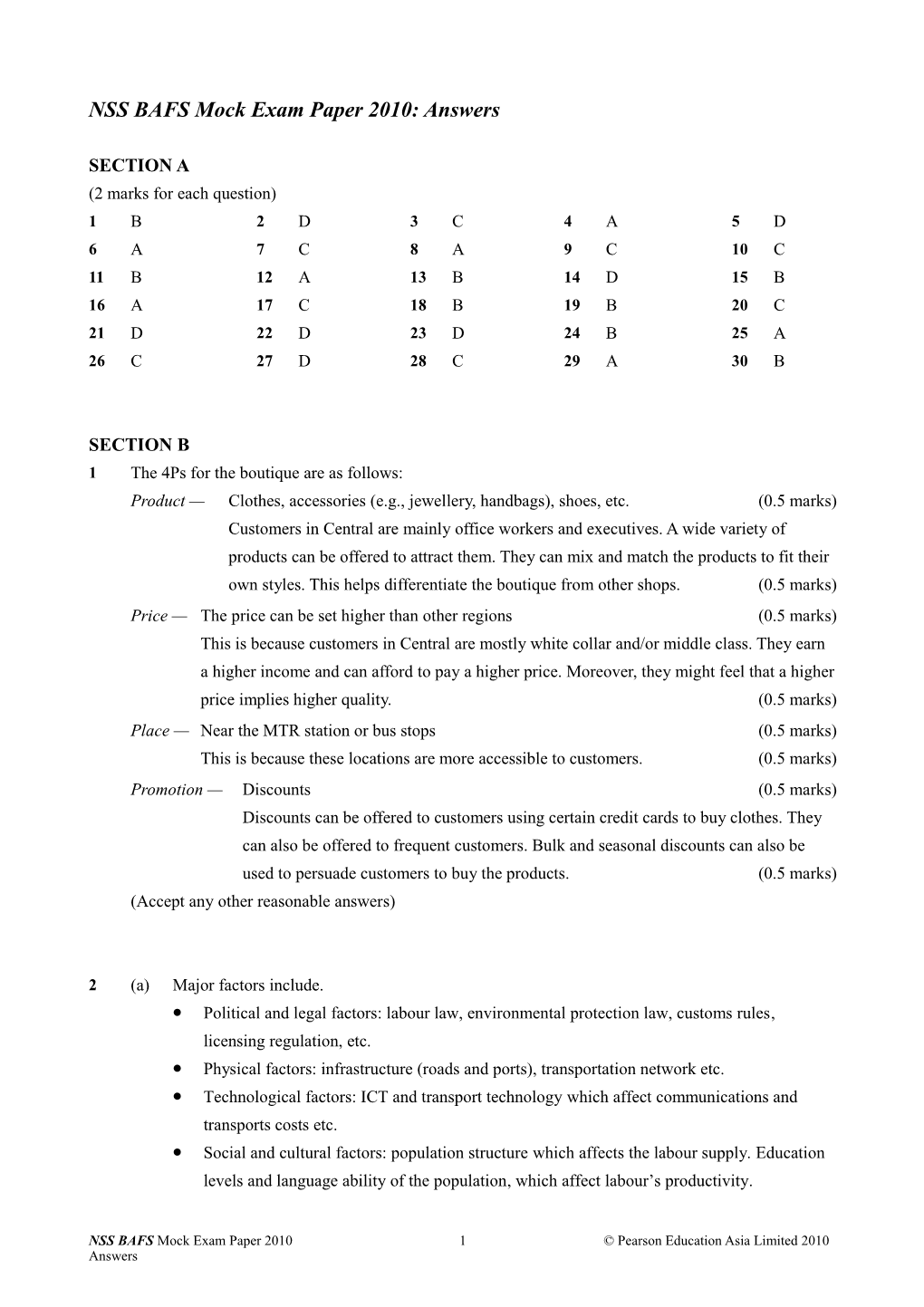

NSS BAFS Mock Exam Paper 2010: Answers

SECTION A (2 marks for each question) 1 B 2 D 3 C 4 A 5 D 6 A 7 C 8 A 9 C 10 C 11 B 12 A 13 B 14 D 15 B 16 A 17 C 18 B 19 B 20 C 21 D 22 D 23 D 24 B 25 A 26 C 27 D 28 C 29 A 30 B

