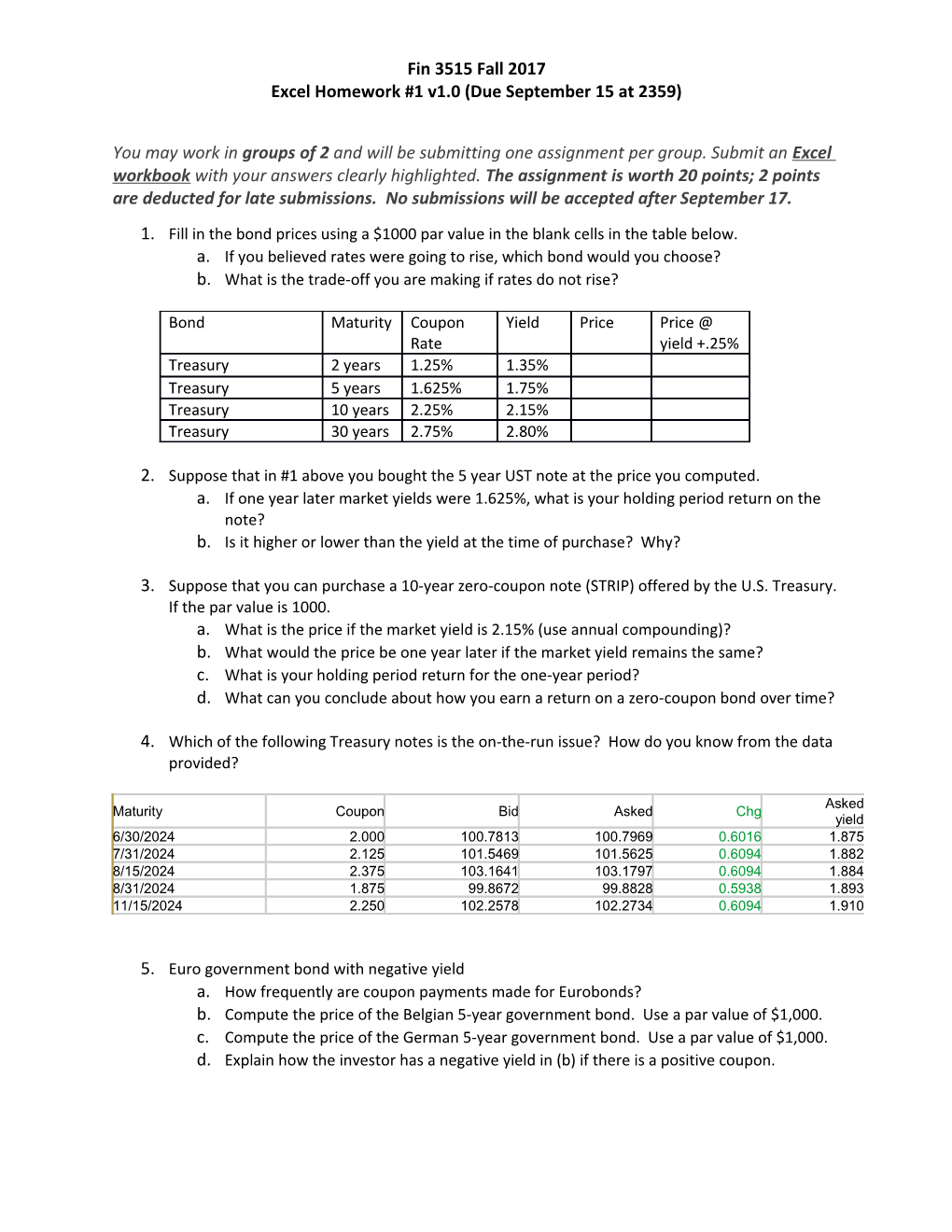

Fin 3515 Fall 2017 Excel Homework #1 v1.0 (Due September 15 at 2359)

You may work in groups of 2 and will be submitting one assignment per group. Submit an Excel workbook with your answers clearly highlighted. The assignment is worth 20 points; 2 points are deducted for late submissions. No submissions will be accepted after September 17.

1. Fill in the bond prices using a $1000 par value in the blank cells in the table below. a. If you believed rates were going to rise, which bond would you choose? b. What is the trade-off you are making if rates do not rise?

Bond Maturity Coupon Yield Price Price @ Rate yield +.25% Treasury 2 years 1.25% 1.35% Treasury 5 years 1.625% 1.75% Treasury 10 years 2.25% 2.15% Treasury 30 years 2.75% 2.80%

2. Suppose that in #1 above you bought the 5 year UST note at the price you computed. a. If one year later market yields were 1.625%, what is your holding period return on the note? b. Is it higher or lower than the yield at the time of purchase? Why?

3. Suppose that you can purchase a 10-year zero-coupon note (STRIP) offered by the U.S. Treasury. If the par value is 1000. a. What is the price if the market yield is 2.15% (use annual compounding)? b. What would the price be one year later if the market yield remains the same? c. What is your holding period return for the one-year period? d. What can you conclude about how you earn a return on a zero-coupon bond over time?

4. Which of the following Treasury notes is the on-the-run issue? How do you know from the data provided?

Asked Maturity Coupon Bid Asked Chg yield 6/30/2024 2.000 100.7813 100.7969 0.6016 1.875 7/31/2024 2.125 101.5469 101.5625 0.6094 1.882 8/15/2024 2.375 103.1641 103.1797 0.6094 1.884 8/31/2024 1.875 99.8672 99.8828 0.5938 1.893 11/15/2024 2.250 102.2578 102.2734 0.6094 1.910

5. Euro government bond with negative yield a. How frequently are coupon payments made for Eurobonds? b. Compute the price of the Belgian 5-year government bond. Use a par value of $1,000. c. Compute the price of the German 5-year government bond. Use a par value of $1,000. d. Explain how the investor has a negative yield in (b) if there is a positive coupon. Fin 3515 Fall 2017 Excel Homework #1 v1.0 (Due September 15 at 2359)