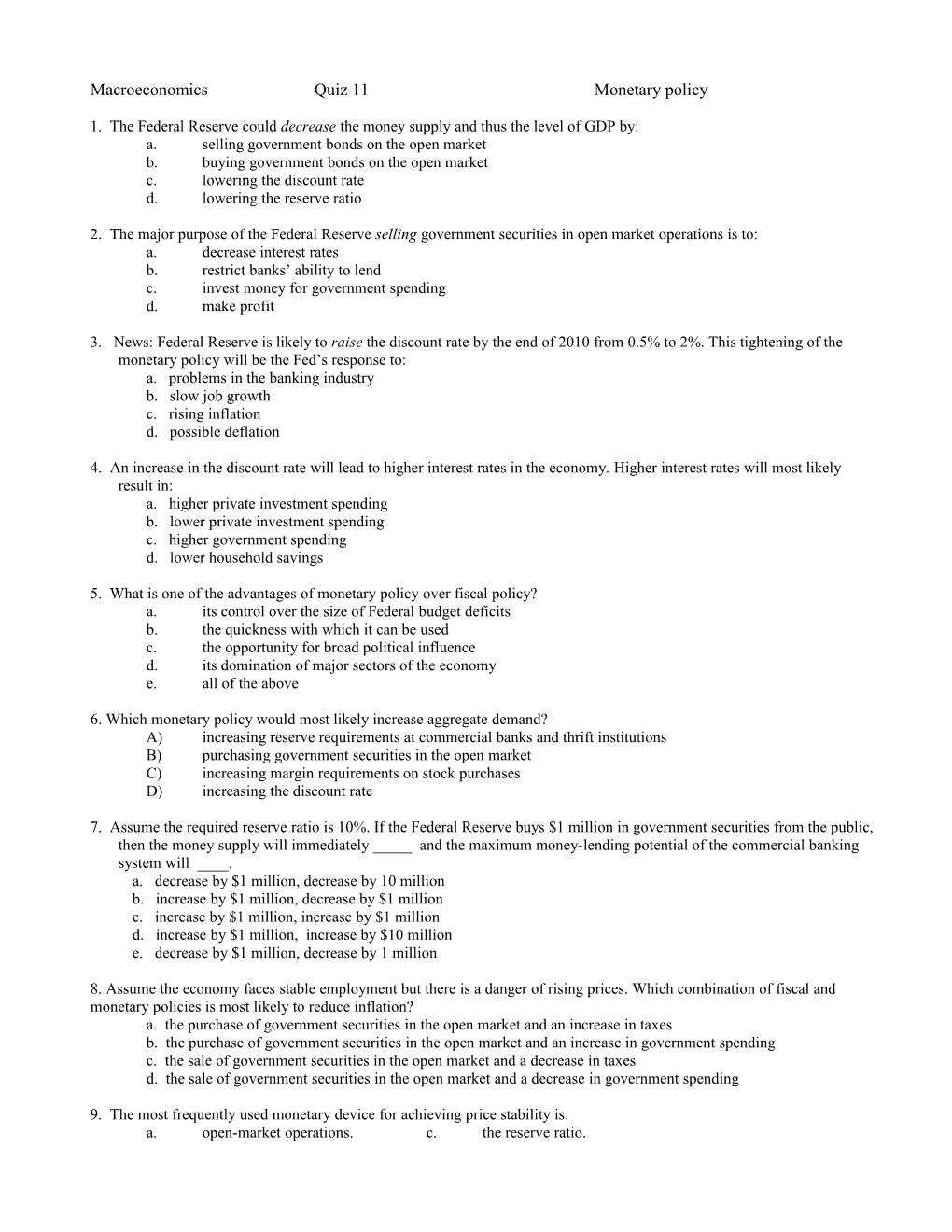

Macroeconomics Quiz 11 Monetary policy

1. The Federal Reserve could decrease the money supply and thus the level of GDP by: a. selling government bonds on the open market b. buying government bonds on the open market c. lowering the discount rate d. lowering the reserve ratio

2. The major purpose of the Federal Reserve selling government securities in open market operations is to: a. decrease interest rates b. restrict banks’ ability to lend c. invest money for government spending d. make profit

3. News: Federal Reserve is likely to raise the discount rate by the end of 2010 from 0.5% to 2%. This tightening of the monetary policy will be the Fed’s response to: a. problems in the banking industry b. slow job growth c. rising inflation d. possible deflation

4. An increase in the discount rate will lead to higher interest rates in the economy. Higher interest rates will most likely result in: a. higher private investment spending b. lower private investment spending c. higher government spending d. lower household savings

5. What is one of the advantages of monetary policy over fiscal policy? a. its control over the size of Federal budget deficits b. the quickness with which it can be used c. the opportunity for broad political influence d. its domination of major sectors of the economy e. all of the above

6. Which monetary policy would most likely increase aggregate demand? A) increasing reserve requirements at commercial banks and thrift institutions B) purchasing government securities in the open market C) increasing margin requirements on stock purchases D) increasing the discount rate

7. Assume the required reserve ratio is 10%. If the Federal Reserve buys $1 million in government securities from the public, then the money supply will immediately _____ and the maximum money-lending potential of the commercial banking system will ____. a. decrease by $1 million, decrease by 10 million b. increase by $1 million, decrease by $1 million c. increase by $1 million, increase by $1 million d. increase by $1 million, increase by $10 million e. decrease by $1 million, decrease by 1 million

8. Assume the economy faces stable employment but there is a danger of rising prices. Which combination of fiscal and monetary policies is most likely to reduce inflation? a. the purchase of government securities in the open market and an increase in taxes b. the purchase of government securities in the open market and an increase in government spending c. the sale of government securities in the open market and a decrease in taxes d. the sale of government securities in the open market and a decrease in government spending

9. The most frequently used monetary device for achieving price stability is: a. open-market operations. c. the reserve ratio. b. the discount rate. d. federal funds rate 10. Assume the economy faces high unemployment but stable prices. Which combination of government policies is most likely to reduce unemployment? A) the purchase of government securities in the open market and an increase in taxes B) the sale of government securities in the open market and a decrease in taxes C) the sale of government securities in the open market and a decrease in government spending D) the purchase of government securities in the open market and an increase in government spending

11. Higher interest rates in the US will make US assets ______attractive for foreign investors. This will _____ the demand for dollars, so the dollar will ______. a. more, increase, depreciate b. more, increase, appreciate c. less, decrease, depreciate d. more, decrease, appreciate

12. What is the difference between fiscal and monetary policy?

13. Draw and demand and supply graph showing equilibrium in the money market. Suppose the Fed want s to lower the interest rate. Show on the graph how the Fed accomplishes this objective. Is this contractionary or expansionary policy? Next, sketch an Aggregate demand and Aggregate supply graph showing the impact of lower interest rates on real GDP and the P level. 14. Find a news article related to current monetary policy of the Fed (keywords: money supply, interest rates). Comment.