected adjusted gross revenue, the amount generated by a 35% tax and the distribution of the casino gambling tax revenue after the first full year of operations. All dollar amounts are in millions of dollars. The adjusted gross receipts are estimated based on two main assumptions. First, significant capital investment will occur at each location and facilities will be built that are attract patrons from across the region. The second assumption is that participation in casino style gambling will increase over current participation rates.

Adjusted Gross 35% Tax Receipts First Full Year of Operations (est. $1,080 $378 CY2007) Administrative Cost $5 Gamblers Assistance fund $2 Subtotal $371 Medicaid $74.20 Seniors Prescription Drug $18.55 County & City Governments $37.10 Veterans Trust Fund $7.42 Road Fund $7.42 Capital Construction / Economic $37.10 BudgetDevelopment Reserve Trust Fund $21.70 Water & Sewer/KIA $18.55 UofL Equine Program $0.56 Education $148.40

DATA SOURCE(S) LRC staff; KRS; Assessment of the Economic and Social Impact of Expanded Gaming in the Commonwealth and Neighboring Region, Price Waterhouse Coopers; An Examination of Gaming Opportunities to Protect & Increase KLC Revenues & Dividends in the Face of Increasing Competition, Kentucky Lottery Commission; Gambling in Louisiana, A Benefit/Cost Analysis, The Louisiana Gaming Control Board; Casino Gaming in Missouri: The Spending Displacement Effect and Gaming's Net Economic Effect, Don Phares, University of Missouri, for The 2001 Missouri Economics Conference; additional LRC and general studies and news accounts; horse racetrack officials; Kentucky League of Cities and Kentucky Association of Counties officials; Legislative meetings

NOTE NO. 84 PREPARER Barry Boardman, Ph.D and Terry Jones REVIEW TJ DATE 03/05/04 2004 RS-BR0457-HB637 March 5, 2004 Page 3 of 3

LRC 2004-BR0457-HB637