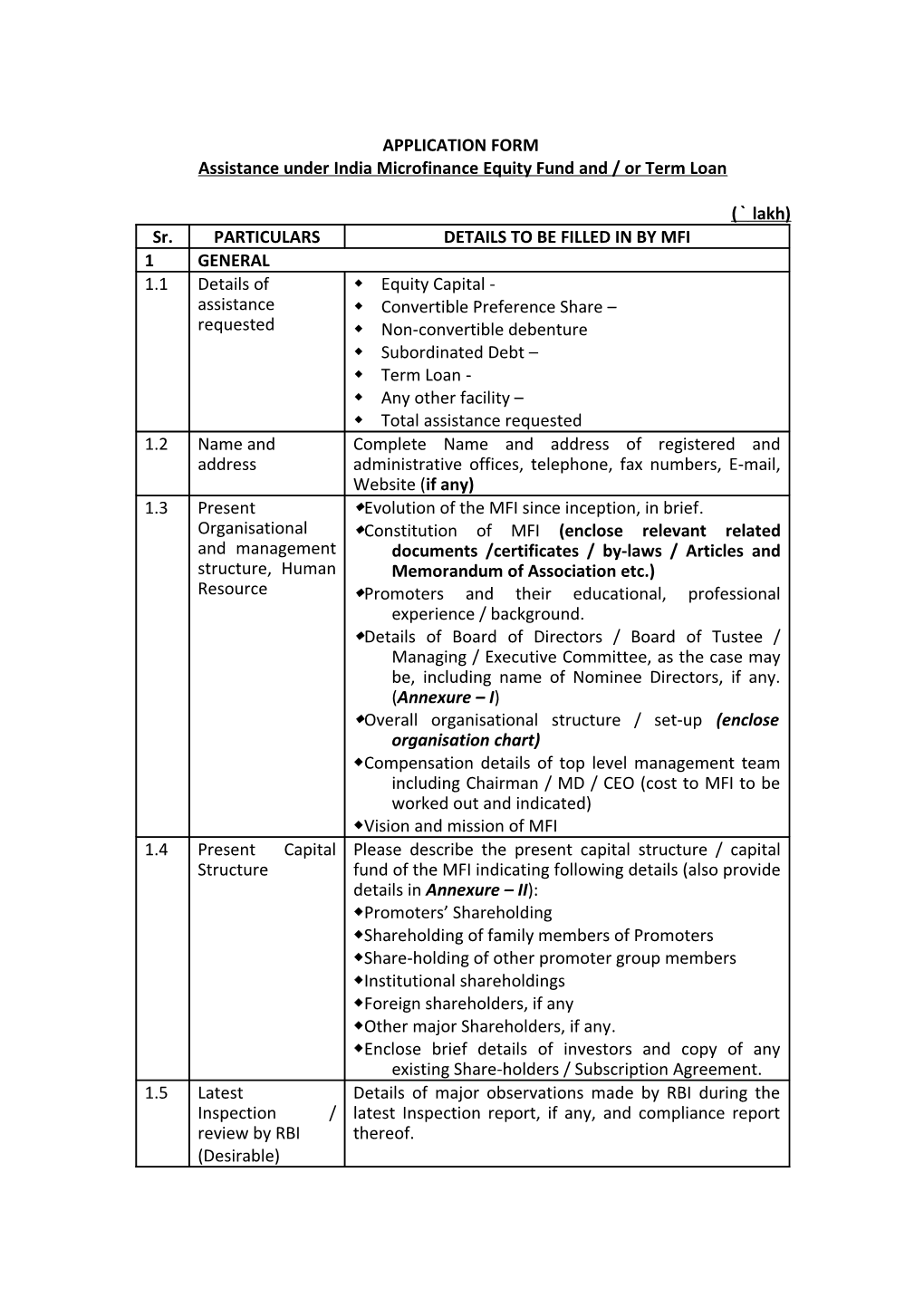

APPLICATION FORM Assistance under India Microfinance Equity Fund and / or Term Loan

