ENSC 201 Assignment 9

Due Friday November 29, 2013

9.1

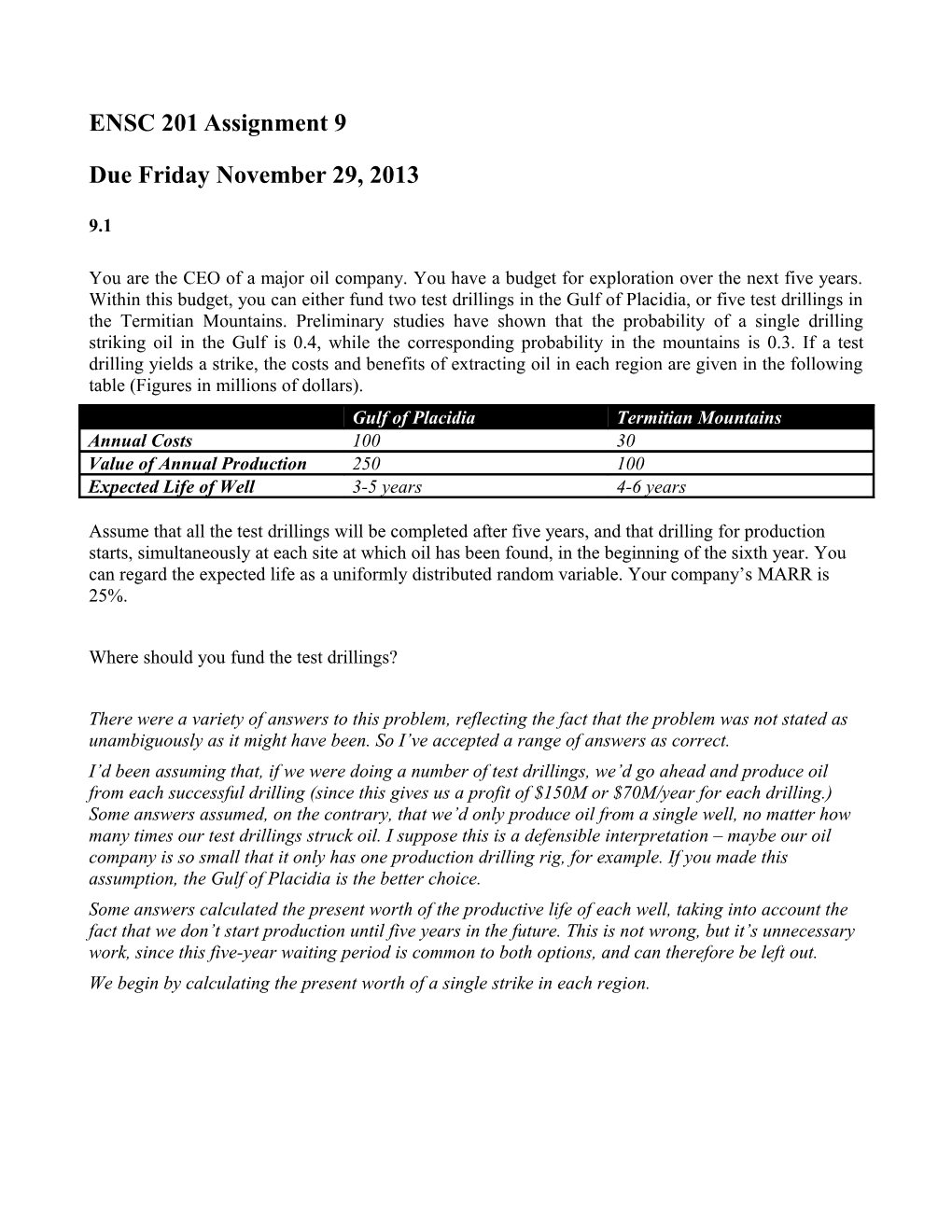

You are the CEO of a major oil company. You have a budget for exploration over the next five years. Within this budget, you can either fund two test drillings in the Gulf of Placidia, or five test drillings in the Termitian Mountains. Preliminary studies have shown that the probability of a single drilling striking oil in the Gulf is 0.4, while the corresponding probability in the mountains is 0.3. If a test drilling yields a strike, the costs and benefits of extracting oil in each region are given in the following table (Figures in millions of dollars). Gulf of Placidia Termitian Mountains Annual Costs 100 30 Value of Annual Production 250 100 Expected Life of Well 3-5 years 4-6 years

Assume that all the test drillings will be completed after five years, and that drilling for production starts, simultaneously at each site at which oil has been found, in the beginning of the sixth year. You can regard the expected life as a uniformly distributed random variable. Your company’s MARR is 25%.

Where should you fund the test drillings?

