AMERITAS DENTAL HIGH/LOW PLAN OPTIONS Ameritas Group dental coverage will remain in force for the 2006 plan year. Premiums for the High Option plan will remain the same; however, the Low Option plan rates effective January 1, 2006 will increase slightly due to our claims experience loss ratio.

The PPO Provider Network remains the same for both plans. Care may be provided from any dentist; however, your out-of-pocket expenses would be considerably more if a non- network provider were utilized; particularly under the Low Option plan. If out-of-network providers are preferred, it would be beneficial to select the High Option plan. Benefit Highlights, High/Low Plan Comparison of Sample Allowable Covered Expenses & Estimated Out- of-Pocket Expenses, and PPO Provider Listings will be available at the open enrollment meetings or through Risk Management upon request.

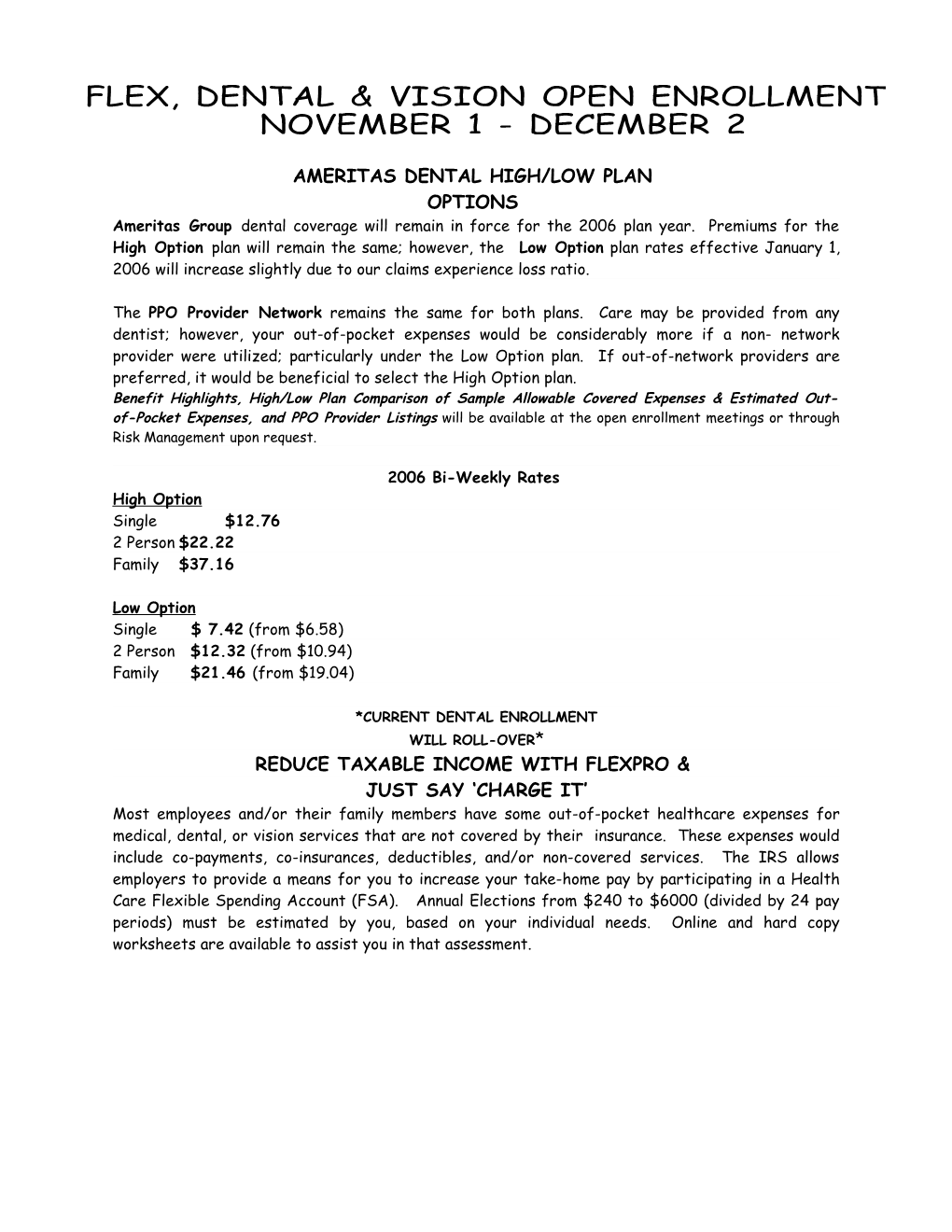

2006 Bi-Weekly Rates High Option Single $12.76 2 Person $22.22 Family $37.16

Low Option Single $ 7.42 (from $6.58) 2 Person $12.32 (from $10.94) Family $21.46 (from $19.04)

*CURRENT DENTAL ENROLLMENT WILL ROLL-OVER* REDUCE TAXABLE INCOME WITH FLEXPRO & JUST SAY ‘CHARGE IT’ Most employees and/or their family members have some out-of-pocket healthcare expenses for medical, dental, or vision services that are not covered by their insurance. These expenses would include co-payments, co-insurances, deductibles, and/or non-covered services. The IRS allows employers to provide a means for you to increase your take-home pay by participating in a Health Care Flexible Spending Account (FSA). Annual Elections from $240 to $6000 (divided by 24 pay periods) must be estimated by you, based on your individual needs. Online and hard copy worksheets are available to assist you in that assessment. Flex Convenience Debit Cards that have been issued to all participants since 2004 allow for payment of goods and services directly from your FSA account; thereby reducing the likelihood of unused deposits being forfeited. Also, a 2 ½ month Grace Period after the end of the plan year was just implemented this plan year; wherein, eligible expenses incurred between January 1 and March 15 may be reimbursed from the previous plan year, if there is a balance remaining in that account. However, Debit Cards will only be usable for expenses applied toward the current Plan Year; claims must be submitted for reimbursement from a prior year’s account. DO NOT DISCARD DEBIT CARDS USED THIS YEAR AS THEY WILL BE REISSUED ONLY UPON YOUR REQUEST.

