Options for Implementing 100% Bonus Depreciation for 2011

The following options will be discussed in this document:

Create Life of 1 month for STL Depreciation Method to apply to newly purchased assets that qualify for the 100% bonus depreciation

Create Life (Multiple 1 month-1 year) for STL Depreciation Method to apply to newly purchased assets that qualify for the 100% bonus depreciation

Create bonus rules to apply to newly purchased assets that qualify for the 100% bonus depreciation

Use unplanned depreciation to apply to newly purchased assets that qualify for the 100% bonus depreciation

Use depreciation override

Create Life (1month) for STL Depreciation Method:

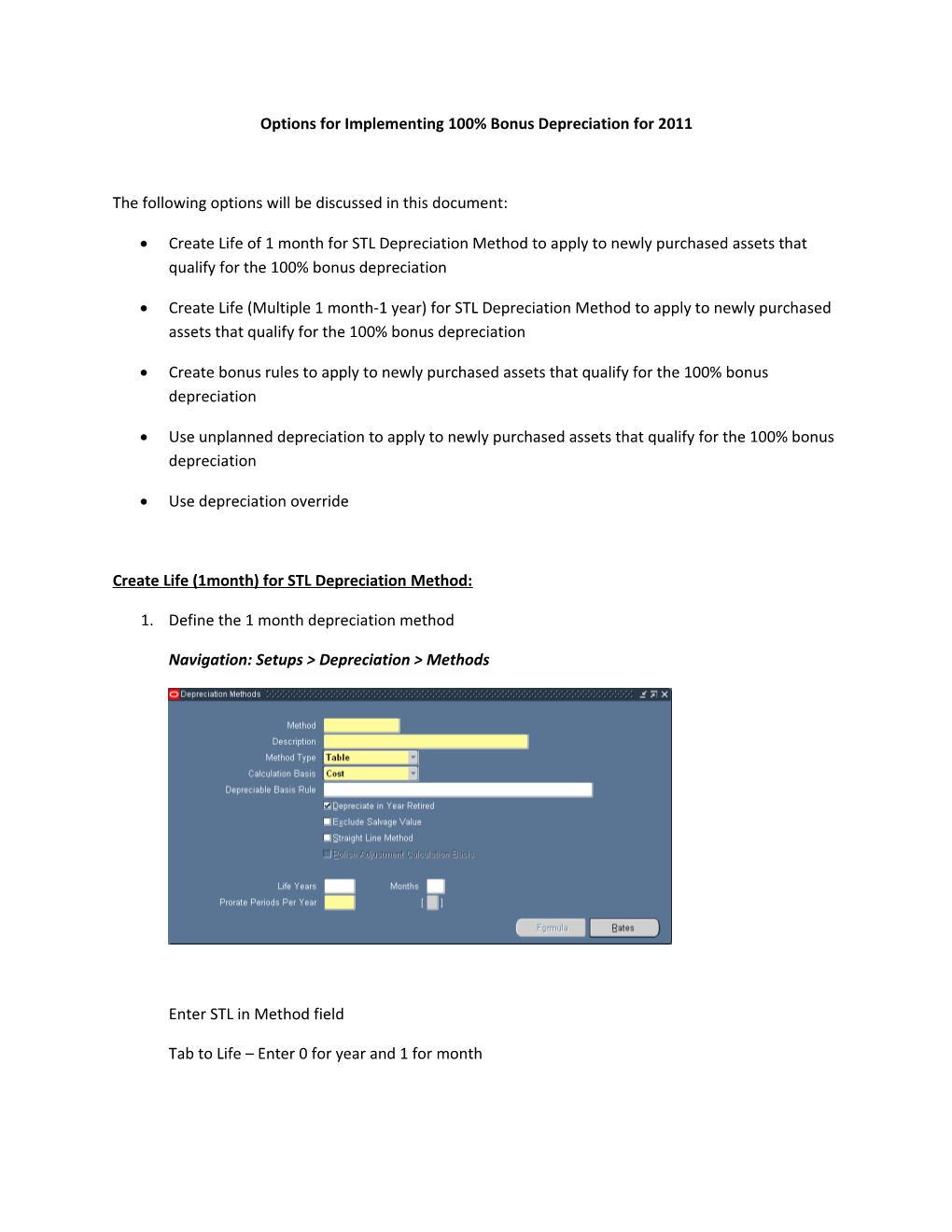

1. Define the 1 month depreciation method

Navigation: Setups > Depreciation > Methods

Enter STL in Method field

Tab to Life – Enter 0 for year and 1 for month Save

NOTE: Since this is a 100% bonus – it does not matter or should not matter what depreciation method is used, therefore we will use the seeded Straight-Line method (STL)

