April 1, 2005 Research Digest Research Associate: Millind Jaiswal, MBA Editor: R.C. Fuhrmann, CFA 312.630.9880 x.437 [email protected] www.zackspro.com 155 North Wacker Drive Chicago, IL 60606

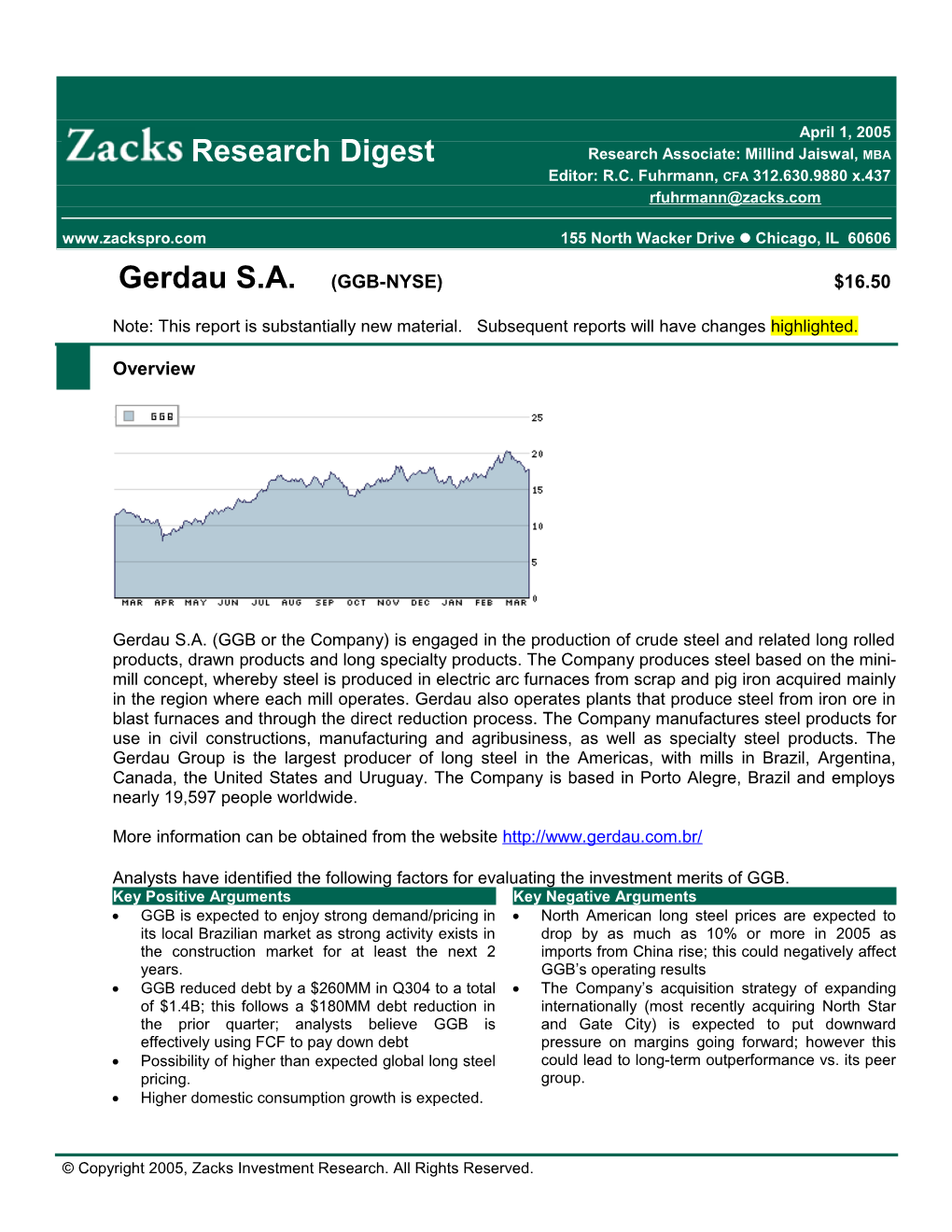

Gerdau S.A. (GGB-NYSE) $16.50

Note: This report is substantially new material. Subsequent reports will have changes highlighted.

