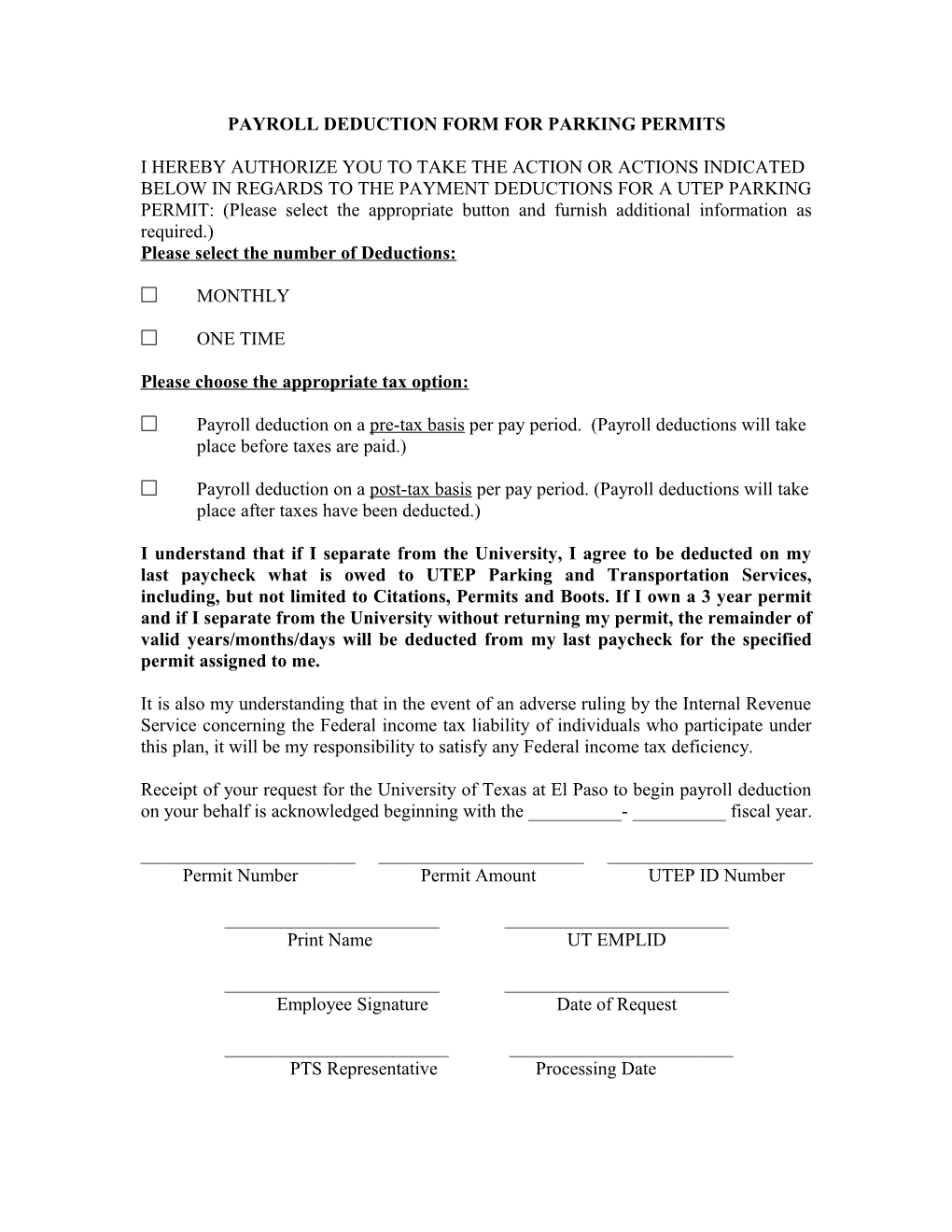

PAYROLL DEDUCTION FORM FOR PARKING PERMITS

I HEREBY AUTHORIZE YOU TO TAKE THE ACTION OR ACTIONS INDICATED BELOW IN REGARDS TO THE PAYMENT DEDUCTIONS FOR A UTEP PARKING PERMIT: (Please select the appropriate button and furnish additional information as required.) Please select the number of Deductions:

MONTHLY

ONE TIME

Please choose the appropriate tax option:

Payroll deduction on a pre-tax basis per pay period. (Payroll deductions will take place before taxes are paid.)

Payroll deduction on a post-tax basis per pay period. (Payroll deductions will take place after taxes have been deducted.)

I understand that if I separate from the University, I agree to be deducted on my last paycheck what is owed to UTEP Parking and Transportation Services, including, but not limited to Citations, Permits and Boots. If I own a 3 year permit and if I separate from the University without returning my permit, the remainder of valid years/months/days will be deducted from my last paycheck for the specified permit assigned to me.

It is also my understanding that in the event of an adverse ruling by the Internal Revenue Service concerning the Federal income tax liability of individuals who participate under this plan, it will be my responsibility to satisfy any Federal income tax deficiency.

Receipt of your request for the University of Texas at El Paso to begin payroll deduction on your behalf is acknowledged beginning with the ______- ______fiscal year.

______Permit Number Permit Amount UTEP ID Number

______Print Name UT EMPLID

______Employee Signature Date of Request

______PTS Representative Processing Date