Statistics 845.3 –Assignment 4

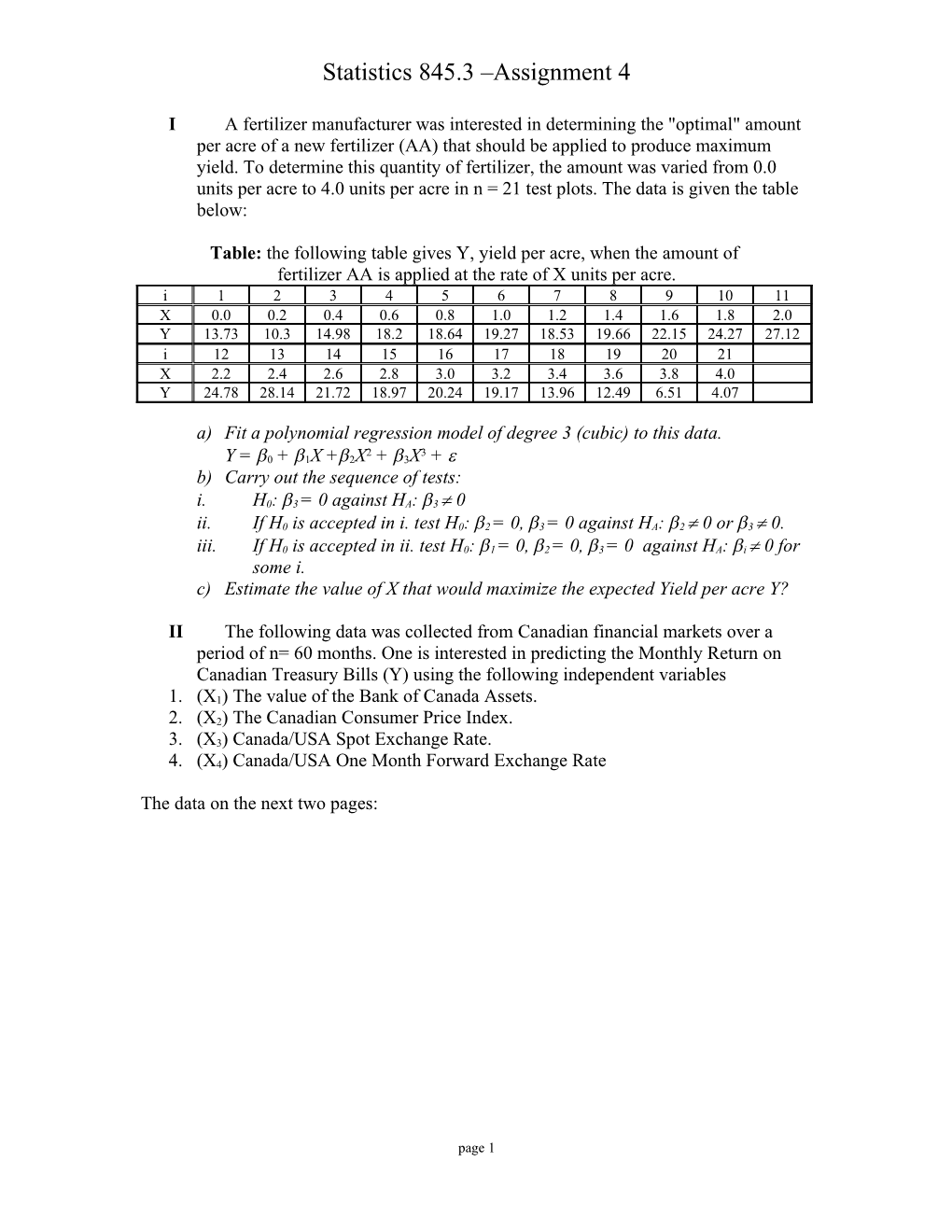

I A fertilizer manufacturer was interested in determining the "optimal" amount per acre of a new fertilizer (AA) that should be applied to produce maximum yield. To determine this quantity of fertilizer, the amount was varied from 0.0 units per acre to 4.0 units per acre in n = 21 test plots. The data is given the table below:

Table: the following table gives Y, yield per acre, when the amount of fertilizer AA is applied at the rate of X units per acre. i 1 2 3 4 5 6 7 8 9 10 11 X 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 Y 13.73 10.3 14.98 18.2 18.64 19.27 18.53 19.66 22.15 24.27 27.12 i 12 13 14 15 16 17 18 19 20 21 X 2.2 2.4 2.6 2.8 3.0 3.2 3.4 3.6 3.8 4.0 Y 24.78 28.14 21.72 18.97 20.24 19.17 13.96 12.49 6.51 4.07

a) Fit a polynomial regression model of degree 3 (cubic) to this data. 2 3 Y = 0 + 1X +2X + 3X + b) Carry out the sequence of tests:

i. H0: 3 = 0 against HA: 3 0

ii. If H0 is accepted in i. test H0: 2 = 0, 3 = 0 against HA: 2 0 or 3 0.

iii. If H0 is accepted in ii. test H0: 1 = 0, 2 = 0, 3 = 0 against HA: i 0 for some i. c) Estimate the value of X that would maximize the expected Yield per acre Y?

