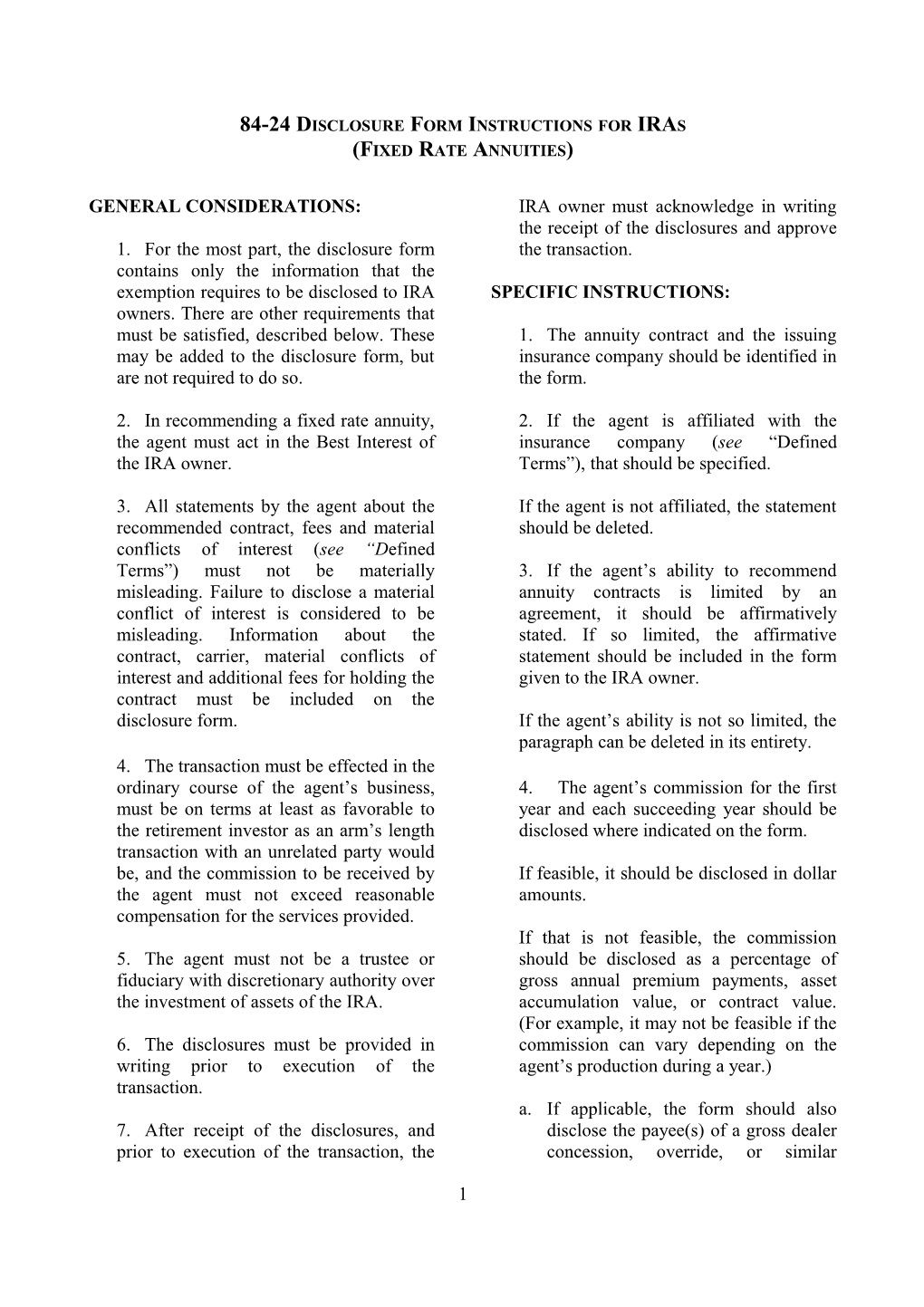

84-24 DISCLOSURE FORM INSTRUCTIONS FOR IRAS (FIXED RATE ANNUITIES)

GENERAL CONSIDERATIONS: IRA owner must acknowledge in writing the receipt of the disclosures and approve 1. For the most part, the disclosure form the transaction. contains only the information that the exemption requires to be disclosed to IRA SPECIFIC INSTRUCTIONS: owners. There are other requirements that must be satisfied, described below. These 1. The annuity contract and the issuing may be added to the disclosure form, but insurance company should be identified in are not required to do so. the form.