Overview

Gerdau S.A. (GGB or the Company) is engaged in the production of crude steel and related long rolled products, drawn products and long specialty products. The Company produces steel based on the mini- mill concept, whereby steel is produced in electric arc furnaces from scrap and pig iron acquired mainly in the region where each mill operates. Gerdau also operates plants that produce steel from iron ore in blast furnaces and through the direct reduction process. The Company manufactures steel products for use in civil constructions, manufacturing and agribusiness, as well as specialty steel products. The Gerdau Group is the largest producer of long steel in the Americas, with mills in Brazil, Argentina, Canada, the United States and Uruguay. The Company is based in Porto Alegre, Brazil and employs nearly 19,597 people worldwide.

More information can be obtained from the website http://www.gerdau.com.br/

Analysts have identified the following factors for evaluating the investment merits of GGB. Key Positive Arguments Key Negative Arguments GGB is expected to enjoy strong demand/pricing in North American long steel prices are expected to its local Brazilian market as strong activity exists in drop by as much as 10% or more in 2005 as the construction market for at least the next 2 imports from China rise; this could negatively affect years. GGB’s operating results GGB reduced debt by a $260MM in Q304 to a total The Company’s acquisition strategy of expanding of $1.4B; this follows a $180MM debt reduction in internationally (most recently acquiring North Star the prior quarter; analysts believe GGB is and Gate City) is expected to put downward effectively using FCF to pay down debt pressure on margins going forward; however this Possibility of higher than expected global long steel could lead to long-term outperformance vs. its peer pricing. group. Higher domestic consumption growth is expected.

© Copyright 2005, Zacks Investment Research. All Rights Reserved. NOTE: GGB’s fiscal year ends on 31st December; all fiscal references coincide with the calendar year end.

Recent Events

Acquisition of assets from North Star Steel: On November 1, Gerdau Ameristeel concluded the acquisition of fixed assets and working capital of North Star Steel that includes four long steel producing mills, three wire-rod processing facilities and a mining industry grinding ball production unit. The four mills have an installed capacity of approximately 2M short tons per year in long rolled steel and the four downstream units can produce about 300 thousand short tons per year of reinforced concrete mesh, wire fences and industrial wires along with grinding balls.

Ameristeel concluded the acquisition of assets from Gate City Steel, Inc. and RJ Rebar, Inc., in the United States. These units are suppliers of fabricated rebars, with and without epoxy coating, to the Mid-West and Southern regions of the U.S. and have an installed capacity of 150 thousand short tons per year.

The expansion of Ouro Branco Mill is expected to increase crude steel installed capacity from 3.0 million metric tons to 4.5 million metric tons per annum by the end of 2007.

Gerdau will invest R$930 million through 2007 to build a new specialty steel mill in the city of Rio de Janeiro. The new unit will provide steel to the auto industry and should have an installed capacity of 800 thousand metric tons per annum of crude steel and 500 thousand metric tons of rolled products.

Gerdau Cosigua is expected to increase its crude steel installed capacity from 1.2 million metric tons to 1.8 million metric tons and 1.3 million metric tons to 1.6 million metric tons of rolled products per year.

Revenues

FY2004 FY2005E FY2006E Sales $7,382.9 $9,839.0 $8,436.0

Revenue for 4Q04 improved 39.2% to $4.9B reflecting the performance of operations, with better prices in international markets and the recovery of domestic demand along with consolidation of new units acquired in FY2004. Consolidated gross revenues increased by 48.3% to R$23.4 billion in 2004. Of this total, 55.2% (R$12.9 billion) stemmed from the Brazilian operations, 40.4% (R$9.5 billion) from units in North America and 4.4% (R$1.0 billion) from other companies in Chile, Uruguay and Argentina. Revenues generated by exports reached US$1.1 billion, 39.0% more than the previous year, due to increases in international prices. The production of slabs, blooms and billets reached 13.4 million metric tons in FY2004.