2. Create Asset and assign the new STL 1 month depreciation rule

Navigation: Assets > Asset Workbench > QuickAdditions (Button)

3. Run Depreciation

Navigation: Depreciation > Run Depreciation

Enter Book: PBUS TEST

Period: Defaults

Select Run (Button)

4. View Results

Navigation: Assets > Asset Workbench > Query Asset 474049 > Find (Button) > Financial Inquiry 5. View 2011 Results

Navigation: Assets > Asset Workbench > Query Asset > Find (Button) > Financial Inquiry

January 2011

NOTE: This option will work regardless of the period the asset was added – you can further automate this by updating the Asset Categories and setting the depreciation default rules to STL 0 YR 1 Month for all applicable asset categories. Create Life (Mutiple 1month – 1 year) for STL Depreciation Method:

1. Define the 1 month depreciation method

Navigation: Setups > Depreciation > Methods

Enter STL in Method field

Tab to Life – Enter 0 for year and 1 for month

Arrow down

Enter STL in Method field

Tab to Life – Enter 0 for year and 2 for month Arrow down

Enter STL in Method field

Tab to Life – Enter 0 for year and 3 for month

Arrow down

Enter STL in Method field

Tab to Life – Enter 0 for year and 4 for month Arrow down

Enter STL in Method field

Tab to Life – Enter 0 for year and 5 for month

Arrow down

Enter STL in Method field

Tab to Life – Enter 0 for year and 6 for month Arrow down

Enter STL in Method field

Tab to Life – Enter 0 for year and 7 for month

Arrow down

Enter STL in Method field

Tab to Life – Enter 0 for year and 8 for month Arrow down

Enter STL in Method field

Tab to Life – Enter 0 for year and 9 for month

Arrow down

Enter STL in Method field

Tab to Life – Enter 0 for year and 10 for month Arrow down

Enter STL in Method field

Tab to Life – Enter 0 for year and 11 for month

Arrow down

Enter STL in Method field

Tab to Life – Enter 1 for year and 0 for month Save

NOTE: Since this is a 100% bonus – it does not matter or should not matter what depreciation method is used, therefore we will use the seeded Straight-Line method (STL)

2. Assign New Method / Life combinations to the Asset Categories

Navigation: Setup > Asset System > Asset Categories > Default Rules (Button)

End Date OF 31-DEC-2010 Select Green + to insert new record

Add rules for each month for 2011

January 2011

Enter To Date: 31-JAN-2011

Method: STL

Life 1YR 0 Months Select Green + to insert new record

February 2011

Enter To Date: 28-FEB-2011

Method: STL

Life 0 YR 11 Months Select Green + to insert new record

March 2011

Enter To Date: 31-MAR-2011

Method: STL

Life 0 YR 10 Months

Select Green + to insert new record

April 2011

Enter To Date: 30-APR-2011

Method: STL

Life 0 YR 9 Months Select Green + to insert new record

May 2011

Enter To Date: 31-MAY-2011

Method: STL

Life 0 YR 8 Months Select Green + to insert new record

June 2011

Enter To Date: 30-JUN-2011

Method: STL

Life 0 YR 7 Months Select Green + to insert new record

July 2011

Enter To Date: 31-JUL-2011

Method: STL

Life 0 YR 6 Months

Select Green + to insert new record

August 2011

Enter To Date: 31-AUG-2011

Method: STL

Life 0 YR 5 Months Select Green + to insert new record

September 2011

Enter To Date: 30-SEP-2011

Method: STL

Life 0 YR 4 Months Select Green + to insert new record

October 2011

Enter To Date: 31-OCT-2011

Method: STL

Life 0 YR 3 Months Select Green + to insert new record

November 2011

Enter To Date: 30-NOV-2011

Method: STL

Life 0 YR 2 Months

Select Green + to insert new record

December 2011

Enter To Date: 31-DEC-2011

Method: STL

Life 0 YR 1 Months Select Green + to insert new record

January 2012

Enter To Date:

Method: Standard Fed Method

Life: Standard Life Save

3. Create Assets throughout the year or 2011

Navigation: Assets > Asset Workbench > QuickAdditions (Button)

January 2011 Addition

February 2011 Addition May 2011 Addition

August 2011 Addition

December 2011 Addition

6. Run Depreciation

Navigation: Depreciation > Run Depreciation

Enter Book: PBUS TEST

Period: Defaults

Select Run (Button) 7. View Results

Navigation: Assets > Asset Workbench > Query Asset> Find (Button) > Financial Inquiry

January 2011

February 2011

May 2011

August 2011

December 2011

8. View 2011 Results

Navigation: Assets > Asset Workbench > Query Asset > Find (Button) > Financial Inquiry

