April 14, 2006

Research Associate: Ranjan Chatterjee, MA (Eco) Editor: Nelson Bishop, CFA Research Digest Sr. Ed: Ian Madsen, CFA, [email protected]; 1-800-767-3771, x417

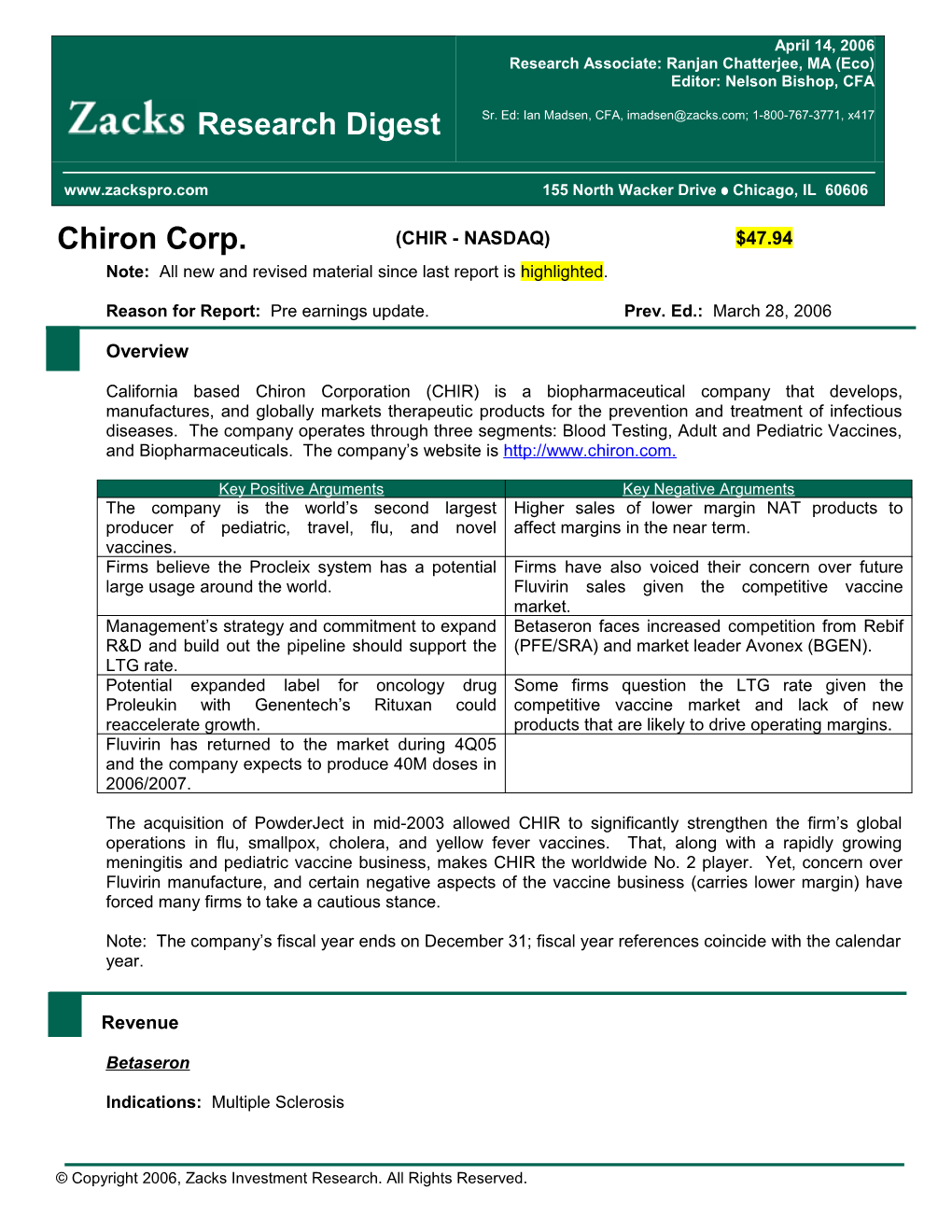

www.zackspro.com 155 North Wacker Drive Chicago, IL 60606 Chiron Corp. (CHIR - NASDAQ) $47.94 Note: All new and revised material since last report is highlighted.

Reason for Report: Pre earnings update. Prev. Ed.: March 28, 2006

Overview

California based Chiron Corporation (CHIR) is a biopharmaceutical company that develops, manufactures, and globally markets therapeutic products for the prevention and treatment of infectious diseases. The company operates through three segments: Blood Testing, Adult and Pediatric Vaccines, and Biopharmaceuticals. The company’s website is http://www.chiron.com.

Key Positive Arguments Key Negative Arguments The company is the world’s second largest Higher sales of lower margin NAT products to producer of pediatric, travel, flu, and novel affect margins in the near term. vaccines. Firms believe the Procleix system has a potential Firms have also voiced their concern over future large usage around the world. Fluvirin sales given the competitive vaccine market. Management’s strategy and commitment to expand Betaseron faces increased competition from Rebif R&D and build out the pipeline should support the (PFE/SRA) and market leader Avonex (BGEN). LTG rate. Potential expanded label for oncology drug Some firms question the LTG rate given the Proleukin with Genentech’s Rituxan could competitive vaccine market and lack of new reaccelerate growth. products that are likely to drive operating margins. Fluvirin has returned to the market during 4Q05 and the company expects to produce 40M doses in 2006/2007.

The acquisition of PowderJect in mid-2003 allowed CHIR to significantly strengthen the firm’s global operations in flu, smallpox, cholera, and yellow fever vaccines. That, along with a rapidly growing meningitis and pediatric vaccine business, makes CHIR the worldwide No. 2 player. Yet, concern over Fluvirin manufacture, and certain negative aspects of the vaccine business (carries lower margin) have forced many firms to take a cautious stance.

Note: The company’s fiscal year ends on December 31; fiscal year references coincide with the calendar year.

Revenue

Betaseron

Indications: Multiple Sclerosis

© Copyright 2006, Zacks Investment Research. All Rights Reserved. Stage of development: Mature

Partners: CHIR manufactures Betaseron and markets it through Schering AG and its associates worldwide. The collaboration is valid till October 2008.

