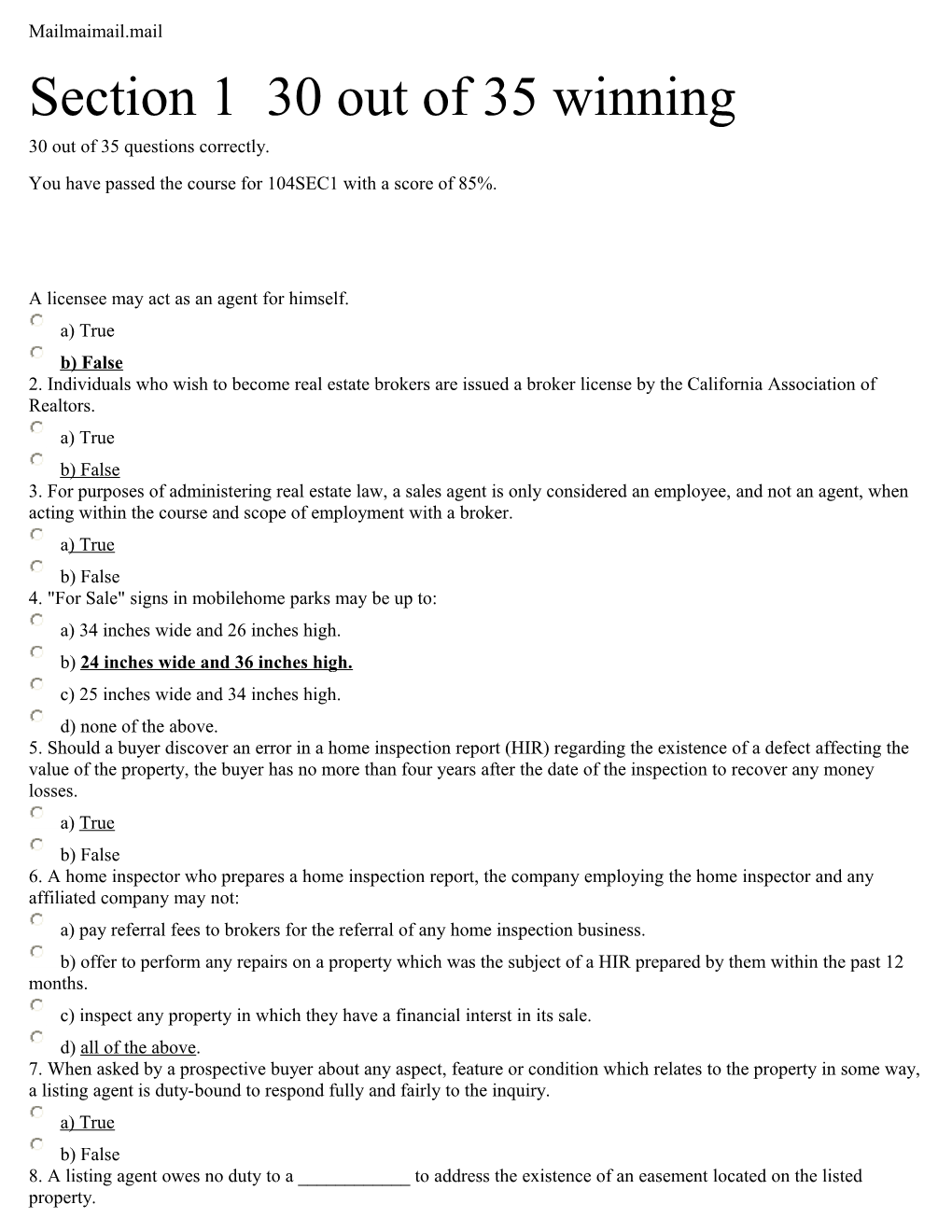

Mailmaimail.mail Section 1 30 out of 35 winning 30 out of 35 questions correctly. You have passed the course for 104SEC1 with a score of 85%.

A licensee may act as an agent for himself. a) True b) False 2. Individuals who wish to become real estate brokers are issued a broker license by the California Association of Realtors. a) True b) False 3. For purposes of administering real estate law, a sales agent is only considered an employee, and not an agent, when acting within the course and scope of employment with a broker. a) True b) False 4. "For Sale" signs in mobilehome parks may be up to: a) 34 inches wide and 26 inches high. b) 24 inches wide and 36 inches high. c) 25 inches wide and 34 inches high. d) none of the above. 5. Should a buyer discover an error in a home inspection report (HIR) regarding the existence of a defect affecting the value of the property, the buyer has no more than four years after the date of the inspection to recover any money losses. a) True b) False 6. A home inspector who prepares a home inspection report, the company employing the home inspector and any affiliated company may not: a) pay referral fees to brokers for the referral of any home inspection business. b) offer to perform any repairs on a property which was the subject of a HIR prepared by them within the past 12 months. c) inspect any property in which they have a financial interst in its sale. d) all of the above. 7. When asked by a prospective buyer about any aspect, feature or condition which relates to the property in some way, a listing agent is duty-bound to respond fully and fairly to the inquiry. a) True b) False 8. A listing agent owes no duty to a ______to address the existence of an easement located on the listed property. a) seller b) broker c) prospective buyer d) title company 9. A listing agent may use information obtained from a seller concerning the size of a property in an advertisement offering property for sale. a) True b) False 10. It is the duty of a listing agent to advise a prospective buyer to investigate the consequences of disclosed facts before deciding to buy. a) True b) False 11. A transaction exempt from delivery of a condition of property statement includes transfers from neighbor to neighbor. a) True b) False 12. Garage door openers installed after ______are required to have a sensor which, in the event of an obstruction, causes a closing door to open and prevents an open door from closing. a) January 1, 1990 b) January 1, 1991 c) January 1, 1992 d) January 1, 1993 Garage Door Sensors - eHow.com By law, garage door openers must have a safety device installed to shut off ... Garage door openers made after Jan. 1, 1993, use a photo-eye sensor ... In the 1990s, government-imposed federal regulations required garage door openers to ...

13. Every agent has an affirmative duty owed to a buyer to disclose prior deaths when the death might affect the buyer's valuation or desire to own the property. a) True b) False 14. On receiving notice that a smoke detector is inoperable, the landlord is required to promptly repair or replace it. a) True b) False 15. Actual use of the Natural Hazard Disclosure Statement by sellers and their agents is mandated on the sale of one-to- four unit residential properties. a) True b) False 16. A seller and listing agent may obtain natural hazard information: a) directly from the public records themselves. b) by employing a natural hazard expert, such as a geologist. c) both a and b. d) neither a nor b. 17. Lead-based paint is defined as paint or surface coating that contains lead equal to at least .5 milligrams per square centimeter or 1% by weight.

a) True b) False

Lead-Based Paint means paint or other surface coatings that contain lead equal to ... one milligram per square centimeter or more that 0.5 percent by weight. ... that contains total lead equal to or exceeding four hundred parts per ..

