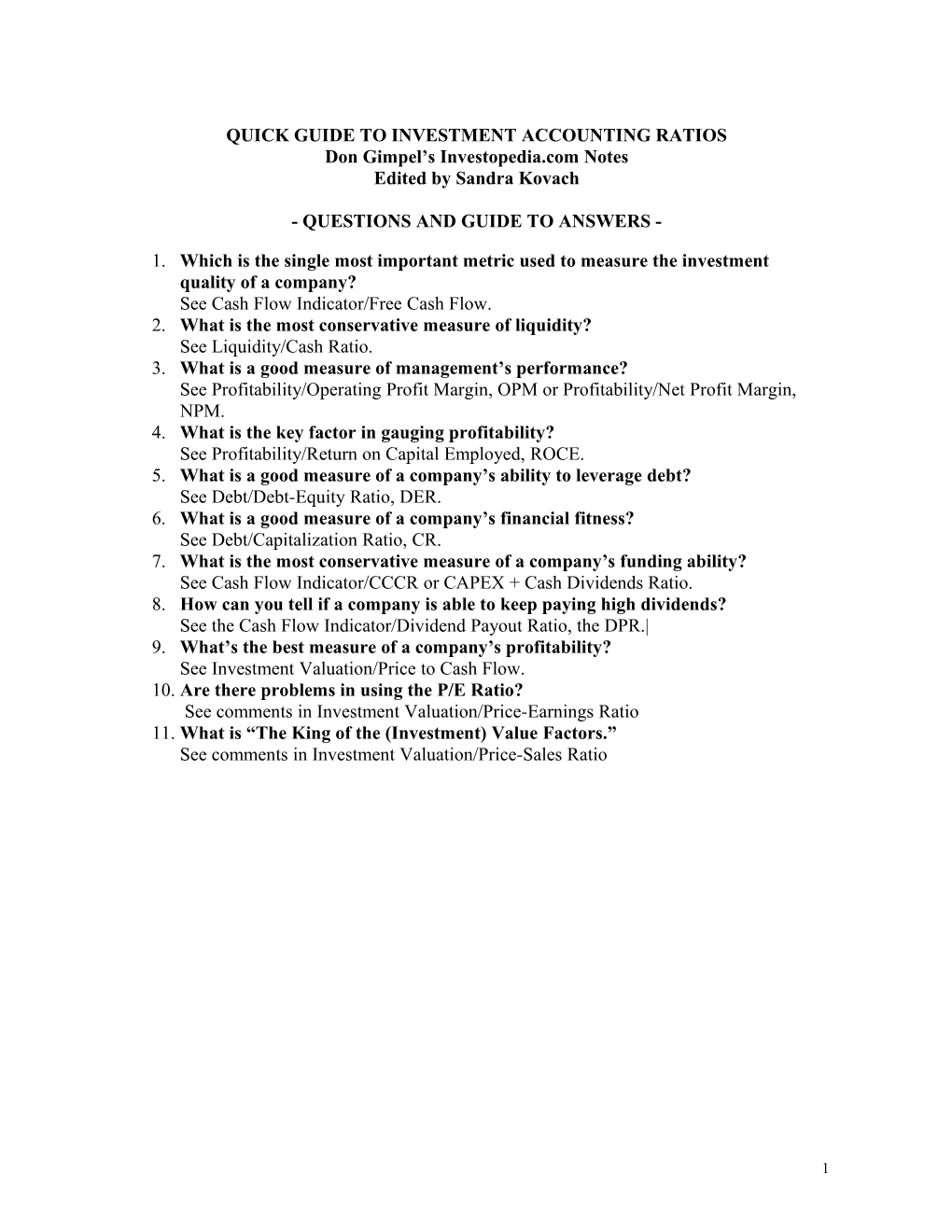

QUICK GUIDE TO INVESTMENT ACCOUNTING RATIOS Don Gimpel’s Investopedia.com Notes Edited by Sandra Kovach

