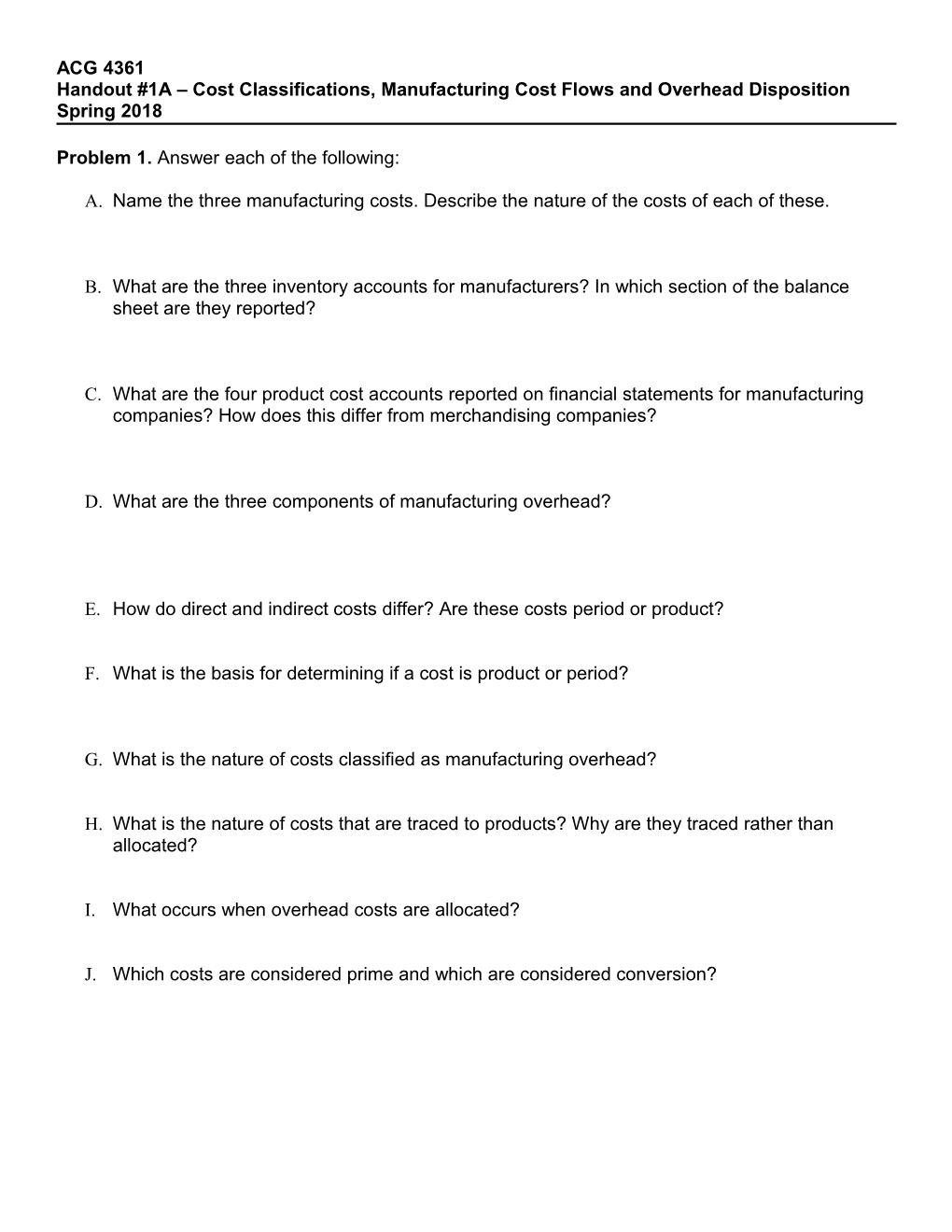

ACG 4361 Handout #1A – Cost Classifications, Manufacturing Cost Flows and Overhead Disposition Spring 2018

Problem 1. Answer each of the following:

A. Name the three manufacturing costs. Describe the nature of the costs of each of these.

B. What are the three inventory accounts for manufacturers? In which section of the balance sheet are they reported?

C. What are the four product cost accounts reported on financial statements for manufacturing companies? How does this differ from merchandising companies?

D. What are the three components of manufacturing overhead?

E. How do direct and indirect costs differ? Are these costs period or product?

F. What is the basis for determining if a cost is product or period?

G. What is the nature of costs classified as manufacturing overhead?

H. What is the nature of costs that are traced to products? Why are they traced rather than allocated?

I. What occurs when overhead costs are allocated?

J. Which costs are considered prime and which are considered conversion? Problem 2. For each of the following costs incurred in a manufacturing company, indicate the proper classification by placing an X in the correct columns.

Fixe Variabl Produc Perio Prime Conversion Indirect d e t d 1. Salary of the CFO 2. Tires used to produce bicycles 3. Wages of clerical staff in corporate office 4. DDB Depreciation of factory machines 5. Property taxes on the factory 6. Maintenance cost on delivery trucks 7. Factory janitor salary 8. Sales personnel commissions 9. Wages of assembly workers 10. Shipping cost to acquire production materials Problem 3 Speedster Inc. manufactures custom all-terrain vehicles (ATVs). March's beginning inventory consisted of the following components: Raw materials $ 15,000 Work in process 17,000 Finished goods 40,000 Speedster applies factory overhead based using normal costing. Budgeted direct labor is $102,000. Budgeted factory overhead for March is $110,600. Speedster tracks both direct and indirect materials in its Raw Materials Inventory. Over or underapplied overhead is considered to be immaterial.