18. The seller and the listing broker must each keep a copy of the lead-based paint disclosure statement for at least three years from the date the sale is completed. a) True b) False 19. When conditions are the subject of contingency provisions, the conditions are initially distinguished by whether they: a) do occur, called personal-satisfaction contingencies. b) are approved, called event-occurrence contingencies. c) both a and b. d) neither a nor b. 20. Conditions concurrent consist of noncontingent, mandatory performance provisions calling for the buyer or seller to perform such activity which must occur. a) True ????? b) False 21. A written contingency does not need to include: a) a description of the event addressed in the contingency. b) the method for service of the notice of cancellation on the other person. c) a waiver of the right to cancel the transaction. d) the time period in which the event called for in the contingency must occur. 22. The existence of an oral or written contingency provision in a purchase agreement does not render the agreement void. a) True b) False 23. An arbitration provision in a real estate purchase agreement, listing or lease: a) is an arbitration agreement between the arbitrator and each person who agrees to be bound by the provision. b) defines the arbitrator's powers and limitations on those powers. c) both a and b. d) neither a nor b. 24. The widely understood purpose for including a time-essence clause in a purchase agreement is to protect the seller from delays in the buyer's payment of the sales price. a) True b) False 25. Before either a buyer or seller can effectively cancel a transaction, they must "place the other person in default". a) True b) False 26. Failure of a buyer to deposit funds into escrow as called for in the purchase agreement and escrow instructions always means the buyer is in default. a) True b) False 27. When a syndicator exercises an option, a ______is automatically formed. a) land sales contract b) unilateral sales contract c) bilateral sales contract d) none of the above 28. An option agreement provides benefits for both buyer and seller. a) True?? b) False 29. A right of first refusal is also called a(n) ______to purchase. a) option b) preemptive right c) discretionary right d) none of the above 30. Prior to closing a sale, a seller-in-foreclosure has a statutory three-day right to cancel the equity purchase agreement he has entered into with an EP investor. a) True b) False 31. The broker representing an EP investor must, when negotiating an EP transaction, deliver to the seller-in- foreclosure a written EP disclosure statement that the buyer's agent representing the EP investor is: a) a licensed real estate broker. b) bonded by a surety insurer for twice the property's fair market value. c) both a and b. d) neither a nor b. 32. Buyer-occupants are frequently unwilling to purchase property in foreclosure since the property is often physically damaged or unattractive and improperly encumbered. a) True b) False 33. A seller who is faced with a breaching buyer and the loss of the sales transaction must first decided whether to: a) enforce the purchase agreement and have a court order the buyer to close escrow. b) remarket the property for sale promptly and diligently seek to locate a buyer. c) retain the property and postpone or entirely forego any resale effort. d) all of the above. 34. The use of the word transmutation is required in a transfer document to transmute separate or community property. a) True b) False The use of the word “transmutation” is not required in a transfer document to transmute property. A transmutation would have taken place had the consent agreement contained the provision, “I give to the account holder any interest I have in the funds deposited in this account.” [In re Estate of MacDonald (1990) 51 C3d 262]

35. An instrument which can be used to authorize one spouse to manage and control community property is: a) a power of attorney. b) a revocable trust in which one spouse is the named trustee. c) a limited partnership. d) all of the above.

======Section 2

1. When the ownership in property is vested as a joint tenancy, the death of a joint tenant automatically extinguishes the deceased joint tenant's interest in the real estate. a) True b) False 2. In federal law, the classic definition of a corporate security is: a) an investment of money. b) a common enterprise, providing for mutual success or failure of the group in its investment goals. c) an expectation of profits produced by the efforts of others. d) all of the above. 3. A homestead is a dollar amount of the equity held by a homeowner in his dwelling with priority on title over most judgment liens and some government liens. a) True b) False 4. A quiet title action determines the priority of the debtor's lien and the recorded homestead on the title. a) True b) False 5. The good faith requirement prevents an intentional exploitation of the balancing hardships rule. a) True b) False 6. A landlord's viable option for the collection of unpaid late charges from the tenant is to accept the rent check and file an action in small claims court for the unpaid late charge amounts. a) True b) False 7. A residential landlord may not deduct from the security deposit amounts reasonably necessary to dispose of abandoned personal property. a) True b) False 8. A residential landlord must deliver an itemized statement of deductions and any security deposit remaining no later than 21 days after the tenant vacates the premises. a) True b) False 9. A partial payment agreement entered into by a residential landlord and tenant on acceptance of a portion of the rent due is evidence of: a) the landlord's receipt of partial rent. b) the tenant's promise to pay the remainder of the rent by the rescheduled due date. c) notification of the landlord's right to serve a 3-day notice on failure to pay the remaining balance. d) all of the above. 10. A residential or nonresidential 30-day notice to vacate the premises is only effective when used by a landlord or tenant to terminate a periodic tenancy. a) True b) False 11. A landlord is not required to expend extraordinary amounts of time and money constantly conducting extensive searches for possible dangerous conditions. a) True b) False 12. The discount rate is important to private money lenders: a) who are not licensed real estate brokers. b) who do not arrange their loans through real estate brokers. c) both a and b. d) neither a nor b. 13. When a lender breaches its oral commitment, a borrower's reliance on anything less than an unconditional written loan commitment is not legally justified. a) True b) False 14. Equity purchase statutes do not apply to all EP investors. a) True b) False 15. A ______is a final lump sum payment of remaining unpaid principal, which is due on an earlier date than had the periodic payment schedule continued until the principal was fully amortized. a) compound payment b) due-date payment c) balloon payment d) all of the above 16. The prepayment penalty clause in most trust deeds allows the lender to charge a penalty if the loan is voluntarily or involuntarily paid off before the due date. a) True b) False 17. An impound account is a money reserve consisting of the property owner's funds held by a beneficiary and used for paying property taxes, insurance premiums or bonded offsite improvements. a) True b) False 18. A deficiency judgment is based on a cash value of the secured real estate consistent with market conditions at the time of the foreclosure sale, called the ______of the property. a) asset price deflation b) intrinsic value c) current resale value d) fair market value 19. Seller financing does not include the creation of alternative documentation, sometimes called masked security devices. a) True b) False 20. A buyer and seller should determine and analyze the risks and benefits accompanying their use of an unescrowed, unrecorded and uninsured land sales contract before they: a) sign and deliver an offer to purchase on a land sales contract. b) sign and deliver the land sales contract and transfer downpayment funds and possession. c) both a and b. d) neither a nor b. 21. Taxwise, lease-option sales are recharacterized by the Internal Revenue Service, the state Franchise Tax Board and the county assessor as carryback financing or land sales contracts. a) True b) False 22. Today, the remaining goal of usury laws is the prevention of ______by private lenders. a) loan-sharking b) forfeiture of interest c) exemption d) none of the above 23. An all-inclusive note is also called a wraparound note or overriding note. a) True b) False 24. The two variations of the AITD are differentiated by the amount of the payoff demand the carryback seller can request for satisfaction of the all-inclusive note and reconveyance of the AITD. a) True b) False 25. Capital is withdrawn in a §1031 reinvestment plan: a) in the form of cash or principal in a carryback note received on the sale of the property sold. b) by assuming a lesser amount of debt on the purchase of the replacement property than the amount of the debts encumbering the property sold without executing a carryback note as an offset. c) both a and b. d) neither a nor b. 26. On the sale of a homeowner's residence, up to $250,000 in profit per owner-occupant qualifies to be excluded from income and is not taxed. a) True b) False 27. The sole basis for allowing the personal interest deduction for a mortgage on a first and second residence is the federal policy of encouraging homeownership. a) True b) False 28. An owner who incurs income from discharge-of-indebtedness on recourse financing does not need to report the discharge as income when: a) the discharge occurs in Chapter 11 bankruptcy. b) the discharge occurs when the owner is insolvent. c) the loan discharged is qualified farm indebtedness. d) all of the above Short payoffs on recourse and nonrecourse loans | first tuesday ... May 5, 2003 ... Thus, the lender avoids the need to foreclose and acquire the ... the short sale requires the owner to report the discounted and discharged ... the owner also incurs discharge-of-indebtedness income of $40000. ... net proceeds do not themselves finance the purchase or improvement of the residence. ... firsttuesdayjournal.com/short-payoffs-on-recourse-and-nonrecourse-loans/ - Cached

29. The sale of every parcel of real estate produces a profit for a seller if the price exceeds the seller's cost basis in the property. a) True b) False 30. The alternative minimum tax (AMT) rates on ordinary AMT income are: a) 26% on amounts up to $175,000 and 28% on amounts over $175,000. b) 28% on amounts up to $175,000 and 26% on amounts over $175,000. c) 16% on amounts up to $175,000 and 18% on amounts over $175,000. d) 18% on amounts up to $175,000 and 18% on amounts over $175,000.

Alternative Minimum Tax ( AMT ) | Ameriprise Financial If you're confused by the alternative minimum tax (AMT), you're not alone. ... The AMT tax rates are 26% on the first $175000 of AMT taxable income (over the ... If you're at risk for the AMT, however, you may want more ordinary income ... budgeting-investing.ameriprise.com/tax.../tax...tax-strategies/reducing-alternative-minimum-tax.asp - Cached

31. To be passive category income, rentals need only be occupied by tenants for an average of less than 30 days. a) True b) False 32. Interest earned on the net proceeds from the sale of a §1031 property is included as funds held by the §1031 trustee. a) True b) False

The purchase and control of the § 1031 replacement property | first ... Apr 4, 2004 ... The funds will be placed in an interest-bearing trust account to fund the ... receive all the interest earned on the net sales proceeds held by the buyer's ... Once the net sales proceeds are deposited to the investor's account ... which has accrued on the sales proceeds held by the §1031 trustee is ... firsttuesdayjournal.com/the-purchase-and-control-of-the-§1031-replacement-property/ - Cached

33. To qualify for the deduction of home office expenses, the licensee must perform the most important activities in the course of his business while working in the home office. a) True b) False 34. Section 1031 property is property held either for investment or productive use in business. a) True b) False 35. Parents cannot combine their separate $1,000,000 assessment exclusions to jointly convey property for a combined exclusion of $2,000,000. a) True b) False

The broker representing an EP investor must, when negotiating an EP transaction, deliver to the seller-in-foreclosure a written EP disclosure statement that the buyer’s agent representing the EP investor is: a ••licensed real estate broker; and bonded•• by a surety insurer for twice the property’s fair market value.[CC §1695.17(a)] 29. The broker representing an equity purchase (EP) investor must, when negotiating an EP transaction, deliver to the seller-in-foreclosure a written EP disclosure statement that the buyer’s agent representing the EP investor is: a) a licensed real estate broker. b) a licensed mortgage loan originator (MLO). c) bonded by a surety insurer for at least four times the property’s fair market value. d) bonded by a surety insurer for half of the property’s fair market value.

