Appendix 2

Treasury Management and Prudential Indicators Monitoring Report

Background

The prudential system for capital expenditure is now well established. One of the requirements of the Prudential Code is to ensure adequate monitoring of the capital expenditure plans, prudential indicators (PIs) and treasury management activity. This report fulfils that requirement. The treasury strategy and PIs were previously reported to Council on 27 February 2008 (CFPO/14/08).

This report highlights the changes to the key PIs, to enable an overview of the current status of the capital expenditure plans. It incorporates any new or revised schemes approved by the Executive Board. Changes required to the residual PIs and other related treasury management issues are also included. The treasury management activity in response to these changes is also included.

Key Prudential Indicators

This part of the report is structured to update: The Council’s capital expenditure plans; The revenue impact of these plans on the Band D Council Tax/Housing Rents; How these plans are being financed; The effect of these PIs on the Council’s underlying need to borrow; and The limits in place for borrowing activity.

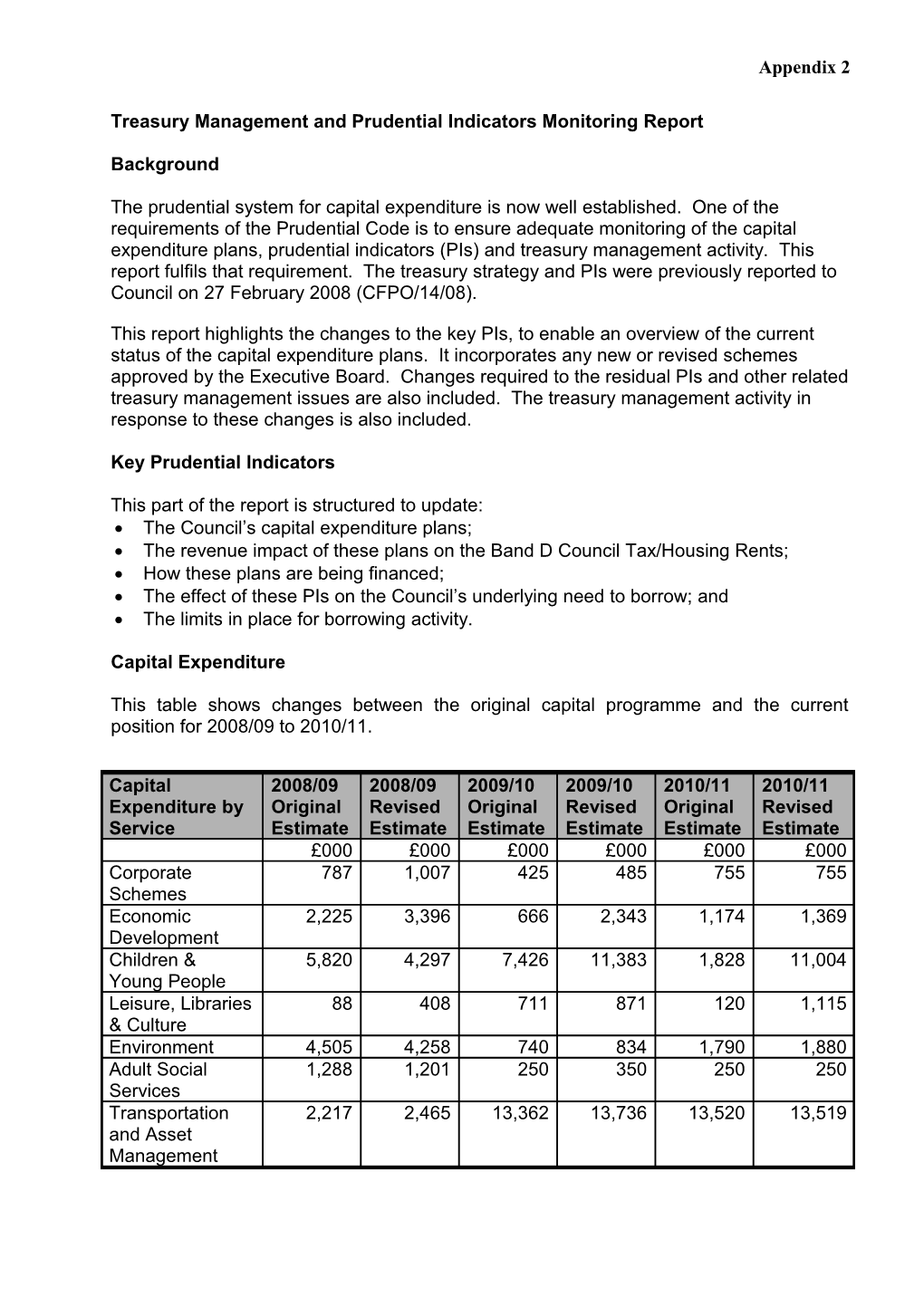

Capital Expenditure

This table shows changes between the original capital programme and the current position for 2008/09 to 2010/11.

