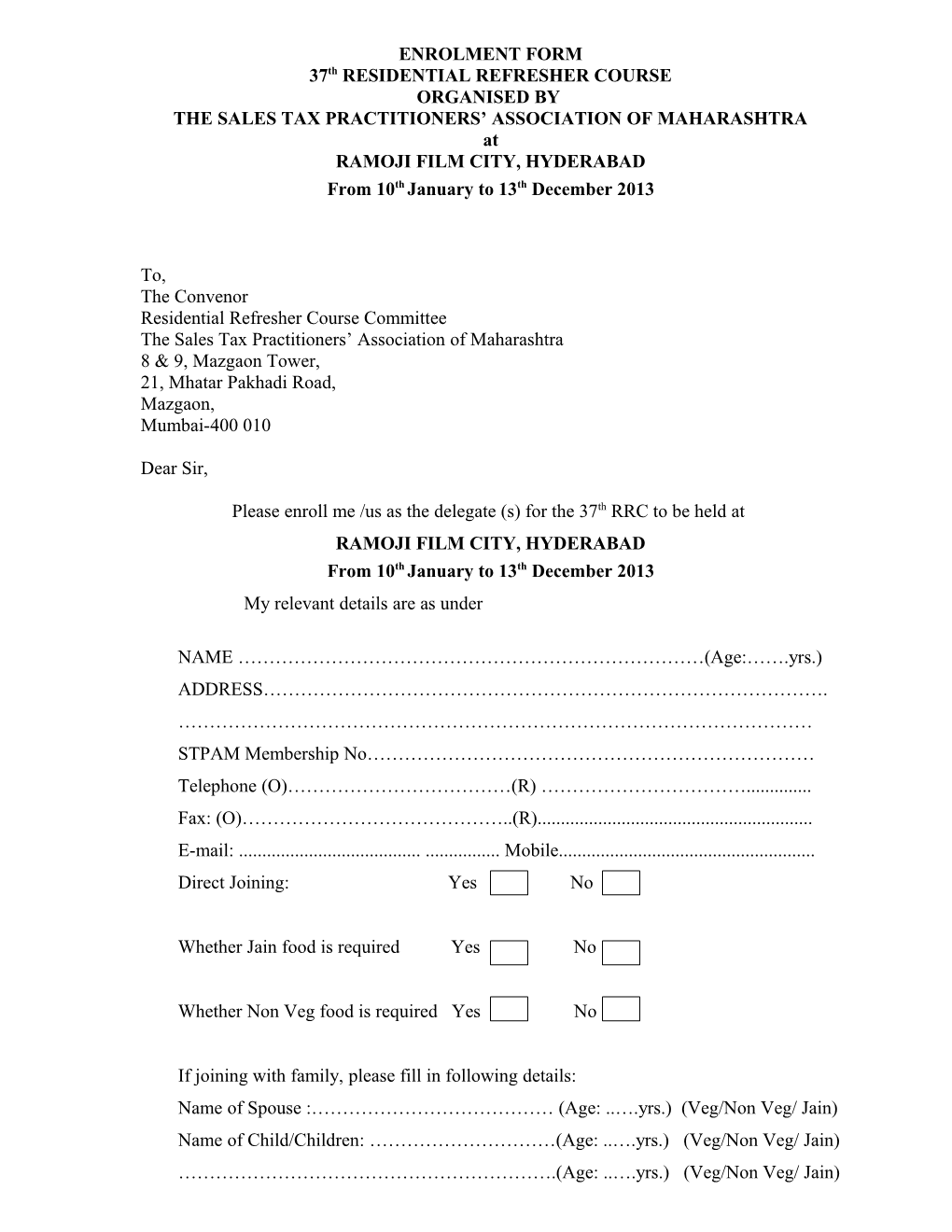

ENROLMENT FORM 37th RESIDENTIAL REFRESHER COURSE ORGANISED BY THE SALES TAX PRACTITIONERS’ ASSOCIATION OF MAHARASHTRA at RAMOJI FILM CITY, HYDERABAD From 10th January to 13th December 2013

To, The Convenor Residential Refresher Course Committee The Sales Tax Practitioners’ Association of Maharashtra 8 & 9, Mazgaon Tower, 21, Mhatar Pakhadi Road, Mazgaon, Mumbai-400 010

Dear Sir,

Please enroll me /us as the delegate (s) for the 37th RRC to be held at RAMOJI FILM CITY, HYDERABAD From 10th January to 13th December 2013 My relevant details are as under

NAME …………………………………………………………………(Age:…….yrs.) ADDRESS………………………………………………………………………………. ………………………………………………………………………………………… STPAM Membership No……………………………………………………………… Telephone (O)………………………………(R) ……………………………...... Fax: (O)……………………………………..(R)...... E-mail: ...... Mobile...... Direct Joining: Yes No

Whether Jain food is required Yes No

Whether Non Veg food is required Yes No

If joining with family, please fill in following details: Name of Spouse :………………………………… (Age: ..….yrs.) (Veg/Non Veg/ Jain) Name of Child/Children: …………………………(Age: ..….yrs.) (Veg/Non Veg/ Jain) …………………………………………………….(Age: ..….yrs.) (Veg/Non Veg/ Jain) My preference of Room Partner (in case of not accompanied by a family member) 1. ……………………………………………………………………………………….. 2. ………………………………………………………………………………………..

Signature Enrolment Fee per person Sr. Amount No.of Total No persons Amount payable 1 Cost of RRC inclusion of Train Fare – Rs. 16,500/- Per Member 2 Direct Joining – Per Member Rs. 14,500/- 3 Direct Joining – Per Child ( 5 to 11 years) – Rs. 9,000/- Member

4 Cost of RRC inclusion of Train Fare – Rs. 17,250/- Per Non-Member 5 Direct Joining – Per Non- Member Rs. 15,250/- 6 Direct Joining – Per Child ( 5 to 11 years) Rs. 9,750/- (Non-Member)

Note :- Above delegate fees includes Service Tax @ 12.36%. Member means member of our Association along with his/her Spouse and Children only.

Cheque/ D.D. No……………Bank………………………………………….Branch……………… Dated…………………… Note: 1. Please tick/fill in the appropriate boxes 2. Outstation members are requested to make the payment only by D.D. drawn in favour of “The Sales Tax Practitioners’ Association of Maharashtra”, payable at Mumbai.