Importance: Betaseron (interferon beta-1b) for multiple sclerosis is the company’s leading therapeutic product. Yet brokerage firms are pessimistic about its growth due to a tough competitive environment in the multiple sclerosis market. The drug is currently approved for relapsing/remitting multiple sclerosis as well as for secondary progressive multiple sclerosis in major countries including the U.S.

Revenue: Betaseron revenues were $40.5 M (up 19.3% year-over-year) in 4Q05 above the digest estimate of $37M primarily due to price increases and a shift from third-party to in-house production. This was partially offset by a reduction in shipments to Berlex and inventory ordering patterns. Annual sales were $142.2M (up 8.6% year-on-year) and above the digest estimate of $139.0M.

Regulatory issues: During late 2003 and early 2004, CHIR had introduced a modified version of Betaseron in the U.S. and the Japanese market to further enhance the drug’s ease of use and to strengthen the drug’s presence in the $3B multiple sclerosis market. CHIR began shipping a pre-filled syringe of Betaseron (the modified version) to allow a greater convenience in dosing.

Competitors: The firms (MorganStanley, Prudential, Merrill, UnionBankSwitz.) see little increase in sales due to tough competition from marketed products like Rebif (PFE/SRA), Copaxone (TEVA), and Avonex (BIIB).

Others: In the European market, Betaseron is sold under the brand name Betaferon, supplied by Boehringer Ingelheim, for which CHIR receives royalty payments.

On February 24, 2006, Chiron announced that Schering AG has intended to exercise its option under the collaboration agreement with Chiron to purchase or lease all assets used by Chiron in the manufacture of Betaseron interferon beta-1b products and all contractual rights at their fair market or lease value. The purchase/lease option, as stipulated in a change-in-control clause in the agreement, is subject to the closing of the proposed acquisition of Chiron by Novartis.

2005A 2006E 2007E 2008E Est. Growth Betaseron Sales $142.2M $156.7M $154.1M $153.0M 5.6%

TOBI

Indications: Pseudomonas aeruginosa

Stage of development: Mature

Importance: TOBI (a formulation of tobramycin) looks positioned for growth over the next few years. The product is the first and only approved inhaled solution in the U.S. for the treatment of pseudomonas aeruginosa lung infection in cystic fibrosis patients. It is currently being approved for sale in the European Union, Canada, Switzerland, Norway, Israel, Argentina and Brazil. The product’s ease of use (inhaled solution) has allowed it to increase its penetration in the mild cystic fibrosis (CF) market.

Sales: TOBI recorded revenues of $65.2M (up 23.0% year-over-year) for 4Q05 and above consensus estimate of $60M primarily due to price increases and increased patient demand in both the United States and Europe, partially offset by wholesaler ordering patterns. The annual sales stood at $232.6M (up 9.2% year-over-year, and from digest average of $231M).

Regulatory issues: TOBI is being evaluated in patients with severe bronchiectasis in a Phase II clinical study. Bronchiectasis is a chronic, destructive lung disease defined by irreversible, abnormal dilation of

Zacks Investment Research Page 2 www.zackspro.com the airways’ anatomical structure. Approximately 70,000 to 100,000 patients have bronchiectasis in the U.S. The company plans to initiate Phase III studies using this new formulation. The first study, TPI002, will be the pivotal efficacy study conducted on 140 TOBI-naive CF patients. The second study, TPI003, is a supportive safety and efficacy study to be conducted on 330 CF patients. The company indicated that it might start worldwide registration filings for this product in 2007. The company believes that the next generation tobramycin product (Tobramycin inhalation powder, TIP) will return the Cystic Fibrosis (CF) product line to a pattern of growth. Chiron anticipates the introduction of TIP will drive greater CF market penetration in patients with less severe disease.

Chiron and partner Nektar Therapeutics announced the initiation of ASPIRE I, the first of two Phase III trials of Tobramycin inhaled powder (TIP) for treatment of Pseudomonas aeruginosa infection in patients with CF in October 2005. ASPIRE I is an ongoing randomized, double blind, multicenter, multinational, placebo-controlled trial. During the first 28 days only, subjects will be randomized to TIP or placebo followed by two treatment cycles with TIP. The second Phase III trial, ASPIRE II, will assess the safety of TIP versus TOBI in CF patients and is anticipated to initiate in 2006. As a hand-held device with full portability, capsule-based inhaler, TIP could potentially provide increased convenience and a shorter administration time to patients.

Others: TOBI should continue to expand throughout the US and EU based on the following publications. The American Journal of Respiratory and Critical Care Medicine issued an article showing TOBI’s efficacy in treating pseudomonas aeruginosa lung infections in pediatric patients with CF.

2005A 2006E 2007E 2008E Est. Growth TOBI Sales $232.6M $249.9M $262.1M $263.0M 7.2%

Proleukin

Indications: Metastatic renal cell carcinoma and melanoma drug.

Stage of development: Mature

Importance: Proleukin (aldesleukin) interleukin-2, Chiron’s leading cancer product, has a proven record in the treatment of metastatic melanoma and metastatic renal cell cancer and is being tested in combination with monoclonal antibodies for the treatment of non-Hodgkin’s lymphoma (NHL).

Revenue: Proleukin revenues were $31.3M (up 0.8% year-over-year) and marginally above consensus figure of $31M in 4Q05. The yearly revenues were $123.5M, down 4.0% year-over-year (but above consensus estimate of $123M) owing to decreased patient demand in the United States and Europe, partially offset by price increases.

Regulatory issues: The company is conducting a Phase II study of this regimen in Rituxan-refractory low-grade NHL patients. The company is conducting another Phase II study to explore the combination of Proleukin with Rituxan in chemotherapy-relapsed/refractory follicular lymphoma patients called the PEaRL study (Proleukin Enhances Rituximab in Lymphoma). This large, randomized, controlled international study is being conducted in Rituxan-naïve patients. This study is targeted to enroll 300 patients with a primary efficacy endpoint of overall response rate and a secondary endpoint of time to tumor progression within two years. This trial is being conducted in combination with Genentech/Biogen Idec, with interim results expected in 1Q06. The company plans to genotype patients in order to identify those patients who are most likely to respond to the treatment.