- QUESTIONS AND GUIDE TO ANSWERS -

1. Which is the single most important metric used to measure the investment quality of a company? See Cash Flow Indicator/Free Cash Flow. 2. What is the most conservative measure of liquidity? See Liquidity/Cash Ratio. 3. What is a good measure of management’s performance? See Profitability/Operating Profit Margin, OPM or Profitability/Net Profit Margin, NPM. 4. What is the key factor in gauging profitability? See Profitability/Return on Capital Employed, ROCE. 5. What is a good measure of a company’s ability to leverage debt? See Debt/Debt-Equity Ratio, DER. 6. What is a good measure of a company’s financial fitness? See Debt/Capitalization Ratio, CR. 7. What is the most conservative measure of a company’s funding ability? See Cash Flow Indicator/CCCR or CAPEX + Cash Dividends Ratio. 8. How can you tell if a company is able to keep paying high dividends? See the Cash Flow Indicator/Dividend Payout Ratio, the DPR.| 9. What’s the best measure of a company’s profitability? See Investment Valuation/Price to Cash Flow. 10. Are there problems in using the P/E Ratio? See comments in Investment Valuation/Price-Earnings Ratio 11. What is “The King of the (Investment) Value Factors.” See comments in Investment Valuation/Price-Sales Ratio

1 QUICK GUIDE TO INVESTMENT ACCOUNTING RATIOS These notes are based in part upon material found in www.investopedia.com/university/ratios

LIQUIDITY … A measure of a company’s ability to pay its short-term debts Type/Measurement What it means The ratio Comments Current Ratio, CR or The proportion of current assets CR = N / D This method is flawed because a company available to cover current N = Cash or cash equivalents + marketable is a going concern and its ability to cover Current to Working liabilities. The higher the ratio, securities + receivables and inventory it’s current debts is not really significant Cash Position the better D = Notes payable + current ST debt payables + accrued expenses+ taxes (1+5+2+3)/(35+11+32+34) Quick Ratio, QR, or This is a measure of the amount QR = N / D The most liquid assets available to cover Quick Assets Ratio, of the most liquid assets to N = Cash & Equivalents + ST Inventory + current liabilities. A more conservative QAR cover current liabilities. The Accounts Receivable valuation than the Current Ratio. The higher the ratio the better. D = Current Liabilities “quickness” of the ratio depends upon the (1+3+2)/33 time required to collect receivables.

Cash Ratio, CashR A refinement of the current CashR = N / D The most conservative liquidity measure. It ratio to cover current liabilities. N = Cash & Cash Equivalents + Invested Funds is not realistic to have a CR>1 because it The higher the ratio the better. D = Current Liabilities might be considered poor asset utilization. 1/33 Cash Conversion # Days a company’s cash is tied Cycle, CCC up in production and sales. The shorter the better. Note: The numbers in column 3 refer to Balance Sheet or P&L line items.

2 PROFITABILITY … A measure of a company’s valuation Type/Measurement What it means The ratio Comments Profit Margin, GPM These four ratios measure a GPM = Gross Profit / Net Sales GPM measures how efficiently a company’s ability to make = ( 1 – Cost of Goods Sold / Net Sales) company uses its raw materials, labor Operating Profit money. The higher the ratio 16-COGS/16 and mfg.-related assets. M., OPM the better. OP = Gross Profit – Operating Expenses Management has real control of OPM so Pretax Profit (16-COGS)-36 this is a good measure of performance. Margin, PPM OPM = OP / Net Sales PPM is similar to OPM. Net Profit Margin, = (Gross Profit–Selling Exp.-GA ) / Net NPM is the bottom line and a good NPM sales performance measure.. ((16-COGS)-37-38)/16 PPM = Pretax Profit / Net Sales 17/16 NPM = Net Income / Net Sales 18/16 GA = General & Administrative Expenses Effective Tax Rate, Provides a good understanding ETR = Income Tax Expenses / Pre Tax Income Some analysts prefer to use the pretax ETR of a company’s tax rate. 20/17 profit instead of the net profit number for the profitability. Return on Assets, This shows how profitable a ROA = Net Income / Average Total Assets This is best used for historical purposes ROA company is compared to total 18/19 AVG because businesses vary widely in their assets. The higher the better. Fixed Asset requirements. Return on Capital This compliments the ROE by ROCE = Net Income + Capital Employed Factoring debt liability into the total capital Employed,. ROCE adding debt liabilities. 18+(11+12AVG)+8AVG provides a more comprehensive measure of Capital Employed = Avg. Debt + Average how well management is using debt. Shareholders Equity Focus on ROCE as the key factor to gauge profitability. ROCE should be >= a company’s borrowing rate.