Triggering the right

The seller need not enter into an actual purchase agreement to trigger the tenant’s right of first refusal. Any indication that the seller has decided to sell the property is sufficient to activate the right to buy.

The seller may indicate his decision to sell by: offering the property to the buyer; •• offering the property to another buyer or accepting an offer from or making a counteroffer to an••other buyer; listing the property for sale; or •• granting a purchase option on the property to a third party. •• For example, a buyer with knowledge of an outstanding right of first

27. Any indication of the owner’s decision to sell the property is sufficient to trigger the tenant’s right to buy, except: a) the owner’s conveyance of the property to his heirs. b) offering the property to a buyer. c) granting a purchase option to another person. d) listing or advertising the property for sale.

The right of first refusal is not triggered by the conveyance of the property to the seller’s heirs on the seller’s death. The heirs simply take title subject to the first refusal right.

Benefits for opposing positions

An option agreement provides benefits for both buyer and seller.

A buyer should consider acquiring an option when: he does not yet want to commit himself to buy; •• he is speculating in a depressed market that values will soon rise; •• he needs time to investigate and determine whether the property will operate profitably;•• he needs time to do promotional work such as syndicating, subdividing, rezoning, obtaining per••mits or loan commitments, or to complete a §1031 reinvestment; or he is a tenant and may want to own the leased premises some day. •• A seller should consider granting an option when: he wants to retain ownership rights to the property for a fixed period into the future (for tax pur••poses); he wants to sell at a price based on higher future market values; •• he needs to provide an incentive to induce a prospective tenant to lease the property; or •• he wants to give a promoter incentive to work up a marketing or use plan and buy the property. 23. An option agreement provides benefits for: a) the buyer only. b) both the buyer and the seller. c) the seller only. d) the lender.

22. When a syndicator exercises an option to buy, a ______is automatically formed. a) bilateral sales contract b) unilateral sales contract c) land sales contract. d) None of the above.

Here, a counteroffer form will not be used to respond to the syndicator’s offer.A counteroffer would incorporate the terms of the syndicator’s purchase offer, subject to any modifications stated in the counteroffer. In this situation, the seller simply prepares and hands the syndicator an offer to grant an option, which is attached to the seller’s offer.Thus, the seller rejects the syndicator’s offer in its entirety.[See first tuesday Form 160]

20. For the buyer or seller to place the other in default, all the following transactional facts must exist, except: a) a date crucial to the continuation of the transaction must have passed. b) the person canceling must have failed to fulfill both the conditions precedent and conditions concurrent. c) the condition called for in the purchase agreement did not occur by the scheduled date. d) the person canceling must have fulfilled both the conditions precedent and conditions concurrent. For the buyer or seller to place the other in default, three transactional facts must exist: a 1. date crucial to the continuation of the transaction must have passed; the condition called for in the purchase agreement 2. did not occur by the scheduled date; and the person canceling must have 3. fully performed all activities required of him in order for the other person to perform by the scheduled date, called conditions precedent, and have performed or be ready, willing and able to perform, at the time of cancellation, all activities he was obligated to perform in order to close escrow, called conditions concurrent.

19. The ______clause in a purchase agreement places a risk of cancellation on the transaction. a) time essence b) arbitration c) assignation d) lock-in

Exculpatory clause

An exculpatory clause in a note converts a lender’s recourse paper into nonrecourse paper.Conversely, recourse paper is created when the note carried back by a seller is either separately or additionally secured by property other than the property sold.[See Figure 9] When an exculpatory clause is included in a cross-collateralized note (two or more properties are described as the security), the private lender and the carryback seller cannot obtain a money judgment for any deficiency on a judicial foreclosure of the secured property. Thus, the note has agreed-to anti-deficiency protection.

However, when asked by the prospective buyer or a buyer’s agent about any aspect, feature or condition which relates to the property or the transaction in some way, the listing agent is duty-bound to respond fully and fairly to the inquiry.The response must include material facts known to the listing agent about the subject matter of the inquiry and be free of half-truths and misleading statements. P35 The dumb agent rule 9. When asked by a prospective buyer about any condition which relates to the property in some way, a listing agent is duty-bound to respond ______and ______to the inquiry. a) quickly ; accurately b) actively ; confidently c) at least partially ; somewhat fairly d) fully ; fairly

Also, if a nonresidential landlord deducts amounts from a security deposit to cover the costs of cleaning or making repairs to the premises, any remaining portion must be refunded no more than 30 days from the date the landlord receives possession.[CC §1950.7(c)]

However, if unpaid rent is deducted from a security deposit after a nonresidential tenant vacates, the landlord is required to refund the security deposit within two weeks from the date he takes possession of the property.

Should the buyer discover an error in the HIR regarding the existence or nonexistence of a defect affecting the value or desirability of the property, the buyer has no more than four years after the date of the inspection to file a legal action to recover any money losses. [Bus & P C §7199]

1. A licensee cannot act as an agent for: a) a client. b) another person. c) himself. d) All of the above.

Two issues arise.First, did the owner, selling property he held for his own account, at any time act as an agent for anyone in the transaction?

No, the owner never undertook an agency relationship with anyone in the transaction.A licensee acts as an agent when he represents another person.A licensee cannot act as an agent for himself; it is a legal impossibility.[Calif.Civil Code §2295]

If a licensee represents both himself and the other party in a sales or a loan transaction, he is acting as both: a principal for his own account; and •• an agent for the ••other principal in the transaction.

2. A seller’s listing agent who names himself as the buyer is required to disclose: a) title information. b) the dollar amount of all earnings from the transaction. c) he is a flipper. d) All of the above.

Licensee is still the seller

When a licensee sells property he owns, holding himself out only as the seller, the licensee is required to make only the disclosures required by any seller of real estate.For instance, if the property is a one-to-four unit residence, the seller must complete and hand the buyer a Condition of Property Statement as well as a hazard disclosure.[CC §1102.3] The seller also is required to disclose all material facts he knows or should have known as the seller of the property, even though he is not acting as a licensee on behalf of the buyer while negotiating the transaction.[Easton v.Strassburger (1984) 152 CA3d 90]

3. A(n) ______fact is any information known to a seller which might adversely affect the buyer’s decision. a) immaterial b) material c) unknown d) None of the above. 4. A newly licensed agent hired by a broker who trains under the supervision of the broker is known as a: a) expert. b) greenhorn. c) ringer. d) runner.

A step in the right direction would be two years of on-the-job training for a new agent as an assistant, sometimes called a runner, to his broker or an experienced agent in the office. The agent then learns the ropes under a high-volume agent in the office, or with the office’s transaction coordinator.

5. Agents are employees according to: a) California real estate law. b) the California real estate trade union. c) all real estate brokers. d) All of the above.

