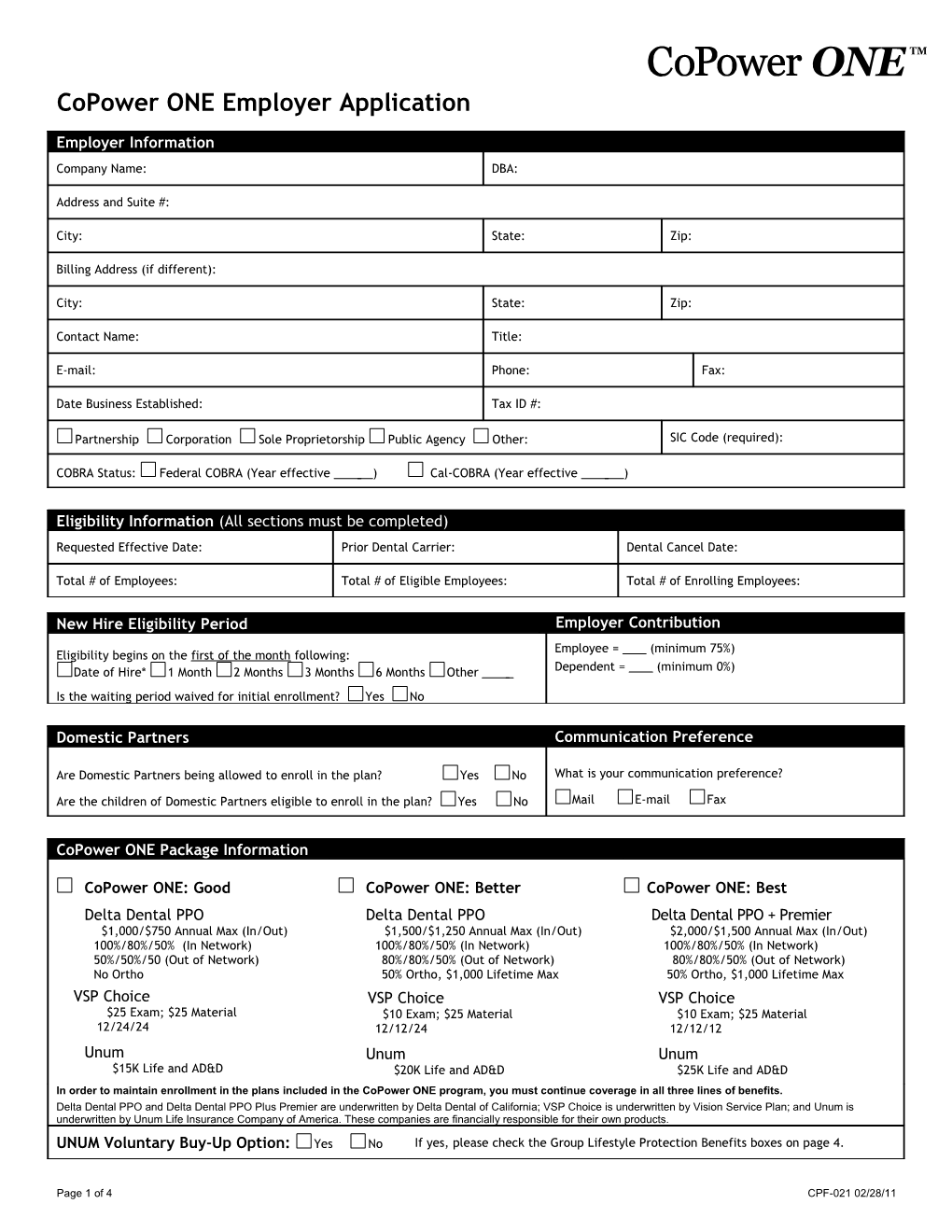

CoPower ONE Employer Application

Employer Information

Company Name: DBA:

Address and Suite #:

City: State: Zip:

Billing Address (if different):

City: State: Zip:

Contact Name: Title:

E-mail: Phone: Fax:

Date Business Established: Tax ID #:

Partnership Corporation Sole Proprietorship Public Agency Other: SIC Code (required):

COBRA Status: Federal COBRA (Year effective ) Cal-COBRA (Year effective )

Eligibility Information (All sections must be completed)

Requested Effective Date: Prior Dental Carrier: Dental Cancel Date:

Total # of Employees: Total # of Eligible Employees: Total # of Enrolling Employees:

New Hire Eligibility Period Employer Contribution

Employee = (minimum 75%) Eligibility begins on the first of the month following: Dependent = (minimum 0%) Date of Hire* 1 Month 2 Months 3 Months 6 Months Other

Is the waiting period waived for initial enrollment? Yes No

Domestic Partners Communication Preference

Are Domestic Partners being allowed to enroll in the plan? Yes No What is your communication preference?

Are the children of Domestic Partners eligible to enroll in the plan? Yes No Mail E-mail Fax

CoPower ONE Package Information

CoPower ONE: Good CoPower ONE: Better CoPower ONE: Best Delta Dental PPO Delta Dental PPO Delta Dental PPO + Premier $1,000/$750 Annual Max (In/Out) $1,500/$1,250 Annual Max (In/Out) $2,000/$1,500 Annual Max (In/Out) 100%/80%/50% (In Network) 100%/80%/50% (In Network) 100%/80%/50% (In Network) 50%/50%/50 (Out of Network) 80%/80%/50% (Out of Network) 80%/80%/50% (Out of Network) No Ortho 50% Ortho, $1,000 Lifetime Max 50% Ortho, $1,000 Lifetime Max

VSP Choice VSP Choice VSP Choice $25 Exam; $25 Material $10 Exam; $25 Material $10 Exam; $25 Material 12/24/24 12/12/24 12/12/12 Unum Unum Unum $15K Life and AD&D $20K Life and AD&D $25K Life and AD&D In order to maintain enrollment in the plans included in the CoPower ONE program, you must continue coverage in all three lines of benefits. Delta Dental PPO and Delta Dental PPO Plus Premier are underwritten by Delta Dental of California; VSP Choice is underwritten by Vision Service Plan; and Unum is underwritten by Unum Life Insurance Company of America. These companies are financially responsible for their own products. UNUM Voluntary Buy-Up Option: Yes No If yes, please check the Group Lifestyle Protection Benefits boxes on page 4.

