Financial Analysis – Apple Incorporated (NASDAQ: AAPL)

Group B: Stu Haack, Amy Kull, Kristy Junio, Zeyad Maasarani

What is the current financial health of the company based on your analysis?

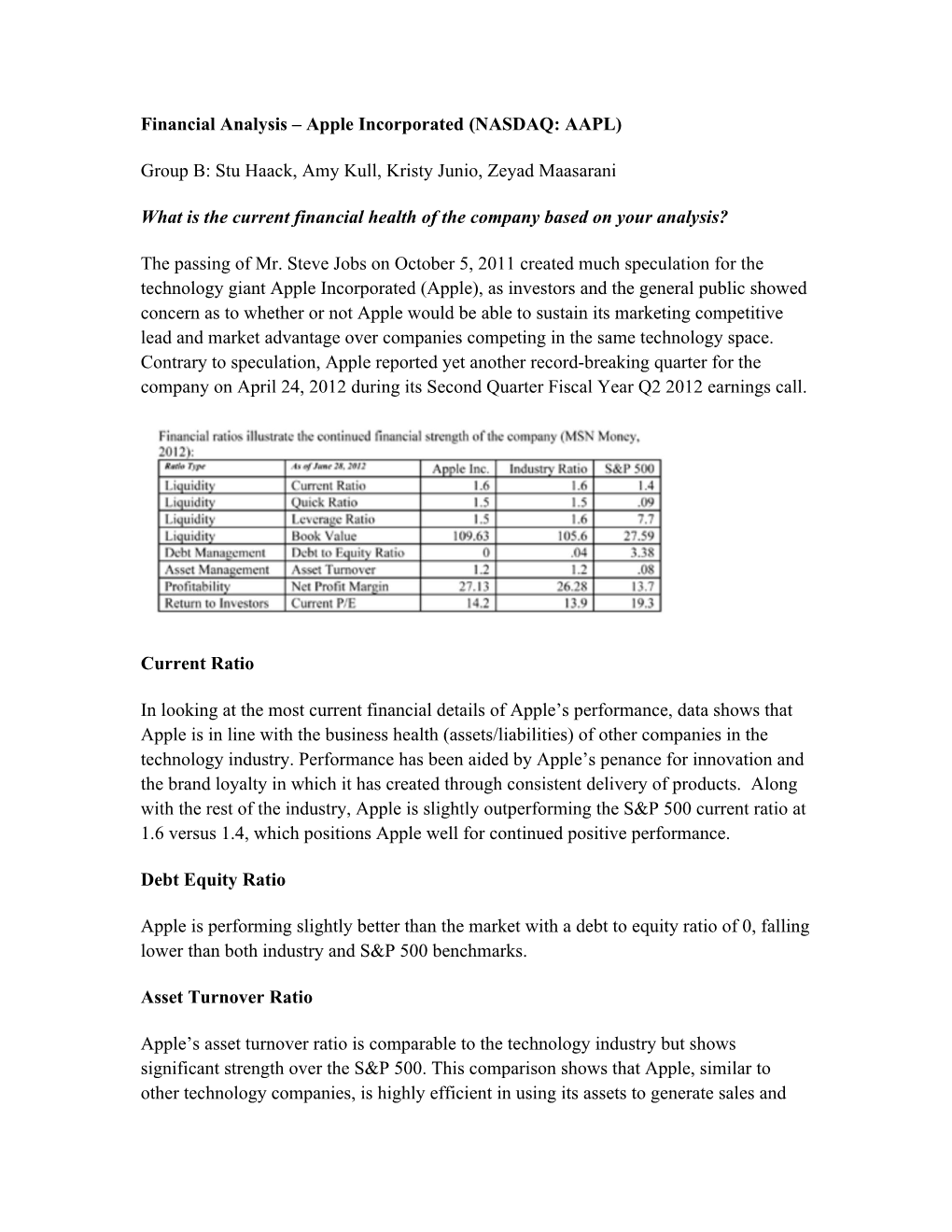

The passing of Mr. Steve Jobs on October 5, 2011 created much speculation for the technology giant Apple Incorporated (Apple), as investors and the general public showed concern as to whether or not Apple would be able to sustain its marketing competitive lead and market advantage over companies competing in the same technology space. Contrary to speculation, Apple reported yet another record-breaking quarter for the company on April 24, 2012 during its Second Quarter Fiscal Year Q2 2012 earnings call.