January 2011 February 2011

May 2011 August 2011 December 2011 Create Bonus Rules:

1. Define Bonus Rule

Navigation: Setups > Depreciation > Bonus Rules

2. Assign Bonus Rule to Asset Category

Navigation: Setup > Asset System > Asset Categories > Default Rules (Button)

Enter Bonus Rule in Bonus Rule field > Save 3. Create Assets throughout the year or 2011

Navigation: Assets > Asset Workbench > QuickAdditions (Button)

January 2011

February 2011 May 2011

August 2011 December 2011

4. Run Depreciation

Navigation: Depreciation > Run Depreciation

Enter Book: PBUS TEST

Period: Defaults

Select Run (Button) 5. View Results

Navigation: Assets > Asset Workbench > Query Asset > Find (Button) > Financial Inquiry

January 2011

February 2011

May 2011 August 2011

December 2011 9. View 2011 Results

Navigation: Assets > Asset Workbench > Query Asset > Find (Button) > Financial Inquiry

January 2011 February 2011

May 2011

August 2011

December 2011 Unplanned Depreciation:

1. Create Assets throughout the year or 2011

Navigation: Assets > Asset Workbench > QuickAdditions (Button)

January 2011

Change Method to a NON-Rate Table Method (STL) Prior to saving

February 2011 May 2011

2. Enter Unplanned Depreciation

Navigation: Assets > Asset Workbench > Query Asset (Find) > Books > Unplanned Depreciation (Button)

January 2011 Select Done (Button) February 2011

May 2011

3. Change Depreciation Method Back to Standard (MACRS HY 5YR) Select Done (Button) 4. Run Depreciation

Navigation: Depreciation > Run Depreciation

Enter Book: PBUS TEST

Period: Defaults

Select Run (Button)

5. View Results

Navigation: Assets > Asset Workbench > Query Asset > Find (Button) > Financial Inquiry

January 2011

February 2011 May 2011

10. View 2011 Results

Navigation: Assets > Asset Workbench > Query Asset > Find (Button) > Financial Inquiry

January 2011 February 2011

May 2011 Depreciation Override:

1. Create Assets throughout the year or 2011

Navigation: Assets > Asset Workbench > QuickAdditions (Button)

January 2011

2. Enter Depreciation Override

Navigation: Depreciation > Override

Select New (Button) Enter required fields

3. Run Depreciation

Navigation: Depreciation > Run Depreciation

Enter Book: PBUS TEST

Period: Defaults Select Run (Button) 4. View Results

Navigation: Assets > Asset Workbench > Query Asset 474053 > Find (Button) > Financial Inquiry

5. View 2011 Results

Navigation: Assets > Asset Workbench > Query Asset > Find (Button) > Financial Inquiry

January 2011 Summary of the following options:

Create Life of 1 month for STL Depreciation Method to apply to newly purchased assets that qualify for the 100% bonus depreciation

o Easy to define

. Create 1 Depreciation Method / Life combination STL 0 yr 1 month

. Link new method / Life combination to asset categories

o Oracle calculates depreciation properly and fully reserve the asset the period added

Create Life (Multiple 1 month-1 year) for STL Depreciation Method to apply to newly purchased assets that qualify for the 100% bonus depreciation

o More steps to step up

. Create multiple Depreciation Method / Life combinations

. Link new method / life combinations to asset categories (13 new default rules per asset categories) – may be over kill

o Oracle will calculate depreciation properly and fully reserve the asset over the first year added

o NOTE: Setups may vary depending upon the prorate convention used – in my example I used a prorate of same month, if I used Following month then the asset added in January would have a life of 11 months instead of 12 months.

Create bonus rules to apply to newly purchased assets that qualify for the 100% bonus depreciation

o Unable to get this to work

Use unplanned depreciation to apply to newly purchased assets that qualify for the 100% bonus depreciation

o Test one:

. Added Asset with Depreciation Method of STL

. Enter Unplanned Depreciation

. Change Depreciation Method back to MACRS HY

. Run Depreciation . Failed to fully reserve asset

o Test two:

. Added Asset with Depreciation Method defaulted

. Enter Unplanned Depreciation – unable to enter

. Change Depreciation Method to STL

. Enter Unplanned Depreciation

. Run Depreciation

. Failed to fully reserve asset

o Test three:

. Added Asset with Depreciation Method of STL

. Enter Unplanned Depreciation

. Run Depreciation

. Failed to fully reserve asset

o Unable to get this to work – however in theory it should work

o Needs to be defined for each asset added – might be too much depending upon the volume of assets

o Needs to be define prior to running depreciation for the first time on the asset

Use depreciation override

o Needs to be defined for each asset added – might be too much depending upon the volume of assets

o Needs to be define prior to running depreciation for the first time on the asset