Schools Finance v5.84 STAR ACCOUNTS – User Guide Section 9 - Reimbursements & Advances

Entering / Revising Imprest Advance – Process Tab

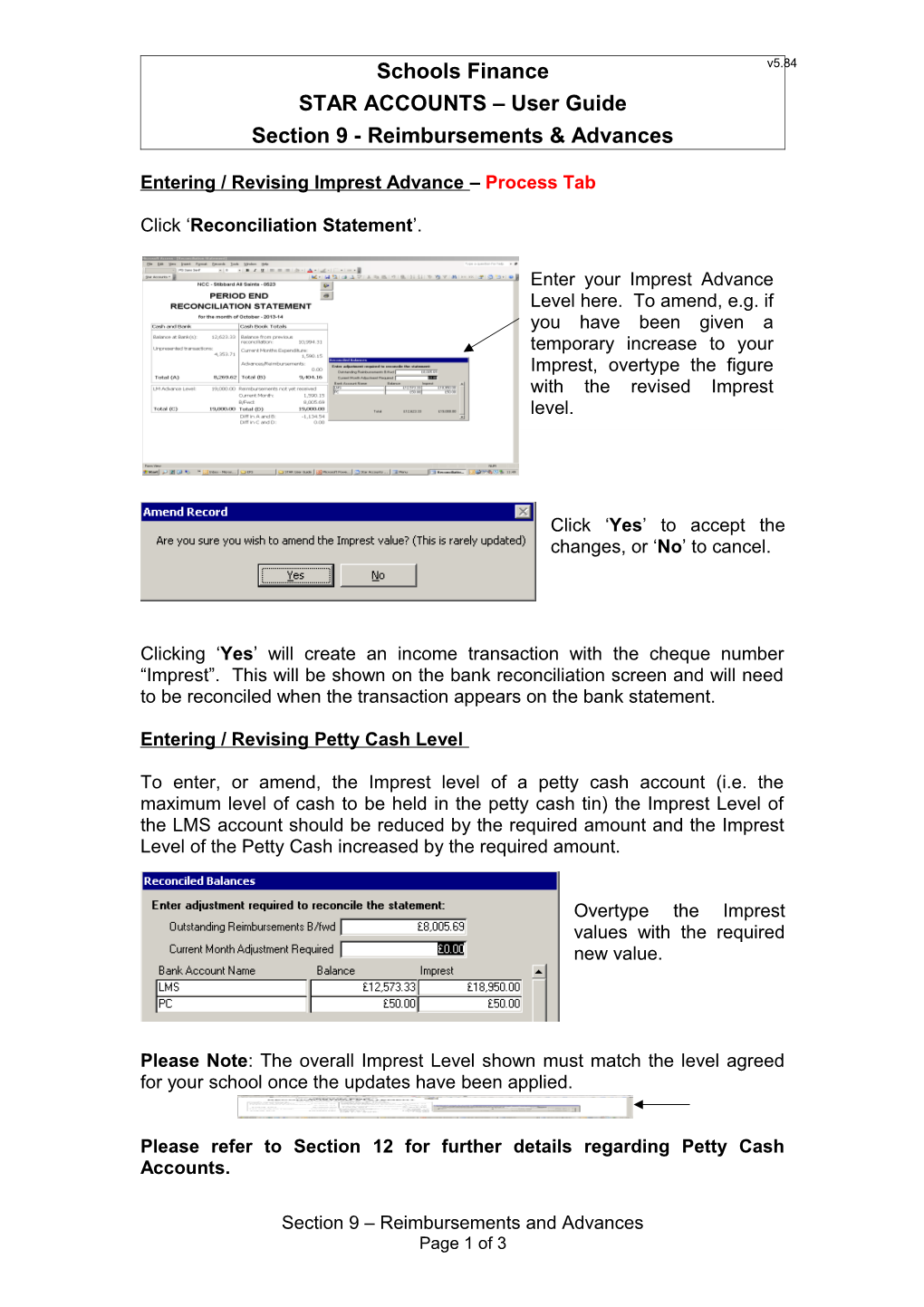

Click ‘Reconciliation Statement’.

Enter your Imprest Advance Level here. To amend, e.g. if you have been given a temporary increase to your Imprest, overtype the figure with the revised Imprest level.

Click ‘Yes’ to accept the changes, or ‘No’ to cancel.

Clicking ‘Yes’ will create an income transaction with the cheque number “Imprest”. This will be shown on the bank reconciliation screen and will need to be reconciled when the transaction appears on the bank statement.

Entering / Revising Petty Cash Level

To enter, or amend, the Imprest level of a petty cash account (i.e. the maximum level of cash to be held in the petty cash tin) the Imprest Level of the LMS account should be reduced by the required amount and the Imprest Level of the Petty Cash increased by the required amount.

Overtype the Imprest values with the required new value.

Please Note: The overall Imprest Level shown must match the level agreed for your school once the updates have been applied.

Please refer to Section 12 for further details regarding Petty Cash Accounts.

Section 9 – Reimbursements and Advances Page 1 of 3 Schools Finance v5.84 STAR ACCOUNTS – User Guide Section 9 - Reimbursements & Advances

Type A Bank Accounts

Entering Advances

Example: Paid into the bank account in July: £36,800.00 July Advances EB Budget share 29,500.00 SEN Funding 5,500.00 EC Capital & IT Funds 1,800.00 Use E832 – Total 36,800.00 reimbursement control account subjective code. The Advances split is detailed on the Statement of Cash Advances sent to schools each month. A separate transaction must be entered for each element of the Cash Advance.

Click on the Transactions tab, then on ‘Add New Transaction’.

Select ‘Income’ and enter a normal income transaction for each element of the Cash Advance, using Norfolk County Council as the supplier.

Enter the whole amount as Gross using VAT Rate “T”.

Section 9 – Reimbursements and Advances Page 2 of 3 Schools Finance v5.84 STAR ACCOUNTS – User Guide Section 9 - Reimbursements & Advances

Each element of the Cash Advance should be entered as above using the following subjective codes to ensure the correct Budget Line on the BCR is updated.

Subjective Code CFR Heading Budget Share 98940 I01 Sixth Form Funding 98950 I02 SEN Funding 98980 I03 Ethnic Minority Grant Funding 98960 I04 Pupil Premium Grant 99010 I05 Other Grant Funding 92530 I07

Capital Advances

When entering the (EC) Capital & IT Funds you must use Subjective C8720 with the corresponding capital code, e.g. ECAPFM = Capital Formula Funding.

Payroll Reduction

This should be entered using the income screen as above without the minus in the ‘Gross’ field using Subjective code E9320.

Section 9 – Reimbursements and Advances Page 3 of 3