( ` lakh) Sr. PARTICULARS DETAILS TO BE FILLED IN BY MFI 1 GENERAL 1.1 Details of w Equity Capital - assistance w Convertible Preference Share – requested w Non-convertible debenture w Subordinated Debt – w Term Loan - w Any other facility – w Total assistance requested 1.2 Name and Complete Name and address of registered and address administrative offices, telephone, fax numbers, E-mail, Website (if any) 1.3 Present wEvolution of the MFI since inception, in brief. Organisational wConstitution of MFI (enclose relevant related and management documents /certificates / by-laws / Articles and structure, Human Memorandum of Association etc.) Resource wPromoters and their educational, professional experience / background. wDetails of Board of Directors / Board of Tustee / Managing / Executive Committee, as the case may be, including name of Nominee Directors, if any. (Annexure – I) wOverall organisational structure / set-up (enclose organisation chart) wCompensation details of top level management team including Chairman / MD / CEO (cost to MFI to be worked out and indicated) wVision and mission of MFI 1.4 Present Capital Please describe the present capital structure / capital Structure fund of the MFI indicating following details (also provide details in Annexure – II): wPromoters’ Shareholding wShareholding of family members of Promoters wShare-holding of other promoter group members wInstitutional shareholdings wForeign shareholders, if any wOther major Shareholders, if any. wEnclose brief details of investors and copy of any existing Share-holders / Subscription Agreement. 1.5 Latest Details of major observations made by RBI during the Inspection / latest Inspection report, if any, and compliance report review by RBI thereof. (Desirable) APPL. FOR EQUITY/ PREF. SHARE/SUB-DEBT

1.6 Rating details Current and two previous rating(s) of MFI (if available), (CAR and / or its nature, validity period and name(s) of rating BLR) agency(ies) (enclose copy of complete rating report). 1.7 Name of Auditors. Name(s) of Statutory Auditor and Internal Auditor, if any (enclose copy of internal audit report at corporate level, if available). 1.8 Details of Credit Details of credit information bureau with which MFI information shares information of their borrowers. Total number of Bureau borrowers whose information has been shared and number of existing borrowers whose information has not been shared as on date. 1.9 Capital Adequacy wCapital Adequacy Ratio (CAR) as on the date of the last Ratio (CAR) audited accounts / Balance-sheet. wEnclose copy of last quarterly reporting to RBI, if any. 1.10 Compliance with w MFI’s compliance / comments on the following. Any RBI and other non-compliance to be specifically mentioned and guidelines (to be MFI’s plan / time-frame for compliance of the same furnished by all to be indicated. MFIs whether (i)RBI notification of May 03, 2011 on Bank Loans to NBFC-MFI or MFI (for non NBFC-MFI) / RBI notification dated otherwise) December 02, 2011 (for NBFC_MFIs). (ii)Compliance with Tenets of Responsible Lending. (iii)Any other matters. Information to be submitted in the Format provided in Annexure-III and a CA certificate indicating compliance with said RBI guidelines including for “Qualifying assets” “Pricing guidelines” and conditions stipulated for qualification as NBFC-MFI to be submitted (if applicable) 1.11 Compliance with Compliance with FEMA / FCRA, as applicable, in case of Forex guidelines foreign investment / funding / grants etc. 2 MICRO FINANCE OPERATIONS 2.1 Micro credit Detailed information on the present micro credit programme programme incorporating, inter alia, the following:- w No. of years in operation wGeographical spread – State-wise details of no. of villages, towns, districts, etc. covered and number of branch and other offices of MFI. wCredit delivery methodology:- Joint Liability Group (JLG) SHGs Individuals Others wTypes of loan products, purpose, duration, repayment frequency and loan sizes wRepayment terms of loans (weekly / fortnightly / monthly / quarterly etc.) wPresent interest rate charged to borrowers – on effective reducing balance basis. wIf effective rate is higher than 26% p.a. (on effective reducing balance basis), road-map to reduce the same to 26% p.a. of as specified by extant regulations.