6. Should a buyer discover an error in a home inspection report (HIR) regarding the existence of a defect affecting the value of the property, the buyer has no more than ______after the date of the inspection to recover any money losses. a) three years b) two years c) four years d) nine months

Should the buyer discover an error in the HIR regarding the existence or nonexistence of a defect affecting the value or desirability of the property, the buyer has no more than four years after the date of the inspection to file a legal action to recover any money losses. [Bus & P C §7199]

7. A home inspector who prepares a home inspection report (HIR), the company employing the home inspector and any affiliated company may not: a) pay referral fees to brokers for any home inspection business. b) offer to perform any repairs on a property which was the subject of an HIR prepared by them within the past 12 months. c) inspect any property if they have a financial interest in its sale. d) All of the above. 8. A listing agent owes a prospective buyer as well as the buyer’s agent ______to voluntarily provide information on a listed property. a) a fiduciary duty b) a limited, nonclient general duty c) a client agency duty d) no duty 9. When asked by a prospective buyer about any condition which relates to the property in some way, a listing agent is duty-bound to respond ______and ______to the inquiry. a) quickly ; accurately b) actively ; confidently c) at least partially ; somewhat fairly d) fully ; fairly 10. A listing agent owes no duty to a ______to address the existence of an easement located on the listed property. a) seller b) broker c) prospective buyer d) All of the above. 11. When using information obtained from a seller concerning the size of a property in an advertisement offering property for sale, a listing agent: a) is not required to confirm the consistency of the information. b) must confirm the consistency of the information by measuring the property. c) must confirm the consistency of the information with observations made by the listing agent while conducting his visual inspection of the property. d) must confirm the consistency of the information by checking public records. 12. It is not the duty of a listing agent to: a) advise a prospective buyer to investigate the consequences of the facts disclosed before deciding to buy. b) conduct a reasonably diligent visual inspection of a property for defects which adversely affect its value. c) note on the seller’s Condition of Property (TDS) disclosure any defects observable or known to the agent. d) All of the above. 13. The conditions of a purchase agreement address the: a) price of the property. b) performance of closing activities by the buyer and seller. c) terms for payment. d) All of the above. 14. To avoid a breach or be excused from closing escrow, an exit strategy must be agreed to in the: a) purchase agreement. b) listing agreement. c) good faith estimate. d) None of the above. 15. In the event a listing agent discloses a material fact that adversely affects the buyer’s decision after an offer is accepted, the buyer: a) may change his offer. b) may request concessions. c) must perform. d) may cancel. 16. The rights of a seller in the buyer’s contingency provision include: a) an assurance the buyer will act reasonably to satisfy the contingency. b) a guarantee the buyer will perform on the contract. c) the ability to cancel the purchase agreement at any time. d) None of the above. 17. A defect in an arbitrator’s award is neither reviewable nor correctable, unless: a) the arbitrator incorrectly interpreted the law. b) the arbitrator is not a retired judge. c) the disputants find the award excessive. d) the arbitrator acted fraudulently. 18. The preferred alternative to arbitration in real estate transaction dispute resolution is: a) housing counseling. b) mediation. c) litigation. d) public debate. 19. The ______clause in a purchase agreement places a risk of cancellation on the transaction. a) time essence b) arbitration c) assignation d) lock-in 20. For the buyer or seller to place the other in default, all the following transactional facts must exist, except: a) a date crucial to the continuation of the transaction must have passed. b) the person canceling must have failed to fulfill both the conditions precedent and conditions concurrent. c) the condition called for in the purchase agreement did not occur by the scheduled date. d) the person canceling must have fulfilled both the conditions precedent and conditions concurrent. 21. A syndicator may submit an offer which calls for the occurrence of several events before he becomes committed to the purchase of the property. These items are known as: a) investment memorandum. b) grant options. c) options to buy. d) contingency provisions. (To acquire the right to buy the property without unconditionally committing himself to purchase the property, the syndicator submits an offer which calls for the occurrence of several events before he becomes committed to the purchase of the property in provisions called contingency provisions.)

22. When a syndicator exercises an option to buy, a ______is automatically formed. a) bilateral sales contract b) unilateral sales contract c) land sales contract. d) None of the above. 23. An option agreement provides benefits for: a) the buyer only. b) both the buyer and the seller. ( An option agreement provides benefits for both buyer and seller.) c) the seller only. d) the lender. 24. The terms in a purchase agreement address: a) the performance of acts by the buyer and seller. b) events which are to occur in the process of closing escrow on the transaction. c) the price and payment of the price. d) All of the above. 25. A right of first refusal is also called a(n) ______to purchase. a) discretionary right b) option c) preemptive right d) None of the above. 26. To create an enforceable option to buy, a(n) ______must exist. a) limited liability company b) contingency c) due-on clause d) mutuality of obligation

27. Any indication of the owner’s decision to sell the property is sufficient to trigger the tenant’s right to buy, except: a) the owner’s conveyance of the property to his heirs. b) offering the property to a buyer. c) granting a purchase option to another person. d) listing or advertising the property for sale.

Triggering the right

The seller need not enter into an actual purchase agreement to trigger the tenant’s right of first refusal. Any indication that the seller has decided to sell the property is sufficient to activate the right to buy.

The seller may indicate his decision to sell by: offering the property to the buyer; •• offering the property to another buyer or accepting an offer from or making a counteroffer to an••other buyer; listing the property for sale; or •• granting a purchase option on the property to a third party. •• For example, a buyer with knowledge of an outstanding right of first refusal tries to avoid the first refusal right by negotiating an option to buy the property which is exercisable only after the right of first refusal expires.

The seller grants the option to purchase the property to the buyer.The granting of the option now binds the seller unconditionally to sell the property, should the option be exercised.

The seller’s willingness to enter into the option agreement is a clear indication of a decision to sell.Thus, the right of first refusal is triggered. [Rollins v.Stokes (1981) 123 CA3d 701] The right of first refusal is not triggered by the conveyance of the property to the seller’s heirs on the seller’s death. The heirs simply take title subject to the first refusal right.

28. Prior to closing a sale, a seller-in-foreclosure has a statutory ______right to cancel the equity purchase (EP) agreement he has entered into with an EP investor. a) two-day b) five-day c) 90-day d) four-day 29. The broker representing an equity purchase (EP) investor must, when negotiating an EP transaction, deliver to the seller-in-foreclosure a written EP disclosure statement that the buyer’s agent representing the EP investor is: a) a licensed real estate broker. b) a licensed mortgage loan originator (MLO). c) bonded by a surety insurer for at least four times the property’s fair market value. d) bonded by a surety insurer for half of the property’s fair market value. 30. An unconscionable method of payment could include an exchange of: a) property titles. b) worthless land. (An unconscionable method of payment could include: carryback paper with an unreasonably low interest rate, long amortization or a due date on the note ••that bears no relationship to current market rates and payment schedules; or an exchange of worthless land, stock, gems or zero coupon bonds at face value with a 20-year ••maturity date. A form of payment which is uncollectible, unredeemable and with no present value would be unconscionable.) c) cash. d) All of the above. 31. Joint tenancies can be created between: a) business partners. b) real estate brokers. c) husband and wife. d) All of the above. 32. A co-owner ______severing the right of survivorship in his interest does not need consent from the other co-owner(s). a) unilaterally b) irresponsibly c) bilaterally d) None of the above. 33. When the ownership in property is vested as a joint tenancy, the death of a joint tenant ______the deceased joint tenant’s interest in the real estate. a) fails to extinguish b) automatically extinguishes c) automatically extinguishes and clears d) clears 34. All of the following are examples of activities that include a securities risk for investors in syndicated real estate transactions, except: a) subdividing the real estate. b) reselling the real estate. c) investing in trust deed notes. d) managing the rental of the real estate. 35. The California risk capital test requires investors’ capital to be placed at risk in a ______activity. a) profit driven b) protected (The California test, on the other hand, only requires that the investors’ capital be placed at risk in an activity controlled by the securities laws, whether or not a profit is expected or intended. Thus, the California securities laws are further- reaching and covers more investment conduct than federal securities laws.) c) value-adding d) All of the above. 36. Encroachments always qualify as a: a) trespass. b) nuisance. c) theft. d) All of the above. 37. ______prevents an intentional exploitation of the balancing hardships rule. a) The good faith requirement (The good faith requirement prevents an intentional exploitation of the balancing hardships rule.) b) A risk management program c) A due diligence amendment d) A limited liability company (LLC) 38. The statute of limitations period begins upon ______of the encroachment: a) discovery b) removal c) creation d) negotiation

Also, for the owner to recover money damages for the encroachment, he has to act within the three-year period of the statute of limitations.If the owner delays too long in making his claim, the encroaching neighbor would earn the right to maintain the encroachment without paying any damages at all.

Even if a new owner of a property burdened by an encroachment seeks an injunction or money damages from the neighbor immediately after acquiring the property, his action can be barred by the statute of limitations.The limitations period does not run from the discovery of the encroachment or the acquisition of the property, but from the creation date of the encroachment. Of course, the buyer could recover losses from the seller caused by the seller’s failure to disclose the existence of a known encroachment.The loss would be based on the diminished value of the property and the excess purchase price paid.