The following descriptions summarize the various transactions that occurred during March:

1. Purchased $126,500 of raw materials on account. 2. Purchased $7,200 of raw materials for cash. 3. Used $135,000 of raw materials in the production process. $124,000 of this amount consisted of parts and other materials directly incorporated into ATVs. The remainder was indirect material for shop supplies and small dollar items that are not otherwise traceable to specific ATVs. 4. Paid $2,400 during the month for shipping costs for raw materials acquired. 5. Paid for materials purchased in transaction 1. 6. Total wages and salaries incurred were $147,000 at an actual wage rate of $16.00 per hour. Of this amount, $99,000 was attributable to direct labor, $12,000 to indirect labor, and $36,000 to general and administrative activities. 7. Depreciation for the period totaled $29,000, with $21,000 related to the factory and factory- related equipment (included in the factory overhead rates). The other $8,000 is related to general and administrative activities. 8. Other general and administrative costs, excluding wages and depreciation, totaled $15,000. 9. Other factory overhead costs, excluding indirect materials, wages, and depreciation, totaled $61,200. 10.Applied manufacturing overhead for the period in the amount of $108,300. 11.Sales for the month amounted to $525,000. All sales are on account. Cash received from customers totaled $522,000. 12.Ending work in process was $33,000. 13.Ending finished goods inventory totaled to $21,500. 14.Income taxes are 30%. Speedster treats under or overapplied overhead as immaterial in amount. A. Draw t-accounts for all product cost accounts and post all transactions to these accounts. B. Prepare a cost of goods manufactured statement for the month of March. C. Prepare a multiple-step full costing income statement for March, D. Show how the inventories would be reported on the company’s March 31 balance sheet. Be sure to indicate the specific balance sheet sections. E. Why do companies apply overhead?

Template provided on next page. Problem 3 template

Trans Assets Revenue Expenses # Raw Materials Work in Process Finished Goods Sales CGS MOH Selling/G&A Exp. BB 15,000 17,000 40,000 actual applied 1 2 3 4 5 6 7 8 9 10 11 12 13 Problem 3 template

Speedster, Inc. Speedster, Inc. Income Statement Cost of Goods Manufactured Month Ending March 31, 2018 Month Ending March 31, 2018

Sales Direct Materials

Cost of goods sold: Beginning RM inventory

Beginning FG inventory Add net purchases

Add cost of goods manufactured Less indirect materials

Less ending FG inventory Less ending RM inventory

Adjust for over/underapplied OH Direct materials used

Cost of goods sold Direct labor incurred

Gross profit Manufacturing overhead cost

Operating expenses: Total manufacturing costs

Gen.Admin. expense Add beginning WIP inventory

Income before taxes Less ending WIP inventory

Income taxes expense Cost of goods manufactured

Net income Problem 4. Hager Inc. applies overhead based on direct labor cost using a normal costing system with a single factory overhead account. The company estimated the following annual amounts:

Estimated manufacturing overhead $42,000 Estimated direct labor 1,600 hours at $15 per hour Actual amounts for the year were: Actual manufacturing overhead $44,000 Actual direct labor 1,550 hours at $16 per hour

A. Determine the amount of over or underapplied overhead using normal costing. In your calculations, draw a t-account will contain this amount and properly post all amounts to it.

B. Repeat part A assuming Hager had used actual costing. Indicate the advantages of both methods.

C. How does the timing of determining the overhead rates differ between normal and actual costing and why? Problem 5. Aruba Breeze produces several ceiling fan styles, employs a normal costing system, and considers under or overapplied overhead to be immaterial. It tracks all material costs in the materials storeroom. During July, its transactions and account balances included the following:

Raw materials purchased on account $132,000 Raw materials inventory, beg. $12,600 Work in process inventory, beginning 12,200 Raw materials inventory, ending 13,400 Work in process inventory, ending 23,500 Product delivery cost to customers 3,400 Finished goods, beginning 19,000 Indirect materials used in production 2,700 Finished goods, ending 12,500 Production supervisor’s salary 6,000 Product advertising costs 2,500 Factory accountant’s salary 3,200 Shipping department costs 2,700 Corporate liability insurance 900 Factory equipment depreciation 3,500 Factory occupancy costs 4,600 Factory janitor wages 1,100 Factory machine maintenance costs 1,700 Total manufacturing overhead applied 26,300 Direct labor cost incurred 50,400

Hint: Be sure to dispose of any under or overapplied MOH. A. How much is the cost of direct materials transferred to production during July? B. How much is the cost of goods manufactured for July? C. How much is total manufacturing costs for July? D. What amount of conversion costs were added to production during July? E. What amount of prime costs were added to production during July? F. How much will Fanna Fans report as cost of goods sold for July? G. Prepare a cost of goods manufactured statement for July.