Competitors: The product faces tough competition from recently approved biologics and numerous other products that are being used off label.

2005A 2006E 2007E 2008E Est. Growth

Zacks Investment Research Page 3 www.zackspro.com Proleukin Sales $123.5 $124.4M $125.5M $113.0M -0.9%

Procleix

Indications: HIV-1 and HCV

Stage of development: Mature

Importance: The blood testing business experienced significant growth in the past since approval of the company’s Procleix system in February 2002. Procleix is a nucleic acid testing (NAT) product used for detecting viruses like HIV-1 and HCV in donated bloods. Chiron received approval for the Procleix West Nile Virus Assay on December 01, 2005. The company expects the WNV assays to convert to commercial pricing in 2006. They plan to submit a U.S. application for the Tigris West Nile Virus Assay by mid-2006.

Partners: The company has tied up with Gen-Probe (GPRO) to develop these NAT products. Under the terms of the collaboration, the company is to manufacture and sell these products and pay roughly 45.75% royalty to GPRO for jointly participating in research and development activities. The company, in association with GPRO, is currently developing two NAT products to detect viruses in blood samples using the fully automated TIGRIS instrument and a semi automated instrument system. One is Procleix West Nile Virus Assay (WNVA) for detecting WNV and the other is Procleix Ultrio for detecting HBV, HIV and HCV.

Revenue: Nucleic acid testing revenues were $273.4M (up 9.4% year-over-year) for FY2005, slightly below the digest estimates of $277M. The increase in sales over FY2004 can be attributed to continued geographic expansion and the introduction of the Procleix Ultrio Assay and Procleix Tigris System into a number of markets outside of the United States. Chiron has achieved its 2005 goals of 50% conversion to the Ultrio assay from the duplex (HIV/HCV) assay in Europe, and the placement of TIGRIS machines in key EU blood centers. Chiron has implemented Procleix Ultrio testing in four new geographic markets (South Africa, Malaysia, Israel and Lithuania) planned for 2005. Testing in South Africa began on October 3, 2005 at three sites and involving eight TIGRIS systems. In addition, testing has been implemented in Lithuania (80,000-100,000 donations annually) and installation has begun in Israel (280,000 donations annually). Procleix routine testing began in South Korea in early February, 2005. In 2006, Chiron has plans to enter four new countries, similar to 2005. One firm (R W. Baird) anticipates NAT business to grow 25% in 2006.

Continued introduction of the fully automated Procleix TIGRIS system, which enables higher throughput and smaller pool blood screening and potential US approval of the TIGRIS system, is expected to fuel growth. At present, 40 TIGRIS systems have been installed worldwide, 13 of which are in the U.S under the West Nile Virus IND.

Regulatory issues: In October 2005, Chiron’s collaborator Gen-Probe announced that the FDA found that Ultrio, run on the TIGRIS platform, was not substantially equivalent to Ultrio running on the semi- automated eSAS platform. Chiron and collaborator Gen-Probe however, announced that they are currently reviewing the application for Ultrio on the TIGRIS system. Chiron remains optimistic that Ultrio on the TIGRIS platform will be approved in 2006.

Management expects U.S. adoption of Procleix Ultrio to follow a similar trajectory as EU adoption, or ~20-30% in the first year, and ~50% in the second year.

CHIR also ships NAT products to Roche for a royalty payment, as well as an HIV-1/HCV assay product to Ortho Diagnostics (a JNJ subsidiary). The company books the Ortho Diagnostic business under the ‘Equity JV’ line on the income statement. Joint business contractual arrangement with Ortho-Clinical Diagnostics recorded increased revenues in 4Q05 primarily due to increased profitability realized by the

Zacks Investment Research Page 4 www.zackspro.com joint business. It settled a dispute with Roche over the royalty payments issue associated with the NAT product sales. This apart, CHIR will receive $64M, which it will recognize in eight equal installments through 2006. Roche may, however, opt for an 11-19% royalty payment through 2006 instead of the $64M payment.

Overall the digest average predicts a CAGR of 15.0% through 2007 in blood testing and NAT sales. One firm (UnionBankSwitz.) describes this business as the Crown Jewel of Chiron.

2005A 2006E 2007E 2008E Est. Growth Blood Tests / NAT $273.4M $332.0M $362.9M $384.0M 13.2%

Fluvirin

Indications: Vaccine for pediatric, travel, and novel applications.

Stage of development: Mature, widely sold.

Importance: CHIR is the world’s No. 2 player in the vaccine market for pediatric, travel, flu, and novel (hepatitis, meningitis) applications with leading market share positions in U.K., Germany and Italy.

Revenue: Chiron reported total vaccine sales of $243.5M for the fourth quarter, above consensus estimate of $234M, attributable to the return of Fluvirin vaccine to the U.S. market. The annual sales figure stood at $580.5M (up 21.2% year-over-year and above consensus estimate of $571M). Sales of Fluvirin vaccine were $96M in 2005, compared to $2M in 2004, which related to sales from the 2003- 2004 influenza season. The company sold around 13M doses of the vaccine to its customers in 2005.

Sales of other influenza vaccines were $129M in 2005, a decrease of 15% compared to 2004, primarily due to no sales of Begrivac vaccine in 2005, compared to $53M of sales in 2004. However, the company expects a comeback of Begrivac in 2006. The decrease was partially offset by increased sales of other influenza vaccines. Chiron reiterated that the Liverpool manufacturing facility would have capacity to support approximately 40M doses of Fluvirin for the 2006/2007 influenza season, but would not provide guidance on the actual production levels expected for the next season. In addition, the company reiterated its confidence in the strong pricing for Fluvirin going into 2006 and is not concerned about the addition of other influenza manufacturers entering the U.S. market.

The increase in travel vaccines sales ($147M compared to $97M in 2004) was primarily due to an increase in sales of Encepur tick-borne encephalitis vaccine and Rabavart/Rabipur rabies vaccines. The decrease in pediatric and other vaccines sales from $201M in FY04 to $166M in FY05 was primarily due to a decline in polio vaccine sales and mumps, measles and rubella vaccine sales due to product unavailability as a result of manufacturing upgrades. In addition, certain other vaccine sales declined due to remediation efforts at Chiron's Liverpool manufacturing facility, which resulted in an interruption of production. These decreases were partially offset by an increase in sales of diphtheria, pertussis and tetanus vaccine concentrate.