39. A tenant who fails to pay rent or otherwise materially breaches a lease may be served with a ______which includes a demand for late charges and any other amounts past due. a) seven-day notice b) two-day notice c) 60-day notice d) three-day notice 40. An unlawful detainer action may not be pursued by a landlord for the collection of: a) unpaid rent. b) unpaid late charges. c) Both a. and b. d) Neither a. nor b. 41. Within ______after vacating residential property, a residential tenant is entitled to an accounting statement itemizing a prior deduction from his security deposit for unpaid late charges, as well as any other deductible expenses incurred by the landlord. a) three weeks b) three days c) two weeks d) 60 days Editor’s note — Within three weeks after vacating residential property, a residential tenant is entitled to an accounting statement itemizing the prior deduction from the security deposit for the unpaid late charges, as well as any other deductible expenses incurred by the landlord.[CC §1950.5(f)]

42. A residential landlord may deduct amounts from the security deposit for all of the following reasons, except: a) to repair normal wear and tear. b) to repair damages to the premises caused by the tenant. c) to clean the premises. d) to dispose of abandoned personal property. 43. After a residential tenant vacates, the residential landlord must: a) refund the security deposit in full. b) replace the carpeting in the unit. c) list the vacant unit for rent. d) provide the tenant with an itemized statement for any deductions to the security deposit.

44. If a residential landlord accepts a partial payment of rent after filing an unlawful detainer (UD) action, the UD action cannot move forward to eviction since: a) the tenant made a good faith effort to pay rent. b) UD actions are unlawful in California. c) the amount of rent due stated in the UD action must be the same as the rent currently due. d) partial rent payments nullify UD actions.

45. A partial payment agreement entered into by a residential landlord and tenant on acceptance of a portion of the rent due is evidence of all of the following, except: a) the landlord’s receipt of partial rent. b) the tenant’s promise to pay the remainder of the rent by the rescheduled due date. c) notification of the landlord’s right to serve a three-day notice on failure to pay the remaining balance. d) the filing of an unlawful detainer (UD) action against the tenant. √ Residential partial payment agreement

The partial payment agreement entered into by a residential landlord and tenant on acceptance of a portion of the rent due is evidence of: the landlord’s receipt of partial rent; •• the tenant’s promise to pay the remainder of the rent by the rescheduled due date; and •• notification of the landlord’s right to serve a 3-day notice on failure to pay the remaining balance. ••[See Form 559] A partial payment agreement is not a notice to the tenant to pay the deferred portion

Brokers limited to listing property

Equity purchase (EP) legislation regulates brokers when they act as a buyer’s agent for EP investors who attempt to buy an owner-occupant’s home that is in foreclosure.

The broker representing an EP investor must, when negotiating an EP transaction, deliver to the seller-in-foreclosure a written EP disclosure statement that the buyer’s agent representing the EP investor is: a ••licensed real estate broker; and bonded•• by a surety insurer for twice the property’s fair market value.[CC §1695.17(a)]

29. The broker representing an equity purchase (EP) investor must, when negotiating an EP transaction, deliver to the seller-in-foreclosure a written EP disclosure statement that the buyer’s agent representing the EP investor is:

a) a licensed real estate broker. b) a licensed mortgage loan originator (MLO). c) bonded by a surety insurer for at least four times the property’s fair market value. d) bonded by a surety insurer for half of the property’s fair market value.

You answered 35 out of 45 questions correctly. You have passed the course for with a score of 77%. You can exit this window and return to the Student Homepage.

Section 2 on 05/12/2011

1. An option to purchase as part of a month-to-month tenancy is subject to change on the landlord’s ______written notice. a) three days’ b) 60 days’ c) 90 days’ d) 30 days’ 2. Landlords of newly constructed residential units, may establish their own reasonable rental rates, if they are subject to rent control ordinances established prior to: a) 1978. b) 1995. Landlords of newly constructed units or individual units (single family residences/condos) may establish their own rental rates, within limitations, if they are subject to rent control ordinances established prior to 1995. c) 2005. d) 1986 3. A landlord is obligated to prevent ______to all persons who may be on the leased premises. a) foreseeable injuryA landlord, by his exercise of reasonable care in the management of his property, must prevent foreseeable injury to all others who may, for whatever reason, be on the leased premises. [Rowland v.Christian (1968) 69 C2d 108; Calif. Civil Code §1714] b) any threat of injury c) inconvenience d) None of the above. 4. A landlord must inspect ______in order to prevent harm to others on the leased property. a) wherever entry is available to the landlord b) only the main entrance to the premises c) every aspect of the leased property d) all outdoor areas on the property 5. When inspecting a property’s safety, a landlord is not required to a) inspect the premises when he enters for any single purpose. b) address dangerous conditions in public areas on his property. c) expend extraordinary amounts of time and money conducting extensive searches. d) test the smoke alarms. 6. When making private money real estate loans, the discount rate is used by lenders: a) who arrange their loans through real estate brokers. b) who are not licensed real estate brokers and who do not arrange their loans through real estate brokers. c) who are licensed real estate brokers. d) None of the above. 7. The maximum annual discount rate on non-exempt loans secured by real estate is the greater of ______or ______. a) 7% per year ; the discount rate plus 10% b) 12% per year ; the discount rate plus 5% c) 5.5% per year ; the discount rate plus 2.5% d) 10% per year ; the discount rate plus 5% 8. The price of ______is determined by using the prime rate as a base rate. a) one-year T-bills b) fixed rate mortgages c) adjustable rate mortgages d) short-term business loans 9. The only legally justified guarantee a borrower may rely on from a lender is a(n): a) oral commitment b) pre-approval letter c) unconditional written loan commitment d) verbal assurance 10. A lender may easily escape liability under a(n): a) unconditional written loan commitment. b) conditional written loan commitment. c) Both a. and b. d) Neither a. nor b. 11. The addition of special provisions to a note: a) protects the noteholder. b) invalidates the note. c) places the noteholder at risk. d) None of the above. 12. A default interest rate used as a special provision for a promissory note is: a) an unenforceable penalty.

a late charge provision in a note specifying an increased interest rate on the entire remaining principal on default of any monthly installment, called a default interest rate, is unenforceable since it is a penalty provision in disguise. A penalty provision is void if it fails to reasonably estimate compensation for the lender’s losses caused by the default. The rate of interest on a default can only be applied to the delinquent principal and interest payment since only an installment is delinquent, not the entire principal balance of the note. [Walker v. Countrywide Home Loans, Inc. (2002) 98 CA4th 1158] b) not considered a penalty. c) standard practice. d) None of the above.

13. A balloon payment is a lump sum payment of: a) remaining unpaid interest. b) remaining unpaid principal. A balloon payment is a final lump sum payment of remaining unpaid principal, which is due on an earlier date than had the periodic payment schedule continued until the principal was fully amortized. c) the fully amortized principal. d) All of the above 14. A private lender or carryback seller is not protected from loss due to a default on his trust deed note by: a) a co-signer’s signature on the note only. b) a co-owner’s signature on the note and trust deed. c) a government guarantee of the note by the Federal Reserve Bank. d) a personal guarantee of the note by one other than the buyer. 15. ______is the occurrence of an event which triggers due-on enforcement of a loan and allows the lender to demand the full amount remaining due to be paid immediately. a) Pre-emption ?? b) Early payoff c) Prepayment d) Acceleration

16. A lease for any term coupled with an option to purchase or a lease with a term over ______triggers a due-on clause. a) one year b) two years c) three years Due-on-lease

The due-on clause is also triggered by: • a lease with a term over three years; or d) six months 17. If an owner of a one-to-four unit property transfers ownership to a spouse or child, the lender’s due-on clause is: a) triggered. b) avoided. c) deferred for 3 years. d) None of the above. 18. Anti-deficiency rules do not apply to a ______when the debt becomes secured by real estate other than the real estate sold. a) carryback debt

Can the seller enforce collection of a carryback debt which became secured, separately or collaterally, by property other than the property sold? Yes! The seller can obtain a money judgment to enforce collection on the note even though it evidences a carryback debt.Anti-deficiency non-recourse rules no longer apply to a carryback debt when the debt becomes secured by real estate other than the real estate sold, called a substitution of security. The carryback seller was able to sue directly on the note without first foreclosing since his security interest in property other than the property sold was wiped out by the senior trust deed foreclosure. [Goodyear v. Mack (1984) 159 CA3d 654] b) short sale c) release of security d) None of the above.