There were a variety of answers to this problem, reflecting the fact that the problem was not stated as unambiguously as it might have been. So I’ve accepted a range of answers as correct. I’d been assuming that, if we were doing a number of test drillings, we’d go ahead and produce oil from each successful drilling (since this gives us a profit of $150M or $70M/year for each drilling.) Some answers assumed, on the contrary, that we’d only produce oil from a single well, no matter how many times our test drillings struck oil. I suppose this is a defensible interpretation – maybe our oil company is so small that it only has one production drilling rig, for example. If you made this assumption, the Gulf of Placidia is the better choice. Some answers calculated the present worth of the productive life of each well, taking into account the fact that we don’t start production until five years in the future. This is not wrong, but it’s unnecessary work, since this five-year waiting period is common to both options, and can therefore be left out. We begin by calculating the present worth of a single strike in each region. Part 1: Expected present worth and expected lifetime How do we deal with the fact that the expected life is a uniformly-distributed random variable? There are at least four ways of doing this, any of which I counted as correct: Simplest method: We will discretize the possibilities and say that there are equal chances of the productive life in the Gulf being 3, 4 or 5 years. It follows that the expected lifetime in the Gulf is 4 years, so we can say: PW of a strike in The Gulf = 150(P/A,0.25,4) = 150(2.3616) = $354.24M Similarly, PW of a strike in the Mountains = 70(P/A,0.25,5) = $188.25M Less simple method: We again discretize the possibilities, but we note that present worth is a non-linear function of lifetime, so the expected value of present worth is not the present worth for the expected lifetime. A more accurate figure for present worth would be: PW of a strike in The Gulf = 150((P/A,0.25,3)/3+(P/A,0.25,4)/3+(P/A,0.25,5)/3) = $350.144M PW of a strike in mountains = 70((P/A,0.25,4)/3+(P/A,0.25,5)/3+(P/A,0.25,6)/3) = $186.72M Even Less simple method: In the case of a Gulf strike, we argue that, since the probable productive life of the well is uniformly distributed over the interval [3,5], there is a 25% chance it will fall in the interval [3.0,3.5] – in which case we will round it down to 3 years – a 50% chance it will fall in the interval [3.5,4.5] – in which case we will round it to 4 years – and a 25% chance it will fall in the interval [4.5,5.0] -- in which case we will round it up to 5 years. PW(strike in The Gulf) = 150((P/A,0.25,3) ×0.25+(P/A,0.25,4) ×0.5+(P/A,0.25,5) ×0.25)) = $351.17M Similarly, PW(strike in mountains) = 70((P/A,0.25,4) ×0.25+(P/A,0.25,5) ×0.25+(P/A,0.25,6) ×0.25)) = $187.10M Not-at-all-simple method For this method, we would treat time as a continuous rather than as a discrete variable. So to find the expected present value, we would write out the present worth as an explicit function of t, then integrate this expression from t=3 to 5, or t=4 to 6. This gives us $352.185M and $187.482M for the two PW’s. Part 2: Expected present worth of one and many test holes Simplest method The success or failure of any one test drilling is independent of the success or failure of any other test drilling. So we can use the fact that, if X and Y are independent random variables, E(X+Y) = E(X) + E(Y) So the expected PW of two test drillings is just twice the expected PW of a single test drilling. If we use the values of PW calculated in the simplest version of Part 1, the expected PW of a single test drilling in the Gulf is E(PWGulf) =0.4 × $354.24M + 0.6 × 0 = $141.70M And the expected PW of two test drillings is therefore 2 ×$141.70M = $283.392M By similar reasoning, the expected PW of a single test drilling in the mountains is E(PWMtn) = 0.3 ×$188.25M + 0.7 × 0 = $56.475M And the expected PW of five test drillings is therefore 5 ×$56.475M = $282.375M

Less simple method: We can equally well say that the expected present worth of drilling in the Gulf is p(1 strike) × $354.24 + p(2 strikes) × 2 × $354.24 And the expected present worth of drilling in the mountains is p(1 strike) × $188.25 + p(2 strikes) × 2 × $188.25 + p(3 strikes) × 3 × $188.25 + p(4 strikes) × 4 × $188.25 + p(5 strikes) × 5 × $188.25 We need to be careful in distinguishing the probability of at least one strike from the probability of exactly one strike. We can get exactly one strike in two ways: the first drilling succeeds and the second doesn’t, or the second drilling succeeds and the second one doesn’t. These two ways each have the same probability, 0.4 × (1-0.4) = 0.24. The two ways are mutually exclusive, so their combined probability is 2 × 0.24 = 0.48 And the probability of two strikes is 0.4 × 0.4 = 0.16. We can work out the corresponding probabilities for drilling in the mountains in the same way, but it will save us some time if we recognize that we’re dealing with a binomial distribution and that the probabilities are therefore: P(k strikes out of n tries) = n!/(k!(n-k)!) × p(one strike)k × ((1-p(one strike))n-k So P(1 out of 5) = 5!/4! × 0.3 × 0.74 = 0.36015 P(2 out of 5) = 5!/(3!2!) × 0.32 × 0.73= 0.3087 P(3 out of 5) = 5!/(2!3!) × 0.33 × 0.72= 0.1323 P(4 out of 5) = 5!/4! × 0.34 × 0.7 = 0.02835 P(5 out of 5) = 0.35 = 0.00243 Putting these probabilities into the expressions for expected present worth, we find that if we use the simplest method of calculating the expected present worth of a single well, the expected present worth of drilling in the Gulf is $283.392M, whereas the expected present worth of drilling in the mountains is $282.375M. We note that these are exactly the same as the numbers we get using the simplest method for Part II. (At this point we may ask ourselves, why would anyone bother to solve this problem the hard way, using the binomial distribution, when the E(X+Y)=E(X)+E(Y) method gives the same answer more easily? The approach using the binomial distribution is more general: suppose, for example, we were to find that, after one well starts producing oil in a given region, the value of production of every subsequent well in that region drops by 10%. Under these circumstances, X and Y would no longer be independent variables, and the equation E(X+Y)=E(X)+E(Y) would no longer hold, so we would have to resort to the binomial distribution method.) If we use the less-simple method in Part I, the two figures for total expected present worth are $280.115M and $280.081M respectively, and if we use the not-at-all-simple method in Part I, they are $281.74M and $281.22M. So whichever method we use, the expected value of the Gulf drilling is marginally higher. However, the margin is so small that, given that our input data probably have a greater margin of error than this, we would be well-advised to look at the variance of the two options as well. If we have used the more complex method in Part 2, we can observe that, though the difference in expected values is very small, the variance of the Gulf option is much greater – there is a 36% chance that we’ll get nothing at all, whereas if we drill in the mountains, the chance of all our test wells being dry is only 17%. So there is a reasonable argument in favour of the Termitian Mountains.