2 APPL. FOR EQUITY/ PREF. SHARE/SUB-DEBT

wAny other fee / tax / charge / cost charged to / recovered from the members / borrowers wDetails of security deposit / margin taken / cash or any other collateral taken from the Borrowers, if any. wActivity profile of borrowers wWhether any group entrepreneurship activity is being supported. Indicate major activities. w% of outstanding loan portfolio eligible under Priority sector lending guidelines of RBI wPortfolio details as per Annexure - IV 2.2 Savings wWhether the MFI is permitted to mobilise savings from programme members / borrowers / others? w If MFI is permitted and have saving mobilization programme, a detailed write-up on the savings programme incorporating, inter alia, the following:- wType of savings products wFrequency of savings (weekly / fortnightly / monthly etc.) wMinimum prescribed amount for compulsory savings, if any wWhether the borrowers have withdrawal options wWhere and how are savings maintained. wAny other additional contribution from members viz. Group Fund etc. 2.3 Insurance Whether insurance services are being facilitated Services /provided by the MFI. If so, a brief write-up on the programme including the role of MFI in providing these services and various fee / charges recovered / charged by the MFI. 2.4 Other products Details of any new / non-conventional products and and services services like water, sanitation, energy efficiency, rural offered by the housing, training and skill development, advisory or any MFI support services officered by MFI to its borrowers. 2.4 Operational Please furnish operational data for last three years and data / details ageing schedule as per Annexure - V. 2.5 Sources of funds wIf credit facility / loans are being availed from banks / for micro credit financial institutions / other lenders for micro operations credit program. wGrant support or capital received in other form received during last three years. wPlease furnish details as per Annexure -VI. 2.6 Details of Details of previous loan and grant assistance received by previous SIDBI the MFI from SIDBI as per Annexure -VII. assistance. 2.7 Financial wAudited financial statements / Annual Reports of the performance MFI together with Schedules and Auditor’s Report for the last three years to be enclosed. wDetails of financial management systems to be given in annexure -

3 APPL. FOR EQUITY/ PREF. SHARE/SUB-DEBT

2.8 Management A brief write-up to be furnished on the following: Information wLevel of computerisation at Head Office / Branch office System / Regional offices. Type of hardware / software / network connectivity used. wWhether MIS is being maintained manually or is it computerized? wIs MIS adequate for the current level of operations and expected growth in the medium term? wDescribe how the MIS is used by the management to facilitate decision making. What reports are prepared / generated and at what frequency? wDoes the MIS allow an immediate assessment of the status of every loan? 2.9 Control Systems wDescribe the internal control system prevalent in the organisation. Describe the level of formalisation of the internal control systems (is the internal control system formally documented into manuals). Does the agency carry out internal audits. Who reviews the internal audits reports and does the management use such reports to facilitate decision making. wDoes the agency undergo external audits? Give details of the external auditors. Who reviews the report of the external auditors. Does the agency use external audit report to facilitate decision making. wA brief write up to be furnished on the control systems in place. 2.10 Details of Details of associated / group concerns giving their associated / business activities, promoters, share-holding / group concerns ownership pattern, Board and audited financial details for the last 3 years (enclose copy of audited financial statement for 3 years). 2.11 Details of Details of on-going litigations against MFI or its litigations, if any promoters / management group by borrowers, other lending institutions, govt. bodies / agencies or others, as the case may be. 3 PROPOSAL FOR PRESENT ASSISTANCE 3.1 Project details Detailed write-up on the proposed project incorporating, inter alia, the following:- wPurpose / proposed utilization of the assistance sought with break-up under various heads and timeline for utilization for various purposes. wIf the MFI is non-NBFC MFI, then (i)proposed road map, for the transformation process, if any, including, inter alia, the new legal form and advantages envisaged. (ii)The process to be adopted for conversion into new entity, appropriate mode of transfer of assets and liability to the new entity, tentative time frame for the completion of the transformation process, preferred equity

4 APPL. FOR EQUITY/ PREF. SHARE/SUB-DEBT

structure, etc. (iii)Comparative advantages of transformation [old vs. new legal entity] 3.2 Expected impact wExpected increase in outreach as a result of envisaged and benefits assistance. wQualitative and quantitative benefits expected to accrue including launch of new loan products, covering new geographies, adding new borrower, improving operational and financial efficiency etc. wAny other benefits / impact. wEnclose copy of Impact Assessment Study, if any. 3.3 Future wFinancial projections as per the format enclosed at projections Annexure -VIII. (The projected financial including cash flow should take into account repayment / redemption / exit period of SIDBI’s proposed assistance, assuming Bank may not exercise its option to convert assistance, wherever applicable, into equity of the MFI.) wA note on operation strategy to meet the financial projections given in Annexure -VIII. wOperation projection (Annexure –IX). DECLARATION I /We hereby certify that: a. all information furnished by me/ us above in this Application along with Project report/Appendix/Annexure/Statements and other papers/ documents enclosed are true and correct to the best of my/ our knowledge and belief; b. I/we have no borrowing arrangements for the applicant MFI and the associate concerns with any other bank/FI/ NBFC/ Institution, etc except as indicated in the application; c. I/We confirm that the MFI and none of the associate concerns/ promoters/ directors/ partners/ Trustees has / have any overdues or have entered into any restructuring or OTS with any bank/FI/ NBFC/ other institutions etc except as indicated in the application. d. there are no arrears of statutory dues and no government enquiries/ proceedings/ prosecution/ legal action are pending/ initiated against MFI / associate concerns/ promoters/ directors/ partners / Trustees except as indicated in the application; e. I/ We also confirm that I/ none of the promoters or directors or partners or Trustees have at any time declared themselves as insolvent f. I/We have no objection if SIDBI furnishes the information submitted by me/us to other banks / FIs/ CIBIL / RBI/ any other agency as may be deemed fit in connection with consideration of my/our application for financial assistance. g. I/We have no objection to SIDBI/its representatives making necessary enquiries/verifications (including in CIBIL or any other credit information agencies data base) while considering my/our application for financial assistance. h. I/We undertake to furnish all other information that may be required by SIDBI in connection with my/our application for financial assistance.

