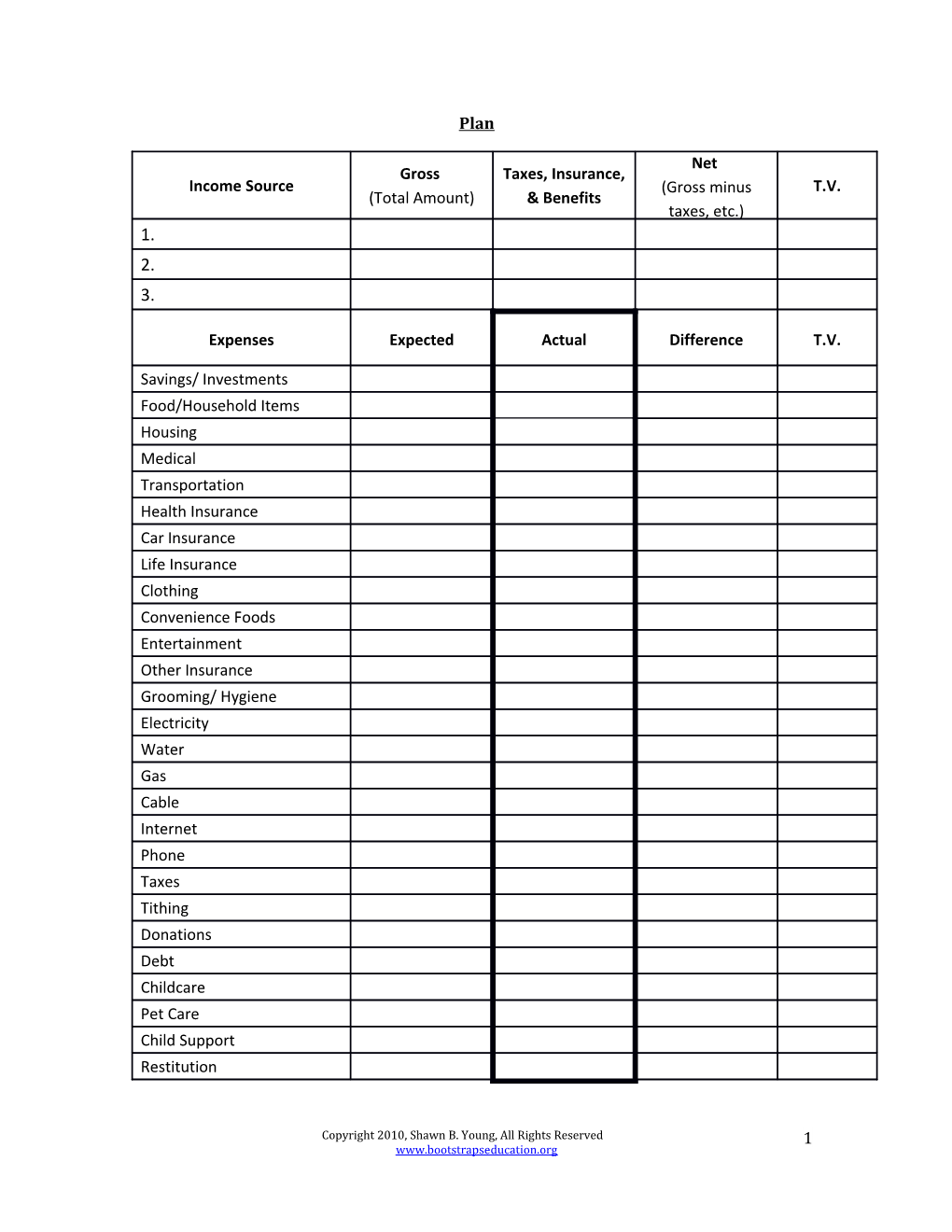

Plan

Net Gross Taxes, Insurance, Income Source (Gross minus T.V. (Total Amount) & Benefits taxes, etc.) 1. 2. 3.

Expenses Expected Actual Difference T.V.

Savings/ Investments Food/Household Items Housing Medical Transportation Health Insurance Car Insurance Life Insurance Clothing Convenience Foods Entertainment Other Insurance Grooming/ Hygiene Electricity Water Gas Cable Internet Phone Taxes Tithing Donations Debt Childcare Pet Care Child Support Restitution

Copyright 2010, Shawn B. Young, All Rights Reserved 1 www.bootstrapseducation.org Net Gross Taxes, Insurance, Income Source (Gross minus T.V. (Total Amount) & Benefits taxes, etc.) 1. 2. 3.

Expenses Expected Actual Difference T.V.

2 Budget Instructions

Budgets are a loaded topic with lots of emotional stuff around it. We have it titled simply as a plan because really that is what a budget is supposed to be.

The point of a budget is not to “stick” to it or else. A budget is simply a plan and when you look at what really happened you can go back and adjust. You can make a better plan next time and work your way towards achieving your goals.

However the meat of the financial planning comes with looking at the “actuals.” If you don’t look at your spending behaviors before you create a budget you are most likely creating a work of fiction and making wild estimates. That is why we encourage people to do the receipt exercise and spending journal so that they will have a true account of their spending behavior. Most people know that once a month they have to pay their rent, car insurance, phone, internet etc. and they know how much those items cost. But what about all the other expenses and other things that come up during a month? When it comes to many of the variable expenses, most people aren’t as accurate with these estimates as they would like to believe. As we said before, we strongly encourage using the receipt exercise and the spending journal before working on the budget.

What makes this budget different from most other budgets is that we put a column in for the “actual” amount of money that is spent and what the difference was from the expected column. Also, there is a column for T.V. (Time Value) in there too so the client can see how much time each expense costs them. Again if you have done the receipt exercise this will be much easier to fill out and by continuing to keep your receipts you will have a correct actual and difference. When you have an accurate picture of what happened, you will be able to adjust your next budget.

Copyright 2010, Shawn B. Young, All Rights Reserved 3 www.bootstrapseducation.org