Auditing and Assurance Services Update February 2006

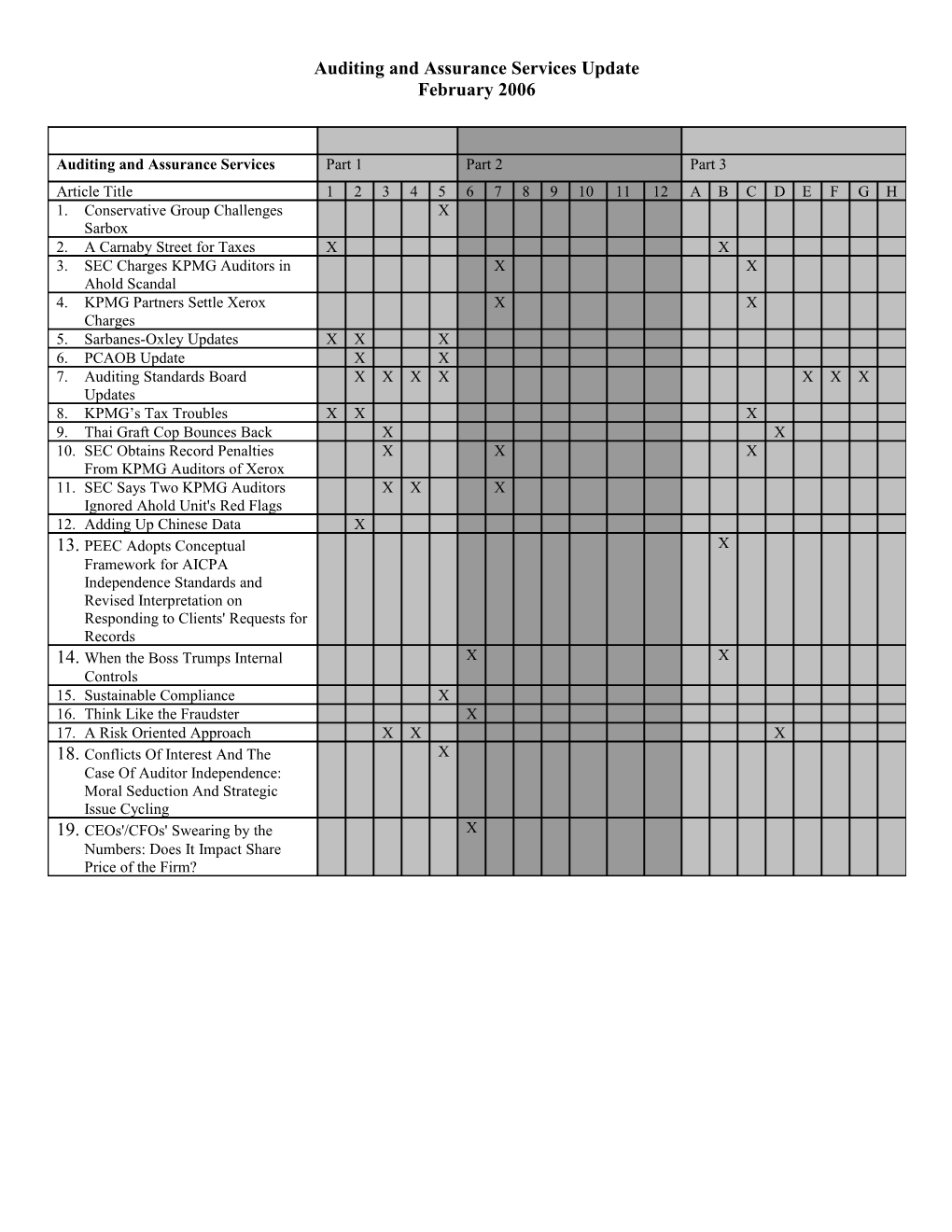

Auditing and Assurance Services Part 1 Part 2 Part 3 Article Title 1 2 3 4 5 6 7 8 9 10 11 12 A B C D E F G H 1. Conservative Group Challenges X Sarbox 2. A Carnaby Street for Taxes X X 3. SEC Charges KPMG Auditors in X X Ahold Scandal 4. KPMG Partners Settle Xerox X X Charges 5. Sarbanes-Oxley Updates X X X 6. PCAOB Update X X 7. Auditing Standards Board X X X X X X X Updates 8. KPMG’s Tax Troubles X X X 9. Thai Graft Cop Bounces Back X X 10. SEC Obtains Record Penalties X X X From KPMG Auditors of Xerox 11. SEC Says Two KPMG Auditors X X X Ignored Ahold Unit's Red Flags 12. Adding Up Chinese Data X 13. PEEC Adopts Conceptual X Framework for AICPA Independence Standards and Revised Interpretation on Responding to Clients' Requests for Records 14. When the Boss Trumps Internal X X Controls 15. Sustainable Compliance X 16. Think Like the Fraudster X 17. A Risk Oriented Approach X X X 18. Conflicts Of Interest And The X Case Of Auditor Independence: Moral Seduction And Strategic Issue Cycling 19. CEOs'/CFOs' Swearing by the X Numbers: Does It Impact Share Price of the Firm? 1. Conservative Group Challenges Sarbox CFO.com, February 8, 2006, Stephen Taub. The Free Enterprise Fund, a free-market advocacy group, has charged that Sarbanes-Oxley has produced unintended adverse consequences for publicly-traded U.S. companies, entrepreneurs, and capital markets. A recent study by the University of Rochester concluded that Sarbanes-Oxley has reduced the total stock market value of U.S. companies by $1.4 trillion. This group concluded that the goals of effective internal controls and transparent financial reporting are better achieved through free market forces than government regulation. http://www.cfo.com/printable/article.cfm/5492263?f=options