3 DEBT … A measure of how well a company is using outside assets in its operations. Type/Measurement What it means The ratio Comments Overview of Debt Debt Ratio, DR This measures the total debt to DR = Total Liabilities / Total Assets The Debt Ratio provides a quick take on a total assets, a measure of a 7/6 company’s financial leverage. company’s debt leverage. The lower the better. Debt-Equity Ratio, This is another leverage ratio. DER = Total Liabilities / Shareholders Equity An easy-to-calculate ratio provides a DER This measures how much 7/8 general indication of a company’s suppliers, lenders, creditors equity-liability relationship. DER and obligors have committed provides a more dramatic perspective on a versus shareholders. The company’s leverage than DR. lower the ratio. Capitalization This ratio provides a key CapR = LT Debt/(LT Debt + Shareholders This measures financial fitness. One of Ratio, CapR insight into a company’s use Equity) the more meaningful debt ratios. of leverage. This is an 12((12+8) excellent measure of investment quality. The lower the ratio the better. Interest Coverage This determines how easily a EBIT – Earnings before Interest and Taxes When ICR < 1.5, the company’s ability to Ratio, ICR company can pay interest on its 9 meet its interest expenses is questionable. debts. The higher the ratio the ICR = EBIT / Interest Expense better. 9/10 Cash Flow to Debt This ratio provides an Total Debt = ST + LT debt A high double-digit ratio is a sign of Ratio, CFDR, or indication of a company’s 11+12 financial strength. A low ratio indicates too Free Cash Flow to ability to cover its total debt CFDR = Operating Cash Flow / Total Debt much debt or weak cash flow generation. Debt Ratio, FCFDR with its yearly cash flow. The Other = Redeemable Preferred Stock + 2/3 of higher the ratio, the better. principal of non-cancellable operating leases. 13/(11+12) FCFDR = Operating Cash Flow/(Total Debt + Other) 13/(11+12)

4 OPERATING PERFORMANCE … A broad measures of a company’s operating health Type/Measurement What it means The ratio Comments Fixed-Asset This is a rough estimate of the FAT = Revenue / (Property + Plant + Equipment) This measures a company’s efficiency in Turnover, FAT productivity of a company’s 14/15 managing fixed assets. Best used with fixed asset utilization. The historical ratios to establish trends. This higher the ratio, the better. ratio is highly dependent on the company’s kind of business Sales Revenue per This a measure of personal SRE = Revenue / # Employees Like others in this class, this measure is Employee, SRE productivity as Net Sales per = Net Sales / # Employees highly dependent upon the nature of the Employee 14/#Employees business. It is best used to determine 16/#Employees trends among competitors. Operating Cycle, OC A measurement of management OC = DIO + DSO – DPO The more efficient the collection performance similar to the DIO = # Days Inventory outstanding = operations, the better. The slower the CCC. The fewer the # days, the Average Inventory divided by Cost of Sales/day payables are paid, the better. The lower the better. Average Inventory = (Io + Ie) / 2 inventory to sales ratio, the better. When Cost of Sales per day = Annual Cost of Sales/365 using the OC, look for historical THINK OF THIS AS CASH consistency. SENT OUT AND THE CASH DSO = # Days Receivable’s Outstanding = COLLECTED. MORE Average Accounts Receivable/Net Sales per day IMPORTANT WITH THE Avg. Acct. Rec = (Initial + Final)Acct. Rec. / 2 RETAIL SECTOR. LOOK Net Sales / Day = Annual Net Sales / 365 FOR THIS INFORMATION IN THE NOTES DPO = # Days Payables Outstanding = Avg. Accts. Payable / Cost of Sales per day Avg. Acct. Payable = (Init. + Final ) Payables/2 Cost of Sales/Day = Annual Cost of Sales / 365