5 APPL. FOR EQUITY/ PREF. SHARE/SUB-DEBT

Encl.: As above

Place: (Signature with official stamp) Date: Name & Designation of Chief Executive

6 APPL. FOR EQUITY/ PREF. SHARE/SUB-DEBT

Annexure - I

List of Board Members and CEO along with brief background

Name & Designation Age Qualification Experience

7 APPL. FOR EQUITY/ PREF. SHARE/SUB-DEBT

Annexure - II Shareholding pattern

Name of the Shareholder No. of Face value Premium Percentage of shares Amount (`__) share holding

Total

Background of Investors

. . . .

8 APPL. FOR EQUITY/ PREF. SHARE/SUB-DEBT Annexure - III Compliance with Qualifying Assets, Credit Pricing, Fair Practices in Lending, Corporate Governance and T enets of Responsible Lending Practices (Ref. – RBI Notifications dated May 03, 2011 and December 02, 2011, Guidelines of IMEF and any subsequent modification thereof) Sl. No. Covenants Compliance / Remarks For NBFC-MFI 1 Minimum Net Owned Fund of `5 crore (`2 crore for NBFC- MFI registered in North East Region)

2 MFI has CAR of 15% (12% for FY 2012 for MFI with asset < `100 crore or MFI with loan portfolio of more than 25% in AP)

3 MFI has applied for / received new registration under revised guidelines for classification as NBFC-MFI

4 MFI submits / will submit Statutory Auditors Certificate also indicating that the MFI fulfils all conditions stipulated to be classified as an NBFC-MFI.

Qualifying Assets 1 The loan is extended to a borrower whose annual household income does not exceed `60,000 in rural areas and`1,20,000 in non-rural areas 2 The loan size does not exceed `35,000 for first cycle and `50,000 for subsequent cycles 3 The borrower’s total indebtedness does not exceed `50,000. 4 The loan tenure is not less than 24 months when the loan size is above`15,000 with prepayment without penalty 5 The loan has no collateral security 6 Aggregate amount of loan, extended for income generation activity, is not less than 75% of the total loans given by the MFIs 7 The loan is repayable by weekly, fortnightly or monthly instalments as per the Borrower’s choice 8 85% of total assets of the MFI are in the nature of “Qualifying Assets’’ 9 Only for NBFC-MFI - Remaining 15% of assets are in accordance with the regulations thereof. Pricing of Credit 1 MFIs has a margin cap of not more than 12% in respect of their loans as defined by RBI 2 MFI has an interest cap on individual loans at 26% per annum. Interest to be calculated on reducing balance basis 3 Processing fee does not exceed 1% of gross loan amount

4 Insurance premium is charged to Borrower as per actual and administrative charges as per IRDA guidelines. Fair Practices in Lending

9 APPL. FOR EQUITY/ PREF. SHARE/SUB-DEBT

1 There only three component in pricing of the loan – Interest, processing charges and Insurance premium including administrative charges as permissible under IRDA guidelines

2 There is no penalty charged on delayed payment

3 MFI shall not collect any security deposit / margin from the borrower

4 There is a standard format of loan agreement

5 Borrower’s loan card reflects all the five details as stipulated by RBI

6 Effective rate of interest charged by it is prominently displayed in all its offices, in the literature and on its web- site.

7 Complies with RBI guidelines on multiple-lending, Over- borrowing and Ghost-borrowers

8 MFI follows Non-Coercive methods of recovery as stipulated by RBI

9 MFI complies with RBI guidelines on Corporate Governance as applicable to it.

Responsible Lending Practices 1 Whether MFI obtains cash flows / examines repayment capacities of individual beneficiaries.