Please refer to the Zacks Digest spreadsheet for specific revenue estimates.

Zacks Investment Research Page 2 www.zacks.com Margins

Gross margin for the last quarter was 30.3% compared to 24.7% on a Y-o-Y basis. The gross margin for FY2004 came in at 31.9%. The increase was primarily attributed to the recovery of operating margins in Brazil (due to adjustments in prices as a result of increases in the cost of certain raw materials), and an increase in international prices (which benefited from exports and the North American operations).

Margins FY2004 FY2005E FY2006E Gross 31.9% Operating 22.7% 21.6% 19.3% Pre-Tax 22.6% Net 14.4% 13.8% 12.9%

Please refer to the Zacks Digest spreadsheet for more details on margin estimates.

Earnings Per Share

EPS 4Q04A FY2004A FY2005E FY2006E Zacks Consensus $4.33 $2.55 Digest high $0.97 $3.91 $4.90 $3.66 Digest Low $0.97 $3.44 $3.25 $2.60 Digest Average $0.97 $3.69 $4.24 $3.13 Yearly Growth 102.4% 14.7% -26.1%

The Zacks Digest Consensus model projects EPS to be $4.24 for FY2005 and $3.13 for FY2006. The EPS estimates for the whole year projects Y-o-Y growth of 14.7%. 2005 forecasts (3 in total) range from $3.25 to $4.90; the average is $4.24. 2006 forecasts (2 in total) range from $2.60 to $3.36; the average is $3.13.

Please refer to the Zacks Digest spreadsheet for more extensive EPS figures.

Target Price/Valuation

Target prices for GGB range from $16.50 to $23.0 with an average of $19.75. At this time, there is no common valuation method used among analysts. One analyst (Bear Stearns) employed an EBITDA multiple, while another (Deutsche Bank) applied a multiple on forward EV/EBITDA estimates. One other analyst (JP Morgan) used a FV/EBITDA analysis.

Please refer to the Zacks Digest Spreadsheet for further details on valuation.

Zacks Investment Research Page 3 www.zacks.com Cash Flow

Investments in the last quarter totaled $501.2 million, attributable to the acquisition of the North Star assets and the construction of the new mill in the state of Sao Paulo. Companies in Brazil invested $127.0 million, the mills in North America invested $370 million and the South American units invested the balance of $4 million.

Investments in FY2004, acquisitions included, totaled $771.7 million, of which $325.6 million was invested in Brazil-based units, $435.8 million in industrial sites in North America and $10.3 million in South American mills.

Net debt stood at $4.3 billion as of December 2004.

Long-Term Growth

GGB is the largest long steel producer in Latin America, and has made an important contribution in building the history of the Brazilian industry. 2004 has been one of the better years for steel producers. International demand, led by China, and the resumption of economic growth in Brazil have allowed for record high cash generation for companies such as GGB. Chinese demand has significantly pushed up steel prices.

Individual Analyst Opinions

POSITIVE RATINGS

Deutsche Bank (updated 02/01/2005) – The stock is rated a BUY with a target price of $23. Analyst expresses confidence that sales in Brazil are expected to pick up by the first quarter, with good prospects from the Brazilian economy, which will improve sales mix and margins.

NEUTRAL RATINGS

Bear Stearns (updated 02/02/2005)– The stock is rated PEER PERFORM with a $16.50 price target. Analyst believes demand for steel is expected to remain strong with higher debt assumption being offset by stronger operating estimates.

JP Morgan (updated 02/01/2005) – The stock is rated NEUTRAL with no target price. Analyst does not find any catalyst but expects possible upside with a higher than expected global steel pricing, lower scrap and energy costs, and increased domestic consumption in Brazil.

Zacks Investment Research Page 4 www.zacks.com