5 CASH FLOW INDICATOR … A measure of how efficiently a company uses its cash assets Type/Measurement What it means The ratio Comments Operating Cash Flow The Operating Cash Flow to OCF/S = Operating Cash Flow / Sales There are three sources of cash flow: (1) to Sales Ratio, Sales Ratio measures how the OCF is taken from the Cash Flow Statement. from operations, (2) from Investing and (3) OCF/S cash generated from operations Net Sales is taken from the Income Statement from Financing. Use only the part derived varies over time. Generally, the 13/16 from operations, which is usually the greater the ratio, the better. foremost source of cash. Free Cash Flow to This is the fraction of cash FCF/OCF=(1–Capital Exp./Operating Cash Many investment institutions value Free Operating Cash flow available for expansion, Flow) Cash Flow ahead of earnings as the single Flow, FCF/OCF acquisitions and/or financial 1-(17/13) most important financial metric used to stability to enable a company measure the investment quality of a to weather difficult company. conditions. The higher the ratio, the better. Cash Flow These are measures of the STDC = OCF / ST Debt 13/11 These ratios determine the company’s Coverage Ratio, ability of a company’s OCF to CEC = OCF / Cap. Exp. 13/17 funding ability. The last ratio is a really CCCR meet its obligations. The DC = OCF / Cash Dividends 13/21 stringent measure that puts cash to the higher the ratio the better. CAPEX + Cash Dividends Ratio = ultimate test. It is “free cash flow on OCF / (Cash Expenditures + Cash Dividends ) steroids” and indicates high investment 13/17+21 quality Dividend Payout Measures the fraction of DPR = Dividends per Common Share This ratio is only used for dividend Ratio, DPR earnings allocated for cash Earnings per Share paying companies. Look for consistent dividends. This is a measure (21/24)/(18/24) or steadily increasing ratios. Be of how well earnings support skeptical of excessively high dividends the dividend payment. The because the company might not be able smaller the ratio the better. to keep it up triggering a sharp stock price decline.

6 INVESTMENT VALUATION … A measure of how an investment is valued Type/Measurement What it means The ratio Comments Per Share Data Price to Book Value This ratio is how many times a PB = Stock Price / Shareholder’s Equity per share When a company’s stock price is less than Ratio, PB company’s stock value is 23/(8/24) it’s book value then (1) the stock is trading per share compared to a undervalued and represents a buying value company’s book value per share or (2) if that evaluation is correct, the investment will be perceived as a losing proposition or at best a stagnant investment Price to Cash Flow This ratio is used to evaluate PCF = Stock price / Operating Cash Flow per This ratio is similar to PB but many Ratio, PCF an investment’s share analysts consider it more reliable for attractiveness. The lower the 23/(13/24) evaluating acceptability of current ratio the better. pricing because it is not as easily manipulated. Price to Earnings This is the best known PE = Stock Price / Earnings per share This ratio is often optimistic during bull Ratio, PE investment valuation 23/(18/24) markets and pessimistic during bear indicator. Substitutions for the denominator include: markets. It should be looked at TTM = Trailing Twelve-month Earnings/Share skeptically particularly if forward Obtain from 25 Price/Sales Ratio earnings estimates are used. High P/Es FEPS = Estimate future 12-month imply a growth company where potential Earnings/Share Obtain from 22 Earnings per investors are willing to pay extra for Share Growth – Growth is an estimate potential growth. This ratio is highly sensitive to changes in accounting practices.

