ACC-201 (Financial Accounting) Working Papers – Chapter 02

Note: Items below, highlighted in green do not have the answers provided on the “answer sheet”. The items (in green below) carry more “weight” in the grading / scoring of the assignment.

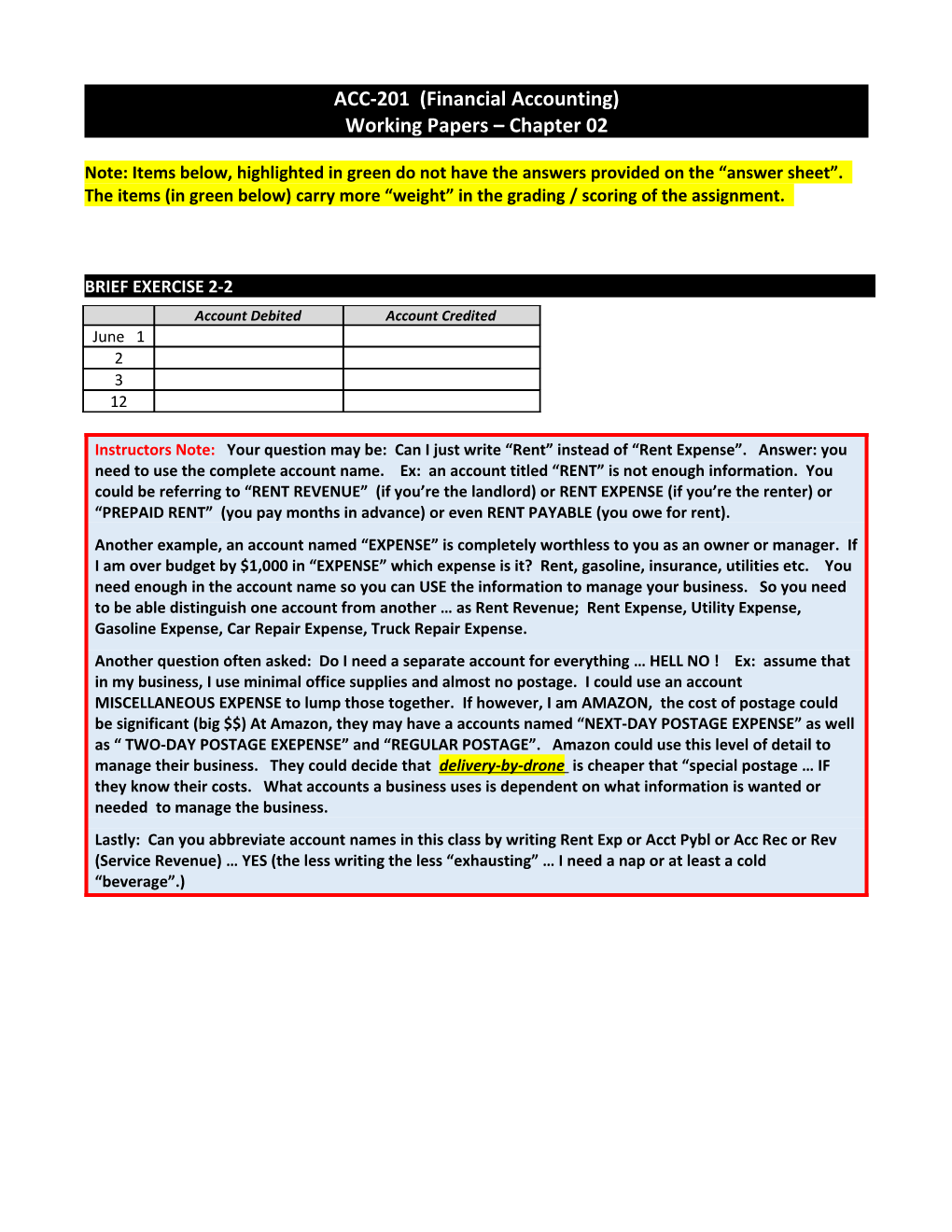

BRIEF EXERCISE 2-2 Account Debited Account Credited June 1 2 3 12

Instructors Note: Your question may be: Can I just write “Rent” instead of “Rent Expense”. Answer: you need to use the complete account name. Ex: an account titled “RENT” is not enough information. You could be referring to “RENT REVENUE” (if you’re the landlord) or RENT EXPENSE (if you’re the renter) or “PREPAID RENT” (you pay months in advance) or even RENT PAYABLE (you owe for rent). Another example, an account named “EXPENSE” is completely worthless to you as an owner or manager. If I am over budget by $1,000 in “EXPENSE” which expense is it? Rent, gasoline, insurance, utilities etc. You need enough in the account name so you can USE the information to manage your business. So you need to be able distinguish one account from another … as Rent Revenue; Rent Expense, Utility Expense, Gasoline Expense, Car Repair Expense, Truck Repair Expense. Another question often asked: Do I need a separate account for everything … HELL NO ! Ex: assume that in my business, I use minimal office supplies and almost no postage. I could use an account MISCELLANEOUS EXPENSE to lump those together. If however, I am AMAZON, the cost of postage could be significant (big $$) At Amazon, they may have a accounts named “NEXT-DAY POSTAGE EXPENSE” as well as “ TWO-DAY POSTAGE EXEPENSE” and “REGULAR POSTAGE”. Amazon could use this level of detail to manage their business. They could decide that delivery-by-drone is cheaper that “special postage … IF they know their costs. What accounts a business uses is dependent on what information is wanted or needed to manage the business. Lastly: Can you abbreviate account names in this class by writing Rent Exp or Acct Pybl or Acc Rec or Rev (Service Revenue) … YES (the less writing the less “exhausting” … I need a nap or at least a cold “beverage”.) BRIEF EXERCISE 2-3 Date Accounts Name Debit $ Credit $ June 1

2

3

12

Note: Example of Journal Entries (JE) – REQUIRED - format: Dat Accounts Name Ref Debit Amount Credit Amount e 17 Debit account name (2) 4 5 Credit account t name (3) 6 7