One firm (Deutsche Bank) continues to anticipate consolidation in the vaccines industry due to expected increases in global demand for influenza vaccine and intensifying concern over the potential of an avian flu pandemic. It estimates to market 35 to 40M Fluvirin doses with sales reaching $260M in 2006.

In February 2006, Chiron entered into agreements with the UK and the US governments regarding supply of the H5N1 avian influenza vaccine containing CHIR’s MF59 adjuvant. Delivery of the stockpile remains subject to internal and regulatory release procedures. As part of its avian influenza vaccine strategy, Chiron expects to manufacture avian influenza vaccines during the traditional break between seasonal influenza vaccine campaigns, finishing these activities in time for the seasonal influenza vaccine production to avoid interruption of the normal manufacturing cycle.

Zacks Investment Research Page 5 www.zackspro.com Regulatory issues: In October, 2005 Chiron obtained approval from the UK Medicines and Healthcare Products Regulatory Agency (MHRA) and the FDA to start supplying its egg-based, injectable flu vaccine, Fluvirin, to the market. The company has started shipping 5M Fluvirin doses, 3.4M of which has been released by the FDA. One firm (Goldman) views the approval of Fluvirin as a positive step in Chiron’s establishment of its flu franchise in the U.S.

On February 7, 2006 CHIR announced that the Securities and Exchange Commission (SEC) has decided to terminate its investigation of whether Chiron violated any federal securities laws in connection with the previous suspension by the UK Medicines and Healthcare products Regulatory Agency (MHRA) of Chiron's license to manufacture Fluvirin influenza virus vaccine and has ended its inquiry into the company's restatement of financial results for the second and third quarters of 2004. Chiron has been informed that no enforcement action has been recommended against the company in connection with these matters.

Competitors: However, competition has intensified significantly, with capacity expansion at Sanofi- Aventis, GlaxoSmithKline and ID Biomedical, potential relaunch of MedImmune’s FluMist with a more stable formulation and additional indication for children in 2007, assuming positive Phase III data in Q405, and proposed acquisition of ID Biomedical by GlaxoSmithKline as announced on 9/7/05. Despite the below-consensus results, one firm (B. of America) believes the timing is positive in strengthening Chiron’s competitive position beyond the 2005-2006 season in a dynamic and consolidating flu vaccine market.

Menjugate

Indications: Meningococcal disease

Stage of development: Phase II/III

Importance: The company sells Menjugate, a conjugate vaccine, for meningococcal disease outside the U.S. The meningococcal ACWY opportunity is approximately $850M in the U.S., $300M in Europe and $450M in the rest of the world. One firm (MorganStanley) expects it to be launched in 2008.

Regulatory issues: For the U.S. market, CHIR was evaluating the vaccine in Phase III trials. As a background, CHIR had filed the BLA in late 2004. However, additional analysis requested by the FDA forced the company to plan for a regulatory submission in 2005. With CHIR now deciding not to file the BLA, one firm (Morgan Stanley) has eliminated these vaccine sales from its model. The firm believes this decision will make a minimum impact on the company’s long-term growth prospects as the company will now focus on Menjugate ACWY vaccine, a potential blockbuster product.

MeNZB

Indications: Meningococcal B vaccine

Stage of development: Phase II

Importance: CHIR received a license for a New Zealand meningococcal B (MeNZB) vaccine, currently under Phase II trial. The meningococcal B bacterium is highly infectious and affects the areas around the brain and the spinal cord, leading to meningitis and blood poisoning. New Zealand’s Ministry of Health aims to vaccinate 90% of the New Zealanders under the age of 20 in a $200M nationwide vaccination program. However, specific financial details were not disclosed.

Regulatory issues: The company plans to initiate MeNZB’s Phase III study in 2005. The company has also filed an IND application with the U.S. FDA for initiation of clinical studies during 3Q04. In addition, it

Zacks Investment Research Page 6 www.zackspro.com has also begun discussions with the FDA regarding a regulatory pathway. The company believes it may be in a position to submit a regulatory filing in Europe in 2006.

Additional trials: A combination HIV/HCV vaccine also provides reason to be optimistic. CHIR is working with partners Vaccine Trials Network and St. Louis University to develop an HIV and HCV vaccine. Both are in early Phase I trials. Chiron has completed enrollment of its Phase I studies of these vaccines. The company is also working on a cell culture derived flu vaccine for both the U.S. and European markets. For this product, CHIR has initiated a Phase III trial for European submission some time in 2006.

Revenue: The increased sales in meningococcal vaccines in 4Q05 was primarily due to increased sales of MENZB(TM) meningococcal B vaccine to the Ministry of Health in New Zealand and an increase in tender sales of MENJUGATE meningococcal C vaccine.

2005A 2006E 2007E 2008E Est. Growth Vaccine Sales $580.5M↓ $778.3M $821.5M $891.0M 19.7%

Some firms are pessimistic on CHIR’s late-stage pipeline, citing a lack of visibility on any major therapeutic programs. Much of the current R&D effort is concentrated on additional NAT and vaccine products. CHIR is looking for ways to increase both TOBI and Proleukin sales via additional clinical trials. Additionally, there are therapeutic development programs that look interesting:

Tifacogin

Indications: The product is a recombinant form of a tissue factor pathway inhibitor (TFPI) to be evaluated on 2,100 patients with severe community acquired pneumonia (CAP).

Stage of development: Phase III

Importance: The first is an antibiotic, Tifacogin, in Phase III clinical trials called CAPTIVATE. Tifacogin had previously failed in a Phase III study conducted on patients with severe sepsis. There are no products in the market for CAP, so CHIR’s management decided to pursue the clinical trial given the large market potential. There are roughly 500K CAP patients in the U.S and EU.

