Department of Accounts Payroll Bulletin

Calendar Year 2014 May 14, 2014 Volume 2014-08

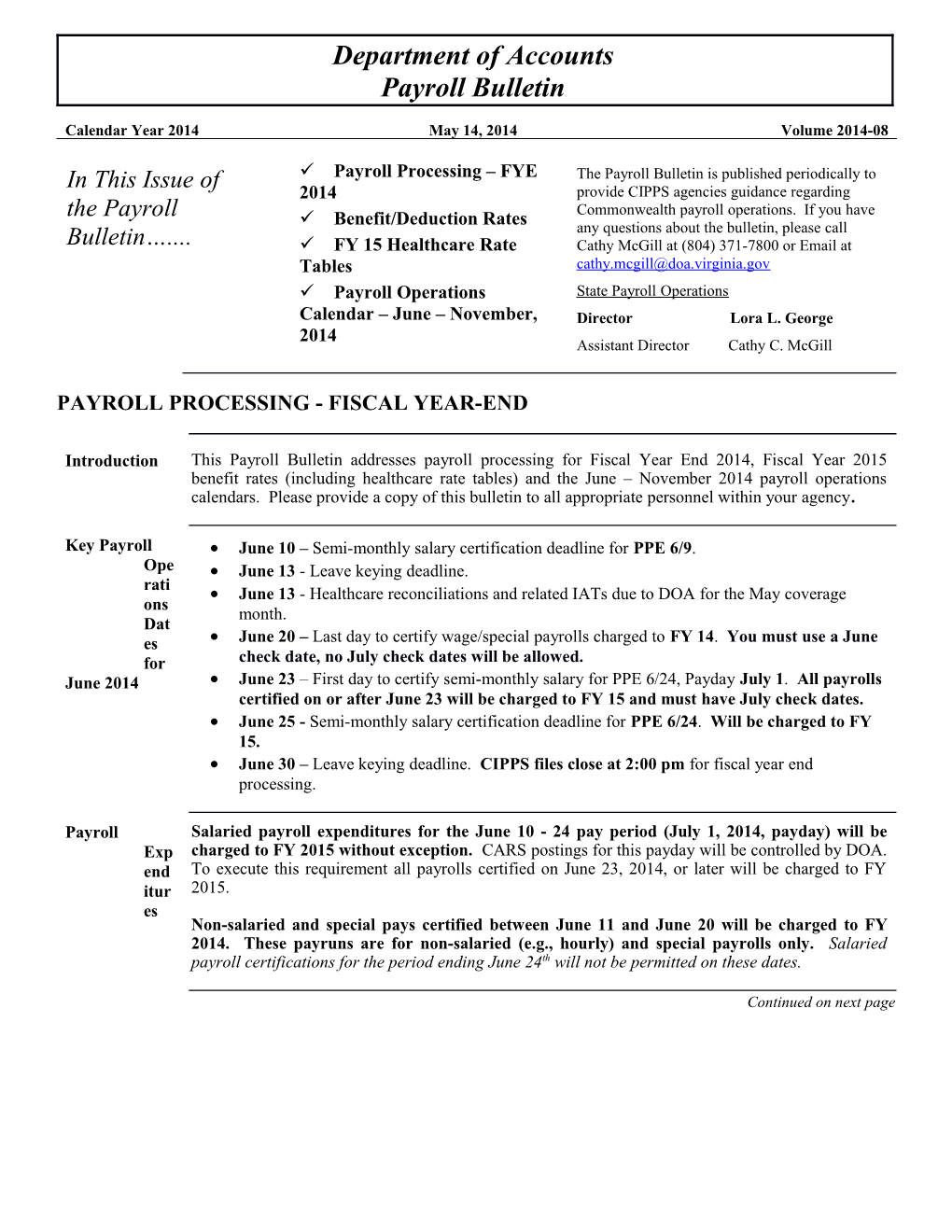

In This Issue of Payroll Processing – FYE The Payroll Bulletin is published periodically to 2014 provide CIPPS agencies guidance regarding the Payroll Commonwealth payroll operations. If you have Benefit/Deduction Rates any questions about the bulletin, please call Bulletin….... FY 15 Healthcare Rate Cathy McGill at (804) 371-7800 or Email at Tables [email protected] Payroll Operations State Payroll Operations Calendar – June – November, Director Lora L. George 2014 Assistant Director Cathy C. McGill

PAYROLL PROCESSING - FISCAL YEAR-END

Introduction This Payroll Bulletin addresses payroll processing for Fiscal Year End 2014, Fiscal Year 2015 benefit rates (including healthcare rate tables) and the June – November 2014 payroll operations calendars. Please provide a copy of this bulletin to all appropriate personnel within your agency.

Key Payroll June 10 – Semi-monthly salary certification deadline for PPE 6/9. Ope June 13 - Leave keying deadline. rati June 13 - Healthcare reconciliations and related IATs due to DOA for the May coverage ons month. Dat es June 20 – Last day to certify wage/special payrolls charged to FY 14. You must use a June for check date, no July check dates will be allowed. June 2014 June 23 – First day to certify semi-monthly salary for PPE 6/24, Payday July 1. All payrolls certified on or after June 23 will be charged to FY 15 and must have July check dates. June 25 - Semi-monthly salary certification deadline for PPE 6/24. Will be charged to FY 15. June 30 – Leave keying deadline. CIPPS files close at 2:00 pm for fiscal year end processing.

Payroll Salaried payroll expenditures for the June 10 - 24 pay period (July 1, 2014, payday) will be Exp charged to FY 2015 without exception. CARS postings for this payday will be controlled by DOA. end To execute this requirement all payrolls certified on June 23, 2014, or later will be charged to FY itur 2015. es Non-salaried and special pays certified between June 11 and June 20 will be charged to FY 2014. These payruns are for non-salaried (e.g., hourly) and special payrolls only. Salaried payroll certifications for the period ending June 24th will not be permitted on these dates.

Continued on next page Calendar Year 2014 May 14, 2014 Volume 2014-08

PAYROLL PROCESSING - FISCAL YEAR-END, continued

FY 15 VRS Contribution rates for VRS-administered programs are found below. The rates presented are in the Reti Appropriations Act, but have not yet been approved. Notice will be provided should the final rates rem differ. The maximum annual compensation for retirement contributions for Plan Year 2015 (pay ent periods 6/25/2014 – 06/24/2015) is $260,000 for participants with membership dates on or after Rat April 9, 1996. The maximum is $385,000 for employees who became plan members before April 9, es 1996.

116 – 127 - Amt Reported to Total Charged Retirement - Plan 1 1111 1165 VRS Agency State Employees – Elected Officials 12.33% 5.00%* 17.33% 17.33% State Employees – All Others 12.33% N/A 17.33% 12.33% State Police (SPORS) 25.82% N/A 30.82% 25.82% Judicial 51.66% 5.00%* 56.66% 56.66% VaLORS 17.67% N/A 22.67% 17.67% Retirement - Plan 2 State Employees 12.33% N/A 17.33% 12.33% State Police (SPORS) 25.82% N/A 30.82% 25.82% Judicial 51.66% N/A 56.66% 51.66% VaLORS 17.67% N/A 22.67% 17.67%

116- 105- 106- Total Charged Hybrid 1111 1166 1166 Agency State Employees 8.83% - 11.33% 1.0% .5% - 2.5% 12.33% Judicial 48.16% - 50.66% 1.0% .5% - 2.5% 51.66%

Amt Reported to Total Charged Group Life Insurance 120 - 1114 VRS Agency 1.19% 1.19% 1.19%

Retiree Health Insurance 115 - 1116 Credit 1.05% 1.05% 1.05%

VSDP 136/144 - 1117 0.66% 0.66% 0.66%

* 5% member-portion continues to be paid for Plan 1 elected officials and Judicial coverage by the employer. All other Plan 1 employees pay the member portion.

Optional The rates for ORPs will not change for FY 15. The employer-contribution rates will be 10.4% and Reti 8.5% for existing “Plan 1” and “Plan 2” participants, respectively. Plan 2 participants continue to rem contribute 5% from pay. ent Rat The maximum annual compensation for retirement contributions for Plan Year 2015 (checks dated es 7/1/2014 – 6/30/2015) is $260,000 for participants with membership dates on or after April 9, 1996. The maximum is $385,000 for employees who became plan members before April 9, 1996.

Page 2 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

Continued on next page

Page 3 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

PAYROLL PROCESSING - FISCAL YEAR-END, continued

“P” and “N” Agencies are not required to use the “P” or “N” on payroll vouchers processed through CIPPS. Vou CIPPS payrolls post to CARS as a batch type 9, which does not require the “P/N” voucher process. cher s

Optional Effective July 1, 2014 (July 16, 2014 payday) the Optional Group Life rates for the age brackets Gro shown below will be reduced. The rates will continue to be based on the salary of the member and up the age of the member or spouse as of January 1, 2014. Rates for coverage of dependent children Life remain unchanged. Pre miu Age 30 – 34 Reduced $0.01 from $0.06 to $0.05, per month, per $1,000 of coverage m Age 35 – 39 Reduced $0.01 from $0.07 to $0.06, per month, per $1,000 of coverage Upd Age 55 – 59 Reduced $0.01 from $0.34 to $0.33, per month, per $1,000 of coverage ate Age 60 – 64 Reduced $0.01 from $0.66 to $0.65, per month, per $1,000 of coverage Age 65 – 69 Reduced $0.12 from $1.27 to $1.15, per month, per $1,000 of coverage

Reports documenting the coverage and premium amounts will be distributed around the middle of June. The file to change the Deduction 035 amounts will be loaded on June 30. Be sure to review the Report U024, OPTIONAL GROUP LIFE PREMIUM LISTING, and Report U025, OPTIONAL GROUP LIFE ERROR REPORT, in sufficient time to identify and make any necessary adjustments prior to certification.

Questions regarding coverage or premiums should be directed to Joe Chang at Minnesota Life at:

Joe Chang, Richmond Branch Office [email protected] Phone: 1-800-441-2258, ext. 101 Fax: 804-644-2460

CIPPS Security If you make changes to the individuals authorized to approve payroll expenditures on the Authorized Signatories Form (DA-04-121), be sure that you also complete the CIPPS Security Authorization form to add or remove that person’s access to CIPPS. Also keep in mind that updates to Payline/PAT Masking and CIPPS FINDS access may be necessary.

Deferred Comp The maximum amount of Supplemental Plan cash match that may be made for eligible employees and continues to be $20 per pay period. Based on the number of pay periods, maximum deduction Ann amounts per pay period are as follows: uity Cash Max. Match Max. Match Mat No Pays Amt No Pays Amt ch 9 $53.34 18 $26.67 10 $48.00 20 $24.00 11 $43.64 22 $21.82 12 $40.00 24 $20.00

Note: Hybrid employees contributing less than 4% voluntary contribution to the hybrid plan are not eligible for this supplemental cash match. Page 4 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

Continued on next page

Page 5 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

PAYROLL PROCESSING - FISCAL YEAR-END, continued

Page 6 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

Flexible Mass transactions to deactivate the flexible benefit deductions (Deduction 021, Dependent Care, Bene Deduction 022, Medical Reimbursement and Deduction 023, Administration Fees) and zero the fits amount and goal fields will be executed by DOA on June 30.

DOA will then establish the new deduction amounts for Plan Year 2015 and administrative fees from data provided through BES. No data entry will be required by agency personnel for flexible benefit deductions, unless an employee is listed on the REPORT U130, BES/CIPPS TRANSACTION ERROR LISTING. Please review all transactions for accuracy.

Page 7 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

Flexible Benefit The flexible spending account administrative fee (Deduction 023) will be $3.65 per month Adm effective July 1, 2014 (July 16 check date). This is an employee-paid, pre-tax fee withheld the first in pay period of each month. The annual fee of $43.80 is pro-rated based on the employee’s number Fee of pays (see fee schedule below).

Number of Pays 12/24 11/22 10/20 9/18 Fee Amount (Ded 023) $3.65 $3.99 $4.38 $4.87 YTD Amount (Goal) $43.80 $43.80 $43.80 $43.80

The deduction goal will be set to decrement (a value of “1” in the eighth position in the utility field) with a deduction end date of 06/30/2015.

Continued on next page

Page 8 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

PAYROLL PROCESSING - FISCAL YEAR-END, continued

Page 9 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

Healthcare On July 1, 2014, the new healthcare premiums specified in DHRM’s Spotlight Spring 2014 Pre Open Enrollment Issue will take effect. All codes and rates for CIPPS processing are miu provided on the following pages. These rates do not include the premium reward and are m subject to final state budget approval. Sche dule s

Provider Active Involuntary Project Code Provider Separation Code Provider Code COVA Care Basic (Includes basic dental) 42 92 93002 COVA Care Expanded Dental 44 94 93002 COVA Care Out-of-Network 43 93 93002 COVA Care Out-of-Network and Expanded 45 95 93002 Dental COVA Care Out-of-Network and Vision, 47 97 93002 Hearing and Expanded Dental COVA Care Vision, Hearing and Expanded 46 96 93002 Dental COVA HDHP (High Deductible Health Plan) 50 90 93005 COVA HDHP ED (High Deductible Health 105 155 93005 Plan Expanded Dental) COVA Health Aware Basic 101 151 93033 COVA HealthAware and Expanded Dental 103 153 93033 COVA HealthAware, Expanded Dental and 102 152 93033 Vision Kaiser Permanente HMO (Available in 06 56 93003 Northern Virginia Only) TRICARE 110 160 93038 Healthcare premium changes will occur July 1, 2014, with the BES to CIPPS automated update. If you have any questions about the schedules, contact Denise Halderman, via e- mail at [email protected] or (804) 371-8912.

LWOP and Effective December 1, 2012, codes used on HMCU1 to indicate employees in a LWOP status Health were discontinued in CIPPS. Previously these codes established the employee-paid deduction for Insurance health insurance premiums at a rate of zero ($0) and the employer-paid deduction at the full premium amount. In lieu of LWOP health care codes the automated reconciliation between BES and CIPPS will ensure that the Health Insurance Fund (HIF) receives all the funds due. The automated recon provides a clear audit trail for audit/fiscal staff to identify employees whose entire health insurance premium is paid by the agency due to LWOP or insufficient pay situations. It is the agency’s responsibility to collect the funds from the identified employee in accordance with DHRM’s guidelines.

Continued on next page

Page 10 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

COVA Care Basic (BES – ACC0) Provider Code: 42/92

Employee Semi-Monthly Monthly Coverage Code

Employee Agency Total Employee Agency Total S - Employee $37.50 $264.50 $302.00 $75.00 $529.00 $604.00 Only D - Employee $85.50 $474.00 $559.50 $171.00 $948.00 $1,119.00 Plus One F - Family $115.00 $695.00 $810.00 $230.00 $1,390.00 $1,620.00 O - Employee $302.00 $0.00 $302.00 $604.00 $0.00 $604.00 Only - Part Time T - Employee $559.50 $0.00 $559.50 $1,119.00 $0.00 $1,119.00 Plus One - Part Time M - Family - $810.00 $0.00 $810.00 $1,620.00 $0.00 $1,620.00 Part Time

COVA Care OON (BES – ACC1) Provider Code: 43/93

Employee Semi-Monthly Monthly Coverage Code

Employee Agency Total Employee Agency Total S - Employee $44.50 $264.50 $309.00 $89.00 $529.00 $618.00 Only D - Employee $95.00 $474.00 $569.00 $190.00 $948.00 $1,138.00 Plus One F – Family $128.00 $695.00 $823.00 $256.00 $1,390.00 $1,646.00 O - Employee $309.00 $0.00 $309.00 $618.00 $0.00 $618.00 Only - Part Time T - Employee $569.00 $0.00 $569.00 $1,138.00 $0.00 $1,138.00 Plus One - Part Time M - Family - $823.00 $0.00 $823.00 $1,646.00 $0.00 $1,646.00 Part Time

COVA Care ED (BES – ACC2) Provider Page 11 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

Code: 44/94

Employee Semi-Monthly Monthly Coverage Code

Employee Agency Total Employee Agency Total S - Employee $50.00 $264.50 $314.50 $100.00 $529.00 $629.00 Only D - Employee $109.50 $474.00 $583.50 $219.00 $948.00 $1,167.00 Plus One F – Family $151.50 $695.00 $846.50 $303.00 $1,390.00 $1,693.00 O - Employee $314.50 $0.00 $314.50 $629.00 $0.00 $629.00 Only - Part Time T - Employee $583.50 $0.00 $583.50 $1,167.00 $0.00 $1,167.00 Plus One - Part Time M - Family - $846.50 $0.00 $846.50 $1,693.00 $0.00 $1,693.00 Part Time

Page 12 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

COVA Care OON/ED (BES – ACC3) Provider Code: 45/95

Employee Coverage Code Semi-Monthly Monthly

Employe Agency Total Employee Agency Total e S - Employee Only $57.00 $264.50 $321.50 $114.00 $529.00 $643.00 D - Employee Plus One $119.00 $474.00 $593.00 $238.00 $948.00 $1,186.00 F - Family $164.50 $695.00 $859.50 $329.00 $1,390. $1,719.00 00 O - Employee Only - Part Time $321.50 $0.00 $321.50 $643.00 $0.00 $643.00 T - Employee Plus One - Part Time $593.00 $0.00 $593.00 $1,186.00 $0.00 $1,186.00 M - Family - Part Time $859.50 $0.00 $859.50 $1,719.00 $0.00 $1,719.00

COVA Care V/H/ED (BES – ACC4) Provider Code: 46/96

Employee Coverage Code Semi-Monthly Monthly

Employe Agency Total Employee Agency Total e S - Employee Only $57.50 $264.50 $322.00 $115.00 $529.00 $644.00 D - Employee Plus One $122.00 $474.00 $596.00 $244.00 $948.00 $1,192.00 F - Family $168.50 $695.00 $863.50 $337.00 $1,390. $1,727.00 00 O - Employee Only - Part Time $322.00 $0.00 $322.00 $644.00 $0.00 $644.00 T - Employee Plus One - Part Time $596.00 $0.00 $596.00 $1,192.00 $0.00 $1,192.00 M - Family - Part Time $863.50 $0.00 $863.50 $1,727.00 $0.00 $1,727.00

COVA Care FULL (BES – ACC5) Provider Code: 47/97

Employee Coverage Code Semi-Monthly Monthly

Employe Agency Total Employee Agency Total e S - Employee Only $64.50 $264.50 $329.00 $129.00 $529.00 $658.00 D - Employee Plus One $131.50 $474.00 $605.50 $263.00 $948.00 $1,211.00 F - Family $181.50 $695.00 $876.50 $363.00 $1,390. $1,753.00 00 O - Employee Only - Part Time $329.00 $0.00 $329.00 $658.00 $0.00 $658.00 T - Employee Plus One - Part Time $605.50 $0.00 $605.50 $1,211.00 $0.00 $1,211.00 M - Family - Part Time $876.50 $0.00 $876.50 $1,753.00 $0.00 $1,753.00

Page 13 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

COVA HealthAware Basic (BES – CHA) Provider Code: 101/151

Employee Coverage Code Semi-Monthly Monthly

Employe Agency Total Employee Agency Total e S - Employee Only $13.00 $264.50 $277.50 $26.00 $529.00 $555.00 D - Employee Plus One $40.50 $474.00 $514.50 $81.00 $948.00 $1,029.00 F - Family $48.00 $695.00 $743.00 $96.00 $1,390. $1,486.00 00 O - Employee Only - Part Time $277.50 $0.00 $277.50 $555.00 $0.00 $555.00 T - Employee Plus One - Part Time $514.50 $0.00 $514.50 $1,029.00 $0.00 $1,029.00 M - Family - Part Time $743.00 $0.00 $743.00 $1,486.00 $0.00 $1,486.00

COVA HealthAware + ED & Vision (BES – CHA1) Provider Code: 102/152

Employee Coverage Code Semi-Monthly Monthly

Employe Agency Total Employee Agency Total e S - Employee Only $29.50 $264.50 $294.00 $59.00 $529.00 $588.00 D - Employee Plus One $71.50 $474.00 $545.50 $143.00 $948.00 $1,091.00 F – Family $94.00 $695.00 $789.00 $188.00 $1,390. $1,578.00 00 O - Employee Only - Part Time $294.00 $0.00 $294.00 $588.00 $0.00 $588.00 T - Employee Plus One - Part Time $545.50 $0.00 $545.50 $1,091.00 $0.00 $1,091.00 M - Family - Part Time $789.00 $0.00 $789.00 $1,578.00 $0.00 $1,578.00

COVA HealthAware + ED (BES – CHA2) Provider Code: 103/153

Employee Coverage Code Semi-Monthly Monthly

Employe Agency Total Employee Agency Total e S - Employee Only $25.50 $264.50 $290.00 $51.00 $529.00 $580.00 D - Employee Plus One $64.50 $474.00 $538.50 $129.00 $948.00 $1,077.00 F – Family $84.50 $695.00 $779.50 $169.00 $1,390. $1,559.00 00 O - Employee Only - Part Time $290.00 $0.00 $290.00 $580.00 $0.00 $580.00 T - Employee Plus One - Part Time $538.50 $0.00 $538.50 $1,077.00 $0.00 $1,077.00 M - Family - Part Time $779.50 $0.00 $779.50 $1,559.00 $0.00 $1,559.00

Page 14 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

Page 15 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

COVA HIGH DEDUCTIBLE HEALTH PLAN (BES – CHD) Provider Code: 50/90

Employee Coverage Code Semi-Monthly Monthly

Employe Agency Total Employee Agency Total e S - Employee Only $0.00 $228.00 $228.00 $0.00 $456.00 $456.00 D - Employee Plus One $0.00 $423.50 $423.50 $0.00 $847.00 $847.00 F - Family $0.00 $618.50 $618.50 $0.00 $1,237. $1,237.00 00 O - Employee Only - Part Time $228.00 $0.00 $228.00 $456.00 $0.00 $456.00 T - Employee Plus One - Part Time $423.50 $0.00 $423.50 $847.00 $0.00 $847.00 M - Family - Part Time $618.50 $0.00 $618.50 $1,237.00 $0.00 $1,237.00

COVA HIGH DEDUCTIBLE HEALTH PLAN ED (BES – CHD1) Provider Code: 105/155

Employee Coverage Code Semi-Monthly Monthly

Employe Agency Total Employee Agency Total e S - Employee Only $12.50 $228.00 $240.50 $25.00 $456.00 $481.00 D - Employee Plus One $24.00 $423.50 $447.50 $48.00 $847.00 $895.00 F - Family $36.50 $618.50 $655.00 $73.00 $1,237. $1,310.00 00 O - Employee Only - Part Time $240.50 $0.00 $240.50 $481.00 $0.00 $481.00 T - Employee Plus One - Part Time $447.50 $0.00 $447.50 $895.00 $0.00 $895.00 M - Family - Part Time $655.00 $0.00 $655.00 $1,310.00 $0.00 $1,310.00

KAISER PERMANENTE HMO (BES – KP) Provider Code: 06/56

Employee Coverage Code Semi-Monthly Monthly

Employe Agency Total Employee Agency Total e S - Employee Only $29.00 $245.50 $274.50 $58.00 $491.00 $549.00 D - Employee Plus One $68.50 $436.50 $505.00 $137.00 $873.00 $1,010.00 F - Family $98.00 $638.00 $736.00 $196.00 $1,276. $1,472.00 00 O - Employee Only - Part Time $274.50 $0.00 $274.50 $549.00 $0.00 $549.00 T - Employee Plus One - Part Time $505.00 $0.00 $505.00 $1,010.00 $0.00 $1,010.00 M - Family - Part Time $736.00 $0.00 $736.00 $1,472.00 $0.00 $1,472.00

Page 16 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm Calendar Year 2014 May 14, 2014 Volume 2014-08

TRICARE (BES – TRC) Provider Code: 110/160

Employee Coverage Code Semi-Monthly Monthly

Employe Agency Total Employee Agency Total e S - Employee Only $30.50 $0.00 $30.50 $61.00 $0.00 $61.00 D - Employee Plus One $60.00 $0.00 $60.00 $120.00 $0.00 $120.00 F - Family $80.50 $0.00 $80.50 $161.00 $0.00 $161.00 O - Employee Only - Part Time $30.50 $0.00 $30.50 $61.00 $0.00 $61.00 T - Employee Plus One - Part Time $60.00 $0.00 $60.00 $120.00 $0.00 $120.00 M - Family - Part Time $80.50 $0.00 $80.50 $161.00 $0.00 $161.00

Page 17 of 24 http://www.doa.virginia.gov/Payroll/Payroll_Bulletins/Payroll_Bulletins_Main.cfm 18 June 2014

Saturd Sunday Monday Tuesday Wednesday Thursday Friday ay 1 2 3 4 5 6 7 9AM - VNAV/CIPPS Deferred Comp 9AM - CIPPS files CIPPS files open - no Interface Transaction open - no edits or TPA Upload Upload edits or payruns payruns 8 9 10 11 12 13 14 9AM - Semi-monthly Leave keying 9AM - CIPPS files CIPPS files open - no salaried deadline open - no edits or certification Post leave edits or payruns payruns deadline accruals Period #1 (5/25-6/09) (5/25-6/09) May Healthcare Cert Due 15 16 17 18 19 20 21 9AM - Payday for TPA Upload Last day to 9AM - CIPPS files CIPPS files open - no semi-monthly certify open - no edits or salaried wage/special edits or payruns payruns employees for FY 14 – NO EXCEPTIONS

CHARGE FY 14 CHARGE FY 14 CHARGE FY 14 CHARGE FY 14 22 23 24 25 26 27 28 9AM - Semi-monthly 9AM - CIPPS files CIPPS files open - no salaried open - no edits or certification edits or payruns payruns deadline Period #2 (6/10-6/24)

CHARGE FY 15 CHARGE FY 15 CHARGE FY 15 CHARGE FY 15 CHARGE FY 15 Must have July Must have July Must have July Must have July Must have July Check Date Check Date Check Date Check Date Check Date 29 30 9AM - CIPPS close at CIPPS files open - no 2 pm for FYE edits or processing payruns Leave keying deadline 2 pm (6/10-6/24)

CHARGE FY 15 Must have July Check Date

18 July 2014

Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1 2 3 4 5 Payday for VNAV/CIPPS Deferred State Holiday: 9AM - CIPPS files open - no edits or semi-monthly Interface Comp Independence payruns salaried TPA Upload Transaction Day employees Upload

6 7 8 9 10 11 12 9AM - CIPPS files Semi- 2nd Qtr Recon 9AM - CIPPS files open - no edits or open - no edits or payruns monthly of taxable payruns salaried wages due to certification DOA deadline Period #1 (6/25-7/09) 13 14 15 16 17 18 19 9AM - CIPPS files Leave keying Payday for 9AM - CIPPS files open - no edits or open - no edits or payruns deadline semi-monthly payruns (6/25-7/09) salaried employees

20 21 22 23 24 25 26 9AM - CIPPS files TPA Upload 9AM - CIPPS files open - no edits or open - no edits or payruns payruns

27 28 29 30 31 9AM - CIPPS files Semi- Leave open - no edits or payruns monthly keying salaried deadline certification (7/10-7/24) deadline June Period #2 Healthcare (7/10-7/24) Cert Due 20 August 2014

Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1 2 Payday for 9AM - CIPPS files open - no edits or semi-monthly payruns salaried employees

3 4 5 6 7 8 9 9AM - CIPPS files VNAV/CIPPS Deferred 9AM - CIPPS files open - no edits or open - no edits or payruns Interface Comp payruns TPA Upload Transaction Upload

10 11 12 13 14 15 16 9AM - CIPPS files Semi-monthly Leave keying Payday for 9AM - CIPPS files open - no edits or open - no edits or payruns salaried deadline semi-monthly payruns certification (7/25-8/09) salaried deadline employees Period #1 (7/25-8/09) 17 18 19 20 21 22 23 9AM - CIPPS files TPA Upload 9AM - CIPPS files open - no edits or open - no edits or payruns payruns

24 25 26 27 28 29 30 9AM - CIPPS files Semi-monthly Leave keying Payday for 9AM - CIPPS files open - no edits or open - no edits or payruns salaried deadline semi-monthly payruns certification (8/10-8/24) salaried deadline employees Period #2 (8/10-8/24) July Healthcare Cert Due 31 9AM - CIPPS files open - no edits or payruns

20 September 2014

Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1 2 3 4 5 6 State TPA Upload Deferred 9AM - CIPPS files open - no edits or Holiday: VNAV/CIPP Comp payruns Labor Day S Interface Transaction Upload

------NATIONAL PAYROLL WEEK ------7 8 9 10 11 12 13 9AM - CIPPS files Semi- 9AM - CIPPS files open - no edits or open - no edits or payruns monthly payruns salaried certification deadline Period #1 (8/25-9/9) 14 15 16 17 18 19 20 9AM - CIPPS files Leave keying Payday for TPA Upload 9AM - CIPPS files open - no edits or open - no edits or payruns deadline semi-monthly payruns (8/25-9/09) salaried employees

21 22 23 24 25 26 27 9AM - CIPPS files Semi- 9AM - CIPPS files open - no edits or open - no edits or payruns monthly payruns salaried certification deadline Period #2 (9/10-9/24 28 29 30 9AM - CIPPS files Leave keying Payday for open - no edits or payruns deadline semi-monthly (9/10-9/24) salaried employees

Military Leave Reset

August Healthcare Cert Due

22 October 2014

Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1 2 3 4 VNAV/CIPP Deferred 9AM - CIPPS files open - no edits or S Interface Comp payruns TPA Upload Transaction Upload 5 6 7 8 9 10 11 9AM - CIPPS files Semi- 3RD Qtr 9AM - CIPPS files open - no edits or open - no edits or payruns monthly Recon of payruns salaried Taxable certification Wages due to deadline DOA Period #1 (9/25-10/09)

12 13 14 15 16 17 18 9AM - CIPPS files State Leave keying Payday for 9AM - CIPPS files open - no edits or open - no edits or payruns Holiday: deadline semi-monthly payruns Columbus (9/25-10/09) salaried Day employees

19 20 21 22 23 24 25 9AM - CIPPS files TPA Upload 9AM - CIPPS files open - no edits or open - no edits or payruns payruns

26 27 28 29 30 31 9AM - CIPPS files Semi- Leave keying Payday for open - no edits or payruns monthly deadline semi-monthly salaried (10/10-10/24) salaried certification employees deadline TPA Upload Period #2 September (10/10-10/24) Healthcare Cert Due

22 November 2014

Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1 9AM - CIPPS files open - no edits or payruns

2 3 4 5 6 7 8 9AM - CIPPS files VNAV/CIPPS Deferred Semi- 9AM - CIPPS files open - no edits or open - no edits or payruns Interface Comp monthly payruns Transaction salaried Upload certification Period #1 (10/25- 11/09) 9 10 11 12 13 14 15 9AM - CIPPS files State Holiday: Leave keying Payday for 9AM - CIPPS files open - no edits or open - no edits or payruns Veterans’ Day deadline semi- payruns (10/25-11/09) monthly salaried employees

TPA Upload

16 17 18 19 20 21 22 9AM - CIPPS files Semi- 9AM - CIPPS files open - no edits or open - no edits or payruns monthly payruns salaried certification deadline Period #2 (11/10- 11/24) 23 24 25 26 27 28 29 9AM - CIPPS files Leave State State 9AM - CIPPS files open - no edits or open - no edits or payruns keying Holiday: Holiday: payruns Deadline Thanksgiving Day After (11/10- Day Thanksgivi 11/24) ng

October Healthcare Cert Due

Half-Day Holiday Files close at noon 3024 9AM - CIPPS files open - no edits or payruns

24