Tax Information & Payments

Property Tax

TAX TIMELINE Mid-December – Tax Bills are mailed. Understanding your tax bill (link) If you do not receive your bill, you are responsible to look it up online (Guide to Online Tax & Property Data) or to contact the Treasurer’s Office (715-732-7430 or email) for the information. o Ask what you owe o Ask what mailing address we have on file. If it needs updating, please fill out the Address Update form and return to us.

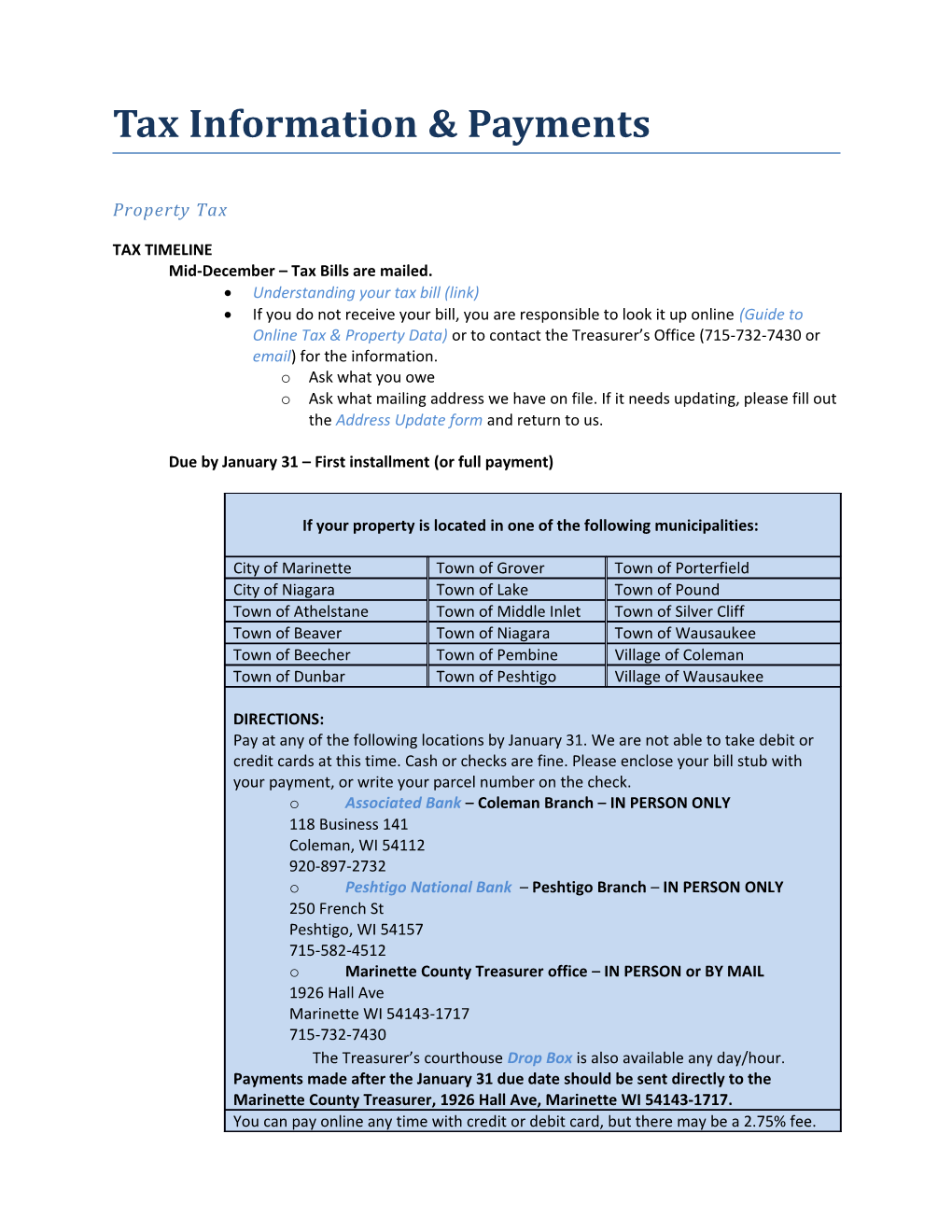

Due by January 31 – First installment (or full payment)