Current Ratio

In looking at the most current financial details of Apple’s performance, data shows that Apple is in line with the business health (assets/liabilities) of other companies in the technology industry. Performance has been aided by Apple’s penance for innovation and the brand loyalty in which it has created through consistent delivery of products. Along with the rest of the industry, Apple is slightly outperforming the S&P 500 current ratio at 1.6 versus 1.4, which positions Apple well for continued positive performance.

Debt Equity Ratio

Apple is performing slightly better than the market with a debt to equity ratio of 0, falling lower than both industry and S&P 500 benchmarks.

Asset Turnover Ratio

Apple’s asset turnover ratio is comparable to the technology industry but shows significant strength over the S&P 500. This comparison shows that Apple, similar to other technology companies, is highly efficient in using its assets to generate sales and revenues (Investopedia, n.d.). Although high profit margins tend to lead to low asset turnover rates, in the case of Apple, which has both a high net profit margin and asset turnover ratio, it is highly likely that consumer demands has greatly driven up the asset turnover ratio.

Net Profit Margin

Apple’s net profit margin is performing slightly better than the industry but significantly outpaces the S&P 500, more than doubling net profit margins in comparison. This combined with its high volume of sales creates a strong revenue stream for the technology giant, which has nearly doubled its earnings year over year.

Current P/E

Apple is built on its ability to create competitive advantage through innovation. The company builds market anticipation through timed product releases. The company has also been able to subsidize its supply chain with a highly profitable retail chain. The company has been able to sustain a competitive advantage that other companies have not been able to mimic.

Furthermore, Apple’s ability to keep trade secrets under wraps and its consumer appeal has created a pop culture following for the company. Apple continues to build high levels of anticipation for the release of its products, which are developed under a shroud of secrecy. This is a clear demonstration that strong marketing, a diverse portfolio of products and innovation creates a breeding environment for financial performance.

Financial analysis shows steady year-over-year growth, with profit margins, revenue, assets and liabilities all advancing. There is no question that Apple’s platform of innovation has catapulted its growth over the past five years and it is likely to continue in this path based on current reported performance.

Do the numbers in your analysis seem to align with the text in the letter to shareholders and the business review in the annual report?

Based on our findings, Apple's annual report certainly seems to align with that of our financial analysis. They are unquestionably in good financial standing, especially when shareholders look at pg. 35 of the annual report, which states that Apple's net sales in 2011 was over $108B, while its cost of sales was only slightly higher than $64B (Apple Inc., 2012).

In true Apple rebelliousness and "Think Different" style, the company of course did not provide a typical letter to shareholders for the recent fiscal year, but rather gave a topical look throughout the annual report with regard to its assets and liabilities, giving quite thorough descriptions of all elements affecting its financial stature, including existing products, research and development and potential legal issues around the globe.

Our report indicates that the current ratio of Apple is 1.6, which is only in line with that of its industry. That doesn't necessarily mesh with Apple's overall and unequivocally high ranking in the technology industry. However, there are certain reflections within the annual report, which indicate high expenditures that would correspond to Apple's lowered Current Ratio. These equalizers are research and development, marketing and retail growth. In addition, some of this discrepancy could be attributable to the immeasurable but critically important asset of goodwill. It doesn’t show up on the balance sheet, but the deep loyalty -- almost cultish following by some -- of Apple’s customers and the strength of its brand must be behind some of its high ranking in the industry. Because of Apple's reputation and brand loyalty, it is difficult to assess its financial health based solely on financial numbers. When Apple is discussed, there's a level of expectation, a level of innovation, that is not consistently present with other companies in the technology industry such as IBM, Xerox, and the like.

What are the reasons provided for the current health of the company?

Apple attributes its continued acclaimed performance to record Q2 sales of iPhones, iPads, and Macs as being behind its net profit increases of 94% from March 2011 to March 2012, with the iPad and iPhone being the main drivers for this success. Apple’s total gross margin during this same time frame was 47.4% due to lower than expected commodity costs, higher than expected revenue from product mix, and some one time items taken in Q2 (Seeking Alpha, 2012).

The company cites that sales of the iPhone continue to skyrocket, with 88% growth over March 2011 compared to 42% category growth for smart phones during the same time period; iPhones are making strong gains in the enterprise sector (Seeking Alpha, 2012). Apple’s iPad continues to set the world on fire with year-over-year sales growth of 132%; this breakthrough technology and its strength as an educational tool has opened previously untapped markets in government, education and enterprise. Q2 sales of Macs were the highest ever and over half of the units sold at retail were to new users.