2 Whether any suitable grievance redressal mechanism is put in place by the MFI and both field level personnel as well as clients are aware of the same.

3 Whether MFI complies with KYC guidelines of RBI

4 Whether MFI employs any agent to run its microfinance operations and employs any coercive recovery methods.

5 Whether there is any overlap between beneficiaries of SHGs of banks and JLGs of the MFI.

6 Whether remuneration of senior management including CEO of the MFI is as per the accepted practice.

7 Whether furnishes or agrees to furnish financial and operational data in the specified format to the India Microfinance Platform (IMFP) within reasonable timelines and with accuracy.

10 APPL. FOR EQUITY/ PREF. SHARE/SUB-DEBT

8 Whether MFI has undergone / agrees to undergo a third party Code of Conduct Assessment with a view to assess the degree of adherence to the voluntary microfinance Code of Conduct through accredited agencies.

9 Whether MFI has undergone / agrees to undergo a Systems and Portfolio Audit involving detailed examination of operational systems and procedures, funds utilization, assessment of loan portfolio in respect of the risk parameters, finance as well as planning and control, etc. by an external agency.

10 Whether MFI ensures transparency and uniformity in calculating and reporting (to clients and in the public domain) the effective cost (on reducing balance basis) being charged to the ultimate beneficiaries.

11 Whether MFI has a Board / Management Committee approved note on recovery practices that are displayed in local language at each branch

12 Whether MFI has a Board / Management Committee approved strategy to check multiple lending / over indebtedness amongst clients, has implemented the same and thereafter obtains annual affirmation of the strategy by its Board.

13 Whether MFI furnishes regularly, accurate and comprehensive data about beneficiaries to Credit Bureaus.

14 Whether MFI participates and furnishes information to the Unique Identification (UID) initiative of the GOI or agrees to do so when asked upon , and

15 Whether it maintains a satisfactory financial management system, and prepares satisfactory financial statements in accordance with consistently applied Indian accounting standards as issued by the Institute of Chartered Accountants of India; and (ii) has such financial statements audited by independent auditors in accordance with consistently applied auditing standards generally accepted in India, and promptly furnishes the audited statements to SIDBI.

11 APPL. FOR EQUITY/ PREF. SHARE/SUB-DEBT

Annexure – IV Loan products, break up of portfolio, etc. of ______

Table A - Details of products

Name of Maximum loan Repayment Rate of interest Fees / product period Flat / reducing charges balance (%)

Table B - State-wise break up of portfolio

Name of State Value of portfolio (` lakh)

Table C - Activity-wise Outstanding Activity % Small business Animal Husbandry Service sector Agriculture and allied activities Others Total

Table D – Class / group classification of beneficiaries of the MFI

Class / Caste % Scheduled Castes Scheduled Tribes Other Backward Classes Minority communities Others Total

Table E – Urban / Semi-urban / Rural classification of beneficiaries MFI

12 APPL. FOR EQUITY/ PREF. SHARE/SUB-DEBT

Spread % Urban Semi-urban Rural Total

13 Annexure – V OPERATIONAL DATA

(` lakh) Sr. Particulars Performance for last three years FY ___ FY ___ FY ____ Latest performance Client details 1 No. of active members at the start of year 2 No. of active borrowers at the start of year 3 No. of active members at the end of year 4 No. of active borrowers at the end of year of which, ,

h men c i

h women w

f rural borrowers (men & women) o urban / semi-urban borrowers (men & women) 5 No. of savers at the end of year, if any Organisational details 6 No. of field offices / branches 7 Total staff strength ,

h field staff c i

h managerial staff w

f o Portfolio details (on-balance sheet) 8 No. of loans disbursed during the year 9 Amount of loans disbursed during the year 10 Principal due during the year 11 Principal recovered during the year

14 Sr. Particulars Performance for last three years FY ___ FY ___ FY ____ Latest performance 12 Recovery rate (%) (11/10) 13 Principal overdue (i.e. due but not received) 14 Portfolio in arrears (total outstanding of loans that have one or more payments in arrears) 15 No. of loans outstanding at the end of year 16 Gross loan outstanding at the end of year 17 Out of the above, loan for Income generating activities 18 Break-up of Income generating loan For Farm sector For non-farm sector For others 19 Amount of loans written off during the year, if any 20 Savings mobilized during the year 21 Savings withdrawn during the year 22 Balance savings at the end of year

