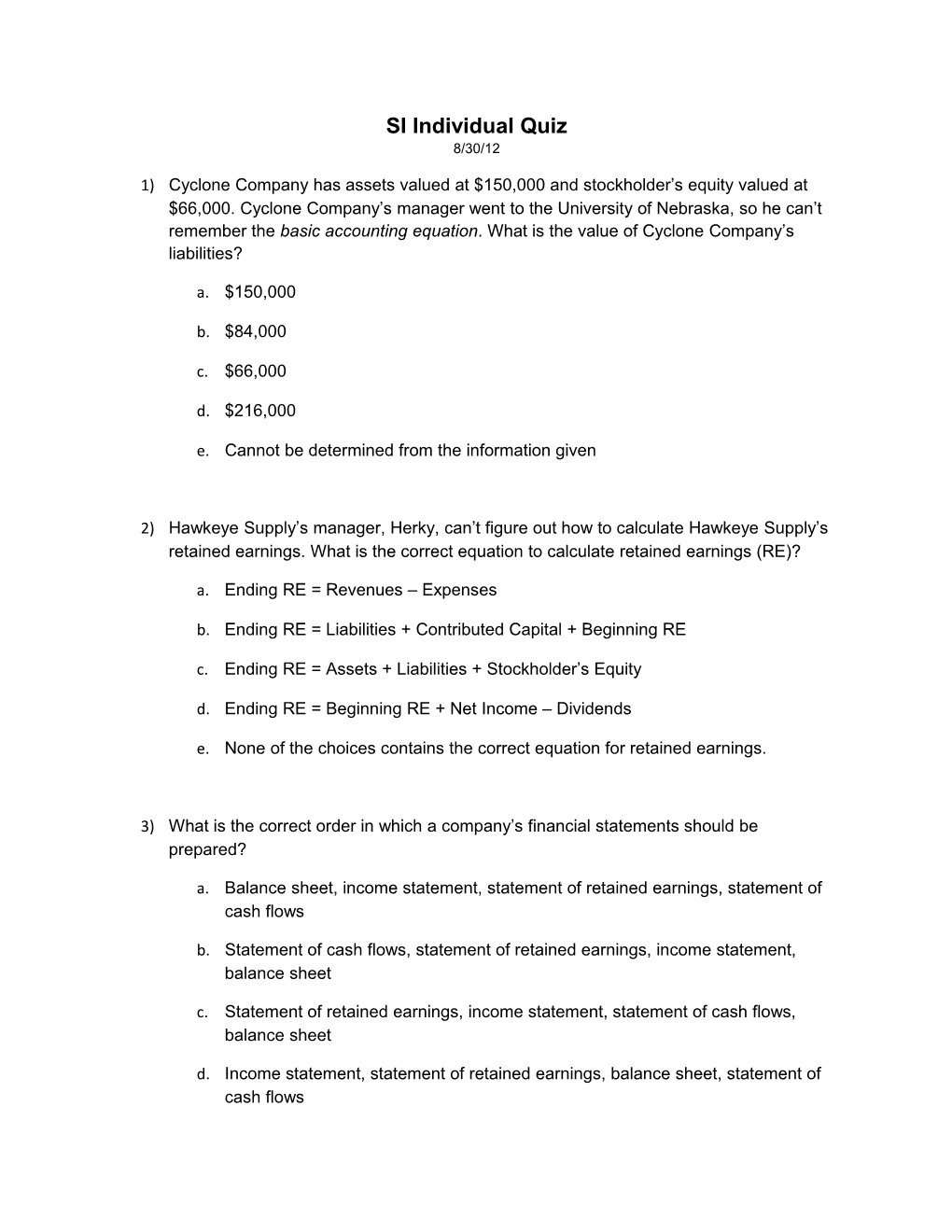

SI Individual Quiz 8/30/12

1) Cyclone Company has assets valued at $150,000 and stockholder’s equity valued at $66,000. Cyclone Company’s manager went to the University of Nebraska, so he can’t remember the basic accounting equation. What is the value of Cyclone Company’s liabilities?

a. $150,000

b. $84,000

c. $66,000

d. $216,000

e. Cannot be determined from the information given

2) Hawkeye Supply’s manager, Herky, can’t figure out how to calculate Hawkeye Supply’s retained earnings. What is the correct equation to calculate retained earnings (RE)?

a. Ending RE = Revenues – Expenses

b. Ending RE = Liabilities + Contributed Capital + Beginning RE

c. Ending RE = Assets + Liabilities + Stockholder’s Equity

d. Ending RE = Beginning RE + Net Income – Dividends

e. None of the choices contains the correct equation for retained earnings.

3) What is the correct order in which a company’s financial statements should be prepared?

a. Balance sheet, income statement, statement of retained earnings, statement of cash flows

b. Statement of cash flows, statement of retained earnings, income statement, balance sheet

c. Statement of retained earnings, income statement, statement of cash flows, balance sheet

d. Income statement, statement of retained earnings, balance sheet, statement of cash flows e. Financial statements can be prepared in any order, as the information contained in each statement is fully independent of the information contained in the other financial statements.

4) What is the purpose of the income statement (as discussed in class)?

a. To report revenues less expenses for the accounting period

b. To report how net income and the distribution of dividends affected the financial position of the company for the accounting period

c. To report inflows and outflows of cash during the accounting period.

d. To report on assets, liabilities, and stockholder’s equity

e. To report to stockholders that they can have reasonable assurance that net income is correctly stated in the other three financial statements

5) Herbie Husker isn’t very bright, so he can’t figure out net income for his company, Cornhusker Commodities. HE knows he revenues totaled $267,000, but he had expenses totaling $94,000. You looked at his workbook and also noticed he paid Cornhusker Commodities’ shareholders a $50,000. What is Herbie’s net income?

a. $361,000

b. $411,000

c. $311,000

d. 173,000

e. Cannot be determined from the information given

6) According to the class notes, which of the following has the actual responsibility to set accounting rules in the US?

a. SEC

b. FASB

c. PCAOB

d. GAAP

e. IASB 7) What qualitative characteristic of accounting information refers to information that is verifiable and an accurate representation of a firm’s economic condition?

a. Comparability

b. Consistency

c. Relevance

d. Reliability

e. Completeness

8) Herky Hawkeye decided he wants to start a new business. Herky got fired from his last job as a manager at Hawkeye Supply, so he doesn’t have a lot of his own money to invest right off the bat, and he can’t afford to accept any liability if the company fails. Using what you learned in class, what type of business entity would you recommend that Herky start?

a. Corporation

b. Sole proprietorship

c. Partnership

d. Limited liability partnership

e. S-corporation

9) Sooner Schooner of Oklahoma Company is trying to create his company’s Statement of Cash Flows. He was a football player for the University of Oklahoma back in the day, so he can’t remember what he learned in his financial accounting classes. Sooner sees that his company bought $150,000 in equipment using a credit account from the supplier. To date, Sooner hasn’t made any cash payments on the account. Where on the Statement of Cash Flows should Sooner put this information?

a. Operating section

b. Investing section

c. Financing section

d. Managing section

e. That information does not belong on the Statement of Cash Flows.

10) In response to ethical issues in accounting in the early 2000s, Congress issued this act, which (among other things) requires top managers of public companies to take responsibility for the contents of their company’s financial statements and maintain an audited system of internal controls.

a. Enron Act of 2002

b. Accounting Ethics Act of 2002

c. Corporate Responsibility Act of 2002

d. Sarbanes-Oxley Act of 2002

e. Auditing Regulations Act of 2002