If your property is located in one of the following municipalities:

City of Marinette Town of Grover Town of Porterfield City of Niagara Town of Lake Town of Pound Town of Athelstane Town of Middle Inlet Town of Silver Cliff Town of Beaver Town of Niagara Town of Wausaukee Town of Beecher Town of Pembine Village of Coleman Town of Dunbar Town of Peshtigo Village of Wausaukee

DIRECTIONS: Pay at any of the following locations by January 31. We are not able to take debit or credit cards at this time. Cash or checks are fine. Please enclose your bill stub with your payment, or write your parcel number on the check. o Associated Bank – Coleman Branch – IN PERSON ONLY 118 Business 141 Coleman, WI 54112 920-897-2732 o Peshtigo National Bank – Peshtigo Branch – IN PERSON ONLY 250 French St Peshtigo, WI 54157 715-582-4512 o Marinette County Treasurer office – IN PERSON or BY MAIL 1926 Hall Ave Marinette WI 54143-1717 715-732-7430 The Treasurer’s courthouse Drop Box is also available any day/hour. Payments made after the January 31 due date should be sent directly to the Marinette County Treasurer, 1926 Hall Ave, Marinette WI 54143-1717. You can pay online any time with credit or debit card, but there may be a 2.75% fee. MC Jurisdiction Code: 5957 Important: Be sure to get a confirmation number verifying that your payments transaction is complete! (link to Guide to Online Tax & Property Data)

If your property is located in one of the following municipalities:

City of Peshtigo Town of Stephenson Village of Pound Town of Amberg Town of Wagner Town of Goodman Village of Crivitz

DIRECTIONS: Send your first (or full) installment to your local municipal treasurer. Their address will be on your tax bill. It is also available under “Municipalities” at www.marinettecounty.com. Payments made after the January 31 due date should be sent directly to the Marinette County Treasurer, 1926 Hall Ave, Marinette WI 54143-1717.

Postmarks of Jan. 31 or before qualify as “on time.” Late payments will have 1% interest added beginning February 1. One percent interest is added on the 1st day of each month.

Due by July 31 – Second installment

All Municipalities

DIRECTIONS: Send payment to Marinette County Treasurer. 1926 Hall Ave Marinette WI 54143-1717 You can pay online any time with credit or debit card, but there is a 2.75% fee. MC Jurisdiction Code: 5957 Important: Be sure to get a confirmation number verifying that your payments transaction is complete! (link to Official Payments)

Postmarks of July 31 or before qualify as “on time.” Late payments will have 1% interest added for each delinquent month, starting in February. So payments made in August will also have 7 months of interest added – February – August.

September – Reminders are mailed to anyone still owing on the current tax year. The reminder will also note if there are prior year taxes still due. Example of Reminder FORECLOSURE TIMELINE

April 1 – We begin the foreclosure process on parcels that are 3 years delinquent. A $100 In-REM fee is attached to the bill. From this point forward, no personal checks are allowed. Payments must be made with certified funds, money orders, bank checks, cash, or online payments. August 31 – Tax year in foreclosure must be paid in full, or the property will proceed to court and final foreclosure. Example: April 1, 2017 – The foreclosure process will begin on parcels with delinquent 2013 taxes. A $100 In-REM fee will be added to the bill. August 31, 2017 – 2013 taxes and fees must be paid in full to prevent foreclosure. April 1, 2018 – The foreclosure process will begin on parcels with delinquent 2014 taxes. A $100 In-REM fee will be added to the bill. August 31, 2018 – 2014 taxes and fees must be paid in full to prevent foreclosure.