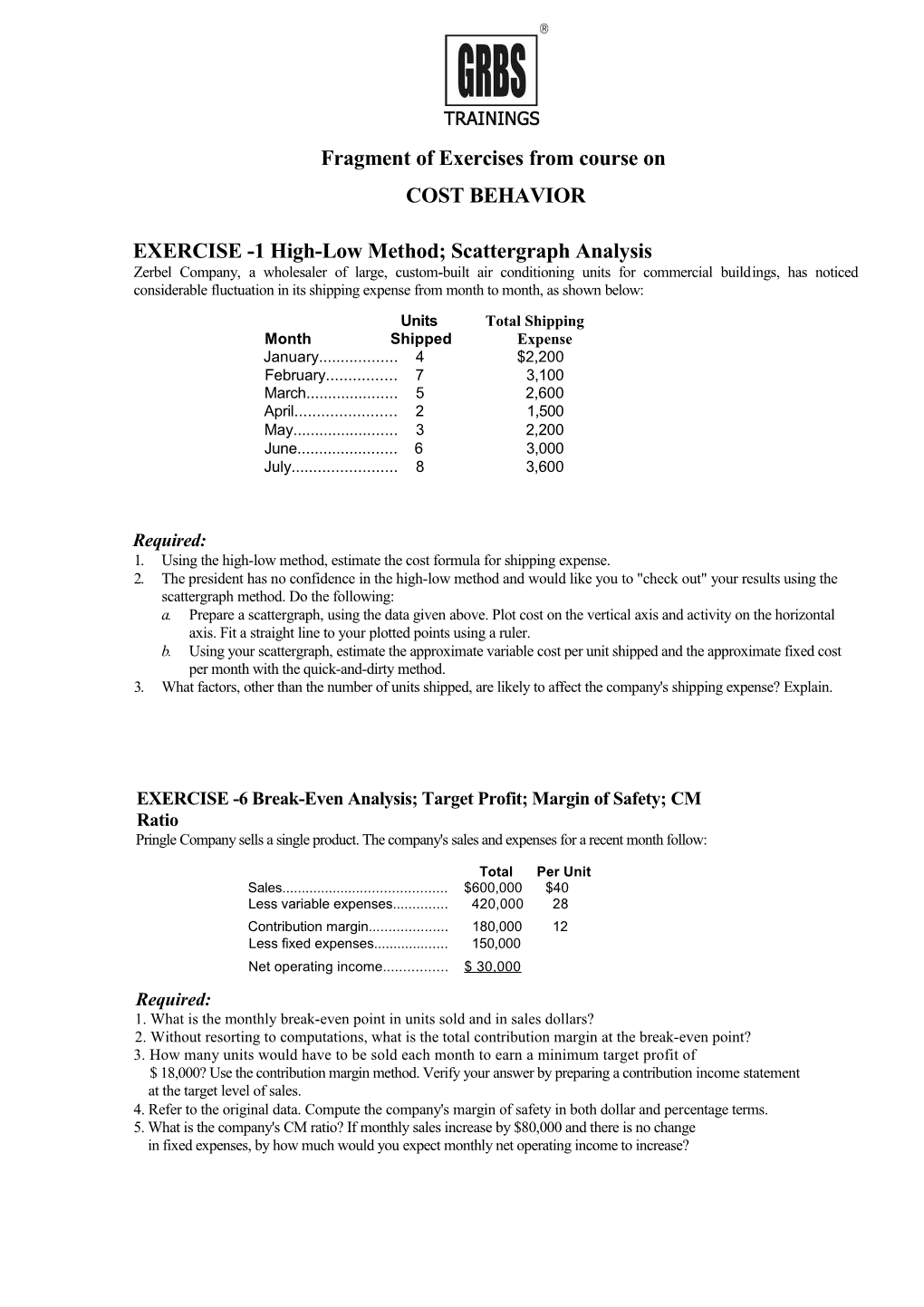

Fragment of Exercises from course on COST BEHAVIOR

EXERCISE -1 High-Low Method; Scattergraph Analysis Zerbel Company, a wholesaler of large, custom-built air conditioning units for commercial buildings, has noticed considerable fluctuation in its shipping expense from month to month, as shown below: Units Total Shipping Month Shipped Expense January...... 4 $2,200 February...... 7 3,100 March...... 5 2,600 April...... 2 1,500 May...... 3 2,200 June...... 6 3,000 July...... 8 3,600

Required: 1. Using the high-low method, estimate the cost formula for shipping expense. 2. The president has no confidence in the high-low method and would like you to "check out" your results using the scattergraph method. Do the following: a. Prepare a scattergraph, using the data given above. Plot cost on the vertical axis and activity on the horizontal axis. Fit a straight line to your plotted points using a ruler. b. Using your scattergraph, estimate the approximate variable cost per unit shipped and the approximate fixed cost per month with the quick-and-dirty method. 3. What factors, other than the number of units shipped, are likely to affect the company's shipping expense? Explain.

EXERCISE -6 Break-Even Analysis; Target Profit; Margin of Safety; CM Ratio Pringle Company sells a single product. The company's sales and expenses for a recent month follow:

Total Per Unit Sales...... $600,000 $40 Less variable expenses...... 420,000 28 Contribution margin...... 180,000 12 Less fixed expenses...... 150,000 Net operating income...... $ 30,000 Required: 1. What is the monthly break-even point in units sold and in sales dollars? 2. Without resorting to computations, what is the total contribution margin at the break-even point? 3. How many units would have to be sold each month to earn a minimum target profit of $ 18,000? Use the contribution margin method. Verify your answer by preparing a contribution income statement at the target level of sales. 4. Refer to the original data. Compute the company's margin of safety in both dollar and percentage terms. 5. What is the company's CM ratio? If monthly sales increase by $80,000 and there is no change in fixed expenses, by how much would you expect monthly net operating income to increase?