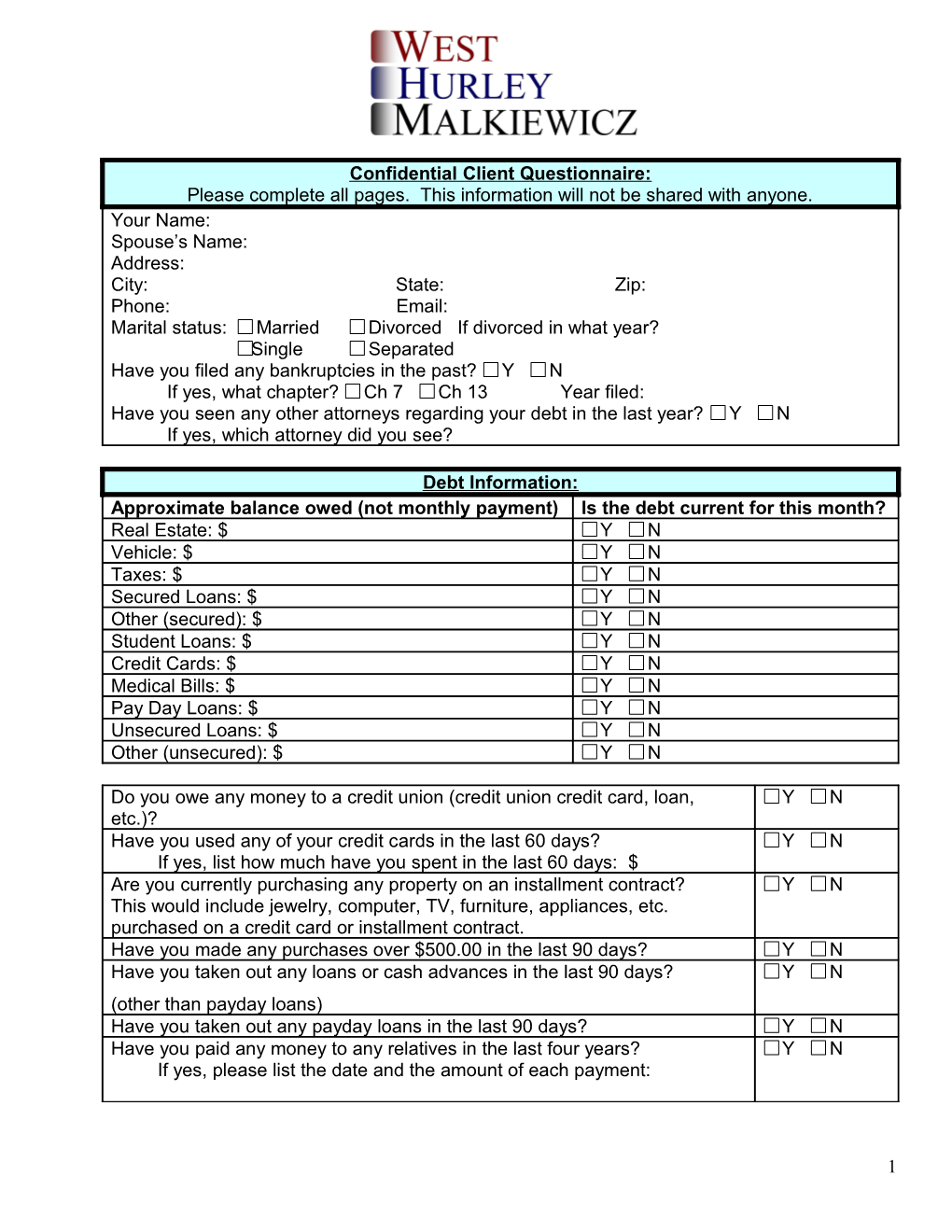

Confidential Client Questionnaire: Please complete all pages. This information will not be shared with anyone. Your Name: Spouse’s Name: Address: City: State: Zip: Phone: Email: Marital status: Married Divorced If divorced in what year? Single Separated Have you filed any bankruptcies in the past? Y N If yes, what chapter? Ch 7 Ch 13 Year filed: Have you seen any other attorneys regarding your debt in the last year? Y N If yes, which attorney did you see?

