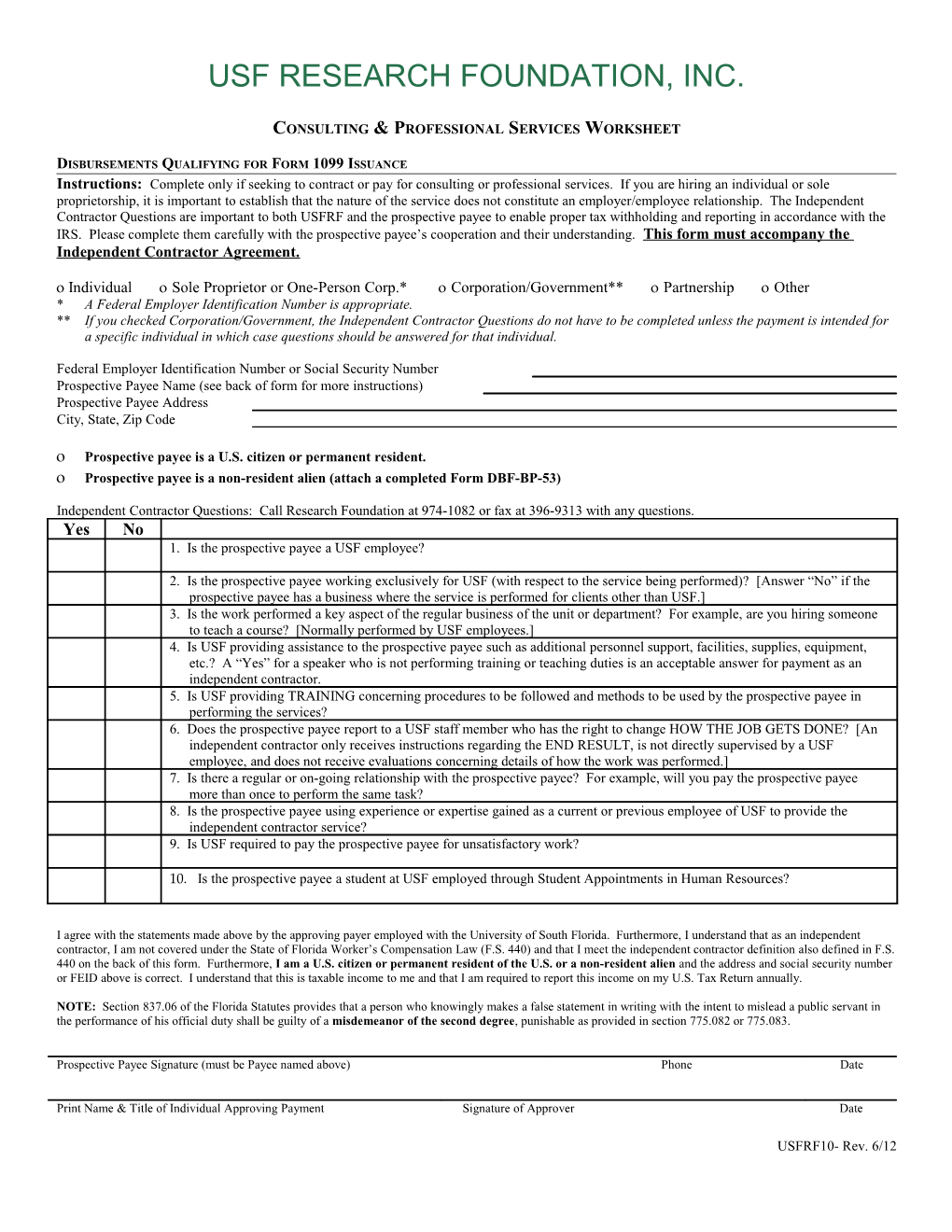

USF RESEARCH FOUNDATION, INC.

CONSULTING & PROFESSIONAL SERVICES WORKSHEET

DISBURSEMENTS QUALIFYING FOR FORM 1099 ISSUANCE Instructions: Complete only if seeking to contract or pay for consulting or professional services. If you are hiring an individual or sole proprietorship, it is important to establish that the nature of the service does not constitute an employer/employee relationship. The Independent Contractor Questions are important to both USFRF and the prospective payee to enable proper tax withholding and reporting in accordance with the IRS. Please complete them carefully with the prospective payee’s cooperation and their understanding. This form must accompany the Independent Contractor Agreement.

Individual Sole Proprietor or One-Person Corp.* Corporation/Government** Partnership Other * A Federal Employer Identification Number is appropriate. ** If you checked Corporation/Government, the Independent Contractor Questions do not have to be completed unless the payment is intended for a specific individual in which case questions should be answered for that individual.

Federal Employer Identification Number or Social Security Number Prospective Payee Name (see back of form for more instructions) Prospective Payee Address City, State, Zip Code

Prospective payee is a U.S. citizen or permanent resident. Prospective payee is a non-resident alien (attach a completed Form DBF-BP-53)

Independent Contractor Questions: Call Research Foundation at 974-1082 or fax at 396-9313 with any questions. Yes No 1. Is the prospective payee a USF employee?

