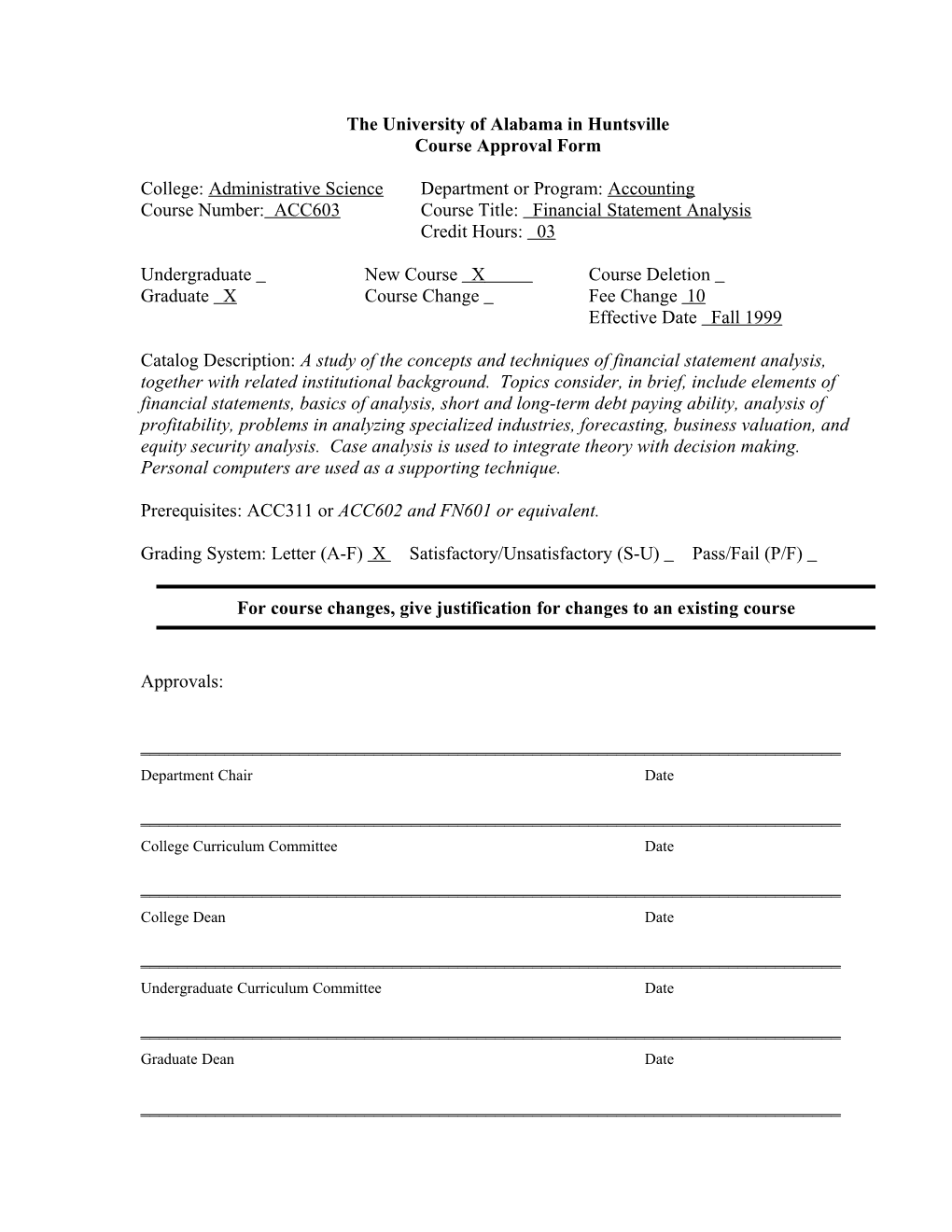

The University of Alabama in Huntsville Course Approval Form

College: Administrative Science Department or Program: Accounting Course Number: ACC603 Course Title: Financial Statement Analysis Credit Hours: 03

Undergraduate New Course X Course Deletion Graduate X Course Change Fee Change 10 Effective Date Fall 1999

Catalog Description: A study of the concepts and techniques of financial statement analysis, together with related institutional background. Topics consider, in brief, include elements of financial statements, basics of analysis, short and long-term debt paying ability, analysis of profitability, problems in analyzing specialized industries, forecasting, business valuation, and equity security analysis. Case analysis is used to integrate theory with decision making. Personal computers are used as a supporting technique.

