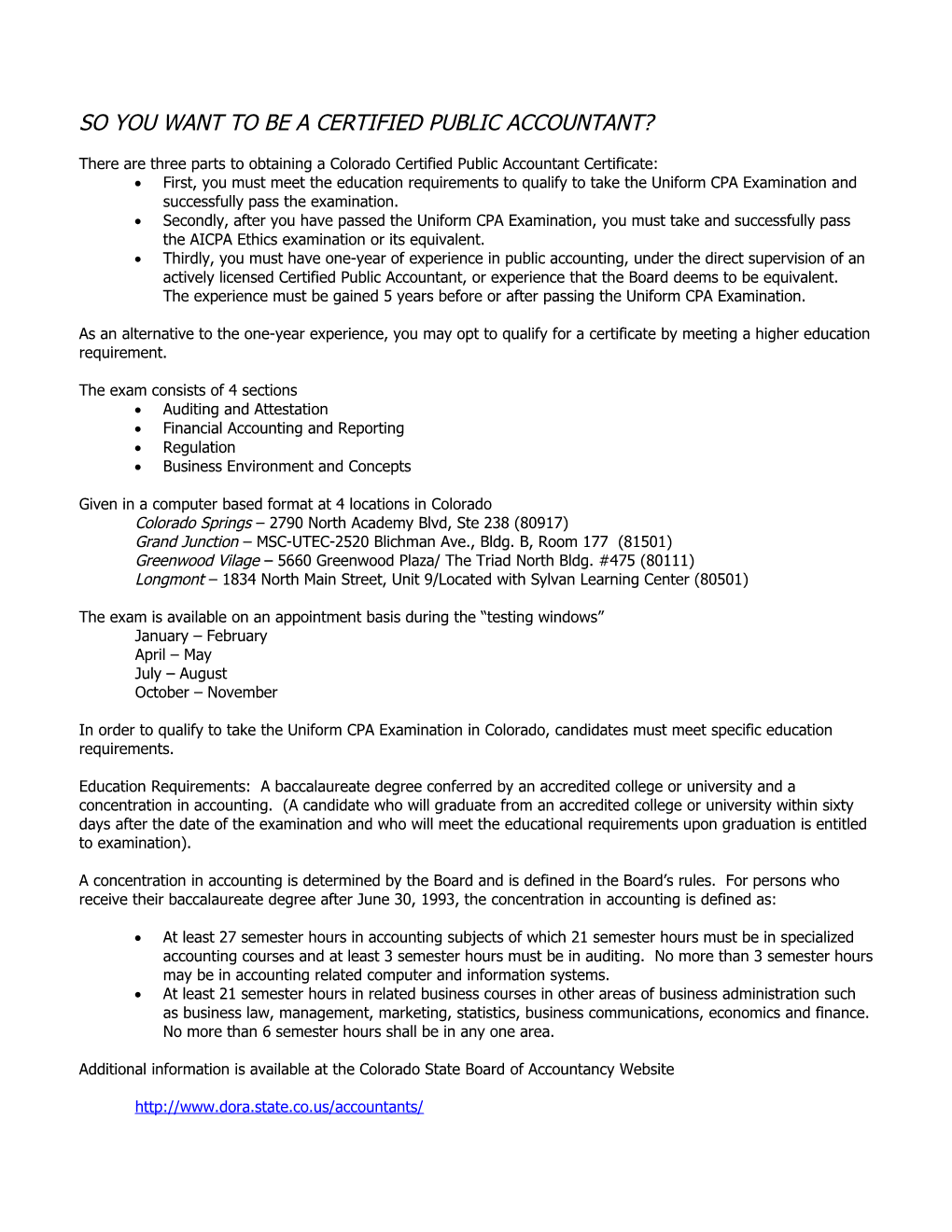

SO YOU WANT TO BE A CERTIFIED PUBLIC ACCOUNTANT?

There are three parts to obtaining a Colorado Certified Public Accountant Certificate: First, you must meet the education requirements to qualify to take the Uniform CPA Examination and successfully pass the examination. Secondly, after you have passed the Uniform CPA Examination, you must take and successfully pass the AICPA Ethics examination or its equivalent. Thirdly, you must have one-year of experience in public accounting, under the direct supervision of an actively licensed Certified Public Accountant, or experience that the Board deems to be equivalent. The experience must be gained 5 years before or after passing the Uniform CPA Examination.

As an alternative to the one-year experience, you may opt to qualify for a certificate by meeting a higher education requirement.

The exam consists of 4 sections Auditing and Attestation Financial Accounting and Reporting Regulation Business Environment and Concepts

Given in a computer based format at 4 locations in Colorado Colorado Springs – 2790 North Academy Blvd, Ste 238 (80917) Grand Junction – MSC-UTEC-2520 Blichman Ave., Bldg. B, Room 177 (81501) Greenwood Vilage – 5660 Greenwood Plaza/ The Triad North Bldg. #475 (80111) Longmont – 1834 North Main Street, Unit 9/Located with Sylvan Learning Center (80501)

The exam is available on an appointment basis during the “testing windows” January – February April – May July – August October – November

In order to qualify to take the Uniform CPA Examination in Colorado, candidates must meet specific education requirements.

Education Requirements: A baccalaureate degree conferred by an accredited college or university and a concentration in accounting. (A candidate who will graduate from an accredited college or university within sixty days after the date of the examination and who will meet the educational requirements upon graduation is entitled to examination).

A concentration in accounting is determined by the Board and is defined in the Board’s rules. For persons who receive their baccalaureate degree after June 30, 1993, the concentration in accounting is defined as:

At least 27 semester hours in accounting subjects of which 21 semester hours must be in specialized accounting courses and at least 3 semester hours must be in auditing. No more than 3 semester hours may be in accounting related computer and information systems. At least 21 semester hours in related business courses in other areas of business administration such as business law, management, marketing, statistics, business communications, economics and finance. No more than 6 semester hours shall be in any one area.

Additional information is available at the Colorado State Board of Accountancy Website

http://www.dora.state.co.us/accountants/