2. Is the prospective payee working exclusively for USF (with respect to the service being performed)? [Answer “No” if the prospective payee has a business where the service is performed for clients other than USF.] 3. Is the work performed a key aspect of the regular business of the unit or department? For example, are you hiring someone to teach a course? [Normally performed by USF employees.] 4. Is USF providing assistance to the prospective payee such as additional personnel support, facilities, supplies, equipment, etc.? A “Yes” for a speaker who is not performing training or teaching duties is an acceptable answer for payment as an independent contractor. 5. Is USF providing TRAINING concerning procedures to be followed and methods to be used by the prospective payee in performing the services? 6. Does the prospective payee report to a USF staff member who has the right to change HOW THE JOB GETS DONE? [An independent contractor only receives instructions regarding the END RESULT, is not directly supervised by a USF employee, and does not receive evaluations concerning details of how the work was performed.] 7. Is there a regular or on-going relationship with the prospective payee? For example, will you pay the prospective payee more than once to perform the same task? 8. Is the prospective payee using experience or expertise gained as a current or previous employee of USF to provide the independent contractor service? 9. Is USF required to pay the prospective payee for unsatisfactory work?

10. Is the prospective payee a student at USF employed through Student Appointments in Human Resources?

I agree with the statements made above by the approving payer employed with the University of South Florida. Furthermore, I understand that as an independent contractor, I am not covered under the State of Florida Worker’s Compensation Law (F.S. 440) and that I meet the independent contractor definition also defined in F.S. 440 on the back of this form. Furthermore, I am a U.S. citizen or permanent resident of the U.S. or a non-resident alien and the address and social security number or FEID above is correct. I understand that this is taxable income to me and that I am required to report this income on my U.S. Tax Return annually.

NOTE: Section 837.06 of the Florida Statutes provides that a person who knowingly makes a false statement in writing with the intent to mislead a public servant in the performance of his official duty shall be guilty of a misdemeanor of the second degree, punishable as provided in section 775.082 or 775.083.

Prospective Payee Signature (must be Payee named above) Phone Date

Print Name & Title of Individual Approving Payment Signature of Approver Date

USFRF10- Rev. 6/12 An independent contractor under Chapter 440.02(13)(d), F.S.: a. Maintains a separate business with his/her work facility, truck, equipment, materials or similar accommodations; b. Holds or has applied for a federal employer identification number (FEIN), unless the independent contractor is a sole proprietor who is not required to obtain a federal employer identification number under state or federal requirements; c. Performs or agrees to perform specific services or work for specific amounts of money and controls the means of performing the services or work; d. Incurs the principal expenses related to the service or work that he/she performs or agrees to perform; e. Is responsible for the satisfactory completion of work or services that he/she performs or agrees to perform and is or could be held liable for a failure to complete the work or services; f. Receives compensation for work or services performed for a commission or on a per-job or competitive-bid basis; g. May realize a profit or suffer a loss in connection with performing work or services; h. Has continuing or recurring business liabilities or obligations; and i. Is successful in his/her business when his/her business has receipts greater than expenses.

Prospective Payee Name: If you are an individual, you must generally provide the name shown on your social security card. However, if you have changed your last name, for instance, due to marriage, without informing the Social Security Administration of the name change, please enter your first name, the last name shown on your social security card, and your new last name.

If you are a sole proprietor, you must furnish your individual name and either your SSN or FEIN. You may also enter your business name or “doing business as” name. Enter your name(s) as shown on your social security card and/or as it was used to apply for your FEIN on Form SS-4.

The Prospective Payee Signature and Signature of Approver must be original signatures. A facsimile will be accepted to begin the approval process, however, original signatures must be provided before payment is made.

TEMPORARY PERSONNEL AGENCIES which are corporations or partnerships only: 1. The agency will only fill out the worksheet once. 2. Business Office will keep a copy of the worksheet on file and will only issue payment to corporations with the form on file.

NOTE: Any payment made to a person who is a USF employee must be made through payroll. Approval to pay dual compensation is not approval to pay an individual as an independent contractor. Any payment made to a USF student employed through Student Appointments in Human Resources must be made through payroll.

Examples of Persons that are Employees of USF: 1. A person teaching a course for credit (even if the course in only one day long). 2. A person teaching a continuing education course not for credit (even if the course is only one day long). 3. A person teaching a workshop lasting more than one day. 4. A person employed by USF in any other capacity (including Student Appointments in Human Resources). 5. Persons performing services that are a key aspect of the regular business of a USF department (ex. aerobics instructor at Recreation Center, accountant in Finance & Accounting, computer specialist in Information Technologies, attorney in Office of General Counsel). 6. Former employees that return on a part-time basis to perform similar duties.

Examples of Persons that may be Independent Contractors: 1. A person who is not a USF employee presenting a brief lecture. 2. A person who is not a USF employee that is in the business of providing a service to the general public and provides the same service to USF (ex. move piano, string tennis racquet, CPA firm evaluating business practices).

ANY TAXES, INTEREST OR PENALTIES ASSESSED AGAINST USF OR USFRF BY THE IRS DUE TO MISCLASSIFICATION OF AN INDIVIDUAL AS AN INDEPENDENT CONTRACTOR WILL BE PAID BY THE DEPARTMENT AUTHORIZING THIS FORM.

USFRF10- Rev. 6/12