Prerequisites: ACC311 or ACC602 and FN601 or equivalent.

Grading System: Letter (A-F) X Satisfactory/Unsatisfactory (S-U) Pass/Fail (P/F)

For course changes, give justification for changes to an existing course

Approvals:

______Department Chair Date

______College Curriculum Committee Date

______College Dean Date

______Undergraduate Curriculum Committee Date

______Graduate Dean Date

______Provost Date Distribution: Provost, Dean, Department, Scheduling, Undergraduate Advising or Graduate Studies COMPLETE FOR NEW COURSE OFFERINGS

Compare with existing catalog offerings, with justification if apparent overlap:

A brief introduction to financial statement analysis is provided in ACC600 and FN601. Neither provide comprehensive of topic.

Course(s) for which this course is a prerequisite: None Is this course part of a program (college) core? No Is this course part of a new major or minor? No Is this course part of an accreditation requirement? No If so, discuss content requirement and any faculty affiliation requirement:

Discuss demonstrated value of course. If appropriate, discuss previous offering in the form of special topics courses and enrollments. Discuss academic justification (for example: is the course a traditional offering at other universities).

MAcc curriculum specifies a requirement for two 600 level accounting electives. We need to offer a minimum of two such electives each year. Because of faculty interests and staffing requirements, we only have the capability of offering one of the existing two on a regular basis. This will be the second regularly scheduled 600 level accounting elective. At other universities, financial statement analysis is one of the most popular graduate accounting courses for majors other than accounting. Hence, it will help the MSM program.

Attach a detailed syllabus giving an overview and detailed outline of topics to be covered, including narrative description, course goals and structure (breadth or depth, analysis, design, laboratory): See attached master course syllabus.

Textbooks Typical: Gibson, Charles H., Financial Statement Analysis: Using Financial Accounting Information, 7th edition, South Western Publishing Co., 1998. Palepu, Bernard, & Healy, Business Analysis and Valuation: Using Financial Statements, South Western Publishing Co., 1996.

Intended Instructors: Folami

Implications for faculty workload (e.g. what other courses will be offered less frequently or dropped):

ACC311 will be offered in each summer rather than each fall. ACC603 will be offered each fall.

Implications for facilities (are new facilities required; do new facilities necessitate a new course): None.

First semester to be offered: F1999 Frequency of offering: Once a year.

Provision for review: Continuous by course instructor and department chair. MASTER COURSE SYLLABUS

Date: February 2002

Course Number: ACC603

Course Title: Financial Statement Analysis

Instructor(s): Kile

Typical Textbooks: Penman, Financial Statement Analysis & Security Valuation, Irwin McGraw Hill, 2001

Catalog Description: A study of the concepts and techniques of financial statement analysis, together with related institutional background. Topics consider, in brief, include elements of financial statements, basics of analysis, short and long- term debt paying ability, analysis of profitability, problems in analyzing specialized industries, forecasting, business valuation, and equity security analysis. Case analysis is used to integrate theory with decision making. Personal computers are used as a supporting technique.

Prerequisites: Completion of all MAcc program prerequisites or ACC602 or equivalent and FN601. MASTER COURSE SYLLABUS ACC603 February 2002

Subject Matter: (based on 14 two hour and forty minute sessions)

Item Sessions 1. In-depth review of the Balance Sheet 1

2. In-depth review of the Income Statement 1

3. Introduction to analysis and comparative statistics 1

4. Case analysis 1

5. Short-term liquidity 1

6. Long-term liquidity 1

7. Analysis of profitability 1

8. Review and analysis of the Statement of Cash Flows 1

9. Business Strategy Analysis 1

10. Cover problems in analyzing specialized industries 1

11. Prospective Analysis: Forecasting 1

12. Prospective Analysis: Valuation based on Discounted Cash Flows 1

13. Prospective Analysis: Accounting Based Valuation Techniques 1

14. Equity Security Analysis 1

Cases: Extensive use of cases in every session. Computer Usage: Spreadsheet, Word-Processor and Valuation Software. Oral and Written Communication: Group case presentations