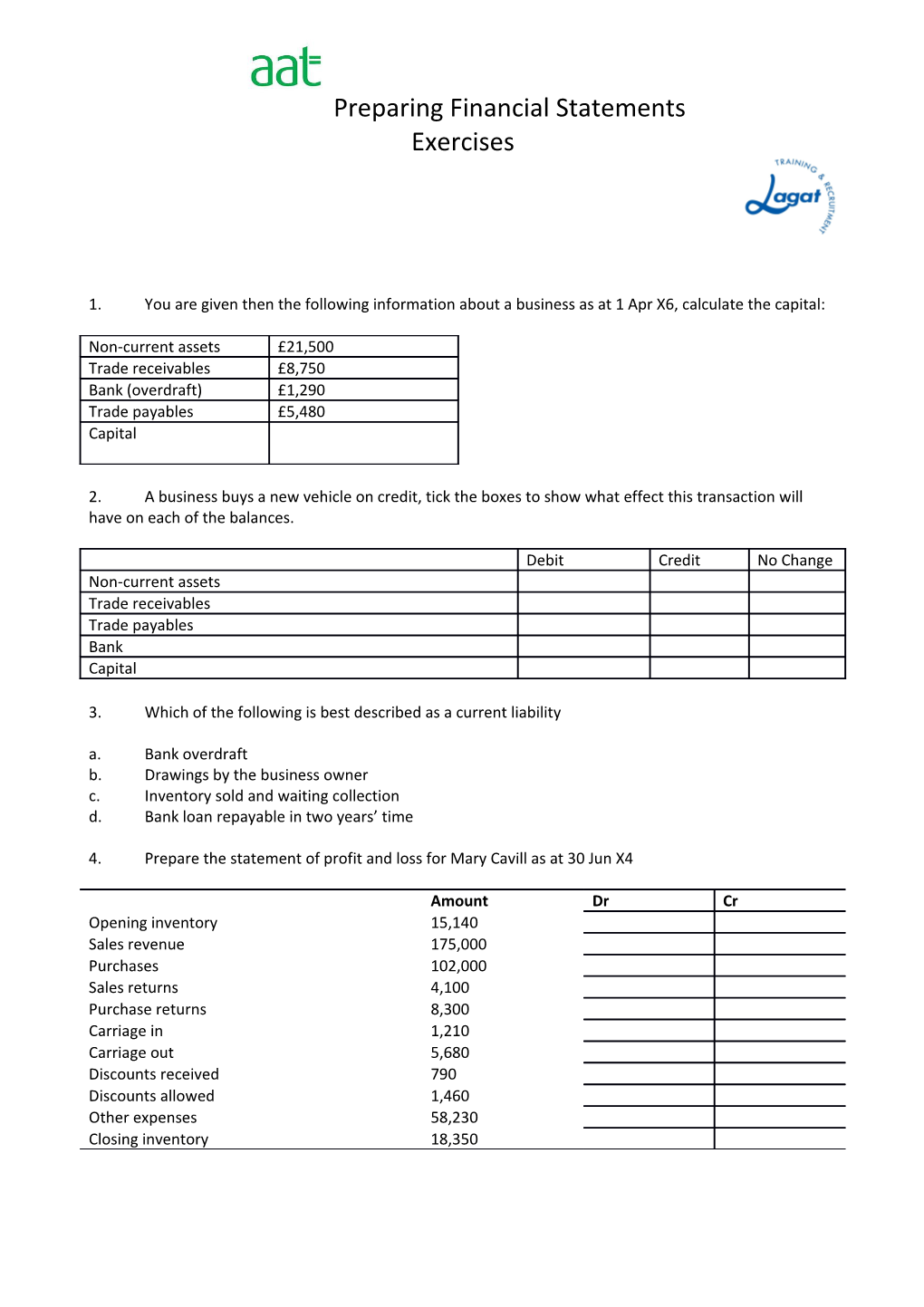

Preparing Financial Statements Exercises

1. You are given then the following information about a business as at 1 Apr X6, calculate the capital:

Non-current assets £21,500 Trade receivables £8,750 Bank (overdraft) £1,290 Trade payables £5,480 Capital

2. A business buys a new vehicle on credit, tick the boxes to show what effect this transaction will have on each of the balances.

Debit Credit No Change Non-current assets Trade receivables Trade payables Bank Capital

3. Which of the following is best described as a current liability a. Bank overdraft b. Drawings by the business owner c. Inventory sold and waiting collection d. Bank loan repayable in two years’ time

4. Prepare the statement of profit and loss for Mary Cavill as at 30 Jun X4

Amount Dr Cr Opening inventory 15,140 Sales revenue 175,000 Purchases 102,000 Sales returns 4,100 Purchase returns 8,300 Carriage in 1,210 Carriage out 5,680 Discounts received 790 Discounts allowed 1,460 Other expenses 58,230 Closing inventory 18,350 Preparing Financial Statements Exercises

5. The following trial balance has been extracted by Nick Severn on 31 Dec X7, prepare both the statement of financial position and statement of profit and loss.

Dr Cr Opening inventory 25,000 Purchases 210,000 Sales revenue 310,000 Administration expenses 12,400 Wages 41,000 Rent paid 7,500 Telephone 1,000 Interest paid 9,000 Travel expenses 1,100 Premises at cost 200,000 Machinery at cost 40,000 Trade receivables 31,000 Bank 900 Cash 100 Capital 150,000 Drawings 14,000 Loan from bank 100,000 PLCA 29,000 VAT 4,000 Closing inventory 21,000 21,000 614,000 614,000 Preparing Financial Statements Exercises

6. The following trial balance has been extracted by the bookkeeper of Kevin Brewer as at 30 Jun X7, prepare both the statement of financial position and statement of profit and loss.

Dr Cr Opening inventory 13,250 Capital 70,000 Premises at cost 65,000 Vehicles at cost 5,250 Purchases 55,000 Sales revenue 85,500 Administration expenses 850 Wages 9,220 Rent paid 1,200 Telephone 680 Interest paid 120 Travel expenses 330 Sales ledger control account 1,350 PLCA 6,400 VAT 1,150 Bank 2,100 Cash 600 Drawings 8,100 Closing inventories 18,100 18,100 181,500 181,500