2. In recommending a fixed rate annuity, 2. If the agent is affiliated with the the agent must act in the Best Interest of insurance company (see “Defined the IRA owner. Terms”), that should be specified.

3. All statements by the agent about the If the agent is not affiliated, the statement recommended contract, fees and material should be deleted. conflicts of interest (see “Defined Terms”) must not be materially 3. If the agent’s ability to recommend misleading. Failure to disclose a material annuity contracts is limited by an conflict of interest is considered to be agreement, it should be affirmatively misleading. Information about the stated. If so limited, the affirmative contract, carrier, material conflicts of statement should be included in the form interest and additional fees for holding the given to the IRA owner. contract must be included on the disclosure form. If the agent’s ability is not so limited, the paragraph can be deleted in its entirety. 4. The transaction must be effected in the ordinary course of the agent’s business, 4. The agent’s commission for the first must be on terms at least as favorable to year and each succeeding year should be the retirement investor as an arm’s length disclosed where indicated on the form. transaction with an unrelated party would be, and the commission to be received by If feasible, it should be disclosed in dollar the agent must not exceed reasonable amounts. compensation for the services provided. If that is not feasible, the commission 5. The agent must not be a trustee or should be disclosed as a percentage of fiduciary with discretionary authority over gross annual premium payments, asset the investment of assets of the IRA. accumulation value, or contract value. (For example, it may not be feasible if the 6. The disclosures must be provided in commission can vary depending on the writing prior to execution of the agent’s production during a year.) transaction. a. If applicable, the form should also 7. After receipt of the disclosures, and disclose the payee(s) of a gross dealer prior to execution of the transaction, the concession, override, or similar

1 payment, and the amount of the commission so paid. 10. The completed and written form must be delivered to the IRA owner and 5. The form needs to disclose charges, approved and signed by the IRA owner fees, discounts, penalties or adjustments prior to the execution of the transaction. which may be imposed under the recommended contract in connection with 11. The completed and signed disclosure the purchase, holding, exchange, form must be maintained for a period of termination or sale of the contract. six (6) years, in a manner that is reasonably accessible for audit and All such conditions should be disclosed, examination. as well as their financial impact. 12. If more than one year has passed since 6. The form includes an arbitration this disclosure was made, a new 84-24 clause. This is not required to be included. disclosure must be made for additional While the disclosure form is not labeled as recommendations for purchases. a contract, it is signed by the parties and the signature lines are worded as an DEFINED TERMS: agreement. Affiliate: While the form includes sample language, (a) The term ‘‘Affiliate’’ of a person means: that is just an example. The user should consider substituting its customary (1) Any person directly or indirectly arbitration provision. controlling, controlled by, or under common control with the person; 7. The 84-24 exemption conditions its relief on, among other things, the (2) Any officer, director, employee requirement that the statements by the (including, in the case of Principal insurance agent “about recommended Underwriter, any registered representative investments, fees, Material Conflicts of thereof, whether or not the person is a Interest, and any other matters” relevant to common law employee of the Principal an IRA owner’s decisions are not Underwriter), or relative of any such person, materially misleading at the time they are or any partner in such person; or made. The failure to disclose a material conflict of interest is considered to be a (3) Any corporation or partnership of which misleading statement. the person is an officer, director, or employee, or in which the person is a partner. The disclosure form provides space for the agent to disclose any material conflicts Best Interest: This means that the agent must (see “Defined Terms”). act with the care, skill, prudence, and diligence under the circumstances then 8. The form states that, while the agent prevailing that a prudent person acting in a will prudently recommend the annuity, the like capacity and familiar with such matters agent is not undertaking the continuing would use in the conduct of an enterprise of duty to monitor. like character and with like aims, based on the investment objectives, risk tolerance, 9. The disclosure form provides for the financial circumstances and needs of the date, name and signature of the agent. retirement investor, without regard to the That should be completed at or near the time of delivery. 2 financial or other interests of the agent or any affiliate or other party. Other charges, fees, discounts: Charges, fees, discounts, penalties or adjustments Material conflict of interest: A material which may be imposed under the conflict exists when a person has a financial recommended contract in connection with the interest that a reasonable person would purchase, holding, exchange, termination, or conclude could affect the exercise of its best sale of the contract. judgment as a fiduciary in rendering advice to a plan or IRA.

86399816.6

3