DIY Portfolio Management Support Club

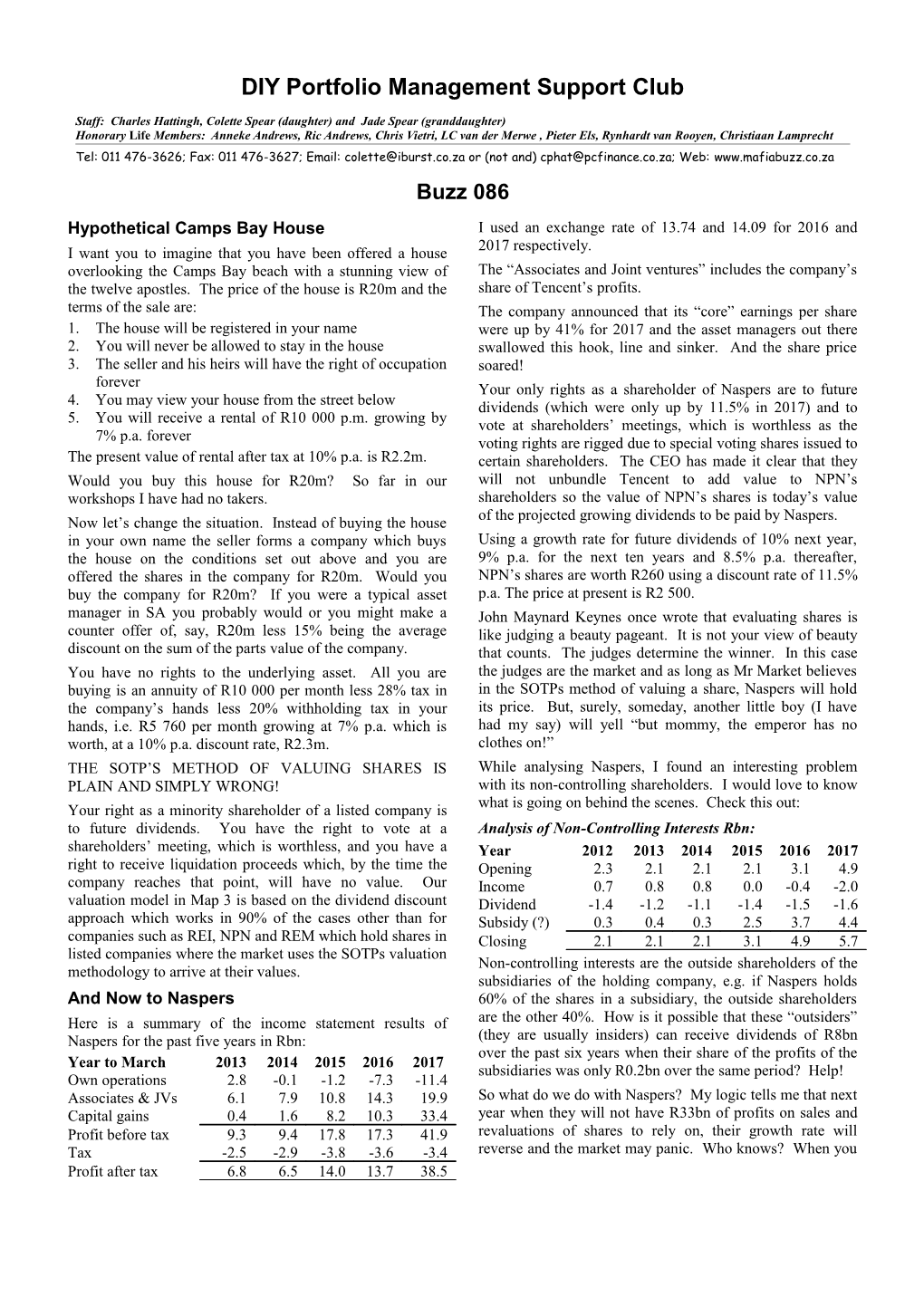

Staff: Charles Hattingh, Colette Spear (daughter) and Jade Spear (granddaughter) Honorary Life Members: Anneke Andrews, Ric Andrews, Chris Vietri, LC van der Merwe , Pieter Els, Rynhardt van Rooyen, Christiaan Lamprecht Tel: 011 476-3626; Fax: 011 476-3627; Email: [email protected] or (not and) [email protected]; Web: www.mafiabuzz.co.za Buzz 086 Hypothetical Camps Bay House I used an exchange rate of 13.74 and 14.09 for 2016 and 2017 respectively. I want you to imagine that you have been offered a house overlooking the Camps Bay beach with a stunning view of The “Associates and Joint ventures” includes the company’s the twelve apostles. The price of the house is R20m and the share of Tencent’s profits. terms of the sale are: The company announced that its “core” earnings per share 1. The house will be registered in your name were up by 41% for 2017 and the asset managers out there 2. You will never be allowed to stay in the house swallowed this hook, line and sinker. And the share price 3. The seller and his heirs will have the right of occupation soared! forever Your only rights as a shareholder of Naspers are to future 4. You may view your house from the street below dividends (which were only up by 11.5% in 2017) and to 5. You will receive a rental of R10 000 p.m. growing by vote at shareholders’ meetings, which is worthless as the 7% p.a. forever voting rights are rigged due to special voting shares issued to The present value of rental after tax at 10% p.a. is R2.2m. certain shareholders. The CEO has made it clear that they Would you buy this house for R20m? So far in our will not unbundle Tencent to add value to NPN’s workshops I have had no takers. shareholders so the value of NPN’s shares is today’s value of the projected growing dividends to be paid by Naspers. Now let’s change the situation. Instead of buying the house in your own name the seller forms a company which buys Using a growth rate for future dividends of 10% next year, the house on the conditions set out above and you are 9% p.a. for the next ten years and 8.5% p.a. thereafter, offered the shares in the company for R20m. Would you NPN’s shares are worth R260 using a discount rate of 11.5% buy the company for R20m? If you were a typical asset p.a. The price at present is R2 500. manager in SA you probably would or you might make a John Maynard Keynes once wrote that evaluating shares is counter offer of, say, R20m less 15% being the average like judging a beauty pageant. It is not your view of beauty discount on the sum of the parts value of the company. that counts. The judges determine the winner. In this case You have no