** FLEX PARTICIPATION DOES NOT ROLL-OVER! ELECTION FORM MUST BE SUBMITTED YEARLY**

SPECTERA VISION

There will be no benefit or rate changes in the Vision care program for the 2006 plan year. Those currently enrolled do not need to complete an enrollment form. No ID cards are issued; simply contact a network provider and they will handle everything from there. Overview of benefits and rates are provided on reverse side.

****

A schedule of open enrollment meetings, and overviews of the Dental and Flex plans are provided on reverse side.

**ENROLLMENT FORMS FOR ELECTIONS/CHANGES/TERMINATIONS & BENEFIT SUMMARIES FOR ALL BENEFITS ARE ACCESSIBLE VIA THE BOCC INTRANET**

Ameritas Option Highlights/Rates High Option Benefits are payable at either the 100/80/50th percentile of Usual/Customary, according to type of service:

Preventative (100%) - Exam, Cleaning, X-rays. No deductible Basic (80%) after deductible is met - Fillings, Oral Surgery, Periodontal (including surgery) * Major (50%) after deductible is met - Root Canals, Crowns, Bridges, Dentures

*High Option plan participants have an 80% benefit for ALL Periodontal services.

Low Option The service type breakdown is the same as listed under High Option, with the above-noted exception. Payment percentages for non-preventive services rendered by a network provider are slightly less: Preventative (100%) - Exam, Cleaning, X-rays. No deductible Basic (73%) after deductible - Fillings, Oral Surgery, Periodontal Maintenance Major (48%) after deductible is met - Root Canals, Crowns, Bridges, Dentures

Out-of-network benefits are payable based on a per procedure schedule of maximum amount covered. The patient’s responsibility is generally much higher in comparison to that of in-network services. (Refer to highlight sheet examples.)

UNDER BOTH PLANS: $50 calendar year deductible $1,000 cal. year benefit max Dental Rewards Program which allows for a $250 carry-over benefit that increases the calendar year maximum every year, provided no more than a $500 benefit is paid.

Spectera SightSelect

Spectera vision care benefits will be the same as those of prior years. The following benefits are available:

Eye exam every 12 months Lenses every 12 months Frames every 24 months Contacts Lenses 4 boxes (12 pair) every 12 months.

Participating provider must be utilized for maximum benefit; however, benefit is available for reimbursement of non-network provider services at lesser benefit level. Co-payments at time of service: Exam: $10 Lenses/Frames/Contacts: $25 (within Selection allowance)

2005 bi-weekly rates as follows: Single Two Person Family $3.13 $5.76 $9.06

FLEX Accounts Flex consists of three accounts: Premium Redirection Account allows for certain insurance premiums to be deducted before taxes; thereby reducing taxable income and increasing take-home pay. Participation is automatic but may be waived for all applicable benefits upon request. Health Care FSA allows money to be set aside tax-free to help pay for eligible healthcare expenses (including healthcare related over-the-counter items) that are not covered by insurance, for you/your family. Participation in the County’s health plan is not required. Dependent Care FSA allows you to set aside money tax-free to help pay for qualified child/elderly dependent care expenses. You must meet eligibility guidelines and pre-pay for services. REMEMBER: NEW FSA ENROLLMENT FORMS MUST BE SUBMITTED EVERY YEAR

OPEN ENROLLMENT MEETINGS Thurs. 11/10 9:30-11:30 a.m. Board Room

Tues. 11/15 1:30-3:30 p.m. Board Room

Mon. 11/21 1:30-3:30 p.m. Board Room

Wed.. 11/30 1:30-3:30 p.m. Board Room

A Sunbelt Worksite Marketing representative will provide plan overview/assistance pertaining to Universal Life, Non-work related Accident and Cancer policies, as the last agenda item.

**** HEALTH PLAN MATTERS UnitedHealthWellness.com was launched by UnitedHealthcare on October 1, 2005. Program features include, but are not limited to:

Wellness Products/Service Discounts for Fitness clubs; Spa services; Vitamins; Health food; Fitness gear/apparel; Weight management; Smoking Cessation Healthy Living Tools –Meal Planner; Fitness Planner, with a virtual trainer; Walking Tracker; Assessment &Improvement tools.A Wellness ID Card has been issued to all covered employees for use in connection with this program, along with a program overview. It is not to replace your benefit ID card

****

PharmaCare reported that they had some implementation issues that delayed the issuance of CVS Discount Cards to all health plan participants, to accommodate the 10/1/05 effective date of a 20% discount off all CVS brand products. Discount Cards and program information are to be mailed to home addresses before the end of October