19. A lender or carryback seller can draw on a letter of credit before or after a trustee’s sale without violating the security first rule or: a) anti-deficiency statutes. The lender or carryback seller can draw on a letter of credit before or after a trustee’s sale without violating anti-deficiency statutes or the security first rule. [CCP §580.5(b)] b) pro-deficiency statutes. c) the security second rule. d) All of the above.

20. When a note is additionally secured by other property, anti-deficiency rules do not bar the lender from collecting a money judgment since the note is: a) no longer recourse paper. b) no longer non-recourse paper. Yes! Anti-deficiency rules do not bar the lender from a money judgment when a purchasemoney note becomes additionally secured by other property. The note no longer is nonrecourse, purchase-money paper. [CCP §580b] c) unsecured. d) None of the above. 21. A deficiency judgment is based on the ______of the property, which is the cash value of the secured real estate that is consistent with market conditions at the time of the foreclosure sale. a) asset price deflation b) original price c) fair market value d) current resale value

22. The risks and benefits accompanying the use of an unescrowed, unrecorded and uninsured land sales contract should be determined and analyzed by the buyer and seller before they: a) abandon the contract. b) enter conveyance escrow. c) contract with a sales agent. d) sign and deliver an offer to purchase.\ The contentious contract The buyer and seller should determine and analyze the risks and benefits accompanying their use of an unescrowed, unrecorded and uninsured land sales contract before they either: • sign and deliver an offer to purchase on a land sales contract [See Figure 2]; or • sign and deliver the land sales contract and transfer downpayment funds and possession. [See Figure 3]

23. The Internal Revenue Service, the state Franchise Tax Board and the county assessor recharacterize ______as carryback financing or land sales contracts for tax purposes. a) land sales contracts b) reverse mortgages c) lease-option sales d) All of the above. 24. Usury laws prevent private lenders from: a) loan sharking. b) charging over 8% interest. c) forfeiting interest earnings. d) None of the above. 25. Lenders who violate usury laws are commonly penalized with: a) the nullifying of all principal for the loan. b) the forfeiture of all interest in the loan. c) jail time. d) None of the above.

26. An all-inclusive note is also called a ______or overriding note. a) land sales contract b) lease-option sale c) compound payment d) wraparound note

27. The two variations of the all-inclusive trust deed (AITD) are the ______and the ______. a) full payoff; short payoff b) short payoff; equity payoff c) full payoff; equity payoff d) partial payoff; equity payoff

28. A transaction in which the lender accepts the seller’s net proceeds from a sale in full satisfaction of a loan is known as a: a) trustee’s sale. b) judicial foreclosure. c) short sale. d) None of the above.

29. To force a lender to foreclose, a homeowner must: a) attempt a short sale. b) default on his payments. c) A homeowner cannot force a lender to foreclose. d) All of the above. 30. A homeowner must be in default for at least three months in order to qualify for: a) FHA pre-foreclosure treatment. b) any lender foreclosure. c) a principal reduction. d) None of the above.

31. For a landlord to qualify as an owner-operator, he must: a) develop a corporation. b) enter into a partnership. c) invest a minimum dollar amount in the business. d) spend a minimum amount of time participating in the business.

32. A landlord who spends ______hours annually handling their rental property will qualify as a material participant for tax purposes. a) more than 500 Time spent handling the rentals exceeds 500 hours annually (about 10 hours weekly); b) more than 1200 c) at least 100 d) 72

33. Rent does not qualify as passive income for an income property owner, if the rental is occupied by tenants for: a) less than one year. b) more than 30 days. c) less than 30 days. d) more than 60 days.+

The mutually exclusive $25,000 deduction To be classified as passive income category property, rentals only need to be occupied by tenants for an average of more than 30 days. The over 30 days’ occupancy rule, together with the owner’s active participation in its operations, locks reporting of a property’s income, expenses, interest and depreciation in the passive income category as rental income. [See IRS Form 1040, Schedule E]

34. A landlord can deduct up to ______from his adjusted gross income (AGI) for rental operating losses remaining after offsetting other passive income. a) $150,000. b) half the landlord’s AGI. c) $25,000. d) $75,000. 35. To qualify for the deduction of home office expenses, the licensee must: a) be a real estate broker. b) use the home office as the principal place of business. c) use his entire residence as a place of business. d) apply for a home office exemption with the Department of Real Estate (DRE).

36. A licensee may deduct ______as direct business expenses. a) rent paid as a tenant. b) utilities. c) mortgage interest. d) repairs made in the area of the residence used exclusively as the home office.

37. A licensee may still qualify for a home office deduction even though: a) his use of the home does not meet business activity standards. b) he does not use his home office as his principal place of business. c) he has both a home office and a non-residential office. d) All of the above.

38. Co-owners who jointly operate a shared property and are vested as tenants in common (TIC) are considered to be: a) property managers. b) agents of one another. c) Both a. and b. d) Neither a. nor b.

39. The ______and coordinated conduct of co-owners determines whether a state law partnership exists. a) effort b) interaction c) contract d) material participation 40. A co-owner’s right in a tenants in common (TIC) vesting to force the sale of the property is known as a: a) partition action. b) trustee’s sales. c) judicial foreclosure. d) split-profit sale.

41. For a tenants in common (TIC) ownership to rise to tax partner status, the co-owners must operate as: a) a limited liability company. b) tenants in common. c) a corporation. d) a declared partnership.

Conversely, federal tax law places emphasis on common law TIC rules to establish co-owner rights, but solely for the purposes of tax reporting. TIC ownership does not rise to tax partner status unless the co-owners are operating as: • a declared partnership, general or limited; • an LLC which has not elected to report as a corporation; or • a cooperating TIC.

42. A property tax is determined by a property’s: a) assessed value minus inflation. b) fair market value minus inflation. c) fair market value. d) assessed value. 43. When an ownership interest in property is acquired, each person must file a change of ownership with the: a) sheriff’s office. b) chamber of commerce. c) county assessor. Every person acquiring an ownership interest in real estate must file a change of ownership report with the county assessor. d) Department of Real Estate.

44. Taxwise, children adopted after 18 years of age do not qualify for the: a) renter’s credit. b) first time homebuyer’s credit. c) mortgage interest tax deduction. d) parent-child exclusion.

45. To qualify for the principal residence exclusion, the claim should be filed with county assessor when: a) the property is reassessed. b) the deed is recorded. c) the preceding tax year is over. d) All of the above.

122681 104SEC24b You answered 41 out of 45 questions correctly.

You have passed the course for with a score of 91%. You can exit this window and return to the Student Homepage.

1. In real estate related transactions, brokers hold an agency duty to: a) their clients. b) the Department of Real Estate (DRE). c) appraisers. d) All of the above.

2. When a client employs and authorizes a broker to act on his behalf in a real estate transaction, this creates a(n) ______relationship.

a) agency b) independent contractor c) specific transaction d) real estate sales

3. An agency relationship can be created by:

a) an oral agreement. b) a written agreement. c) conduct of the client with the broker. d) All of the above.

4. The Agency Law Disclosure is mandated to be presented to all parties when listing a property containing:

a) one-to-four residential unit. b) mobilehomes. c) Both a. and b. d) Neither a. nor b.

The Agency Law Disclosure form is mandated to be presented to all parties, by brokers or their agents, when listing, selling, buying or leasing (for over one year) property containing: •• one-to-four residential units; or •• mobilehomes. [CC §§2079.13(j), 2079.14]

5. The Agency Law Disclosure must be provided to a seller prior to entering into the listing agreement, otherwise a broker could face:

a) a fine of up to $1,500. b) revocation of his license. c) the loss of his fee. d) All of the above.

6. A sales agent is considered the agent of:

a) the Department of Real Estate (DRE). b) the client. c) his broker. d) All of the above.

7. A purchase agreement on an offer to buy a one-to-four unit residential property must contain a(n):

a) counteroffer. b) agency confirmation provision. c) subagency provision. d) None of the above. 8. Should the wording of the seller’s acceptance provision in a purchase agreement state the seller employs the buyer’s broker as part of the seller’s provisions for payment of fees, the buyer’s broker becomes a:

a) non-agent. b) dual agent. c) triple agent. d) subagent.