15 AGE-WISE ANALYSIS OF ARREARS AS ON ______1

(` lakh) AGE NO. OF AMOUNT OF ARREARS PRINCIPAL LOANS OUTSTANDING PRINCIPAL INTEREST OTHERS TOTAL

Less than 30 days 31-60 days 61-90 days 91-180 days Beyond 180 days Total

1 Data to be furnished for the preceding quarter

16 Annexure – VI MICRO CREDIT PROGRAMME: ASSISTANCE RECEIVED TILL

I. Lender-wise outstanding loan for micro finance operations2 as on ______- (` lakh)

Sr. Name of bank / Nature of facility Amount Amount Amount Amount Interest Repayment Type of security Financial (Loan / sub-debt / sanctioned availed outstanding overdue, rate (%) period offered institution WC etc.) if any including moratorium

II. Agency wise grant support received during last three years (` lakh) Sr. Name of donor / financial Purpose Amt. sanctioned Amt. disbursed Amt. utilised institution / agency

III. Any other type of assistance received (Equity / Quasi-equity etc.)

2 Data to be furnished for the preceding quarter

17 Annexure – VII

DETAILS OF LOAN AND GRANT ASSISTANCE RECEIVED FROM SIDBI

I. LOAN FUNDS (` lakh) S.No Nature Loan Disbursement Loan Interest Rate Date Amount Date Amount outstanding

1 Loan-I 2 Loan-II 3 Loan-III 4 Loan-IV

II. CAPACITY BUILDING SUPPORT

S.No. Nature Sanction Disbursement Amount utilised Date Amount Date Amount 1 CB - 1 2 CB - 2 3 CB - 3

18 Annexure – VIII

PROJECTED FINANCIAL STATEMENTS (` lakh) Name of the MFI PROFITABILITY ESTIMATES (on-balance sheet portfolio) Current FY XXX1 FY XXX2 FY XXX3 FY XXX4 FY XXX5

year 1 Interest Income from Micro Credit operations (on-balance sheet portfolio) 2 Processing fee/ charges 3 Interest on TDRs / investments 4 Income from assigned / managed loans 5 Other non-operational income A TOTAL FINANCIAL INCOME ( 1 to 5) 6 Interest expense on borrowings 7 Interest & Commission on deposits 8 Others fees/charges/upfront fee B TOTAL FINANCIAL COSTS (6+7+8) 9 GROSS FINANCIAL MARGIN (A-B) 10 Loan Loss Provision C NET FINANCIAL MARGIN (9-10) 11 Commission payment 12 Personnel Expenses 13 Depreciation 14 Administrative Expenses D Total Operating Expenses (11 to 14) E NET OPERATING PROFIT [C-D] F Corporate Tax (if applicable) G PAT (E-F)

19 Name of MFI (` lakh) Cash flow estimates (on-balance sheet portfolio) Current FY XXX1 FY XXX2 FY XXX3 FY XXX4 FY XXX5 year Inflow Increase in Share Capital/Corpus Net Cash accruals from operations Borrowings from Banks / FI /SIDBI / others Principal repayment received from borrowers, which are not overdue Overdue repayment received from borrowers Increase in Savings Decrease in Investments Others O Total Inflow Outflow Capital Expenditure Disbursements to borrowers Term loan repayment Inv in TDR - for SIDBI TL and other lenders Decrease in other liabilities Refund of cash Collateral / savings Redemption of preference share / sub-debt Others P Total Outflow Q Opening Balance R Surplus / Deficit (O-P) Closing balance (Q+R)

20 Name of MFI (` lakh)

PROJECTED BALANCE SHEET (on-balance sheet portfolio)

Curren Mar. Mar. Mar. Mar. Mar. XXX5 t year XXX1 XXX2 XXX3 XXX4 Share Capital/Corpus/ Donated Equity Preference Share Capital General Reserves & Surplus Redemption Reserve Loan Loss Reserve Term loan (SIDBI+ others) Other Borrowings Cash Collateral / Security Margin received Savings from clients Other Liabilities S Total Liabilities Gross fixed assets Less Depreciation Net fixed assets Micro credit loans extended Cash & bank balance Other current assets Investments T Total ASSETS

21 Annexure – IX

Projected Operational details as on (On-balance sheet)

( ` lakh)

Current year Mar. XXX1 Mar. XXX2 Mar. XXX3 Mar. XXX4 Mar. XXX5 No. of Members No. of Borrowers Average Loan size Projected Portfolio No. of field staff No of total staff No of branches

22