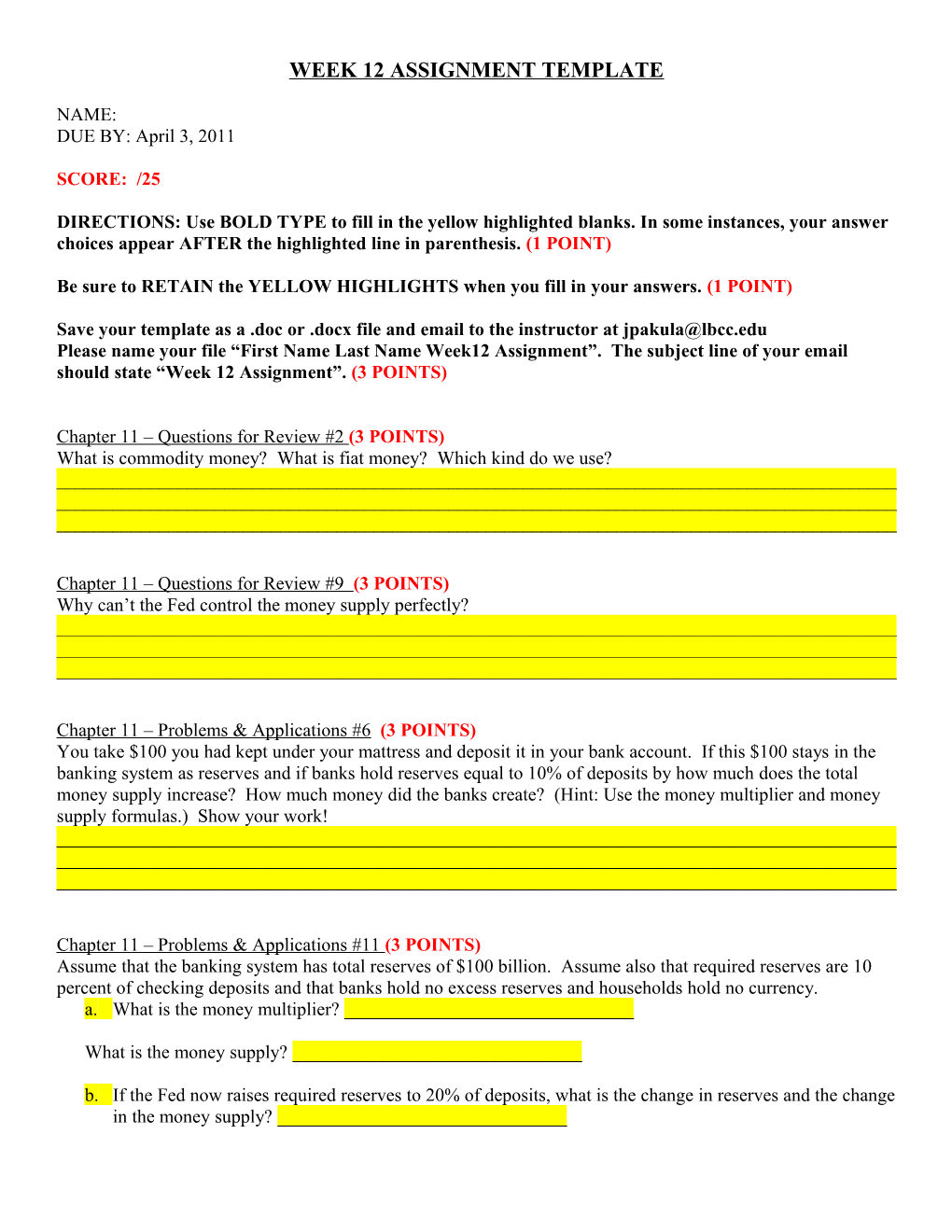

WEEK 12 ASSIGNMENT TEMPLATE

NAME: DUE BY: April 3, 2011

SCORE: /25

DIRECTIONS: Use BOLD TYPE to fill in the yellow highlighted blanks. In some instances, your answer choices appear AFTER the highlighted line in parenthesis. (1 POINT)

Be sure to RETAIN the YELLOW HIGHLIGHTS when you fill in your answers. (1 POINT)

Save your template as a .doc or .docx file and email to the instructor at [email protected] Please name your file “First Name Last Name Week12 Assignment”. The subject line of your email should state “Week 12 Assignment”. (3 POINTS)

Chapter 11 – Questions for Review #2 (3 POINTS) What is commodity money? What is fiat money? Which kind do we use? ______

Chapter 11 – Questions for Review #9 (3 POINTS) Why can’t the Fed control the money supply perfectly? ______

Chapter 11 – Problems & Applications #6 (3 POINTS) You take $100 you had kept under your mattress and deposit it in your bank account. If this $100 stays in the banking system as reserves and if banks hold reserves equal to 10% of deposits by how much does the total money supply increase? How much money did the banks create? (Hint: Use the money multiplier and money supply formulas.) Show your work! ______

Chapter 11 – Problems & Applications #11 (3 POINTS) Assume that the banking system has total reserves of $100 billion. Assume also that required reserves are 10 percent of checking deposits and that banks hold no excess reserves and households hold no currency. a. What is the money multiplier? ______

What is the money supply? ______

b. If the Fed now raises required reserves to 20% of deposits, what is the change in reserves and the change in the money supply? ______Chapter 12 – Questions for Review #3 (3 POINTS) Explain the difference between nominal and real variables and give two examples of each. According to the principle of monetary neutrality, which variables are affected by changes in the quantity of money? ______

Chapter 12 –Questions for Review #7 (2 POINTS) If inflation is less than expected, who benefits – debtors or creditors? Explain. ______

Chapter 12 – Problems & Applications #2 (3 POINTS) Suppose that changes in bank regulations expand the availability of credit cards so that people need to hold less cash. a. How does this event affect the demand for money? ______b. If the Fed does not respond to this event, what will happen to the price level? ______c. If the Fed wants to keep the price level stable, what should it do? ______