1. Date: in the real world you use the name of the month on the top line of each page (assuming you are not using a computer – get real). Computers often require entering the month. This class – just the date is okay (ex: 1, 18 31) – no month is required (less writing = less “exhaustion” (I still need a beverage). The date is only on the first line of the entry, nothing is on the 2nd – or successive – lines. 2. Account Name DEBIT: first line is account name to be DEBITED … The debited account name ALWAYS (yes - always) goes first. NO DESCRIPTION – just the account name. Ex: “Paid Rent” or “Collected Cash” are NOT account names. CASH or RENT EXPENSE are account names. If there are more than one “debit” account then the next debit goes on the next line. A third debit account goes on the third line … (ALL DEBIT ACCOUNTS ARE LISTED BEFORE ANY CREDIT ACCOUNT NAMES).

3. Account Name - CREDIT: INDENT about 5 spaces from the left margin to indicate that this is the name of the account to be CREDITED. If there is more than one “credit” account then the next credit account goes on the next line (also indent the name). 4. Ref: means a reference number to the ledger account number. We will NOT USE this column in the class. (In case I forgot to edit it out of the working papers – leave it blank) In the real world your computer would assignment the account number or the account name depending on what you enter into the system. 5. Debit amount: dollars and cents go here. No dollar sign is needed. If there are no cents, but instead whole dollar amounts then the “.00” (cents) is NOT needed (again – Writing, Exhaustion, Beverage). 6. Credit amount: same as the debit amount BUT one line below and one column to the right. 7. Transaction Description or Explanation: in the world you may write a BRIEF note describing the transaction “paid rent”, “collected from ABC”, “received check #” etc. Enough to indicate what the transaction was but not enough to satisfy an English instructor. In this class we will NOT USE DESCRIPTIONS. W-E-B

EXERCISE 2-4 Oct 1

2

3

6

27

30

EXERCISE 2-5 Date Accounts Name Debit $ Credit $ Oct. 1 Note: You will have EITHER a debit OR a credit amount per line – NOT 2 both for same account). Some spaces will be 3 blank. See the “journal entry” 6 (required format example above) … focus on the 27 pink spaces above.

30

EXERCISE 2-7 (a) Assets = Liabilities + Stockholders Equity 1. = + 2. = + 3. = + 4. = +

(b) Accounts Name Debit $ Credit $ 1

2

3

4

EXERCISE 2-9 (a) Aug Cash Aug Notes Payable

Bal

Aug Accts Receivable Aug Common Stock

Bal

Aug Equipment Aug Service Revenue

Bal

Instructors Note: A Trial Balance is NOT a “financial statement” (it is not “published” or otherwise available to financial statement users). It is an internal worksheet only. It does NOT prove that journal entries are correct (since you may have selected the wrong accounts to debit or credit). It ONLY proves that total debit amounts = total credit amounts. It “proves” that no typo’s or transpositions (like when you type 17 instead of 71) were made during data entry.