SECTION B 1 The 4Ps for the boutique are as follows: Product — Clothes, accessories (e.g., jewellery, handbags), shoes, etc. (0.5 marks) Customers in Central are mainly office workers and executives. A wide variety of products can be offered to attract them. They can mix and match the products to fit their own styles. This helps differentiate the boutique from other shops. (0.5 marks) Price — The price can be set higher than other regions (0.5 marks) This is because customers in Central are mostly white collar and/or middle class. They earn a higher income and can afford to pay a higher price. Moreover, they might feel that a higher price implies higher quality. (0.5 marks) Place — Near the MTR station or bus stops (0.5 marks) This is because these locations are more accessible to customers. (0.5 marks) Promotion — Discounts (0.5 marks) Discounts can be offered to customers using certain credit cards to buy clothes. They can also be offered to frequent customers. Bulk and seasonal discounts can also be used to persuade customers to buy the products. (0.5 marks) (Accept any other reasonable answers)

2 (a) Major factors include. Political and legal factors: labour law, environmental protection law, customs rules, licensing regulation, etc. Physical factors: infrastructure (roads and ports), transportation network etc. Technological factors: ICT and transport technology which affect communications and transports costs etc. Social and cultural factors: population structure which affects the labour supply. Education levels and language ability of the population, which affect labour’s productivity.

NSS BAFS Mock Exam Paper 2010 1 © Pearson Education Asia Limited 2010 Answers Economic factors: wage level, price level (affecting rent and other production costs), control of capital inflows and outflows, taxation policy, foreign exchange policy, etc. (Accept any other reasonable answers) (Any three of the above, one mark each)

(b) Many East Asian countries are politically unstable. Factory owners may not be familiar with their business environments. Information management can help collect important political and legal information. It can also help assess and identify the risks of investing there and develop the most suitable methods for controlling those risks. (2 marks)

3 Overstatement of opening inventory would lead to an overstatement of the cost of goods sold, hence an understatement of reported net profit. In contrast, overstatement of the closing inventory would lead to an understatement of the cost of goods sold and an overstatement of reported net profit. (2 marks)

In this question, overstatement of the opening inventory reduced the reported net profit by $3,000, while overstatement of the closing inventory increased the reported net profit by $4,300. As a result, the reported net profit for the year was overstated by $1,300 ($4,300 $3,000). (2 marks)

4 Fanny Chan 2010 $ 2010 $ Nov 30 Balance c/d 520 Nov 1 Purchases 520 1/4

Dec 1 Balance b/d 520 1/4

Purchases 2010 $ 2010 $ Nov 1 Balance b/f 9,470 Nov 5 Drawings 1,200 1/4 “ 1 Fanny Chan 520 “ 30 Balance c/d 8,790 1/4 9,990 9,990

Dec 1 Balance b/d 8,790 1/4

Drawings 2010 $ 2010 $ Nov 1 Balance b/f 1,270 Nov 30 Balance c/d 2,470 “ 5 Purchases 1,200 1/4 2,470 2,470

Dec 1 Balance b/d 2,470 1/4

NSS BAFS Mock Exam Paper 2010 2 © Pearson Education Asia Limited 2010 Answers Capital 2010 $ 2010 $ Nov 30 Balance c/d 22,050 Nov 1 Balance b/f 21,550 “ 15 Bank 500 1/4 22,050 22,050

Dec 1 Balance b/d 22,050 1/4

Bank 2010 $ 2010 $ Nov 15 Capital 500 Nov 1 Balance b/f 720 1/4 “ 29 Peter Lai 1,264 “ 25 Rent 660 1/4 1/4 “ 30 Balance c/d 384 1,764 1,764

Dec 1 Balance b/d 384 1/4

Rent 2010 $ 2010 $ Nov 1 Balance b/f 880 Nov 30 Balance c/d 1,540 “ 25 Bank 660 1/4 1,540 1,540

Dec 1 Balance b/d 1,540 1/4

Peter Lai 2010 $ 2010 $ Nov 1 Balance b/f 1,320 Nov 29 Bank 1,254 1/4 “ 29 Discounts allowed 66 1/4

1,320 1,320 1/4

Discounts allowed 2010 $ 2010 $ Nov 29 Peter Lai 66 Nov 30 Balance c/d 66 1/4

Dec 1 Balance b/d 66 1/4

5 (a) Cash Book Date Details Discount Cash Bank Date Details Discount Cash Bank 2010 $ $ $ 2010 $ $ $ Jan 1 Balance b/f 800 Jan 1 Balance b/f 400 1/4

NSS BAFS Mock Exam Paper 2010 3 © Pearson Education Asia Limited 2010 Answers “ 5 Mandy Chan 432 “ 1 Petty cash 300 1/4 1/4 “ 8 Nancy Kwan 30 1,170 “ 13 Amy Chan 14 546 1/2 1/2 “ 19 Bank 100 “ 19 Cash 100 1/4 1/4 “ 26 Mandy Chan 20 “ 31 Balance c/d 1,352 1/4 “ 31 Balance c/d 176 30 1,352 1,346 14 1,352 1,346 Feb 1 Balance b/d 1,352 Feb 1 Balance b/d 176 1/2 “ 1 Petty cash 38 1/2