9. A broker’s membership in a ______creates neither a dual agency nor a subagency relationship with the principals of other broker-members.

a) redlining agreement b) conflict of interest situation c) fee splitting agreement d) Multiple Listing Service (MLS)

10. A broker of any type of real estate transaction who fails to promptly disclose his dual agency is subject to the loss of his brokerage fee and:

a) liability for his client’s money losses. b) disciplinary action by the Department of Real Estate (DRE). c) Both a. and b. d) Neither a. nor b.

11. When a(n)______has been established, the broker and agents representing the parties may not pass on any information relating to the confidential price or terms of payment from one party to another.

a) single agency situation b) typical transaction c) dual agency d) subagency

12. The dual agency conflict typically arises when a buyer is ______and is exposed to property listed by the broker.

a) an existing client b) not an existing client c) a potential client d) All of the above.

However, when a dual agency is established in a one-to-four unit residential sales transaction, and both parties are represented by the same broker, the broker (and his agents) may not pass on confidential pricing information such as the price the buyer is willing to pay to the seller or the price the seller is willing to accept from the buyer. Confidential pricing information must remain the undisclosed knowledge of the dual agent, unless authorized to release the information in a writing signed by the principal in question. [CC §2079.21] Thus, without authorization to disclose confidential pricing information, the dual agent is now a “secret agent.” He must keep secret the minimum pricing sought by the seller and the maximum pricing obtainable from the buyer. The decision not to release pricing information must be made and maintained from the moment the dual agency arises. The dual agency conflict typically arises when the buyer is an existing client and is exposed to property listed by the broker. This conflict of dual agency always occurs before the purchase agreement is prepared and its agency confirmation provision is filled out. It is at the moment the conflict arises that it must be disclosed no later than the time the purchase agreement is prepared and submitted. 13. The actions of ______are considered the acts of the employing broker.

a) a sales agent b) both a sales agent and a broker associate c) a broker associate d) a client

14. A seller’s listing agent holds a general non-agency duty to:

a) a prospective buyer. b) the seller. c) the Department Real Estate (DRE). d) other listing brokers.

15. An agent’s opinion becomes a positive statement of truth when he:

a) holds himself out to be specially qualified in the subject matter regarding future expectations. b) expresses doubt of his qualifications in the subject matter regarding future expectations. c) discusses his opinion regarding a property with his client. d) None of the above.

16. The ______prohibits discrimination in the sale, rental and advertisement of residential units.

a) Home Mortgage Disclosure Act (HMDA) b) Equal Credit Opportunity Act (ECOA) c) Unruh Civil Rights Act d) Federal Fair Housing Act (FFHA)

Anti-discrimination legislation for residential property The Federal Fair Housing Act (FFHA) prohibits discrimination in: •• the sale, rental or advertisement of a residence; •• offering and performing broker services; •• making loans to buy, build, repair or improve a residence; •• the purchase of real estate loans; or •• appraising real estate. [42 United States Code §§3601 et seq.]

17. Steering involves:

a) coercing, intimidating, threatening or interfering with any person in the exercise or enjoyment of a residence. b) the restriction of a person seeking to buy or rent a dwelling in a community, neighborhood or development in a manner that perpetuates segregated housing patterns. c) a failure to provide financing in certain communities. d) a broker who induces an owner to sell or rent a dwelling by representing that the entry of certain classes of people into the neighborhood will have an adverse economic effect on property values.

18. Blockbusting involves:

a) a broker who induces or attempts to induce an owner to sell or rent a dwelling by representing that the entry of certain classes of people into the neighborhood will have an adverse economic effect on property values or rental rates. b) coercing, intimidating, threatening or interfering with any person in the exercise or enjoyment of a residence. c) a failure to provide financing in certain communities. d) the restriction of a person seeking to buy or rent a dwelling in a community, neighborhood or development in a manner that perpetuates segregated housing patterns.

19. All U.S. citizens have the right to ______real estate and personal property, regardless of race.

a) hold and convey b) lease c) buy and sell d) All of the above.

All citizens of the United States have the right to purchase, lease, sell, hold and convey real estate and personal property, regardless of race. [42 United States Code §1982]

20. ______is required to provide necessary aids to ensure effective communication with individuals with disabilities.

a) A personal residence b) An inn with only three rooms c) A bar d) All of the above.

A place of public accommodation is required to provide necessary aids, such as telecommunication devices (TDD), closed-caption decoders, etc., to ensure effective communication with individuals with disabilities. This rule is subject to a reasonableness standard. Thus, compliance is not required if it would place an undue burden or significant difficulty or expense on the public accommodation. [28 CFR §36.303] For example, a public accommodation is not required to use telecommunication devices for the deaf (TDDs) for receiving or making telephone calls incidental to operations. [28 CFR §36.303(d)] However, places of public accommodation providing lodging in which televisions are placed in five or more guest rooms must provide closed-caption decoders for the hearing impaired on request. [28 CFR §36.303(e)]

21. California’s______specifically prohibits discrimination by a business establishment.

a) Federal Fair Housing Act (FFHA) b) Equal Credit Opportunity Act (ECOA) c) Home Mortgage Disclosure Act (HMDA) d) Unruh Civil Rights Act

22. Senior citizen housing is housing intended for occupation solely by persons 62 years or older or:

a) intended and operated for occupancy by persons 45 years of age or older. b) intended and operated for occupancy by persons 75 years of age or older. c) intended and operated for occupancy by persons 65 years of age or older. d) intended and operated for occupancy by persons 55 years of age or older.

23. A landlord with a pet restriction policy is not required to rent an apartment to a disabled tenant with a dog if:

a) the apartment is less than 30 units. b) the dog is not specially trained to assist the tenant. c) if the apartment is more than 30 units. d) the dog is specially trained to assist the tenant.

24. A landlord may not refuse to rent to a couple based on the fact that they: a) are an unmarried couple. b) have a poor credit rating. c) refuse to pay the security deposit. d) were recently evicted.

25. A broker has a duty to advise his agents of:

a) anti-discrimination rules. b) California tax law. c) federal lending law. d) All of the above.

26. All of the following are examples of a lender’s unlawful discrimination EXCEPT:

a) placing additional burdens on minority applicants. b) requiring a spouse’s signature on a loan application when an applicant qualifies for a loan individually. c) denying a loan application based on bad credit history. d) denying a loan application based on a couple’s marital status.

27. Redlining involves:

a) a broker who induces or attempts to induce an owner to sell or rent a dwelling by representing that the entry of certain classes of people into the neighborhood will have an adverse economic effect on property values or rental rates. b) coercing, intimidating, threatening or interfering with any person in the exercise or enjoyment of a residence. c) a failure to provide financing in certain communities. d) the restriction of a person seeking to buy or rent a dwelling in a community, neighborhood or development in a manner that perpetuates segregated housing patterns.

28. The federal Home Mortgage Disclosure Act (HMDA) seeks to:

a) prevent lending discrimination. b) prevent unlawful redlining practices on residential loans. c) require lenders to disclose home loan origination information to the public. d) All of the above.

29. The discriminatory preference rule applies to all ______in the business of selling or renting dwellings.

a) brokers b) landlords c) Both a. and b. d) Neither a. nor b.

The discriminatory preference rule applies to all brokers, developers and landlords in the business of selling or renting dwellings. [42 USC §§3603, 3604] 30. On direct inquiry by the buyer or his agent, the listing agent must disclose his knowledge of:

a) any deaths on the real estate, no matter when they occurred. b) only deaths which occurred more than three years prior to the purchase offer. c) only deaths which occurred less than three years prior to the purchase offer. d) None of the above.

31. Any items of value such as ______can be considered trust funds.

a) the pink slip to a car b) coin collections c) good faith deposits d) All of the above.

32. When a broker receives trust funds, he must deposit the funds in a trust account or ______prior to the end of the third business day following the day the broker receives the trust funds.

a) in his personal account b) with the person or escrow depository entitled to the funds c) in the account of the seller d) in his business account

33. Amounts placed in a trust account may be withdrawn when expended for the benefit of the client or on the ______day after the verified accounting is mailed to the client.

a) second b) seventh c) tenth d) fifth The amounts placed in the trust account may be withdrawn when expended for the benefit of the client, or on the fifth day after the verified accounting is mailed to the client. [Calif. Business and Professions Code §10146]

34. A broker who will obtain an advance fee from a client must submit all advance fee solicitations, advertising and agreements to:

a) the Department of Corporations (DOC). b) the Department of Financial Institutions (DFI). c) the Department of Housing and Urban Development (HUD). d) the Commissioner of the Department of Real Estate (DRE).