II The following data was collected from Canadian financial markets over a period of n= 60 months. One is interested in predicting the Monthly Return on Canadian Treasury Bills (Y) using the following independent variables 1. (X1) The value of the Bank of Canada Assets. 2. (X2) The Canadian Consumer Price Index. 3. (X3) Canada/USA Spot Exchange Rate. 4. (X4) Canada/USA One Month Forward Exchange Rate

The data on the next two pages:

page 1 (X1) (X2) (X4) (Y) Month Bank of Canada Canadian Consumer (X3) Canada/USA One Monthly Return on Canada/USA Spot Month Forward i Assets. Price Index Exchange Rate Exchange Rate Canadian Treasury Bills 1 10400 61.2 1.01 1.01 8.59 2 10317 61.5 0.99 1 8.7 3 10580 61.7 0.98 0.99 9.04 4 10559 62 0.98 0.98 8.97 5 10504 62.5 0.98 0.98 8.94 6 10946 62.8 0.97 0.98 8.99 7 10995 63 0.96 0.97 9.02 8 10806 63.3 0.97 0.98 9.12 9 10830 63.6 0.97 0.97 8.97 10 11002 64 0.97 0.97 9.07 11 11759 64.2 0.97 0.97 8.88 12 11843 64.5 1.03 1.03 8.41 13 11362 65 1 1.01 8.08 14 11176 65.6 1.02 1.02 7.67 15 11687 66.3 1.04 1.05 7.61 16 12049 66.7 1.05 1.05 7.55 17 11830 67.2 1.04 1.04 7.26 18 12132 67.7 1.05 1.05 7.07 19 12348 68.3 1.05 1.05 7.12 20 12024 68.6 1.07 1.07 7.16 21 12107 69 1.07 1.07 7.09 22 12503 69.6 1.07 1.07 7.19 23 12303 70.1 1.1 1.1 7.25 24 13416 70.6 1.1 1.1 7.18 25 12471 70.8 1.09 1.09 7.14 26 12948 71.3 1.1 1.1 7.24 27 13439 72.1 1.11 1.11 7.62 28 13783 72.3 1.13 1.13 8.18 29 13119 73.3 1.12 1.12 8.13 30 13804 73.9 1.11 1.11 8.24 31 13541 75 1.12 1.12 8.43 32 13380 75.1 1.13 1.13 8.77 33 14464 74.9 1.15 1.15 9.02 34 16200 75.7 1.18 1.18 9.52 35 13889 76.3 1.16 1.16 10.29 36 15106 76.5 1.16 1.16 10.43 37 14012 77.1 1.18 1.18 10.8

page 2 (X1) (X2) (X4) (Y) Month Bank of Canada Canadian Consumer (X3) Canada/USA One Monthly Return on Canada/USA Spot Month Forward i Assets. Price Index Exchange Rate Exchange Rate Canadian Treasury Bills 38 14291 77.8 1.2 1.2 10.78 39 14992 78.8 1.18 1.18 10.9 40 14841 79.3 1.15 1.15 10.84 41 14513 80.1 1.14 1.14 10.84 42 15338 80.5 1.16 1.16 10.82 43 14989 81.1 1.16 1.16 10.91 44 15636 81.4 1.17 1.17 11.32 45 16381 82.1 1.16 1.16 11.57 46 15133 82.7 1.16 1.15 12.86 47 15566 83.5 1.18 1.18 13.61 48 15746 84 1.16 1.16 13.63 49 14821 84.5 1.16 1.16 13.54 50 15010 85.2 1.15 1.15 13.56 51 17245 86.1 1.14 1.14 14.35 52 15705 86.6 1.19 1.19 15.64 53 16516 87.6 1.18 1.19 12.54 54 15956 88.6 1.15 1.16 11.15 55 16035 89.3 1.14 1.15 10.1 56 17476 90.1 1.15 1.15 10.21 57 16091 90.9 1.15 1.15 10.63 58 17044 91.7 1.17 1.16 11.57 59 17791 92.9 1.17 1.17 12.87 60 17313 93.4 1.19 1.18 16.31

Analyze this data to determine which factors determine the Monthly Return on Canadian Treasury Bills (Y).

page 3