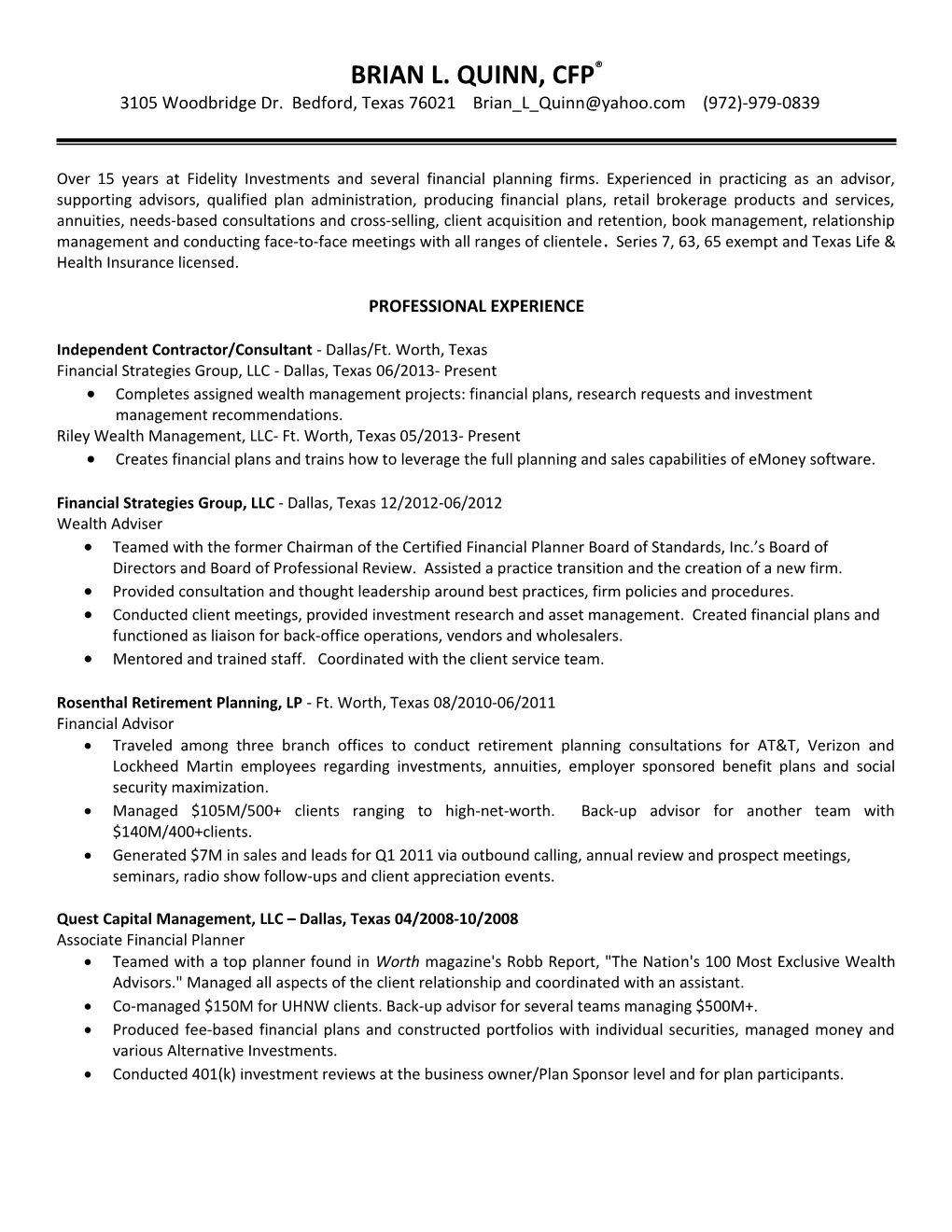

BRIAN L. QUINN, CFP® 3105 Woodbridge Dr. Bedford, Texas 76021 [email protected] (972)-979-0839

Over 15 years at Fidelity Investments and several financial planning firms. Experienced in practicing as an advisor, supporting advisors, qualified plan administration, producing financial plans, retail brokerage products and services, annuities, needs-based consultations and cross-selling, client acquisition and retention, book management, relationship management and conducting face-to-face meetings with all ranges of clientele. Series 7, 63, 65 exempt and Texas Life & Health Insurance licensed.