Regulatory issues: On December 19, 2005 Chiron announced that a planned interim analysis of 900 patients in a Phase III trial examining Tifacogin in severe community acquired pneumonia yielded no safety concerns from a Data Monitoring Committee (DMC). The DMC finding confirms prior safety assessments conducted when the trial enrolled both 300 and 600 patients. The CAPTIVATE study will continue unabated, and Chiron remains blinded to the interim results. As a reminder, Chiron had not expected releasing the outcome of this interim analysis unless DMC determined that the study was unlikely to achieve success (i.e., assessment of futility).

Although Chiron had previously hoped enrollment would be completed by the end of 2006, the company indicated that enrollment is expected to be complete by H1 2007 and the goal is to enroll 2,100 patients in the study. Chiron is conducting the CAPTIVATE study in 200 centers covering 19 countries worldwide. The primary endpoint is reduction in mortality at 28 days. Chiron estimates that approximately 300,000 patients in the U.S. and 145,000 in the EU are affected by severe community acquired pneumonia and approximately 30% die from this indication. One firm (Smith Barney) remains cautious regarding the outlook for Tifacogin given its failure in previous clinical studies.

Royalty: Under a joint program between Chiron and Pfizer, TFPI failed to meet the primary end-point of 28-day all cause mortality in patients with severe sepsis in a Phase III study. The company indicated that they have acquired all of Pfizer’s interest in TFPI. In return, Pfizer will be obligated to receive royalties on sales of TFPI.

Zacks Investment Research Page 7 www.zackspro.com Cubicin

Indications: For skin infection caused by Gram-positive bacteria.

Importance: Another product likely to add value to the company’s business is Cubist Pharmaceutical’s Cubicin (daptomycin). The product is already approved for sale in the U.S. market for skin infections caused by gram-positive bacteria. The use of Cubicin is supported by clinical data from two pivotal Phase III clinical trials conducted by Cubist, which examined the safety and efficacy of Cubicin in the treatment of cSSTI. These trials demonstrated that Cubicin was as effective as a standard therapy in this indication. The launch of Cubicin in Europe provides an important new alternative in the treatment of serious skin infections, which are increasingly resistant to standard drug therapies.

Regulatory issues: On January 23, 2005, Chiron announced that the European Commission has granted marketing approval for Cubicin. The marketing approval was granted in the 25 member states of the European Union, Iceland, Liechtenstein and Norway. Under the approval, Cubicin is indicated for the treatment of complicated skin and soft-tissue infections (cSSTI) caused by gram-positive bacteria. Cubicin is expected to become available in the United Kingdom and the Netherlands shortly followed by additional European countries, in accordance with local legal regulations.

The company had submitted a Marketing Authorization Application (MAA) to the European Medicines Agency (EMEA) for Cubicin. Cubicin is already approved in the U.S. On November 17, 2005 Chiron and Cubist announced that the CHMP (Committee for Medicinal Products for Human Use) has recommended Cubicin for the above mentioned indication. One firm (Thomas Weisel) viewed it as an incremental positive as it validates the safety and efficacy of Cubicin in treating serious skin infections. The firm expects Chiron to also seek an indication for bacteremia and endocarditis in the EU in the near term. A couple of firms (Goldman, UnionBankSwitz.) believe Cubicin’s market is worth $100-$200M in Europe.

Pulminiq

Indication: For lung transplant rejection.

Stage of development: Phase III

Importance: CHIR is developing an aerosolized form of Cyclosporin (Pulminiq) for lung transplant rejection. There are roughly 1100 lung transplants per year. The procedure has a 50% mortality rate and the company believes the market for Cyclosporin is worth about $40-75M. Although the market opportunity is small, one firm (Goldman) believes the margins may be attractive because the product can be sold using Chiron’s existing TOBI sales force.

Regulatory issues: The company filed an NDA last year. The FDA requested additional analysis on the pivotal study and cleared access through an early access program. The FDA extended the PDUFA date to review additional requested data. The FDA briefing document highlights how the Phase II Pulminiq study failed to achieve its primary objective of reducing the incidence of acute rejection episodes in lung transplant patients. In addition, the FDA is concerned about whether there is ample safety data in the NDA.

The company intends to strengthen its oncology franchise through these two alliances — Xoma and Sagres. CHIR formed an alliance with Xoma (XOMA) to develop multiple antibody products for various cancer uses. The products are still in early stage development. Under the terms of the deal, the companies will split profit 70/30, with 70% going to CHIR. CHIR also paid XOMA a $10M upfront payment, and could make $50M in milestone payments going forward. In addition, CHIR has also acquired Sagres Discovery, a privately held company that focuses on developing drugs for the treatment of cancer. During the quarter, Chiron and XOMA initiated a Phase I trial of CHIR-12.12 (anti-CD40 mAb) for the treatment of multiple myeloma. A Phase I trial for the treatment of chronic lymphocytic leukemia (initiated April 2005) is also ongoing. In addition, phase I trials of CHIR-258 (oral kinase inhibitor) in solid

Zacks Investment Research Page 8 www.zackspro.com tumors, acute myelogenous leukemia, and multiple myeloma are ongoing with selection of a Phase II indication anticipated soon and an IND filing for a third compound, CHIR-265 (an oral RAF antagonist) is also anticipated shortly. In its 4Q05 conference call, management reiterated its commitment to continue making progress in its small molecule oncology program in 2006

Chiron is also developing a cell culture based flu vaccine. Such a vaccine would avoid the use of eggs, thus reducing the production time which would be critical in the case of a pandemic. The first Phase III trial has been completed in Europe and enrollment for the second Phase III trial is also complete. Filing is planned for Europe in 2006. Chiron initiated a Phase I/Phase II study of the investigational cell culture- derived vaccine for seasonal influenza in the United States in late October. Protein Sciences is also conducting a Phase II/III trial on a vaccine produced in insect cells. Solvay plans to file its cell culture vaccine (Invivac Tc) for marketing approval in Europe in 2006. GlaxoSmithKline has acquired a vaccine plant in Marietta, Pennsylvania to develop and produce cell culture based flu vaccines. Its clinical trials on avian flu are planned for 2006.

Essentially all the major flu vaccine manufacturers, including Chiron, are developing vaccines against the avian flu strains, including H5N1 and H9N2. Chiron indicated that the Liverpool facility has the capacity to produce 160M doses of the monovalent avian flu vaccine by 2007 or 2008. In addition, Chiron is in discussion with both the FDA and eight other licensing agencies for pandemic preparedness efforts.