Page 1 of 4 CPF-021 02/28/11 Payment

Initial Payment Please make check payable to CoPower and submit with your Employer Application and any other enrollment paperwork. This is a pre-paid plan. Monthly payments are due no later than the first day of the coverage month.

Ongoing Payment Do you wish to have your monthly invoice amount automatically debited from your company account? Yes No

If yes, please complete the following. Allow up to one billing cycle to process your request. You must continue to submit your payment until your invoice indicates that the amount due will be debited from your account.

Bank Account Information (must be a Checking Account) Account Holder’s Name (if different from above): e of Bank: Na

Bank Address: Bank Routing Number: Account Number:

I hereby authorize CoPower to initiate debits from the account identified above. I understand it remains in effect until I give written notice to CoPower, which I must do by the 25th of the month. If I want to change the banking information that CoPower debits, I will submit a new Direct Debit Authorization form by the 25th of the month. In the event a debit is made to my account in error, I authorize CoPower to make a correcting entry to my account. CoPower will notify me of payments returned for insufficient funds or closed accounts, and repayment instructions. Please attach a copy of a voided check.

Signatures My signature on this document certifies that all of the information contained in this application is true and correct to the best of my knowledge. I confirm that all enrollees are eligible employees, COBRA participants, and/or their dependents. In addition, my group complies with all the rules and regulations as set forth by the applicable carrier(s).

Signature of Company Officer: Date:

Name (print): Title (print):

Producer Statement Producer Statement (must be completed for commissions to be paid) (must be completed for commissions to be paid)

Date: Date:

Producer’s Signature: Producer’s Signature:

Producer’s Name (print): Producer’s Name (print):

Federal Tax ID or SSN: Federal Tax ID or SSN:

Company Name: Company Name:

Address: Address:

City: City:

State: Zip: State: Zip:

Telephone: Telephone:

Fax: Fax:

E-mail: E-mail:

Make commissions payable to: Producer Agency Make commissions payable to: Producer Agency

Multiple producer split: : Yes No Multiple producer split: : Yes No

Page 2 of 4 CPF-021 02/28/11 Percentage of split: % Percentage of split: %

GROUP MASTER APPLICATION COMPENSATION DISCLOSURE INSERT

Your insurance or benefits advisor can offer you advice and guidance as you select the policy and provider most appropriate for your needs. At Unum we recognize the important role these professionals play in the sale of our products and services and offer them a variety of compensation programs. Your advisor can provide you with information about these programs as well as those available from other providers. We support disclosure of broker compensation so that customers can make an informed buying decision.

Unless you have agreed in writing to compensate the broker differently, Unum provides Base Commissions to all brokers in connection with the sale of an insurance policy. Base commissions are a fixed percentage of the policy premium, and include and one time, first year flat amount for each policy sold. Base Commissions are paid by Unum to your broker as long as they remain the broker of record on your policy; however, in some circumstances your broker or record may continue to receive commissions on eligible business for a fixed period of time, even after a broker of record change has occurred.

A broker may also qualify for Supplemental Commissions paid by Unum. For group insurance products, Supplemental Commissions may be paid in an amount equal to a fixed percentage of total eligible insurance premiums. The Supplemental Commission percentage may range from: For group life and disability products: 0% to 1.25% of total eligible inforce premiums paid. For the group critical illness product: 0% to 1.25% of total eligible inforce premiums, 0% to 11% of total eligible new sales premiums paid and $1 per application for using our laptop enrollment system.

The exact Supplemental Commission percentage payable to any broker is based upon the total dollar amount of all group insurance or number of policies that the broker had in force with Unum in the prior calendar year. Supplemental Commissions may be calculated differently for other insurance products. The premium you pay is not impacted whether or not your broker receives Supplemental Commissions.

If you would like additional information about the range of compensation programs our company offers for your group insurance policy or any other Unum insurance product, you can find more details at www.unum.com. Should you have other questions not addressed by the website, including the Supplemental Commission percentage applicable to your broker, or if you want to speak to us directly about broker compensation, please call 1-800-633-7491, option 3.

Policyholder Representative Signature:______(must be an officer of the company)

Print Policyholder Representative Name:______

Date:______

Unum Use Only Policy No:

Policyholder Name:

Field Office Contact Name:

Field Office Contact Number: Fax or email to BCS: 423-763-6255 or [email protected]

Unum is providing this notice on behalf of the following insuring companies: Unum Life Insurance Company of America, First Unum Life Insurance Company (NY), Provident Life and Accident Insurance Company and provident Life and Casualty Insurance Company (NY).

Unum is a registered trademark and marketing brand of Unum Group and its insuring subsidiaries.

Page 3 of 4 CPF-021 02/28/11 1052-05-CA (09/08)

Page 4 of 4 CPF-021 02/28/11 Page 5 of 4 CPF-021 02/28/11