rights to the underlying asset. All you are the judges are the market and as long as Mr Market believes buying is an annuity of R10 000 per month less 28% tax in in the SOTPs method of valuing a share, Naspers will hold the company’s hands less 20% withholding tax in your its price. But, surely, someday, another little boy (I have hands, i.e. R5 760 per month growing at 7% p.a. which is had my say) will yell “but mommy, the emperor has no worth, at a 10% p.a. discount rate, R2.3m. clothes on!” THE SOTP’S METHOD OF VALUING SHARES IS While analysing Naspers, I found an interesting problem PLAIN AND SIMPLY WRONG! with its non-controlling shareholders. I would love to know what is going on behind the scenes. Check this out: Your right as a minority shareholder of a listed company is to future dividends. You have the right to vote at a Analysis of Non-Controlling Interests Rbn: shareholders’ meeting, which is worthless, and you have a Year 2012 2013 2014 2015 2016 2017 right to receive liquidation proceeds which, by the time the Opening 2.3 2.1 2.1 2.1 3.1 4.9 company reaches that point, will have no value. Our Income 0.7 0.8 0.8 0.0 -0.4 -2.0 valuation model in Map 3 is based on the dividend discount Dividend -1.4 -1.2 -1.1 -1.4 -1.5 -1.6 approach which works in 90% of the cases other than for Subsidy (?) 0.3 0.4 0.3 2.5 3.7 4.4 companies such as REI, NPN and REM which hold shares in Closing 2.1 2.1 2.1 3.1 4.9 5.7 listed companies where the market uses the SOTPs valuation Non-controlling interests are the outside shareholders of the methodology to arrive at their values. subsidiaries of the holding company, e.g. if Naspers holds And Now to Naspers 60% of the shares in a subsidiary, the outside shareholders Here is a summary of the income statement results of are the other 40%. How is it possible that these “outsiders” Naspers for the past five years in Rbn: (they are usually insiders) can receive dividends of R8bn over the past six years when their share of the profits of the Year to March 2013 2014 2015 2016 2017 subsidiaries was only R0.2bn over the same period? Help! Own operations 2.8 -0.1 -1.2 -7.3 -11.4 Associates & JVs 6.1 7.9 10.8 14.3 19.9 So what do we do with Naspers? My logic tells me that next Capital gains 0.4 1.6 8.2 10.3 33.4 year when they will not have R33bn of profits on sales and Profit before tax 9.3 9.4 17.8 17.3 41.9 revaluations of shares to rely on, their growth rate will Tax -2.5 -2.9 -3.8 -3.6 -3.4 reverse and the market may panic. Who knows? When you Profit after tax 6.8 6.5 14.0 13.7 38.5 are sitting with these risks with the price where it is today, is it worth putting your head in the sand? Your call - me out. Kind regards, Charles Hattingh, July 2017

2