Capital 2008/09 2008/09 2009/10 2009/10 2010/11 2010/11 Expenditure by Original Revised Original Revised Original Revised Service Estimate Estimate Estimate Estimate Estimate Estimate £000 £000 £000 £000 £000 £000 Corporate 787 1,007 425 485 755 755 Schemes Economic 2,225 3,396 666 2,343 1,174 1,369 Development Children & 5,820 4,297 7,426 11,383 1,828 11,004 Young People Leisure, Libraries 88 408 711 871 120 1,115 & Culture Environment 4,505 4,258 740 834 1,790 1,880 Adult Social 1,288 1,201 250 350 250 250 Services Transportation 2,217 2,465 13,362 13,736 13,520 13,519 and Asset Management Private Sector 4,646 5,182 4,095 5,978 4,283 4,283 Housing/Public Protection Housing 12,500 12,500 12,500 12,000 12,500 12,000 Revenue Account Total 34,076 34,714 40,175 47,980 36,220 46,175

The main changes in the capital programme are:

Approval of environmental and traffic works in the vicinity of Eagles Meadow has increased the Economic Development capital programme by £929k in 2008/09, £1,125k in 2009/10.

Confirmation of funding for Secondary Schools Reorganisation has increased the Children and Young People capital programme by £2,850k in 2009/10 and £8,888k in 2010/11.

Impact of Capital Expenditure Plans

Estimates of the incremental impact of capital investment decisions on the council tax – This indicator identifies the trend in the cost of changes in the three year capital programme compared to the Council’s original budget commitments. The impact is measured gross, before allowing for revenue support grant. The housing rent indicator is calculated at nil as there is no planned funding of Housing capital by borrowing.

Council Tax 2008/09 2008/09 2009/10 2009/10 2010/11 2010/11 Original Revised Original Revised Original Revised Estimate Estimate Estimate Estimate Estimate Estimate Band D £31.12 30.64 £30.31 29.73 £30.11 £27.61

Changes to the Financing of the Capital Programme

The table below draws together the main strategy elements of the capital expenditure plans (above), highlighting the original supported and unsupported elements of the capital programme, and the expected financing arrangements for this capital expenditure. The borrowing element of the table increases the underlying indebtedness of the Council in the Capital Financing Requirement (CFR), although this will be reduced in part by revenue charges for the repayment of debt.

2 2008/09 2008/09 2009/10 2009/10 2010/11 2010/11 Original Revised Original Revised Original Revised Estimate Estimate Estimate Estimate Estimate Estimate Capital £000 £000 £000 £000 £000 £000 Expenditure Supported 34,076 34,714 40,175 47,980 36,220 45,175 Unsupported - - - - - 1,000 Total spend 34,076 34,714 40,175 47,980 36,220 46,175 Financed by: ------Borrowing 6,226 6,217 6,226 6,217 6,226 7,217 Capital receipts 7,675 3,633 6,345 7,413 2,294 8,468 Capital grants 16,175 20,864 23,604 29,350 23,700 26,490 Capital Reserves - - - 1,000 - - Revenue 4,000 4,000 4,000 4,000 4,000 4,000 Total 34,076 34,714 40,175 47,980 36,220 46,175

Variations in funding between years are caused by the re phasing of capital projects e.g. Secondary Schools Refurbishment, and the inclusion of Welsh Assembly Government specific grants.

The change in financing by borrowing is due to the Welsh Assembly Government redirecting capital resources from supported borrowing to unhypothecated (General Capital) grant.

Changes to the Capital Financing Requirement and the External Debt

The table shows the CFR, which is the Council’s underlying external need to borrow for a capital purpose. It is increased each year by any new borrowing need (as above), and decreased by any statutory revenue charge for the repayment of debt (the Minimum Revenue Provision)

2008/09 2008/09 2009/10 2009/10 2010/11 2010/11 Original Revised Original Revised Original Revised Estimate Estimate Estimate Estimate Estimate Estimate Prudential Indicator – Capital Financing Requirement £000 £000 £000 £000 £000 £000 CFR – Non 118,871 118,055 120,366 119,246 121,888 121,506 Housing CFR – Housing 12,492 16,311 8,771 15,351 5,129 14,521 Total CFR 131,363 134,366 129,137 134,597 127,017 136,027 Net movement in -2,197 +508 -2,226 +231 -2,120 +1,430 CFR Prudential Indicator – External Debt Borrowing 130,701 133,601 128,712 134,162 126,224 135,774 Other long term 630 630 384 386 183 185 liabilities Total Debt 31 131,331 134,231 129,096 134,548 126,407 135,959 March

3 The increase in the Housing CFR is due to the impact of lower levels of Council House sales on the amount set aside for repayment of debt which in turn results in a higher borrowing requirement.

