Question1

1. A beneficiary received $200,000 in proceeds from a Life Insurance policy. He selected a 20 year fixed period payout at 5% interest and received annual payments of $12,500. How much of each payment will be excluded from tax: A. None B. $2,500 C. $10,000 D. $12,500 Answer: Although life insurance proceeds are not subject to tax, the interest is. To find the tax free amount , divided $200,000 by 20 years, so $10,000 a year is tax free. Any amount received in excess of that amount is interest and is taxable as ordinary income. C is correct.

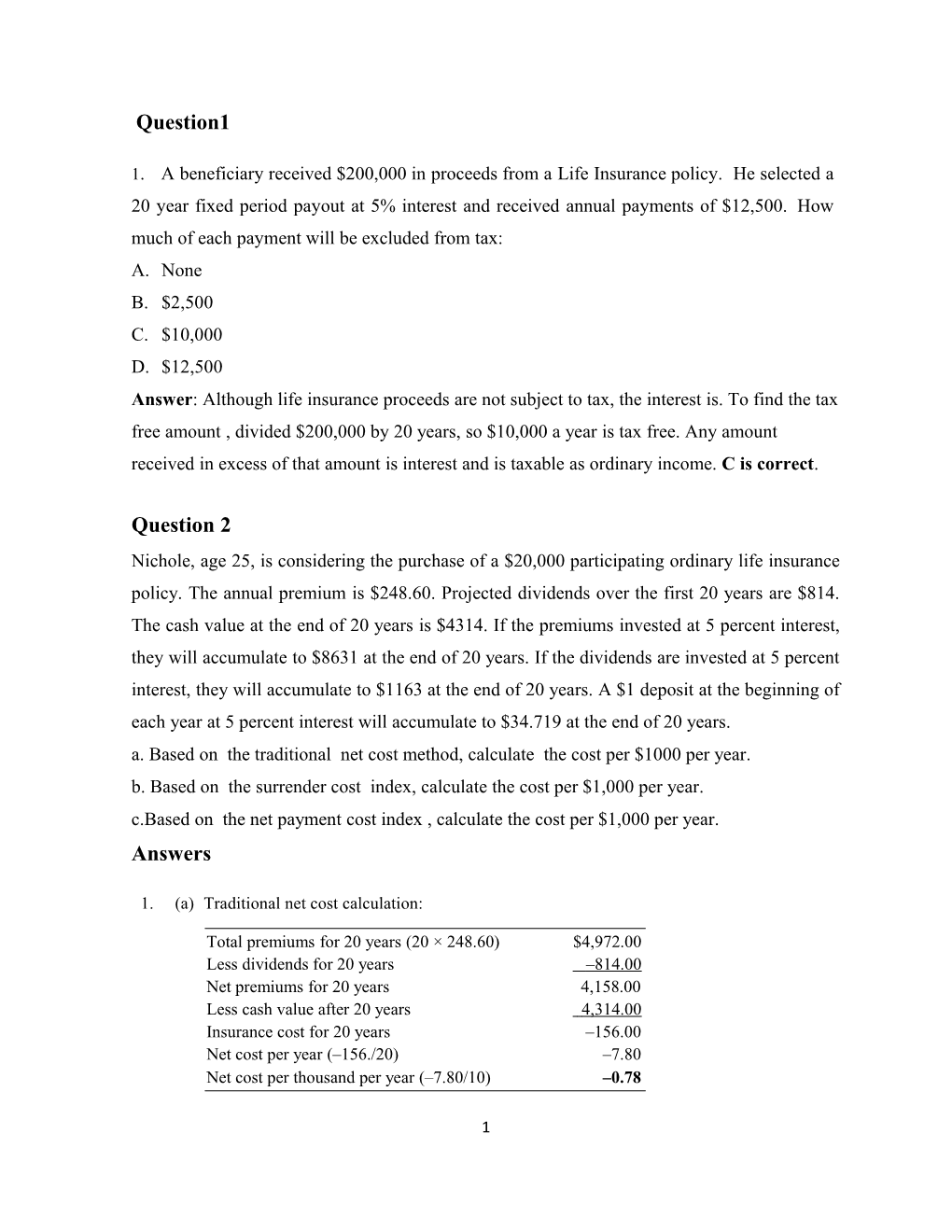

Question 2 Nichole, age 25, is considering the purchase of a $20,000 participating ordinary life insurance policy. The annual premium is $248.60. Projected dividends over the first 20 years are $814. The cash value at the end of 20 years is $4314. If the premiums invested at 5 percent interest, they will accumulate to $8631 at the end of 20 years. If the dividends are invested at 5 percent interest, they will accumulate to $1163 at the end of 20 years. A $1 deposit at the beginning of each year at 5 percent interest will accumulate to $34.719 at the end of 20 years. a. Based on the traditional net cost method, calculate the cost per $1000 per year. b. Based on the surrender cost index, calculate the cost per $1,000 per year. c.Based on the net payment cost index , calculate the cost per $1,000 per year. Answers