Debt Information: Approximate balance owed (not monthly payment) Is the debt current for this month? Real Estate: $ Y N Vehicle: $ Y N Taxes: $ Y N Secured Loans: $ Y N Other (secured): $ Y N Student Loans: $ Y N Credit Cards: $ Y N Medical Bills: $ Y N Pay Day Loans: $ Y N Unsecured Loans: $ Y N Other (unsecured): $ Y N

Do you owe any money to a credit union (credit union credit card, loan, Y N etc.)? Have you used any of your credit cards in the last 60 days? Y N If yes, list how much have you spent in the last 60 days: $ Are you currently purchasing any property on an installment contract? Y N This would include jewelry, computer, TV, furniture, appliances, etc. purchased on a credit card or installment contract. Have you made any purchases over $500.00 in the last 90 days? Y N Have you taken out any loans or cash advances in the last 90 days? Y N (other than payday loans) Have you taken out any payday loans in the last 90 days? Y N Have you paid any money to any relatives in the last four years? Y N If yes, please list the date and the amount of each payment:

1 Have you paid back friends/relatives more than $200 in the last 24 months? Y N Has anyone co-signed a loan or credit card for you? Y N Have you co-signed a loan or credit card for anyone? Y N Have you listed any motor vehicles as collateral for a personal loan? Y N Do you have any unpaid student loans? Y N Do you have any DUI tickets or owe any money as a result of an accident Y N while DUI? Do you have any court ordered restitution or fines? Y N Housing Information: Own How much would your house sell for “as is” today? What is your mortgage payoff amount? $ What is your second mortgage payoff amount? $ What is your third mortgage payoff amount? $ Do you have more than one house? Y N 1st mortgage monthly payment? $ 2nd mortgage monthly payment? $ Does your mortgage payment include taxes & insurance? Y N If no, how much are your Real Estate Taxes per half? $ ÷ 6= $ If no, how much is your homeowner’s insurance per year? $ ÷12=$ Total monthly housing cost: $ Are you current on your monthly mortgage payments? Y N If behind, how many months? Is your house a condominium? Y N If yes, per month fee: $ Do you owe Homeowners Association Fees? Y N Rent Rent amount per month? Other Other (please explain):

Has any property been repossessed in the last ten years? Y N If yes, what was repossessed and when was it repossessed:

Is there anyone currently threatening to repossess your vehicles or Y N foreclose on your home?

2

Income from Employment You Spouse (if any) Job Title Employer Length of time employed there? How often do you get paid Weekly Bi-weekly Weekly Bi-weekly (circle one) Monthly Bi-monthly Monthly Bi-monthly Gross per paycheck $ $ Estimated overtime $ $ Average commission (if any) $ $ Net (take home) per paycheck $ $ Do you expect your income to Y N Y N change in the next year? If so, why?

Other Income Business, Profession $ $ Real Property (rent) $ $ Pension & Retirement $ $ Alimony & Child Support $ $ Social Security $ $ Other Government Assistance $ $ Please explain: Other income from any other $ $ source Please explain: Has your other income been the Y N Y N same each month for the last six months? Dependent Information: If no, please(Please explain list why? all of your dependents even if they do not live with you.) Name Age Relationship Pay or Receive Amount of Monthly Are your wages or bank account currently beingSupport? garnished to pay aSupport? Y N debt If yes, for what debt(s): Do you have any property worth more than $400? Y N This includes bank accounts, stocks, bonds, and life insurance Ifpolicies you pay with child cash support surrender are you value. current on your payments? Y N If you Ifare yes, behind, please how list: much do you owe? $ Have you sold, given away, or transferred any property worth over Y N $500 to anyone in the last 4 years? Other Household Members (other then above): If yes, please list what you transferred, to whom, and the value ofName the property: Age Relationship Do you have anything in your possession that really belongs to Y N someone else? Does anyone have possession of anything that really belongs to Y N you? Do you have any property in your name that belongs to someone Y N 3 else? D:\Docs\2017-12- Do you own any life insurance policies with cash surrender or loan value? Y N