Chiron announced preliminary promising data from a clinical study of its investigational vaccine against an H9N2 avian influenza strain. The trial was supported by the National Institute of Allergy and Infectious Diseases (NIAID) and explored the safety and immunogenicity of four different doses of the investigational vaccine with and without Chiron's adjuvant MF59. All vaccine formulations containing the adjuvant MF59 proved highly immunogenic, inducing antibody levels believed to confer protection against the influenza strain, including at the lowest antigen dose tested, 3.75 mg.

Chiron won a contract to supply the U.S. government with a candidate pre-pandemic influenza vaccine for a stockpile to protect against an H5N1 avian influenza virus strain with the amount payable under the agreement depending upon the amount of bulk vaccine actually delivered, which is subject to manufacturing factors such as yield, throughput and total manufacturing time.

On April 11, 2006, CHIR announced the initiation of a Phase I clinical trial of CHIR-265, a selective Raf kinase inhibitor, in patients with melanoma. CHIR-265 is an investigational drug candidate and has not been approved by the FDA. Preclinical data suggested that CHIR-265 has both direct anti- proliferative/pro-apoptotic activity on tumor cells as well as anti-angiogenic activity that target the tumor blood supply.

The single-agent, open-label Phase I study of CHIR-265 is designed to evaluate the safety, dose tolerability and pharmacokinetic profile of CHIR-265 in patients with melanoma. A translational medicine approach will be used to monitor biomarkers in order to evaluate the biological activity and define the optimal dose. The study is expected to enroll up to 60 patients at three leading cancer centers in the United States.

Total Revenue:

Total revenues for FY05 increased 11.4 percent, to $1919.7M, primarily due to the increase in net product sales, and increases in both royalty and license fee revenues and revenues from the joint business contractual arrangement with Ortho-Clinical Diagnostics. The withdrawal of the MMR vaccine impacted the FY05 revenue.

Royalty and license fee revenues increased, primarily due to various settlements in 2005, including a favorable settlement with Centocor relating to certain patents, which resulted in the recognition of upfront

Zacks Investment Research Page 9 www.zackspro.com payments and royalties, and a settlement with the Scottish National Blood Transfusion Service regarding certain Chiron hepatitis C (HCV) and HIV patents. Betaferon royalties increased primarily due to higher demand and price increases. Royalties related to NAT blood screening received from Roche increased due to higher applicable royalty rates as certain countries entered the EU and an increase in reported donations.

2005A 2006E 2007E 2008E Est. Growth Total Revenues $1919.7M $2189.1M↑ $2352.5M↓ $2538.9M 10.9%

Margins

Gross profit margin for the full year 2005 increased to 61.9% and for Q405 to 64.0% (from corresponding figures of 60.8% in 2004 and 59.2% in Q404, respectively) primarily due to the return of Fluvirin vaccine to the U.S. market in 2005. The company had reported in 2004 that its entire Fluvirin vaccine product inventory was written off, resulting in a $91M charge to cost of sales. However, the increase in gross profit margin was partially offset by Fluvirin remediation costs, no sales of Begrivac influenza virus vaccine due to a product sterility issue, and inventory that were written off in 2005. The gross profit margin for blood testing products was 41% in 2005, compared to 42% for 2004. The gross profit margin for BioPharmaceuticals was 72%, consistent with that of FY2004. The gross profit margin for vaccines was 32%, compared to 23% in FY2004.

Research and development expenses totaled $433.9M for the full year 2005 and increased of 0.6% year- over-year, primarily due to the cost of development efforts in Chiron's oncology and meningococcal vaccine franchises, Tifacogin, and cell culture-derived influenza vaccine. Research and development expenditure for the fourth quarter 2005 was reported at $109.3M, a 15.6% decrease year-over-year owing to the fact that a variety of research and development programs was discontinued by the company in Q405. Selling, general and administrative expenses came at $501.2M, reflecting an increase of 9.1% year-over- year, attributable to a broad range of activities, including Novartis transaction-related costs, the pre- launch program for Cubicin in Europe, higher employee-related costs, compliance with the Sarbanes- Oxley Act and higher Fluvirin vaccine-related legal costs. For the fourth quarter 2005, SG&A spending declined 9.0% year-over-year to $125.4M, primarily due to larger than expected SG&A spending.

Operating income for the fourth quarter 2005 stood at $150.5M, an increase of 1124.0% compared to the year-ago quarter, which had recorded a negative operating income. Full year operating income also increased on a year-over-year basis by 61.2% and was reported at $232.0M.

The effective tax rate as was reported by the company was 11% on an adjusted and GAAP basis for the year ended December 31, 2005, compared to 25% on an adjusted basis and 28% on a GAAP basis for the year ended December 31, 2004. The decrease was primarily due to lower profits in certain ex-U.S. locations and the transfer of certain product rights in 2004. However, Chiron does not consider this tax rate to be indicative of the company's effective tax rate going forward.

2006E Margins: Gross Margin Operating Margin Net Margin Digest Average 64.5%↑ 19.4%↑ 16.6%↑

Operational expenses are soaring. CHIR continues to heavily spend on building out its thin pipeline. Many firms (B. of America, Deutsche Bank, Goldman, Merrill, MorganStanley, Prudential, SG Cowen, Smith Barney) predict sizable increases in both R&D and SG&A ahead. In fact, this is the basis for a few negative ratings on the shares. CHIR will continue to spend on R&D to fund programs for Proleukin

Zacks Investment Research Page 10 www.zackspro.com combination therapy, TOBI, meningitis vaccines, new NAT products, and antibiotics tifacogin and Cubicin (daptomycin).

Earnings per Share

Chiron reported adjusted income from continuing operations of $253.3M, or $1.31 per share, for the year ended December 31, 2005 (above digest estimate of $1.02), compared to adjusted income from continuing operations of $127 M, or $0.67 per share, for the year ended December 31, 2004, reflecting an increase of 99.3% year-over-year. Chiron also reported GAAP income from continuing operations of $180.5M, or $0.94 per share, for the year ended December 31, 2005, compared to GAAP income from continuing operations of $54M, or $0.28 per share, for the year ended December 31, 2004, reflecting an increase of 235.7% year-over-year. For the fourth quarter, the company reported pro forma EPS of $0.78, which was above the consensus estimate of $0.51. The corresponding GAAP figure was reported at $0.68. The better than expected bottomline results were driven by nearly equal contribution from a lower effective tax rate for the fourth quarter and higher-than-expected product sales (primarily from sales of influenza vaccines outside the U.S.) and royalty and other revenues, comments most firms. One firm (Smith Barney) opines that the lower tax rate for the fourth quarter translated into a lower effective tax rate of 11% for the fiscal year and represented a differential of an estimated $0.18 per share. The aggregate higher revenue representing a differential of an additional $65 M (Vaccine sales of +$22 M; Royalty and other revenues of +$29 M), added $0.21 per share, according to the firms. However, the company attributed this one-time favorable tax rate to lower profits in ex-U.S. locations and the transfer of certain product rights in 2004.

Foreign exchange rates resulted in an approximate decrease of $0.01 in adjusted earnings per share and an approximate decrease of $0.01 in GAAP earnings per share for the year ended December 31, 2005.

2006E 2007E Street Consensus $1.79 $1.87↑ Company Guidance - Low Estimate $1.39 $1.76 High Estimate $2.58 $1.96

The company did not provide with any EPS guidance for the full year 2006. One firm (Bernstein) believes the company has little incentive to make the final quarter of 2006 particularly strong, and it does not anticipate a particularly strong guidance, or performance. On the other hand, the company should be very well positioned for a strong rebound in 2006, based on re-accelerating growth in testing revenue, effectively doubled flu vaccine revenue and stable performance in other areas, according to the analyst.

Long-Term Growth

The digest average for LTG rate is about 17.3% ranging between a low of 14% (Lehman) and a high of 20% (Smith Barney). The company definitely enhanced its long-term prospects via the PowderJect acquisition. CHIR seems to be optimistic on worldwide Flu vaccine sales for the 2005/2006 flu season. In addition, the company cites Wyeth’s exit from the needle business as a reason to be optimistic on picking up market share. Wyeth was the world’s No. 3 player behind Chiron and Aventis. Analysts think CHIR also has a strong potential to grow the NAT business with international WNVA and Ultrio sales using the TIGRIS system. They believe single-donor testing is clearly the next big issue in blood testing, and CHIR is well positioned for it. While the company has decided to spend much of its cash flow on R&D and Fluvirin remediation, one firm (SG Cowen) believes that this situation will be untenable in the long term. Another firm (Prudential) continues to anticipate long-term growth challenges for the business regardless of FDA’s decision on Fluvirin. Other firms, however, continue to have faith in Chiron's long-

Zacks Investment Research Page 11 www.zackspro.com term ability to overcome increasing competition for flu vaccine and Menjugate vaccine products, as well for maturing BioPharma products including Betaseron, TOBI, and Proleukin. One firm (R W. Baird) anticipates that Chiron's Biopharmaceutical products have the potential to grow in the 10%-15% area, the pipeline offers longer-term opportunities and TOBI's revenue growth will continue from new formulations and delivery devices.

CHIR continues to invest heavily on R&D in order to support growth. While some firms in the digest group view this as a positive step for maintaining growth in the long run, others believe investments in pipeline products are unlikely to yield meaningful results. The debate is on and that’s probably the reason for such a wide gap in LTG rates expected by different firms. The gap also reflects the uncertainty surrounding Fluvirin production and seasonality of the vaccine business. A strong or a weak flu season has the potential to affect growth. But firms expect the approval of additional flu vaccine suppliers such as ID Biomedical and GlaxoSmithKline will impact the Fluvirin market in the long term. Firms are concerned about the long-term growth of the flu vaccine market, legal risks associated with shareholder lawsuits and competition threats to Chiron’s therapeutic products on multiple fronts. The company however seems confident that even in the wake of strong competition from other influenza drug manufacturers, Fluvirin will be rightly priced. It has made several changes in its Liverpool manufacturing facility and expects to support 40M doses in 2006/2007 influenza season which may partially alleviate the firm community’s concerns.

Target Price/Valuation

The company has posted a good quarter mainly due to the comeback of the drug Fluvirin in the market and expects to continue good sales in future. The current price at which the stock is trading is $47.94, roughly 26.7X 2006 earnings suggesting convergence to the Novartis acquisition price. With a projected LTG rate of 17.3%, the PEG of 1.55X is near average for the biotech group. The target price for CHIR ranges from a low of $44 (Deutsche Bank, 8.22% down from the current price) to a high of $48.90 (Zacks Investment Research, 2.0% up from the current price of $47.94). A few firms have increased their price target to $48 from $45 based on the amended Novartis bid for acquisition of CHIR. The average target price is $46.66 (↑ from the previous value and 2.67% downside from the current price). The most common valuation methodology adopted by the firms is P/E multiple applied to forward EPS estimates. Of the seventeen brokerage firms who cover the stock four have not reported. Of the firms who came up with reports, ten have given a neutral rating to the stock, two have rated the stock negative while one has not rated the stock. However none of the firms in the coverage universe have a positive rating on the stock.

Given the fundamental change in business (toward vaccines), CHIR should trade at a biotech multiple discount. However, with a LTG rate clearly superior to healthcare conglomerates, a premium to large- cap pharma looks warranted. It all comes back to the debate on growth.

Capital Structure/Solvency/Cash Flow/Governance/Other

On April 3, 2006, CHIR made an amendment to its previously announced merger agreement with Novartis, according to which Novartis increased its offer to $48 per Chiron share, reflecting an increase of 6.7% from the previous offer of $45 (to acquire 56% of the CHIR shares that Novartis does not own). The amended merger agreement has been unanimously approved by Chiron's non-Novartis directors. The merger will now require a majority of outstanding shares to be voted in favor of the transaction. As all necessary regulatory approvals were previously received, Chiron expects the merger to close promptly after the stockholder vote on April 19, 2006. One firm (Smith Barney) believes that differences in independent proxy advisor opinions related to the $45 per share bid combined with the shareholder discontent may have provided leverage for Chiron to negotiate again with Novartis to secure the revised

Zacks Investment Research Page 12 www.zackspro.com terms. It believes Chiron and Novartis had aligned interests to close the deal and the revised offer may lead to commencement of the acquisition. CHIR believes that the large group of shareholders who had opposed the merger agreement initially will now vote in favor of the merger.