2. A Carnaby Street for Taxes CFO.com, February 16, 2006, Marie Leone. Auditor independence rules (specifically Section 103 of the Sarbanes-Oxley Act) have resulted in companies requesting certain tax-related services from CPA firms other than those performing the audit of their financial statements. Under the new rules, auditors are prohibited from providing (1) tax-planning services on a contingent fee or commission basis, (2) services related to “aggressive tax transactions”, or (3) tax services to CEOs, CFOs, and other officials that have roles in financial reporting oversight. http://www.cfo.com/printable/article.cfm/5519139?f=options

3. SEC Charges KPMG Auditors in Ahold Scandal CFO.com, February 21, 2006, Stephen Taub. The SEC has charged Kevin Hall (engagement partner) and Rosemary Meyer (senior manager) for failing to recognize and act upon suspicious evidence regarding revenue recognition practices at Ahold. In addition, the SEC alleged that KPMG’s confirmation processes for Ahold violated generally accepted auditing standards. http://www.cfo.com/article.cfm/5541161/c_5541476?f=TodayInFinance022106

4. KPMG Partners Settle Xerox Charges CFO.com, February 23, 2006, Dave Cook. Three current or former KPMG partners have settled with the SEC over revenue recognition issues encountered in past Xerox audits. The SEC charged that KPMG permitted Xerox to inflate its revenues and manipulate income recognition through reserve accounts. http://www.cfo.com/article.cfm/5545542/c_5545937?f=TodayInFinance022306

5. Sarbanes-Oxley Update Suit Seeks to Overturn Sarbanes-Oxley Law, The Wall Street Journal, February 8, 2006, p. C6. Beckstead & Watts LLP, a small accounting firm, and the Free Enterprise Fund, a lobbying group, are challenging the PCAOB’s constitutionality on the grounds that it violates the Constitution’s separation of powers principles. Their legal team includes former Clinton prosecutor Kenneth Starr. The law suit comes at a time when the PCAOB has been under pressure to relax the internal control requirements for middle and small size companies.

Financial Stars Urge Regulators To Not Dilute Sarbanes-Oxley, The Wall Street Journal, February 21, 2006, p. C3. Financial big wigs, including former SEC Chairman Arthur Levitt and former Federal Reserve Chairman Paul Volcker, have signed a letter urging current SEC chairman, Christopher Cox, and William Gradison, acting chairman of the Public Company Accounting Oversight Board not to exempt smaller public companies from the internal control requirements of Sarbanes-Oxley.

6. PCAOB Update SEC Approves PCAOB Auditing Standard No. 4 The Public Company Accounting Oversight Board announced today that the Securities and Exchange Commission has approved PCAOB Auditing Standard No. 4, which would apply when auditors report on whether a previously reported material weakness in a company’s internal control over financial reporting continues to exist as of a date specified by management. http://www.pcaobus.org/News_and_Events/index.aspx

7. Auditing Standards Board Update The Risk Assessment Suite of Auditing Standards To further enhance audit quality, the AICPA Auditing Standards Board has approved a set of eight new Statements on Auditing Standards (SASs) - collectively referred to as the Risk Assessment Standards. 8. KPMG’s Tax Troubles HVB to Cooperate In Tax Inquiry, Pay $29.6 Million, The Wall Street Journal, February 15, 2006, p. C4. German bank HVB Group agreed to a settlement with U.S. Federal prosecutors for its role in financing the the sale of KPMG’s questionable tax shelters. In exchange, the prosecutors will not seek a criminal indictment for conspiracy to defraud the IRS. In a related development, the IRS is sending letters to about 100 law firms and financial institutions who failed to admit their role in the sale of questionable tax shelters. The IRS says that it is owed billions in penalties.

KPMG Tax-Shelter Settlement May Be Revised Amid Opt-Outs, The Wall Street Journal, Februay 10, 2006, p. C4. KPMG’s $225 million class-action settlement has been postponed because of the number of class members (61 of 284 plaintiffs) who have opted out of the settlement because, as one lawyer put, it was too much of "a sweetheart deal for KPMG." KPMG has already agreed to pay the government $456 million.

9. Thai Graft Cop Bounces Back, The Wall Street Journal, February 9, 2006, p. A7. When Thailand's independent auditor general was blocked from performing her official duties, she went public, joining forces with politicians and academics politicians to launch CorruptionWatch.net, a Web site devoted to preventing and detecting government corruption in the country. She was finally reinstated after months of secret negotiations. The article notes that “Ms. Jaruvan's determination to follow through on her mandate illustrates the difficulties facing individuals who take on the intricate machinery of graft in a country where corruption is often the norm.” Thailand’s Prime Minister and his family are under investigation for potential violation of market regulations.