PROFESSIONAL EXPERIENCE

Independent Contractor/Consultant - Dallas/Ft. Worth, Texas Financial Strategies Group, LLC - Dallas, Texas 06/2013- Present Completes assigned wealth management projects: financial plans, research requests and investment management recommendations. Riley Wealth Management, LLC- Ft. Worth, Texas 05/2013- Present Creates financial plans and trains how to leverage the full planning and sales capabilities of eMoney software.

Financial Strategies Group, LLC - Dallas, Texas 12/2012-06/2012 Wealth Adviser Teamed with the former Chairman of the Certified Financial Planner Board of Standards, Inc.’s Board of Directors and Board of Professional Review. Assisted a practice transition and the creation of a new firm. Provided consultation and thought leadership around best practices, firm policies and procedures. Conducted client meetings, provided investment research and asset management. Created financial plans and functioned as liaison for back-office operations, vendors and wholesalers. Mentored and trained staff. Coordinated with the client service team.

Rosenthal Retirement Planning, LP - Ft. Worth, Texas 08/2010-06/2011 Financial Advisor Traveled among three branch offices to conduct retirement planning consultations for AT&T, Verizon and Lockheed Martin employees regarding investments, annuities, employer sponsored benefit plans and social security maximization. Managed $105M/500+ clients ranging to high-net-worth. Back-up advisor for another team with $140M/400+clients. Generated $7M in sales and leads for Q1 2011 via outbound calling, annual review and prospect meetings, seminars, radio show follow-ups and client appreciation events.

Quest Capital Management, LLC – Dallas, Texas 04/2008-10/2008 Associate Financial Planner Teamed with a top planner found in Worth magazine's Robb Report, "The Nation's 100 Most Exclusive Wealth Advisors." Managed all aspects of the client relationship and coordinated with an assistant. Co-managed $150M for UHNW clients. Back-up advisor for several teams managing $500M+. Produced fee-based financial plans and constructed portfolios with individual securities, managed money and various Alternative Investments. Conducted 401(k) investment reviews at the business owner/Plan Sponsor level and for plan participants. Fidelity Investments, LLC - Westlake, Texas 03/1996-04/2008 Retirement Investment Services (RIS) Retirement Brokerage Specialist 08/2005-04/2008 Dedicated consultant to external financial advisors, qualified plan participants and Fidelity’s retail call centers and branch network. Provided client service regarding IRAs, qualified plan design and 401(k) self-directed brokerage accounts which involved loans, real-time trading, investment education, tax reporting, distribution planning, rollovers and trustee to trustee plan conversions.

Retirement Specialist 01/1997-08/2005 Cross-sold retail brokerage products and services to 401(k) participants via phone sales campaigns. Enrolled and educated participants about investments, annuities, retirement income planning, IRAs, qualified plans and tax implications. Retained/rolled $70M+ and consolidated $10M+ outside assets YOY. Multiple Million Dollar Club Member for accounts in sales and retention of $1M+. Lead team in deferral increases and referrals for managed money, annuities & brokerage trading.

Customer Service Support (CSS) Qualified Plan Liaison 01/1997-04/1998 Promoted after one year. Performed the Plan Liaison/PSG role concurrently and coordinated with Fidelity’s Managing Directors and Plan Sponsors. Managed internal communications and escalation issues across several regional call centers for Owens Corning, L-3 Communications, Loral Space Communications and Lockheed Martin’s qualified plans. Facilitated in-person training sessions to client service teams regarding qualified plan design, ERISA, IRS regulations, tax reporting and corporate actions.

Participant Services Group (PSG) Representative 03/1996-04/1998 Responsible for quality control for participant consultations for 50+ Fortune 500 401(k) plans via phone and resolved account inquiries, exchanges, loans, deferrals, distributions and corrective actions. Served as a back-up for client service to lower market segments of qualified plans. Collaborated, co-designed and executed a participant investment education program. Resulted in a new dedicated enrollment group. Series 7 63 CFP Series 7 63 CFP Series 7 63 65 6

EDUCATION

CERTIFIED FINANCIAL PLANNER™, CFP Board of Standards 2002

Financial Planning Certificate Program, University of North Texas

B.B.A., Management, University of Texas at Arlington