Apple continues to dominate the MP3 market in hardware and media, with the iPod remaining the top-selling MP3 player in the world, even though sales were down from a year ago; iTunes generated all-time record results with revenue of almost $1.9 billion in Q2. The iTunes catalog boasts over 28 million songs 45,000 movies. iPhone application downloads also topped previous milestones with the 25th billionth app downloaded in March 2012.

Additionally, Apple’s recent launch of iCloud has delighted consumers; within five months of its introduction, iCloud already had 125 million customers. This growth exceeds expectations for the product in a relatively short period of time since launch.

Apple retail outlets complements the overall growth for Apple, showing strong year-over- year sales with an increase 38% and average store sales up 23% over Q2 2011. The entire IOS ecosystem is thriving and is supporting an entirely new source of independent app producers

How do stakeholders seem to be responding to this company?

Analysts remain cautiously optimistic and rate the stock as a moderate buy (MSN Money, 2012). At fiscal year end, Apple is expected to once again exceed year-over-year growth hitting record high, up 69% for the year (Seeking Alpha, 2012). This projection more than doubles the industry expectations and outpaces the S&P 500 at an exponential rate.

During the Q2 earnings call, analyst called out a few key factors that may influence their assessment of Apple in this fiscal year:

Projected sequential down tick to June quarter revenue guidance compared to previous years – Apple acknowledged this and responded that due to its inventory ramp up in the March quarter, Apple was able to deliver a significant amount of inventory which moved revenue realization earlier into the 2012 fiscal year, with the downstream slowing effect for subsequent quarters. They simply are improving their supply chain and are better able to meet current demand with production (Seeking Alpha, 2012). Price elasticity and new markets – Early results are showing that Apple’s decrease in iPad 2 prices in March 2012 may be spurring sales. It has also helped them to penetrate the educational markets. Although it is too early to tell, this price move may also impact their revenue growth through the 2012 fiscal year (Seeking Alpha, 2012). Carrier subsidies – Analyst showed concern that with the product roll-out for iPhones, service carriers will receive less subsidies thus impacting overall sales since iPhones would carry a higher cost for consumers if they upgrade within contract periods. Apple’s position on this concern is that the carrier subsidies are relatively low in comparison to monthly service fees over a 24-month contract. Additionally, the quality of Apple products and Apple’s stellar reputation with consumers continues to make iPhones attractive to consumers. In their words, “iPhone is the best smart phone on the planet” (Seeking Alpha, 2012).

Consumer demand remains at industry standard with the asset ratio comparing well with the market with a ration of 1.2. Apple products continue to meet and exceed sales projections and Apple continues to expand in different markets including geographical moves in China and educational markets for target segments. Sales are projected to continue to grow, although the rate of growth will likely slow down.

Media critics note that once Steve Jobs’ influence over technological innovations dissipates, which is projected to last for the next five years, Tim Cook’s operational strength may not be enough to sustain Apple’s industry lead in new product design (Gregersen, 2012). Even with doubt lightly shrouding Apple’s future performance, the company at present continues to perform strongly outpacing the industry in sales and product innovations.

Although financial ratios put Apple right in line with the technology industry, its revenue growth strongly outpaces the marketplace. As mentioned previously in this analysis, the review of financial ratios alone does not show the magnitude and strength of Apple’s presence in the marketplace. Consumer power continues to drive forth revenue and brand strength. References

Apple Inc. (2011). Apple Inc., 2011 Annual Report. Cupertino, CA: Edgars Online.

MSN Money. (2012). Apple Inc. Retrieved from https://money.msn.com/.

Gregerson, H. (2012, June 27). The cracks are starting to show at Apple. The Harvard Business Review. Retrieved from http :// blogs . hbr . org / cs /2012/06/ cracks _ starting _ to _ show _ at _ app .html

Asset turnover ratio. (n.d.). In Investopedia Online. Retrieved from http :// www . investopedia . com / terms / a / assetturnover . asp # axzz 1 zIg 1 JsWV

Seeking Alpha. (2012, April 24). Apple’s CEO discusses Q2 2012 results – earnings call transcript. Retrieved from https://www.seekingalpha.com.