On January 23, 2006, the Committee on Foreign Investments in the United States (CFIUS) advised Chiron that it had concluded its review of the proposed acquisition of Chiron by Novartis and determined that there are no issues of national security sufficient to warrant an investigation under the Defense Production Act.

CHIR announced on February 6, 2006, that the European Commission declared CHIR’s acquisition by Novartis is compatible with the common market. This follows approval by the U.S. Federal Trade Commission (FTC) in December 2005 and clearance by the Committee on Foreign Investment in the United States (CFIUS) in January 2006. One analyst (R W. Baird) does not believe this merger will have an impact on GPRO, CHIR's partner in the NAT blood screening market. Novartis said that it is looking to expand CHIR/GPRO's international penetration via Novartis' global infrastructure. Moreover, Novartis may look to expand further into molecular diagnostics.

On March 16, 2006 Chiron announced the recall of Morupar, its measles, mumps and rubella (MMR) vaccine from the Italian market as well as certain developing world markets. Routine pharmaco-vigilance conducted by officials in Italy suggested that Morupar may be associated with higher rates of adverse events including fever, allergic reactions, swelling of glands compared to other MMR vaccines. Although the adverse events were within the range of those commonly associated with vaccination, Chiron chose to recall the product as a precautionary measure. Analysts believe that although the withdrawal will have limited financial impact, it is a reflection of the company’s lingering issues in the vaccine business. As a result of the withdrawal, the company wrote off $6M in inventory, recording a $1.7M product return reserve to cover the cost of the recall. The company restated the 4Q05 results as well as the FY05 financial figures as a consequence of the withdrawal.

Upcoming/Recent Events

Date Event Comments Early 2006 Procleix Ultrio Expect FDA approval. 2006 EU filing for cell culture flu vaccine Filing 2006 Initiate Phase III trial of cell culture flu Filing vaccine in US. 2006 Phase III data on TOBI powder Phase III formulation. H106 Initiate Phase III trial on meningitis ACWY Phase III vaccine in US Q42006 Phase III efficacy Data on Tifacogin for Phase III severe CAP. 2006 Initiate phase II trail on CHIR 258 in Phase II cancer. H106 Initiate phase II trial on meningitis B Phase II vaccine.

Individual Analyst Opinions

POSITIVE RATINGS

Zacks Investment Research Page 13 www.zackspro.com None

NEUTRAL RATINGS

AG Edwards – Hold – February 1, 2006: The firm values Chiron based on underlying earnings power of $2.00 in 2006 commanding a 22X multiple, consistent with sectoral ranges. It thinks that Chiron can grow 10%-15% off the $2.00 that it has estimated for 2006 earnings. It feels that unless one offers a substantial premium for control, Chiron shares will not trade higher than their current range and thus a touch below $45 is likely the current floor. It therefore continues to recommend holding positions in the shares.

Harris Nesbitt – Neutral ($48 – target price) – April 03, 2006: The firm retains its neutral rating on the stock and believes that the merger agreement with Novartis will end after the shareholders vote on April 19, 2006.

Deutsche Bank – Hold ($44 – target price) – April 03, 2006: The firm has calculated its $44 price target based on 17x FY06 EPS estimate of $2.66 and PEG of 0.9x versus its big-cap competitor group of 29x and 1.5x reflecting anticipation of continued consolidation in the vaccines industry, and CHIR’s lack of major upcoming catalysts. This is further reinforced by long-term EPS CAGR of 18.7%, falling in the lower-half of its big-cap competitor group ranging from 17%-39%, as well as protracted Fluvirin uncertainties resulting in lingering concern over management credibility.

Lehman – Equal weight ($45 – target price) – February 2, 2006: The firm believes that that the Q405 performance suggests no change to the Chiron fundamentals and its valuation discounts the return of Fluvirin to the US market.

R W. Baird – Neutral ($48 – target price) – April 03, 2006: The firm is encouraged by Fluvirin’s return in Q405 and expects a full return in 2006. It has increased its price target to $48 based on the revised offer from Novartis.

UnionBankSwitz. — Neutral ($45 – target price) – January 31, 2006: The firm has rated the stock Neutral and has given a price target of $45, which is based on the acquisition bid from Novartis and continues to expect the stock to trade largely in line with this bid.

NEGATIVE RATINGS

J.P. Morgan – Under weight – March 16, 2006: The firm believes that the MMR vaccine withdrawal should not affect the impending acquisition by Novartis, which is anticipated to close in 1H06. It believes that though the withdrawal may not be due to manufacturing issues as was the case with the Fluvirin and Begrivac withdrawals, it does suggest that Chiron's vaccine business remains a matter of concern.

Smith Barney – Sell ($48 – target price) – April 11, 2006: The firm recommends a Sell rating for Chiron shares to reflect the high risk surrounding the Novartis bid price under the proposed merger agreement. It feels that though sales of vaccines and the Procleix eSAS system (NAT-nucleic acid amplification test) for blood screening will remain the key revenue growth drivers, given the seasonality of the company’s business, flu vaccines have become a significant portion of revenues (30% of revenues and 50% of product sales). It opines that Chiron lacks depth in regard to a product pipeline in comparison to its peer group of large cap biotechnology companies.

Thomas Weisel − Peer Perform (no price target) − April 03, 2006: The firm believes that although the Morupar recall is more of a precautionary measure and has limited financial impact, it does signal that

Zacks Investment Research Page 14 www.zackspro.com there are still some lingering issues with Chiron’s vaccine business. It expects the stock to trade around $48, the offer price put forward by Novartis, as investors anticipate the merger agreement to materialize.

NOT EXPLICITLY RATED

Goldman − (no price target) − February 13, 2006: The firm has not rated the stock.

Appendix-A

Analyst sales estimates by product and margin data available in the file CHIR.xls

Copy editor: Uttara G.

Zacks Investment Research Page 15 www.zackspro.com