35. When a listing terminates, the broker:

a) may use the trust funds to offset any fees the client may owe him. b) must return all remaining trust funds to the client. c) is entitled to half the funds in the trust account. d) None of the above.

36. A broker has improperly commingled funds if he deposits more than ______of his own funds in the trust account to cover bank service charges on the account.

a) $200 b) $300 c) $100 d) $50

1. The broker may maintain a deposit of up to $200 of his own funds in the trust account to cover bank service charges on the account; and 2. Fees or reimbursement for costs due the broker from trust funds may remain in the trust account for up to 25 days before disbursement to the broker. [DRE Reg. §2835] 37. Fees or reimbursement for costs due the broker from trust funds may remain in the trust account for up to ______before disbursement to the broker.

a) 15 days b) 20 days c) 25 days d) 30 days

38. The broker named as trustee on a trust fund account is responsible for funds held in the account:

a) only if he is the only one authorized to make withdrawals on the account. b) even if others sign on the account with authorization to make withdrawals from the account. c) only if he does not hire an accountant to keep track of the account’s receipts and disbursements. d) None of the above.

39. A broker must maintain a trust fund record, separate from his bank trust account, with a ledger identifying:

a) the location of trust funds received but not deposited in the trust account. b) the amount of funds expected in the fiscal year. c) entries for the overall trust fund in chronological order. d) the daily balance of the trust account.

40. A broker is required to keep records of checks made payable to others for services if the total amount of all such checks for any one transaction exceeds:

a) $1,000. b) $500. c) $100. d) $1,500.

41. Copies of all trust fund receipts must be kept for:

a) four years. b) five years. c) three years. d) six years. However, on request from the Department of Real Estate (DRE) or the maker of the check exempt from entry in the trust fund ledger, the broker must account for the receipt and distribution of the check. Copies of all receipts must be retained for three years. [DRE Reg. §2831(e)]

42. An unexplained overage must be:

a) withdrawn for the broker’s personal use. b) withdrawn for the broker’s business use. c) left in the trust account, or placed in a separate trust fund account. d) placed in the broker’s personal account.

Unexplained overage ownership Occasionally, the amount of all funds held in a trust account exceed the amount of trust funds held in all the subaccounts for individuals. The excess, however, is not the broker’s commingled funds. An overage occurs when the broker cannot determine who is the owner of the excess funds, called unexplained trust account overages. The overage generally arises due to mathematical errors in the entry of deposits or withdrawals, bank records, or failure to identify the owner of the funds when deposited or withdrawn and entered in the trust account records. Unexplained excess funds — overages — in a trust account are still trust funds, even though the ownership of the funds cannot be determined. An unexplained overage may not be withdrawn for the broker’s business or personal use, or used to offset shortages on individual subaccounts in the trust account. Excess funds are not the broker’s funds since the broker cannot demonstrate he has instructions to withdraw the excess funds. The broker does not know who owns the funds to give the instructions for withdrawal. Unexplained trust account overages must remain in the trust account, or be placed in a separate trust fund account established to hold unexplained overages. Ultimately, the excess funds escheat to the state, unless the ownership of the unexplained overage is Determined

43. Trust fund handling requirements are backed up by a variety of penalties and consequences that apply to a broker who misuses trust funds, except:

a) disciplinary action by the Department of Real Estate (DRE). b) civil liability for money wrongfully converted. c) criminal sanctions for embezzlement. d) federal criminal sanctions for fraud.

Commingling, conversion and restitution A California real estate broker who handles funds entrusted to him by others must deposit the trust funds as instructed by the owner of the funds. Above all, a broker must not convert to his personal use any funds entrusted to him. The trust fund handling requirements are backed up by a variety of penalties and consequences that apply to a broker who misuses trust funds, including: •• civil liability for money wrongfully converted; •• disciplinary action by the Department of Real Estate (DRE); •• income tax liability; and •• criminal sanctions for embezzlement.

44. A broker who misappropriates advance fees can be held liable for:

a) a money award up to three times the amount of the missing trust funds, plus interest and attorney fees. b) a money award up to a judge’s discretion. c) a money award up to three times the amount of the missing trust funds, without interest or attorney fees. d) a money award of at least four times the amount of the missing trust funds.

Also, the broker who misappropriates advance fees can be held liable for a money award up to three times the amount of the missing trust funds, plus interest and attorney fees. [Bus & P C §10146; CC §3287]

45. A broker is guilty of embezzlement when he:

a) uses funds entrusted to him for any purpose other than as authorized. b) deposits trust funds into an account he uses to receive and disburse personal or business funds. c) fails to provide financing in certain communities. d) holds himself out to be specially qualified in the subject matter regarding future expectations.

46. Fees and benefits from ______toward a broker or his agents as compensation are required to be disclosed to the client.

a) professional courtesies b) familial favors c) preferential treatment by others d) All of the above.

47. Potential overlaps of allegiance or prejudice which cause a conflict of interest for a broker or his agent include all of the following, except: a) the broker will receive a fee from his client at the close of the transaction. b) the broker or his agent holds a direct or indirect ownership interest in the real estate involved in the transaction. c) the broker’s or his agent’s concurrent representation of the opposing party. d) an unwillingness of the broker or his agent to work with the opposing party.

48. An agent who fails to make a conflict of interest disclosure and obtain consent before continuing to advise or act on behalf of the client may be subject to:

a) license revocation. b) a fine of up to $10,000. c) imprisonment. d) All of the above.

49. Brokers have an affirmative duty to make a written financial disclosure to the carryback seller about the buyer’s creditworthiness on all sales of:

a) any property. b) one-to-four unit residential property when the seller is to carry back any part of the sales price. c) all residential property when the buyer pays in cash. d) a commercial property.

50. Defacing occurs when a broker:

a) deposits personal funds in a trust fund account. b) fails to disclose a conflict of interest situation. c) coerces, intimidates, threatens or interferes with any person in the exercise or enjoyment of a residence. d) strikes out provisions by crossing them out on a purchase agreement form signed by the buyer.

51. A counteroffer:

a) is never considered to be a rejection of the initial offer. b) is not a valid practice in real estate, and should never be accepted. c) creates a new offer that good brokerage practice requires to be presented on a separate form. d) Both a. and b.

52. The “as-is” sale of a one-to-four unit residential property is:

a) only allowable when the buyer signs a waiver along with the purchase agreement. b) prohibited. c) allowable. d) no different than the sale of a one-to-four unit residential property “as-disclosed.”

53. If a broker fails to disclose his knowledge about the existence and legal consequences of a due-on-sale clause in a second trust deed taken over by an owner, the broker is:

a) liable for the full value of the foreclosed property. b) liable for any loss experienced by the lender. c) liable for the owner’s loss of equity due to a foreclosure. d) not liable, as he is not responsible for the buyer’s purchase decisions.

In another example, an owner contacts a broker to arrange an exchange of his property for other real estate he seeks to purchase. The broker locates replacement property, but does not disclose his knowledge that the second trust deed encumbering the replacement property contains a due-on-sale clause that allows the trust deed loan to be called due and payable after the closing of a sale. The owner agrees to take title to the replacement property subject to the existing second trust deed. No contingency existed to provide for the further approval of a beneficiary statement and trust deed conditions or cancellation of the agreement. After escrow closes, the second trust deed lender discovers the transfer to the owner and calls the loan under the due-on-sale clause. The owner fails to pay the loan balance that is now due on the second. Ultimately, the owner loses the property at the second trust deed lender’s foreclosure sale. Here, the broker is liable for the owner’s loss of equity due to the foreclosure. The broker failed to disclose his knowledge about the existence and legal consequences of the due-on-sale clause in the second trust deed taken over by the owner. The broker’s liability is the value of the equity lost in the replacement property as established by the price set by the broker in the exchange agreement, not the (lesser) fair market (cash) value of the property. [Pepitone v. Russo (1976) 64 CA3d 685]

54. An Annual Property Operating Data Sheet (APOD) is used by a broker to:

a) analyze the suitability of income property for a buyer. b) account for all client funds in a trust account. c) account for the rental income of a property he manages. d) None of the above.

55. A broker who makes a false claim that a lender exists to make a type of loan a borrower seeks can be fined up to ______, imprisoned for six months or both.

a) $10,000 b) $15,000 c) $20,000 d) $25,000