Robert Mendez, Broker Trial Balance August 31, 2014 Account Name Debits Credits Once again – in the debit and credit columns (to the left) you will have one amount in EITHER the debit OR the credit columns – not both columns.

Column Totals EXERCISE 2-10 (a) Accounts Name Debit $ Credit $ 1

4

7

12

15

25

29

30

Instructors Note: “Unearned Revenue” is ALWAYS a liability. It indicates you collected payment (CASH) before you did the work. You OWE the work (or a refund). Cash you collect “In-Advance” is NOT Revenue because you have not yet EARNED it. When you complete the work THEN you will “adjust” your accounting records by decreasing (DEBIT) the liability “Unearned Revenue” and increasing (CREDIT) “Revenue”. Example: you pay Geico $6,000 in-advance for the NEXT 6 months of insurance coverage (you’re a rotten driver). GEICO does not EARN any of the $6,000 when they first receive it. (GEICO would debit CASH and credit UNEARNED REVENUE) AFTER the 1st month has passed GEICO has earned 1/6 (1 month of the 6). (GEICO adjusting entry to recognize earning 1 months’ worth would be: debit UNEARNED REVENUE and credit REVENUE for $1,000 (1 months amount). Each of the remaining 5 months GEICO would make the same adjusting journal entry. After the 6 months GEICO has earned the right to keep all of the cash you had paid in advance … AND … GEICO has NO liability (zero unearned revenue) since they reduced their liability each month – by providing auto insurance coverage.

Padre Landscaping Co Trial Balance April 30, 2014 Account Name Debits Credits

Column Totals 15,400 15,400 EXERCISE 2-13 (a) (b) (c) Error In Balance Difference Larger Column 1. 2. 3. 4. 5. 6.

ESSENTIAL NOTE: Your assignment is Problem 2-2B (page 90) and NOT the problem on page 88 which is 2- 2A. DO Problem 2-2B … (previously, some students copied the answers I provided, turned them in for the 8 points - and then CHOKED on the quiz (resulting in LOW grades or a dropped course). I have provided the answers (click the “answer” link) to the very similar 2-2A in case you need help navigating and completing your assignment … Problem 2-2B (on page 90).

Problem 2-2B (page 90) (a) Accounts Name Debit $ Credit $ 1

1

2

3

10

11

20

30

30 Cash No. 101 Date Explanation Ref Debit Credit Balance Apr 1 J1 2 J1 11 J1 20 J1 30 J1 30 J1 37,400

Accounts Receivable No. 112 Date Explanation Ref Debit Credit Balance Apr 10 J1

Supplies No. 126 Date Explanation Ref Debit Credit Balance Apr 3 J1

Accounts Payable No. 201 Date Explanation Ref Debit Credit Balance Apr 3 J1 30

Unearned Service Revenue No. 209 Date Explanation Ref Debit Credit Balance Apr 11 J1

Common Stock No. 311 Date Explanation Ref Debit Credit Balance Apr 1 J1

Service Revenue No. 400 Date Explanation Ref Debit Credit Balance Apr 10 J1 20 J1

Salaries & Wages Expense No. 726 Date Explanation Ref Debit Credit Balance Apr 30 J1

Rent Expense No. 729 Date Explanation Ref Debit Credit Balance Apr 2 J1 Judi Dench, Dentist Trial Balance April 301, 2014 Account Name Debits Credits Cash 37,400

Column Totals 53,000 53,000

Problem 2-3B (page 91) (a) Accounts Name Debit $ Credit $ 1

1

3

4

5

6

7

8

9

10

11

12 MORE BELOW

Cash (1) (3)

Bal 20,450

Accounts Receivable

Bal

Sup[plies

Bal

Prepaid Insurance

Bal

Prepaid Rent

Bal

Equipment

Bal Accounts Payable

Bal

Common Stock

Bal

Service Revenue

Bal

Salaries & Wages Expense

Bal

Utilities Expense

Bal

Chamberlain Services Trial Balance May 31, 2014 Account Name Debits Credits

Column Totals 93,160 93,160