Price to Earnings to The PEG Ratio is a refinement PEG = PE / G If the PEG = 1. the market is currently Growth Ratio, PEG of the PE Ratio made by (23/(18/24))/22 valuing a stock in accordance with the including the growth factor in Here, G is the E/S Growth. stock’s current estimated earning per share the denominator into the current growth. If the value is

7 Price to Sales Ratio, A stock valuation indicator P/S = Stock price per share / Net Sales per share According to James O’Shaughghnessy P/S similar to the P/E Ratio 23/(16/24) author of “What Works on Wall Street,” except it measures valuation this ratio is “The King of Value Factors.” against Annual Sales. The It beats all others and does so lower the ratio, the better. consistently. Dividend Yield, DY A measure of valuation as the DY = Ann. Dividend/Share / Stock Price per Share This measure depends on the nature of the annual dividend per share (21/24)/23 company’s business, whether it’s “value” divided by the stock price per or “growth” oriented, earnings, cash-flow share and dividend policies. The value of this indicator depends on whether the investor favors value or growth. Enterprise Value This is the ratio of the EVM = EV / EBITDA The EVM is influenced by investor Multiple, EVM, in “enterprise value” by EBITDA. EV = Market Capitalization + Debt + Minority sentiment and market conditions. It years It measures how long it would Interest + Preferred Stock – Cash – Cash measures the value of a company as a going take for an acquisition to pay Equivalents. concern. off its costs. EBITDA = Earnings before Interest, Taxes, Depreciation and Amortization

(23*24)/21+(11+12)+26-27

8 QUICK GUIDE TO INVESTMENT ACCOUNTING RATIOS - ABBREVIATIONS -

CAPEX Capital Expenditure Coverage FCFDR Free Cash Flow to Debt Ratio CapR Capitalization Ratio FEPS Forward (ex ante) Earnings per share CashR Cash Ratio G Earnings per share growth CCC Cash Conversion Cycle GPM Gross Profit Margin CFDR Cash Flow to Debt Ratio ICR Interest Coverage Ratio CR Current Ratio NPM Net Profit Margin DC Dividend Coverage OC Operating Cycle, Days DER Debt-Equity Ratio OCF Operating Cash Flow DIO # Days Inventory Outstanding OCF/S Operating Cash Flow to Sales DPO # Days Payables Outstanding OPM Operating Profit Margin DPR Dividend Payout Ratio PB Price to Book Ratio DR Debt Ratio PCF Price to Cash Flow Ratio DSO # Days Receivables Outstanding PE Price to Earnings Ratio DY Dividend Yield PEG Price to Earnings Growth Ratio EBIT Earnings Before Interest and Taxes PPM Pretax Profit Margin EBITDA Earnings before Interest, Taxes, QAR Quick Assets Ratio Depreciation and Amortization QR Quick Ratio EPS Earnings (ex post) earnings per share ROA Return on Assets ETR Effective Tax Rate ROCE Return on Capital Employed EV Enterprise Value S Sales, Net EVM Enterprise Value Multiple SRE Net Sales per Employee FAT Fixed-Asset Turnover STDC Short-term Debt Coverage FCF Free Cash Flow TTM Trailing 12-Month (Earnings per share) FCF/OCF Free Cash Flow to OCF Ratio