(b) Petty Cash Book Receipt Date Details Total Postage General Ledger expenses account $ 2010 $ $ $ $ 300 Jan 1 Bank 1/4 “ 9 Postage 20 20 1/4 “ 30 General expenses 18 18 1/4 38 20 18 “ 31 Balance c/d 262 300 300 262 Feb 1 Balance b/d 1/4 38 “ 1 Bank 1/2

NSS BAFS Mock Exam Paper 2010 4 © Pearson Education Asia Limited 2010 Answers 6 (a) Working capital = Current assets - Current liabilities $180,000 = Inventory (I) + Accounts receivable (R) + Bank (B) Accounts payable (P) $180,000 = I + R + B P I + R + B = $180,000 + P ---- (1) (1 mark)

Given the current ratio was 2.2 : 1, (I + R + B) ÷ 2.2 = P ÷ 1 I + R + B = 2.2P ---- (2) (1 mark)

Substitute (2) into (1) 2.2P = $180,000 + P (1 mark) 1.2P = $180,000 P = $150,000 Accounts payable as at 31 December 2010 = $150,000 (1 mark)

(b) Given the quick ratio was 1.1 : 1, (R + B) ÷ 1.1 = P ÷ 1 R + B = 1.1 P (1 mark) Substitute P = $150,000 and B = $180,000 × 30% into the equation, R + ($180,000 × 30%) = 1.1 × $150,000 R + $54,000 = $165,000 R = $111,000 (1 mark) Accounts receivable as at that date = $111,000

(c) Substitute R = $111,000, B = $54,000 and P = $150,000 into (1) I + $111,000 + $54,000 = $180,000 + $150,000 I = $165,000 Inventory as at 31 December 2010 = $165,000 (1 mark)

7 (a) Purchases Journal Date Details Amount 2010 $ Jan 3 Lawrence Wong ($1,460 × 90%) 1,314 1/4 " 8 Ronald Tseng ($3,150 × 88%) 2,772 1/4 " 12 Besa Cheung ($3,340 × 85%) 2,839 1/4 " 21 Freda To ($5,670 × 80%) 4,536 1/4 " 31 Total credit purchases for the month 11,461 1/4

NSS BAFS Mock Exam Paper 2010 5 © Pearson Education Asia Limited 2010 Answers Returns Outwards Journal Date Details Amount 2010 $ Jan 16 Ronald Tseng ($400 × 88%) 352 1/4 " 27 Freda To ($500 × 80%) 400 1/4 " 31 Total returns outwards for the month 752 1/4

(b) Gross profit = Sales Cost of goods sold = $32,127 ($11,461 $752) = $21,418 (1 mark)

(c) Gross profit ratio = Gross profit ÷ Sales = $21,418 ÷ $32,127 = 66 2/3% (1 mark)

8 Sandy Wong Income Statement for the year ended 28 February 2010 $ $ $ $ Opening inventory 11,340 Sales 199,170 1/4 1/4 Add Purchases 139,860 Less Returns inwards (4,680 ) 194,490 1/4 1/4 Carriage inwards 185 1/4 140,045 Less Returns outwards (5,985 ) 134,060 1/4 145,400 Less Closing inventory (13,450 ) 1/4 Cost of goods sold 131,950 Gross profit c/d 62,540 1/4 194,490 194,490 Electricity 3,510 Gross profit b/d 62,540 1/4 Rent and rates 2,070 1/4 Salaries and wages 43,650 1/4 Net profit 13,310 1/4 62,540 62,540

Statement calculating total assets for Sandy Wong’s business as at 28 February 2010 $ $ Non-current assets Premises 97,600 1/4 Office equipment 25,200 1/4 Motor vehicles 18,900 141,700 1/4

Current assets Inventory, 28 February 2010 13,450 1/4 Accounts receivable 23,103 1/4 Cash 68 36,621 1/4 178,321

NSS BAFS Mock Exam Paper 2010 6 © Pearson Education Asia Limited 2010 Answers Statement calculating total liabilities for Sandy Wong’s business as at 28 February 2010 $ $ Non-current liabilities Bank loan (repayable on 28 February 2018) 28,800 1/4

Current liabilities Accounts payable 14,144 1/4 Bank overdraft 864 15,008 1/4 43,808

Statement calculating the capital balance for Sandy Wong’s business as at 28 February 2010 $ Capital 130,743 1/4 Profit for the year 13,310 1/4 144,053 Less Drawings (9,540) 1/4 134,513

NSS BAFS Mock Exam Paper 2010 7 © Pearson Education Asia Limited 2010 Answers