10. SEC Obtains Record Penalties From KPMG Auditors of Xerox, The Wall Street Journal, February 23, 2006, p. C3. Former and current KPMG partners agreed to a settlement with the SEC for failing to spot Xerox’s $3 billion accounting fraud, just weeks before their civil fraud trial was set to begin. Penalties were $150,000 each, a record fine for individual auditors. Between 1997 and 2000, Xerox manipulated office equipment leases to meet market earnings expectations.

11. SEC Says Two KPMG Auditors Ignored Ahold Unit's Red Flags, The Wall Street Journal, February 17, 2006, p. A10. The SEC charged two KPMG auditors with missing red flags in their audit of Dutch supermarket chain Ahold. In the fraud scheme, vendors sent false confirmations to the auditors which helped the Ahold’s U.S. subsidiary U.S. Foodservice to overstate income in 2001 and 2002. The SEC alleges that the auditors "found numerous instances where USF recognized income when it should not have, but Hall and Meyer refused to act upon or failed to recognize these and other red flags." The SEC also alleges that the audit workpapers were modified with correction fluid to obscure audit exceptions found by the audit team related to vendor payments.

12. Adding Up Chinese Data, The Wall Street Journal, February 27, 2006, p. C10. China has agreed to substantially adopt international accounting standards next year, offering investors more information about companies trades on the county’s stock exchanges.

13. PEEC Adopts Conceptual Framework for AICPA Independence Standards and Revised Interpretation on Responding to Clients' Requests for Records At its January 30-31, 2006 meeting, the AICPA Professional Ethics Executive Committee (PEEC) adopted a Conceptual Framework for AICPA Independence Standards and a related revision to Interpretation 101-1, under Rule 101, Independence, of the Code of Professional Conduct. The revision to the "Other Considerations" section of Interpretation 101-1 requires that members use the risk-based approach set forth in the Conceptual Framework when making independence decisions involving matters that are not specifically addressed in the independence interpretations and rulings in the Code. The Committee also adopted revisions to Ethics Interpretation 501-1, Response to Requests by Clients and Former Clients for Records, under Rule 501 (Acts Discreditable) that provides guidance to members on their ethical responsibilities when a client or former client makes a request for client records, supporting records, or other documents that are in the custody or control of the member. http://www.aicpa.org/members/div/ethics/index.htm

14. When the Boss Trumps Internal Controls Joseph T Wells. Journal of Accountancy. New York: Feb 2006.Vol.201, Iss. 2 When a college was so broke it couldn't even afford copy paper, toner and other inexpensive supplies, it took some sleuthing to find the reason. This article summarizes the heroic efforts of one CPA, without pay or outside staff (or experience in fraud detection), who helped bring down a powerful and arrogant college president.

15. Sustainable Compliance, Daniel B. Langer, Tony Popanz, Internal Auditor, February 2006, pp. 55-58 Article discusses how companies can make Sarbanes-Oxley compliance part of the daily operations. Discussion includes enterprise-wide governance, control ownership, and best practices

16. Think Like the Fraudster, Antoinette L. Lynch, Internal Auditor, February 2006, pp. 66-70 Article discusses the use of brainstorming in determining how fraudulent activities may occur. The use of brainstorming may provide the auditors a greater breath of possible frauds in an audit then if auditors are left to evaluate fraud as an individual. 17. A Risk Oriented Approach, Hans Beumer, Internal Auditor, February 2006, pp. 72-76 Good case study on how Saurer Ltd. (Swiss textile manufacturer) uses internal audit to minimize the risk that the company’s objectives are achieved.

18. Conflicts Of Interest And The Case Of Auditor Independence: Moral Seduction And Strategic Issue Cycling Don A Moore, Philip E Tetlock, Lloyd Tanlu, Max H Bazerman. Academy of Management. The Academy of Management Review: Jan 2006.Vol.31, Iss. 1 A series of financial scandals revealed a key weakness in the American business model: the failure of the U.S. Auditing system to deliver true independence. We offer a two-tiered analysis of what went wrong. At the more micro level, we advance moral seduction theory, explaining why professionals are often unaware of how morally compromised they have become by conflicts of interest. At the ore macro tier, we offer issue-cycle theory, explaining why conflicts of interest of the sort that compromise major accounting firms are so pervasive.

19. CEOs'/CFOs' Swearing by the Numbers: Does It Impact Share Price of the Firm? Hsihui Chang, Jengfang Chen, Woody M Liao, Birendra K Mishra. The Accounting Review. Jan 2006.Vol.81, Iss. 1 We observe, on average, positive abnormal returns for firms whose CEOs/CFOs certified their financial statements by August 14, 2002. Based on an analysis of bid-ask spreads, certifying firms experienced a significant decline in information asymmetry after certification. In cross-sectional analyses, we find abnormal returns are positively associated with firms that were under investigation, that used Andersen as their auditor, and that practiced aggressive revenue recognition.