Do you have a retirement account? Y N Do you receive any money from an annuity or a trust? Y N Are you repaying any loans against your retirement? Y N Do you expect any gifts, an inheritance, or life insurance proceeds in the Y N next 18 months? Do you have any un-filed tax returns? Y N If yes, for what year(s): Do you owe any taxes? Y N If yes, list the amount for each year owed: Are you expecting any tax refunds? Y N If yes, how much: $ Did you get a tax refund? Y N How much? Do you have any personal injury or worker’s compensation claims? Y N Are you currently being sued or expect to be sued by anyone? Y N Have you been sued in the last 10 years? Y N If yes, please list who sued you, the reason they sued you, when you were sued, and the amount of the claim: Are you required to pay any debts under a Separation Agreement or a Y N Divorce Decree? Have you had any car accidents in the past 4 years? Y N Do you have the right to sue anyone for any reason? Y N If yes, please explain why: Have you owned a business at any time within the past 6 years? Y N If so, do you owe any taxes due to that business? Y N Have you lived in Ohio for the last 4 years? Y N If not, in what year did you move to Ohio? State: How long did you live there?

Do you own any trailers, boats, or recreational vehicles, ATV, Dirt bike etc.? Y N

How did you hear about our office? TV Commercial – Cable Yellow Pages – unknown TV Commercial – Channel 7 Newspaper - Dayton Website (DebtFreeOhio.com or Newspaper - Middletown RichardWestAttorney.com) Mailer from our office SBC Yellow Pages - Dayton Dayton Bar Association SBC Yellow Pages – Middletown Referral (who referred you): Yellow Book Yellow Pages - Dayton Other (please explain): Yellow Book Yellow Pages - Butler/Warren 16\020cb5f1080e46fa195d45191386848d.doc

4 Vehicle Information: Name(s) on the Title: Body Style: Status: Own Purchasing Lease 2 Door Coupe Convertible Date of Purchase: 4 Door Sedan Hybrid Year: Make: Model: Pickup Truck Limousine Mileage: SUV Motorcycle Condition: Crossover Motor Home Comments: Van

Have you ever refinanced this vehicle? Y N If yes, when? If nothing is owed on the vehicle check here: Lender Information: Leaser Information: Lender’s Name: Lender’s Name: Monthly Payment: $ Monthly Payment: $ Number of Missed Payments: Number of Missed Payments: Balance Owed: $ Balance Owed: $ If applicable, Date of Repossession: If applicable, Date of Repossession:

Vehicle Information: Name(s) on the Title: Body Style: Status: Own Purchasing Lease 2 Door Coupe Convertible Date of Purchase: 4 Door Sedan Hybrid Year: Make: Model: Pickup Truck Limousine Mileage: Vehicle Information: SUV Motorcycle Condition:Name(s) on the Title: Body Crossover Style: Motor Home Comments:Status: Own Purchasing Lease Van2 Door Coupe Convertible Date of Purchase: 4 Door Sedan Hybrid Year: Make: Model: Pickup Truck Limousine HaveMileage: you ever refinanced this vehicle? Y N If yes, when? SUV Motorcycle IfCondition: nothing is owed on the vehicle Vehiclecheck here: Information: Crossover Motor Home LenderComments: Information: Leaser Information: Van Body Style: Lender’sName(s) Name:on the Title: Lender’s Name: 2 Door Coupe Convertible MonthlyStatus: Payment: Own Purchasing $ Lease Monthly Payment: $ 4 Door Sedan Hybrid NumberHaveDate ofyou Purchase: of ever Missed refinanced Payments: this vehicle? Y Number N If yes, of Missedwhen? Payments: Pickup Truck Limousine BalanceIfYear: nothing Owed: is owedMake: $ on the vehicle Model:check here: Balance Owed: $ SUV Motorcycle IfLenderMileage: applicable, Information: Date of Repossession: IfLeaser applicable, Information: Date of Repossession: Crossover Motor Home Lender’sCondition: Name: Lender’s Name: Van MonthlyComments: Payment: $ Monthly Payment: $ Number of Missed Payments: Number of Missed Payments: Balance Owed: $ Balance Owed: $ IfHave applicable, you ever Date refinanced of Repossession: this vehicle? Y If applicable,N If yes, when? Date of Repossession: If nothing is owed on the vehicle check here: Lender Information: Leaser Information: Lender’s Name: Lender’s Name: Monthly Payment: $ Monthly Payment: $ Number of Missed Payments: Number of Missed Payments: Balance Owed: $ Balance Owed: $ 5 If applicable, Date of Repossession: If applicable, Date of Repossession: