March 14, 2013

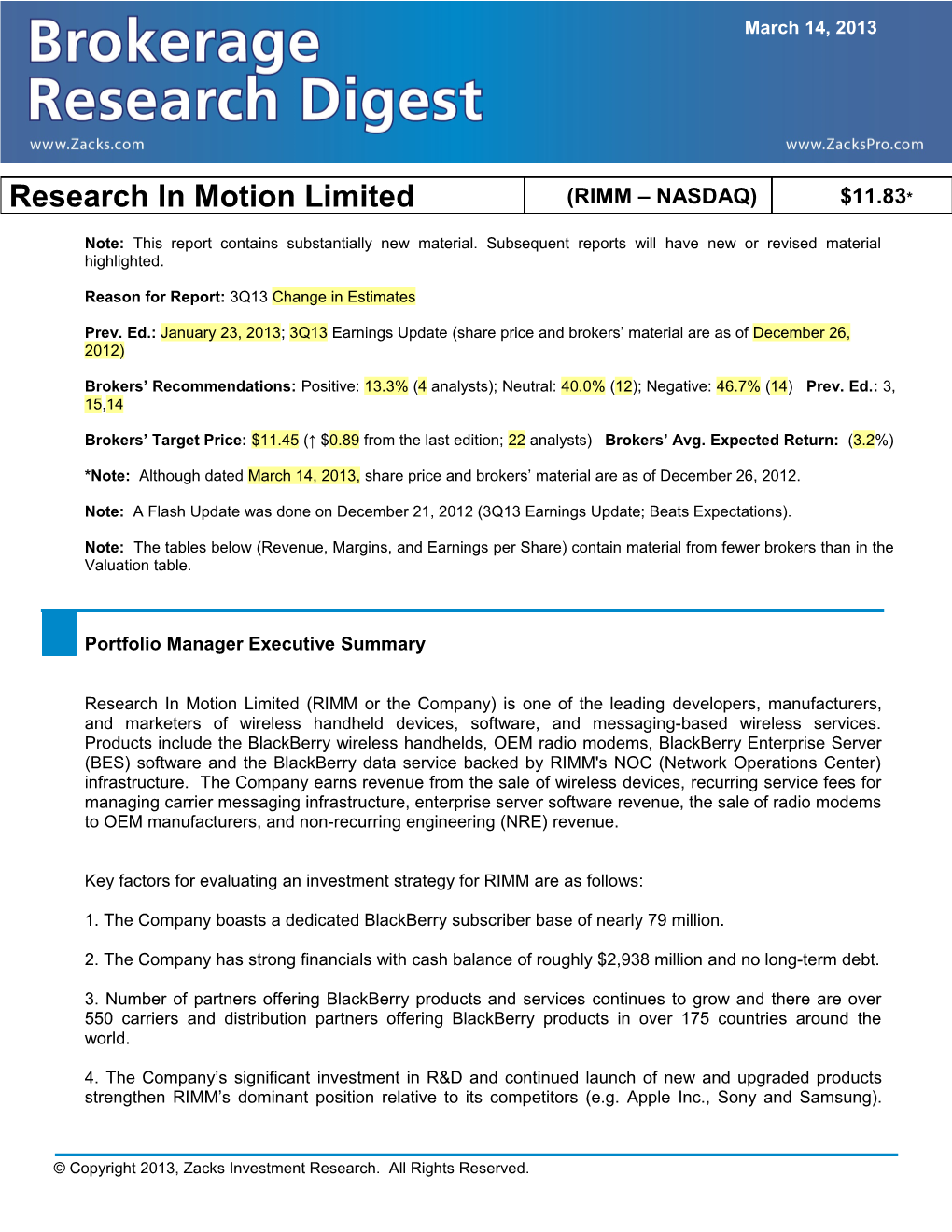

Research In Motion Limited (RIMM – NASDAQ) $11.83*

Note: This report contains substantially new material. Subsequent reports will have new or revised material highlighted.

Reason for Report: 3Q13 Change in Estimates

Prev. Ed.: January 23, 2013; 3Q13 Earnings Update (share price and brokers’ material are as of December 26, 2012)

Brokers’ Recommendations: Positive: 13.3% (4 analysts); Neutral: 40.0% (12); Negative: 46.7% (14) Prev. Ed.: 3, 15,14

Brokers’ Target Price: $11.45 (↑ $0.89 from the last edition; 22 analysts) Brokers’ Avg. Expected Return: (3.2%)

*Note: Although dated March 14, 2013, share price and brokers’ material are as of December 26, 2012.

Note: A Flash Update was done on December 21, 2012 (3Q13 Earnings Update; Beats Expectations).

Note: The tables below (Revenue, Margins, and Earnings per Share) contain material from fewer brokers than in the Valuation table.

Portfolio Manager Executive Summary

Research In Motion Limited (RIMM or the Company) is one of the leading developers, manufacturers, and marketers of wireless handheld devices, software, and messaging-based wireless services. Products include the BlackBerry wireless handhelds, OEM radio modems, BlackBerry Enterprise Server (BES) software and the BlackBerry data service backed by RIMM's NOC (Network Operations Center) infrastructure. The Company earns revenue from the sale of wireless devices, recurring service fees for managing carrier messaging infrastructure, enterprise server software revenue, the sale of radio modems to OEM manufacturers, and non-recurring engineering (NRE) revenue.

Key factors for evaluating an investment strategy for RIMM are as follows:

1. The Company boasts a dedicated BlackBerry subscriber base of nearly 79 million.

2. The Company has strong financials with cash balance of roughly $2,938 million and no long-term debt.

3. Number of partners offering BlackBerry products and services continues to grow and there are over 550 carriers and distribution partners offering BlackBerry products in over 175 countries around the world.

4. The Company’s significant investment in R&D and continued launch of new and upgraded products strengthen RIMM’s dominant position relative to its competitors (e.g. Apple Inc., Sony and Samsung).

© Copyright 2013, Zacks Investment Research. All Rights Reserved. Moreover, the Company plans to launch more user-friendly QNX-based BlackBerry 10 handsets, which are expected to withstand stiff competition from other smartphone makers.

5. The Company has 11 manufacturing sites including the Waterloo facility. Moreover, in the recent past, the Company acquired Certicom, Torch Mobile, The Astonishing Tribe, NewBay, QNX, Gist and Tungle, which will certainly help the Company in its transition phase and will also deliver highly upgradable products to its customers in the forthcoming years.

6. The Company uses Jabil, Flextronics and Celestica for manufacturing finished hardware.

Competition: Research In Motion Limited faces stiff competition in the handset market, most notably from Apple, Samsung and LG, apart from Nokia and HTC. According to the analysts, the competition is expected to intensify with new competitive product launches anticipated in 2013 and beyond.

On the positive side, the analysts also favor RIMM’s end-to-end platform that offers superior user experience, bandwidth efficiency, battery life, reliability, carrier services enablement and support. With increasingly congested 3G networks, spectrum efficiency is a particular edge of BlackBerry, the NOC, and device/software, which work together to optimize user experience and minimize network congestion, sustaining distribution leverage advantage and margins by offering superior carrier profitability.

Of the 30 analysts in the Digest Group covering the stock, four analysts assigned positive ratings, 12 analysts rendered negative ratings while the remaining 14 analysts were negative on the stock. The analysts’ target price ranges from a low of $7.00 to a high of $23.00, with the average at $11.45. On an average, the analysts expect a return of (3.2%) from the stock based on the current price.

Bullish (Buy or equivalent ratings) – 4 analysts or 13.3% – Despite declining sales in the previous few quarters, these analysts remain optimistic about the Company based on the launch of its BB10 based device. The analysts prefer to remain positive on RIMM mainly based on strong financial position, highly- secure BlackBerry Messenger (BBM) service network, strong distribution network, dedicated BBM subscriber base and continuous subscriber growth. Moreover, the Company possesses huge mobile patent portfolio, which may increase the takeover value of the Company.

Neutral (Neutral or equivalent ratings) – 12 analysts or 40.0% – These analysts remain positive about the success of the new BlackBerry10 (BB10) based handset in a crowded smartphone market. However, higher margin pressure and rising material costs remains the near term headwind. Despite making strong progress with the new operating platform, these analysts remain highly apprehensive regarding RIMM’s new near-term growth prospect as the Company lacks popular smartphone portfolio and faces stiff competition from Apple Inc.’s iPhone and Google Inc.’s (GOOG) Android based devices.

Bearish (Negative or equivalent ratings) – 14 analysts or 46.7% – These analysts are negative on the stock based on weaker PlayBook sales, continuous loss of market share, lower Average Selling Price (ASP), declining Average Revenue Per User (ARPU), poor management implementation, fierce competition from Apple and other android smartphones. Furthermore, the Company lacks proper visibility about the success of its upcoming BB10 devices.

Long-Term Outlook: The brokerage firms believe that RIMM is one of the pure-play leaders in the telecom space. The Company offers connectivity to corporate email and other corporate applications through its BlackBerry devices and service. The overall financial trend of the Company is improving, thereby providing RIMM with a market leading position in due course.

March 14, 2013

Zacks Investment Research Page 2 ww.zackspro.com Overview

Brokerage firms have identified the following factors for evaluating the investment merits of RIMM:

Key Positive Arguments Key Negative Arguments Compelling Fundamentals Fundamental Weaknesses Strong balance sheet Increasing dependence on the carrier channel to Competitive Position capture new subscribers Dominant position in the PDA market, leveraging Competitive Threats the popularity of wireless email Pricing pressure due to competition from new entrants Strong brand recognition in the enterprise Emerging competition from standard-based hardware segment vendors (Nokia, Motorola, Samsung, H-P, and others), Strong patents on wireless data solutions and device agnostic software vendors (Microsoft) Offers a stable, intuitive and best performing Market share could decline as new competitive platform in the industry as the only provider that devices and server offerings hit the market controls all key elements of its system Negative Hardware Sales Growth Opportunities Success of RIMM’s BlackBerry Connect Licensing Multiple growth opportunities, such as program may negatively impact hardware sales geographical or carrier expansion, incremental Currency Risks enterprise data solutions and licensing of its A substantial part of operating cost is denominated in technology to third party OEMs C$; and if US dollar depreciates, it could lead to Faster-than-expected market expansion margin compression Leader in wireless email enterprise solutions Legal Proceedings Replacement cycle accelerated by new product Research In Motion Limited is engaged in a number of launches legal battles, which can negatively impact the Company

Founded in 1984 and based in Waterloo, Ontario, Research In Motion Limited (RIMM or the Company) designs, manufactures and markets wireless solutions for the worldwide mobile communications market. The Company provides platforms and solutions for access to time-sensitive information, including email, phone, short-messaging service, organizers, Internet, and intranet-based corporate data applications. Research In Motion Limited’s technology enables third-party developers and manufacturers to enhance their products and services with wireless connectivity. The Company’s award-winning product portfolio includes the BlackBerry wireless platform, the RIMM Wireless Handheld product line, software development tools, radio-modems and software/hardware licensing agreements. The Company’s website is www.rim.net.

Note: The Company’s fiscal year ends in February. All quarterly and annual references are construed accordingly.

March 14, 2013

Long-Term Growth

The Company has been able to successfully differentiate its BlackBerry products from other offerings in the communications market by offering a convenient, reliable, and secure way of accessing corporate email in real time. The Company is continuously introducing next-generation products and incorporating 3G wireless technologies. The demand for its smartphone PDA devices has been overwhelming, especially with the high-end corporate customers. In addition, geographic expansion, new low-cost

Zacks Investment Research Page 3 ww.zackspro.com models, and an emphasis on sales through the wireless carrier channels have driven the Company’s success.

However, of late the Company is facing huge competitive pressure from Apple Inc.’s (AAPL) iPhones and other Android-based devices. A continuous loss of market share in the US and European markets have forced RIMM to enter into the prepaid market mainly targeting the emerging nations by reducing its prices on popular handsets. Management also anticipates that the Company will continue to face such pricing pressure in 2013, thereby putting pressure on both its top and bottom lines.

RIMM’s offering is broader than push email and includes instant messaging, enterprise application services, and PBX functionality, providing it with a significant competitive advantage over other similar offerings. The analysts believe that the recent launch of RIMM’s new smartphones based on QNX and BB10 operating platforms in Jan 2013 is receiving good customer response in the global market. In addition, the analysts noted that distribution channels in Europe, Eastern Europe and Latin America have significant room to ramp, and European carriers are increasing promotions with RIMM devices and the new BlackBerry Unite platform.

The communication equipment industry is characterized by rapidly changing technology, evolving industry standards and continuing improvements in the telecommunications service offerings of common service providers. Given the number of players in this space, the capital required to develop and support telecommunication access systems, and the overall market size, the firms expect vertical integration and consolidation to occur going forward.

March 14, 2013

Target Price/Valuation

Provided below is a summary of target price and rating as compiled by Zacks Research Digest:

Rating Distribution Positive 13.3%↑ Neutral 40.0%↓ Negative 46.7%↑ Avg. Target Price $11.45↑ Maximum Target Price $23.00↑ Minimum Target Price $7.00↑ No. of Analysts with Target Price/Total 22/30

The firms have identified the following risks in the achievement of the target price: deteriorating macroeconomic environment, increased competition from new entrants or current players, delay in penetrating new markets, decline in the subscriber growth rate and slowdown in new model introduction.

March 14, 2013

Zacks Investment Research Page 4 ww.zackspro.com Recent Events

On March 28, 2013 AMT is expected to release its 4Q13 earnings after the market closes.

On January 30, 2013, RIMM announced the launch of its much awaited BlackBerry 10 (BB10) based device. The Company launched BlackBerry Z10 (touch screen) and BlackBerry Q10 (Physical keyboard), powered by BB10 based operating system.

On January 23, 2013, RIMM introduced new Enterprise Mobility Management (EMM) solution, BlackBerry Enterprise Service 10 for its clients.

On December 20, 2012, RIMM announced its 3Q13 financial results. Key highlights are as follows:

Total revenues came in at $2,727 million versus $5,190 million in 3Q12 and were well above the Zacks Consensus Estimate of $2,647 million.

Gross Margin was 30.4% against 27.2% in 3Q12.

Pro forma loss per share was $0.22 against $1.27 in 3Q12 and also better than the Zacks Consensus Estimate of a loss of $0.35.

On July 14, 2012, RIMM incurred a hefty charge of $147.2 million for infringing the patents of Mformation Technologies.

March 14, 2013

Revenue

Provided below is a summary of revenue as compiled by Zacks Research Digest:

Revenue ($M) 3Q12A 2012A 2Q13A 3Q13A 4Q13E 2013E 2014E 2015E Zacks Consensus $2,936.0 $11,332.0↑ $12,094.0↑ Digest High $5,233.0 $18,491.0 $2,873.0 $2,727.0 $3,956.0 $12,370.0↑ $21,436.0↑ $12,862.1↓ Digest Low $5,166.0 $18,432.0 $2,873.0 $2,727.0 $2,540.0 $10,267.0 $9,898.0↑ $9,787.0↓ Digest Average $5,190.5 $18,454.0 $2,873.0 $2,727.0 $2,967.3 $11,303.6↑ $12,882.1↑ $10,987.3↓ Y/Y Growth -5.5% -7.3% -31.1% -47.5% -29.2% -38.8%↓ 14.0%↑ -14.7%↓ Q/Q Growth 24.6% 2.1% -5.1% 8.8% *Note: Blank cells indicate the analysts did not provide any numbers

According to the Company press release and the Digest model, total revenue was $2,727 million in 3Q13, down 47.5% y/y and 5.1% q/q. Tepid demand for BlackBerry smartphones has resulted in such a huge drop in revenue for the Company.

Provided below is a summary of segment revenue as compiled by Zacks Research Digest:

Zacks Investment Research Page 5 ww.zackspro.com Revenue ($M) 3Q12A 2012A 2Q13A 3Q13A 4Q13E 2013E 2014E 2015E Devices $4,081.1 $13,784.3 $1,716.5 $1,620.1 $1,957.6 $6,937.7↑ $8,759.9↑ $8,194.5 Services $993.3 $4,099.6 $1,005.2 $977.6 $931.7 $3,922.3↓ $3,203.0↓ $2,185.0 Software $79.0 $317.9 $68.5 $61.9 $69.6 $264.4↓ $260.6↓ $304.0 Other $36.9 $236.7 $79.3 $50.1 $66.0 $280.0↑ $264.5↑ $246.0 Total Revenue $5,190.5 $18,454.0 $2,873.0 $2,727.0 $2,967.3 $11,303.6↑ $12,882.1↑ $10,987.3 *Note: Blank cells indicate the analysts did not provide any numbers

Provided below is a graphical representation of segmental revenue:

2012A Revenue Segm ents 2013E Revenue Segm e nts

1% 2% 2% 2% 22% Devices Devices 34% Service Service 62% Softw are Softw are 75% Other Other

2014E Re venue Segm e nts 2015E Revenue Segm e nts

2% 2%

2% 3%

26% 20% Devices Device s

Service Service

Softw are 70% Softw are 75% Other Other

Devices/Handhelds (59.4% of 3Q13 revenue): Handheld devices include smartphones and tablets. RIMM generates handheld revenue from sales, primarily to the carriers of BlackBerry wireless devices. Handheld devices revenue came in at $1,620.1 million in 3Q13, down 60.3% y/y and 5.6% q/q.

Services (35.8% of 3Q13 revenue): RIMM generates services revenue from billings to its BlackBerry subscriber account base primarily from a monthly infrastructure access fee to a carrier/distributor. Service revenue was $977.6 million in 3Q13, down 1.6% y/y and 2.7% q/q.

Software (2.3% of 3Q13 revenue): Software licenses revenue consists of fees from licensing BlackBerry Enterprise server (BES) software; client access licenses (CALs); maintenance and upgrades to software; and technical supports. Software revenue was $61.9 million in 3Q13, down 21.7% y/y and 9.6% q/q.

Zacks Investment Research Page 6 ww.zackspro.com Other (1.8% of 3Q13 revenue): Other revenue consists of revenue from non-warranty repair activities, accessory sales, NRE and gains and losses on revenue hedging instruments. Other revenue was $50.1 million in 3Q13, up 35.6% y/y but down 36.9% q/q.

In 3Q13, RIMM sold 6.9 million BlackBerry devices and around 255,000 BlackBerry Playbook tablets. At the end of 3Q13, the global subscriber base of BlackBerry devices increased 1 million to a total of about 79 million.

Outlook

RIMM’s new BB10 based smartphone have much advanced features like the Blackberry Hub, BlackBerry Enterprise service 10 and BlackBerry Balance, which will not only gain new subscribers but will also perk up the Company’s future growth prospects. Moreover, RIMM is planning to tie up with popular telecom carriers across different countries in order to launch its much hyped BB10 smartphone, which these analysts believe will act as a positive catalyst for the Company in future.

Going forward, management remains highly optimistic about the success of the newly launched BlackBerry 10-based devices. The Company has made significant development in its latest platform by enriching it with popular applications and is also making strong investment in promoting its latest operating platform. More than150 carriers have undertaken a trial run of this product and 120 business enterprises have tested its Enterprise services beta programs.

However, the Company believes that the launch of BlackBerry 10-based handsets may slow down the sales of BlackBerry 7–based smartphones, as these customers want the new phone, instead of the older model. Moreover, management expects lower revenue in the fourth quarter, on the back of the increased promotion associated with the launch of the new handset.

Some Analysts believe that the new device is performing well in Canada, UK and UAE. The BlackBerry 10 has recently been launched in Malaysia, Singapore and India. AT&T Inc. (T) recently announced that it will sell the touch screen version of the latest BB10 based device from Mar 22 2013. It is seen as an opportunity that will give the Company a foothold in the lucrative US market. Another large US carrier T- Mobile USA also announced that it will be launching the latest device by the end of March, 2013.

However, third largest US carrier Sprint Nextel Corp (S) announced that it will not sell the touch screen version of the phone and will instead launch the QWERTY based device, when it eventually comes up for sale in the US. Most analysts remain concerned about the sustainability of the latest device and believe that the Company will face competition from Apple Inc.’s (AAPL) new iPhone 5 and yet-to-be-launched Samsung’s Galaxy S4. They sense that RIMM will continue to loose market traction in highly developed markets like the US and Canada.

Margins

Provided below is a summary of margins as compiled by Zacks Research Digest:

Margins 3Q12A 2012A 2Q13A 3Q13A 4Q13E 2013E 2014E 2015E

Gross 37.2% 40.0% 28.4% 31.6% 29.0% 29.4%↑ 29.4%↓ 31.4%

Operating 16.8% 15.0% -7.9% -6.4% -7.5% -8.2%↑ -2.5%↓ -0.8%↓

Pre-Tax 16.9% 15.2% -7.9% -5.8% -6.5% -7.8%↑ -2.1%↓ -0.7%

Net 12.8% 11.9% -4.9% -4.2% -5.0% -5.3%↑ -1.4%↓ 0.9%↓

Zacks Investment Research Page 7 ww.zackspro.com According to the Digest model, gross profit in 3Q13 was $862 million, down by a substantial 55.3% y/y but up 5.8% q/q. Gross margin was 31.6% in 3Q13 against 37.2% in 3Q12 and 28.4% in 2Q13.

Selling, marketing and administration (SG&A) expense was $468 million in 3Q13, down 17% y/y and 8.4% q/q. Research and development (R&D) expense was $389 million in 3Q13, down 6.3% y/y and 12.1% q/q.

EBITDA in 3Q13 was ($50.3) million, down 105% y/y and 71.9% q/q.

Operating loss in 3Q13 was $175 million, down 120% y/y but up 22.9% q/q.

Net loss in 3Q13 was $114.1 million, down by a substantial 117.1% y/y but up 19.5% q/q.

Outlook

Most of the analysts believe that reduction of mobile phone prices in the emerging markets coupled with the reduction of high-value service plans may trigger subscriber growth in the near term but will simultaneously affect the Company’s margin going forward. Moreover, growth of prepaid subscribers as compared with the postpaid subscribers, which happens to be more profitable for the Company will further decline operating margins. These analysts also believe that the launch of new phones will increase RIMM’s material cost on account of use of expensive parts and will further compress the Company’s margin in FY13.

Implementation of Cost Optimization and Resource Efficiency (CORE) strategy undertaken by the Company includes reduction of staff strength by approximately 5,000 workers, restructuring the supply chain management and outsourcing non-core functions. It will not only result in achieving the target savings of $1 billion for the Company but also boost RIMM’s operating margin going forward. In order to control cost and improve efficiency, the Company is outsourcing the Global Repair Services unit, which they believe will drive margins in the years to come. Moreover, reduced handset prices in order to boost sales coupled with monthly infrastructure access fees will continue to impact margins and ARPU growth in the forthcoming quarters.

Earnings per Share

Provided below is a summary of EPS as compiled by Zacks Research Digest:

EPS 3Q12A 2012A 2Q13A 3Q13A 4Q13E 2013E 2014E 2015E Zacks Consensus ($0.28) ($1.21)↓ ($0.44)↓ Digest High $1.27 $4.21 ($0.27) ($0.22) ($0.12) ($0.99)↑ $0.94↓ $0.76↑ Digest Low $1.27 $4.19 ($0.27) ($0.22) ($0.52) ($1.34)↓ ($2.30)↓ ($0.25)↓ Digest Avg. $1.27 $4.20 ($0.27) ($0.22) ($0.29) ($1.13)↓ ($0.44)↓ $0.18↑ Y/Y Growth -27.1% -33.9% -133.7% -117.3% -135.6% -127.0%↓ 61.3%↑ 141.1%↑ Q/Q Growth 58.7% 26.8% 18.8% -29.9% *Note: Blank cells indicate the analysts did not provide any numbers

Outlook

Zacks Investment Research Page 8 ww.zackspro.com According to the Company press release and the Digest model, Pro forma EPS in 3Q13 was ($0.22), down 117.3% y/y but up 18.8% q/q.

Going forward, most of the analysts believe that poor handset sales and huge investment regarding the launch of BB10 handsets will compress EPS growth.

Highlights from the EPS table are as follows:

4Q13 forecasts range from ($0.52) to ($0.12), with an average of ($0.29). 2013 forecasts range from ($1.34) to ($0.99), with an average of ($1.13). 2014 forecasts range from ($2.30) to ($0.94), with an average of ($0.44). 2015 forecasts range from ($0.25) to $0.76, with an average of $0.18.

StockResearchWiki.com – The Online Stock Research Community

Discover what other investors are saying about Research In Motion Limited (RIMM) at:

RIMM profile on StockResearchWiki.com

Research Analyst Kaustav Sarkar Copy Editor Anita Ganguli Content Ed. Nalak Das Reason for Report Daily

Zacks Investment Research Page 9 ww.zackspro.com