1. (a) Traditional net cost calculation:

Total premiums for 20 years (20 × 248.60) $4,972.00 Less dividends for 20 years –814.00 Net premiums for 20 years 4,158.00 Less cash value after 20 years 4,314.00 Insurance cost for 20 years –156.00 Net cost per year (–156./20) –7.80 Net cost per thousand per year (–7.80/10) –0.78

1 The traditional net cost is negative 78 cents per thousand dollars of coverage per year.

b) Surrender cost index calculation:

Future value of the premiums $8,631.00 Less future value of the dividends –1,163.00 Net premiums for 20 years 7,468.00 Less cash value after 20 years –4,314.00 Insurance cost for 20 years 3,154.00 Interest-adjusted cost per year ($3,154.00/34.719) 90.84 Cost per thousand per year (90.84/10) 9.08

The surrender cost index is $9.08 per thousand per year

(c) Net payment cost index calculation:

Future value of the premiums $8,631.00 Less future value of the dividends –1,163.00 Net premiums for 20 years 7,468.00 Interest-adjusted cost per year: ($7,468.00/34.719) 215.10 Cost per thousand per year (215.10/10) 21.51

The net payment cost index is $21.51 per thousand per year.

Question 3: Todd, age 40, is considering the purchase of a $100,000 participating ordinary life insurance policy. The annual premium is $2280. Projected dividends over the first 20 years are $15,624. The cash value at the end of 20 years is $35,260. If the premiums are invested at 5 percent interest, they will grow to $79,159 at the end of 20 years. If the dividends are invested at 5 percent interest, they will accumulate to $24,400 at the end of 20 years. A $1 deposit at the beginning of each year at 5 percent interest will accumulate to $34.719 at the end of 20 years. a. Based on the traditional net cost method, calculate the cost per $1000per year. b. Based on the surrender cost index , calculate the cost per $1000 per year. c. Based on the net payment cost index,, calculate the cost per $1000 per year.

2 Answers:

(a) Traditional net cost calculation:

Total premiums for 20 years $45,600.00 Less dividends for 20 years 15,624.00 Net premiums for 20 years 29,976.00 Less cash value after 20 years 35,260.00 Insurance cost for 20 years – 5284.00 Net cost per year (–5,284/20) –264.20 Net cost per thousand per year (–264.20/10) –26.42

The traditional net cost is a negative $26.42 per thousand per year.

(b) Surrender cost index calculation:

Future value of the premiums $79,159.00 Less future value of the dividends 24,400.00 Net premiums for 20 years 54,759.00 Less cash value after 20 years 35,260.00 Insurance cost for 20 years 19,499.00 Interest-adjusted cost per year (19,499.00/34.719) 561.62 Cost per thousand per year (561.62/10) 56.16

The surrender cost index is $56.16 per thousand per year.

(c) Future value of the premiums 79,159.00 Less future value of the dividends 24,400.00 Net premiums for 20 years 54,759.00 Interest-adjusted cost per year 1577.21 Cost(54,759.00/34.719) per thousand per year (1577.21/10) 157.72

The net payment cost index is $157.72 per thousand per year.

3 Question 4: Allison is trying to complete her income-tax return. A number of questions have come up about life insurance. Explain the tax treatment of each of the following. a. Allison is the beneficiary named in her grandfather’s life insurance policy. Her grandfather dies this year and Allison received a lump-sum payment of $50,000. She wonders if she has to report the 50,000 as taxable income. b. Allison purchased a $100,000 cash value life insurance policy on her own six years ago. This year, the cash value increased by $380. Allison wonders I the cash-value increase must be reported as taxable income. The policy remains in force. c. Allison‘s annual life insurance premium is $350. Allison itemizes her income-tax deductions. She wonders if her insurance premium is a tax-deductible expense. d. Allison’s ordinary life insurance policy is a participating policy. This year she received $120 in policyowner dividends. She wonders if she is required to report the $120 as taxable income. Answers: (a) The lump sum payment of $50,000 is not taxable income. Death proceeds payable to a stated beneficiary are normally not taxable. (b) The cash value increase of $380 is not taxable income. (c) Life insurance premiums generally are not income-tax deductible. (d) The dividend is largely a refund of a redundant premium. The $120 dividend is not taxable income.

4