9 QUICK GUIDE TO INVESTING ACCOUNTING RATIOS - LOCATION OF BALANCE SHEET AND PROFIT/LOSS STATEMENT ITEMS -

ITEM LOCATION Accounts Receivable Balance Sheet/Assets/Current Assets Assets, Total Balance Sheet/Assets/Total Assets Book Value Balance Sheet/Equity Capital Employed Balance Sheet/Equity Capital Expenditures Balance Sheet/Fixed Assets/Property Cash Balance Sheet/Current Assets/Cash Cash, Dividends Income Statement/Footnotes/Dividends per share Cash, Equivalents Balance Sheet/Assets/Current Assets/Cash & Cash Equivalents Cash, Flow Cash Flow Statement Cash, Free Cash Cash Flow Statement Cash Flow, Operating Cash Flow Statement Cost of Goods Sold Income Statement/Expenses/Total Debt, Average Balance sheet/Liabilities and Equity/Long-Term Liabilities./LT Debt, Current Short-Term Balance sheet/Liabilities/Current portion of bank loans Debt, Long-Term Balance Sheet/Liabilities & Equity/LT/Bank Loans Dividend Payout Ratio Income Statement/ Footnotes Dividend Yield Income Statement/Footnotes Earnings Income Statement/Net Earnings Earnings per Share Growth Income Statement/Footnotes Employees, number Personnel Records Enterprise Value Enterprise Value Multiple Expense, Accrued Income Statement/Total Expenses Expense, General & Administrative (GA) Income Statement/Expenses/G&A Expense, Income Tax Income Statement/Scheduled Expenses Expense, Interest Income Statement/Scheduled Expenses Expense, Operating Income Statement/Variable Expenses Expense, Selling Income Statement/Variable Expenses Income, Net Income Statement/Net Earnings Income, Pre-Tax Income Statement/Net Earnings Inventory Balance Sheet/Assets/Current Assets/Inventory Invested Funds Income Statement/Operating Income/Interest Income Liabilities, Current Balance Sheet/Liabilities & Equity/Current Liabilities/Total Liabilities, Total Balance Sheet/Liabilities & Equity/Total Liabilities Minority Interest Notes payable Balance Sheet/Liabilities & Equity/Current Liabilities/Current Portion of Bank Loans Preferred Stock, redeemable Balance Sheet/Equity Price to Sales Ratio Income Statement/Footnote Property, Plant & Equipment Balance Sheet/Assets/Fixed Assets/Property, Plant and Equipment Profit, Gross Income Statement/Gross Profits Profit, Pretax Income Statement/Profit Receivables Balance Sheet/Assets & Equity/Current Assets/Acct. Receivable Sales, Net Income Statement/Revenues/Sales Net Securities, Marketable Balance Sheet/Assets/Current Assets/Cash & Cash Equivalents Shareholders Equity, Average Balance Sheet/Equity/Per share capital Taxes Payable Balance Sheet/Liabilities and Equity/Current and Long Term Liabilities/Taxes Payable

10 INCOME (PROFIT & LOSS) AND QUICK CASH FLOW STATEMENTS

REVENUES QUICK GUIDE REFERENCE 16 Net Operating Sales Net sales Other Income Interest Income 14 TOTAL REVENUE Total revenue

9 EXPENSES 36 Operating Total Expenses, operating 37 Selling Selling expense 38 G & A General & Administrative Expense TOTAL EXPENSES Total expenses

EBITDA Earnings before Interest, Taxes, Depreciation & Amortization

SCHEDULED EXPENSES 10 Interest Depreciation and Amortization 17 Pre-tax Profit Pre-tax Profit 20 Taxes TOTAL SCHEDULED EXPENSES

18 NET EARNINGS Net Earnings

NOTES 21 Cash dividends 24 Average # shares outstanding in period 23 Stock price at close of period 22 Earnings per share growth 25 Price/Sales Ratio

CASH FLOW

CASH FLOW + Net Earnings + Depreciation and Amortization - Change in working capital - Funds Invested in Period

13 QUICK CASH FLOW Quick Cash Flow

11 BALANCE SHEET AND SHAREHOLDERS EQUITY

ASSETS QUICK GUIDE REFERENCE

CURRENT ASSETS 1 Cash & Cash equivalents 27 Cash & Cash Equivalents 2 Accounts Receivable Accounts Receivable, Receivables 3 Inventory 4 Prepaid expenses 5 Securities, marketable Securities, marketable 6 Other current assets

FIXED ASSETS 15 Property, Plant and Equipment 17 Capital expenditures (fixed asset purchases) Goodwill Other intangible fixed assets

6 TOTAL ASSETS 19 Total Assets

LIABILITIES AND SHAREHOLDERS EQUITY

CURRENT LIABILITIES 8 Accounts Payable 9 Current Income Taxes 34 Taxes payable 10 Current portion of bank loans 35 Notes payable 30 Short-term provisions 32 Other 33 Total Short-term Liabilities 11 Current short-term debt, Liabilities-current

LONG TERM LIABILITIES Bank loans Issued debt securities Deferred tax liability 26 Provisions – minority interest 7 Total Long-term Liabilities 12 Debt, long-term

TOTAL LIABILITIES

EQUITY Per Share capital 24 Shareholders equity per share Capital reserves Revaluation reserves Retained profits Preferred stock redeemable 15 Preferred stock redeemable

NOTES Book value Book value

12