Limits to Borrowing Activity

The first key control over the Council’s activity is a Prudential Indicator to ensure that over the medium term, net borrowing will only be for a capital purpose. Net external borrowing should not, except in the short term, exceed the total of CFR in the preceding year plus the estimates of any additional CFR for 2008/09 and next two financial years. This allows some flexibility for limited early borrowing for future years.

2009/09 2008/09 2008/10 2009/10 2010/11 2010/11 Original Revised Original Revised Original Revised Estimate Estimate Estimate Estimate Estimate Estimate £000 £000 £000 £000 £000 £000 Gross Borrowing 131,331 134,231 129,096 134,548 126,407 135,959 Investments 44,008 40,852 38,252 41,119 35,277 33,060 Net Borrowing 87,323 93,379 90,844 93,429 91,130 102,899 CFR 131,363 134,366 129,137 134,597 127,017 136,027

I report that no difficulties are envisaged for the current or future years. This view takes into account current commitments, existing plans, and the proposals in this budget report. A further two PIs control the overall level of borrowing which support. These are:

1. The Authorised Limit – This represents the limit beyond which borrowing is prohibited, and needs to be set and revised by members. It reflects the level of borrowing which, while not desired, could be afforded in the short term, but is not sustainable. It is the expected maximum borrowing need with some headroom for unexpected movements. This is the statutory limit determined under section 3 (1) of the Local Government Act 2003.

2. The Operational Boundary –This indicator is based on the probable external debt during the course of the year; it is not a limit and actual borrowing could vary around this boundary for short times during the year. CIPFA anticipate that this should act as an indicator to ensure the authorised limit is not breached. 2008/09 2008/09 2009/10 2009/10 2010/11 2010/11 Original Revised Original Revised Original Revised Estimate Estimate Estimate Estimate Estimate Estimate £000 £000 £000 £000 £000 £000 Authorised limit 170,900 170,083 168,700 177,721 165,300 182,204 for external debt Operational boundary for external debt Borrowing 132,290 134,193 130,700 134,901 128,710 138,262 Other long term 880 876 630 631 380 386 liabilities Total 133,170 135,069 131,330 135,532 129,090 138,648

4 The Authorised Limit allows for up to 20% of the outstanding debt to be rescheduled in a transaction covering more than one day. The operational boundary has been increased due to the increased borrowing requirement caused by lower anticipated levels of council house sales.

Activity during 2008/09 Additional borrowing of £1,900k was undertaken in October in the form of a PWLB 50 year maturity loan at a rate of 4.5%, partly to replace a maturing loan of £592k at 11% and partly to meet 2008/09 additional financing requirements. No rescheduling or repayment activity has taken place to date in 2008/09. It is anticipated that total debt will be marginally within the Capital Financing Requirement at 31 March 2009.

Supplementary PIs requiring Amendment

Actual and estimates of the ratio of financing costs to net revenue stream – This indicator identifies the trend in the cost of capital (borrowing costs net of interest and investment income) against the net revenue stream.

2008/09 2008/09 2009/10 2009/10 2010/11 2010/11 Original Revised Original Revised Original Revised Estimate Estimate Estimate Estimate Estimate Estimate Non-HRA 5.15 4.82 4.77 5.35 4.88 5.27 HRA 3.80 4.27 2.78 3.68 2.00 3.27

From 2009/10 onwards the ratios have increased due to lower anticipated levels of investment income as a consequence of both falling interest rates and lower levels of investments.

5 Treasury Management Prudential Indicators

Upper Limits On Variable Rate Exposure – This indicator identifies a maximum limit for variable interest rates based upon the debt position net of investments.

Upper Limits On Fixed Rate Exposure – Similar to the previous indicator this covers a maximum limit on fixed interest rates.

£000 2008/09 2008/09 2009/10 2009/10 2010/11 2010/11 Original Revised Original Revised Original Revised Estimate Estimate Estimate Estimate Estimate Estimate Prudential indicator limits based on debt net of investments Limits on fixed 5,984 5,054 5,240 6,263 5,611 6,345 interest rates Limits on variable 1,375 911 1,027 1,519 1,243 1,582 interest rates Prudential indicator limits based on debt only Limits on fixed 8,084 8,082 7,964 8,063 7,811 7,953 interest rates Limits on variable 2,425 2,425 2,389 2,419 2,343 2,386 interest rates Prudential indicator limits based on investments only Limits on fixed 2,100 3,028 2,724 1,800 2,200 1,608 interest rates Limits on variable 1,050 1,514 1,362 900 1,100 804 interest rates

Limits on investment interest have decreased due to lower anticipated levels of investment income.

6