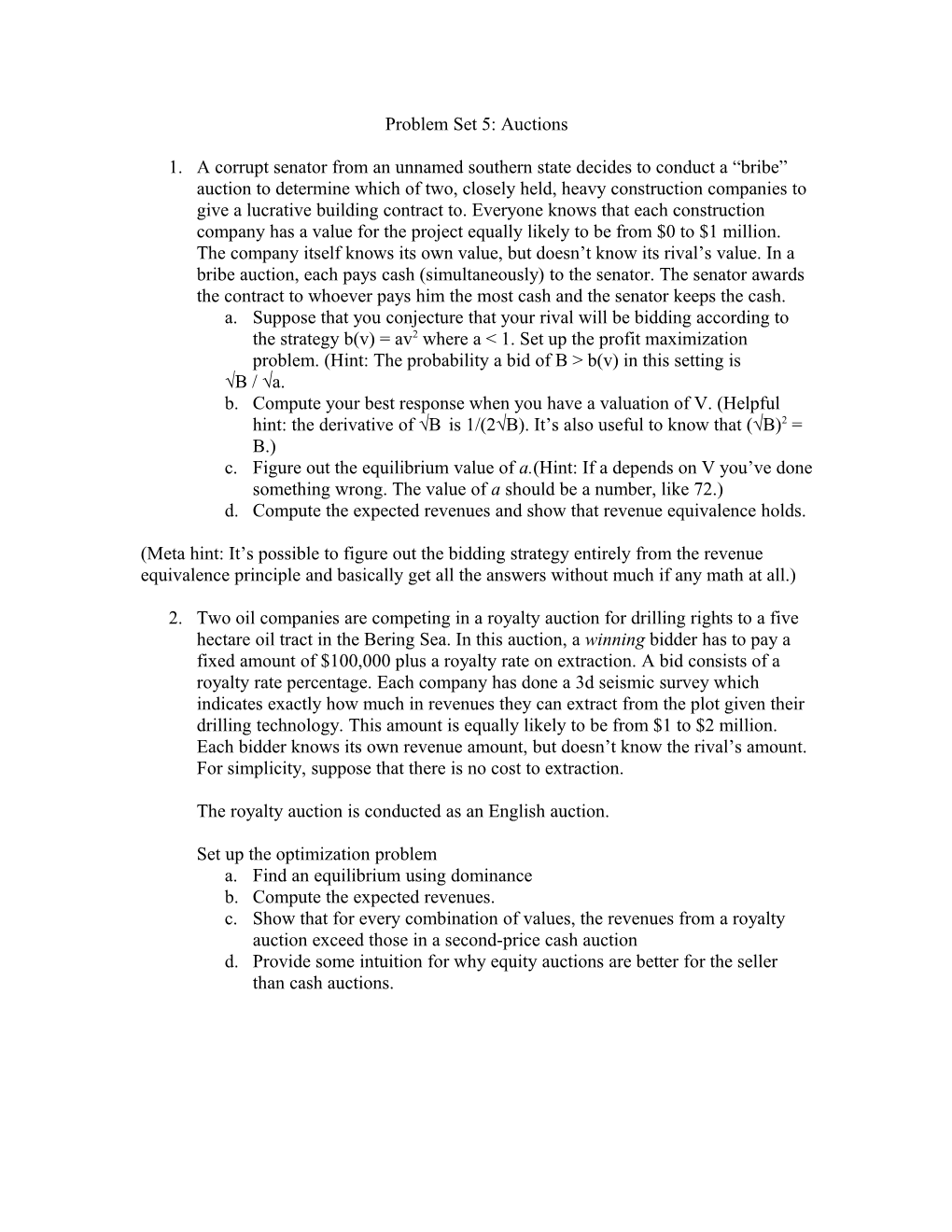

Problem Set 5: Auctions

1. A corrupt senator from an unnamed southern state decides to conduct a “bribe” auction to determine which of two, closely held, heavy construction companies to give a lucrative building contract to. Everyone knows that each construction company has a value for the project equally likely to be from $0 to $1 million. The company itself knows its own value, but doesn’t know its rival’s value. In a bribe auction, each pays cash (simultaneously) to the senator. The senator awards the contract to whoever pays him the most cash and the senator keeps the cash. a. Suppose that you conjecture that your rival will be bidding according to the strategy b(v) = av2 where a < 1. Set up the profit maximization problem. (Hint: The probability a bid of B > b(v) in this setting is √B / √a. b. Compute your best response when you have a valuation of V. (Helpful hint: the derivative of √B is 1/(2√B). It’s also useful to know that (√B)2 = B.) c. Figure out the equilibrium value of a.(Hint: If a depends on V you’ve done something wrong. The value of a should be a number, like 72.) d. Compute the expected revenues and show that revenue equivalence holds.

(Meta hint: It’s possible to figure out the bidding strategy entirely from the revenue equivalence principle and basically get all the answers without much if any math at all.)

2. Two oil companies are competing in a royalty auction for drilling rights to a five hectare oil tract in the Bering Sea. In this auction, a winning bidder has to pay a fixed amount of $100,000 plus a royalty rate on extraction. A bid consists of a royalty rate percentage. Each company has done a 3d seismic survey which indicates exactly how much in revenues they can extract from the plot given their drilling technology. This amount is equally likely to be from $1 to $2 million. Each bidder knows its own revenue amount, but doesn’t know the rival’s amount. For simplicity, suppose that there is no cost to extraction.

The royalty auction is conducted as an English auction.

Set up the optimization problem a. Find an equilibrium using dominance b. Compute the expected revenues. c. Show that for every combination of values, the revenues from a royalty auction exceed those in a second-price cash auction d. Provide some intuition for why equity auctions are better for the seller than cash auctions.