______Your name and Perm #

Econ 234A John Hartman Test 2 March 19, 2014

Instructions:

You have 120 minutes to complete this test, unless you arrive late. Late arrival will lower the time available to you, and you must finish at the same time as all other students.

Each question shows how many points it is worth. Show all work in order to receive credit. You will receive partial credit for incorrect solutions in some instances. Clearly circle your answer(s) or else you may not receive full credit for a complete and correct solution.

Cheating will not be tolerated during any test. Any suspected cheating will be reported to the relevant authorities on this issue.

You are allowed to use a nonprogrammable four-function or scientific calculator that is NOT a communication device. You are NOT allowed to have a calculator that stores formulas, buttons that automatically calculate IRR, NPV, or any other concept covered in this class. You are NOT allowed to have a calculator that has the ability to produce graphs. If you use a calculator that does not meet these requirements, you will be assumed to be cheating.

Unless otherwise specified, you can assume the following: Negative internal rates of return are not possible. All equivalent annual cost problems are in real dollar amounts.

You are allowed to turn in your test early if there are at least 5 minutes remaining. As a courtesy to your classmates, you will not be allowed to leave during the final 5 minutes of the test.

Your test should have 7 problems, some with multiple parts. The maximum possible point total is 60 points. If your test is incomplete, it is your responsibility to notify a proctor to get a new test.

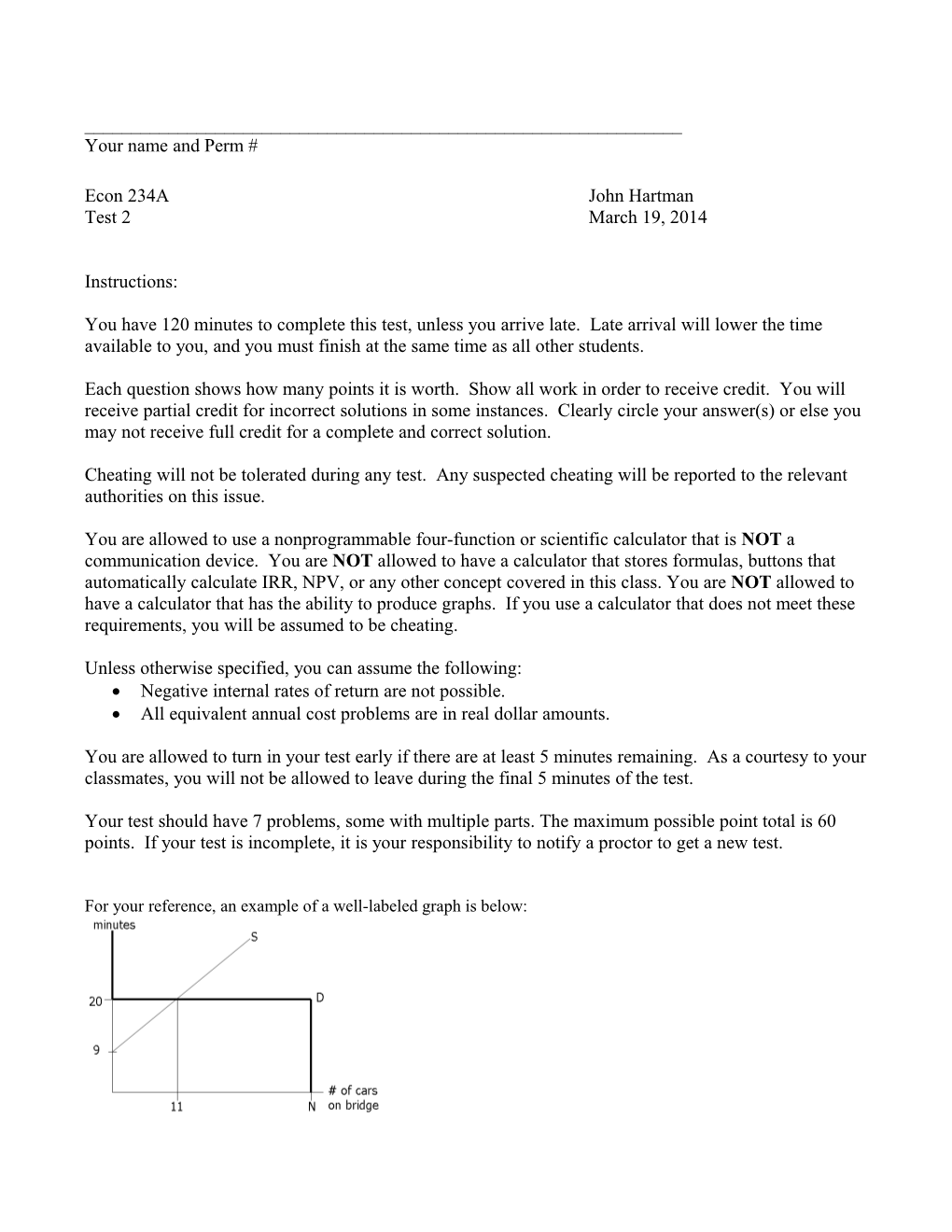

For your reference, an example of a well-labeled graph is below: For the following problems, you will need to write out the solution. You must show all work to receive credit. Each problem (or part of problem) shows the maximum point value. Provide at least four significant digits to each answer or you may not receive full credit for a correct solution.

1. (7 points) Suppose that you have just been hired by the finance department of Mearcy’s, a local department store. Mearcy’s wants to offer its best customers $1000 in credit with the following conditions: There will be 36 monthly payments to completely pay back the money, starting 4 months from today; the stated annual interest rate is 18%, compounded quarterly. When making your calculations, assume that a customer spends $1000 on the line of credit today, and nothing else is spent at Mearcy’s until the $1000 is paid off. How much will each monthly payment be? 2. (8 points) Ramla buys one call option with an exercise price of $70 (per share) today, and two put options with an exercise price of $90 (per share). The expiration date of all of these options is one year from now. Each option is for buying or selling one share of stock. The effective annual discount rate is 10%. Draw a well-labeled graph that shows the present value of a combination of the three options as a function of the value of the stock at expiration. The vertical intercept should have the present value of the combination of the three options. The horizontal intercept should have the value of the stock on the expiration date. Make sure to label your intercepts and other relevant numbers on each axis, where relevant. (Hint: You may want to look at the front page of the test to see a well-labeled graph.) Explain your answer in words, math, and/or additional graphs. Include enough detail so that everything on the graph is unambiguous. 3. (11 points) Stock 1 has a 5% annual rate of return if state A occurs, 7% if state B occurs, and 18% if state C occurs. Stock 2 has a 12% annual rate of return if state A occurs, 4% if state B occurs, and 8% if state C occurs. Assume all 3 states occur with equal probability. What is the standard deviation of a portfolio that has 75% of money invested in stock 1 and 25% invested in stock 2? (Continue Problem 3 here if you need more space) 4. (7 points) Standing Still Silhouettes (SSS), Inc. stock is currently selling for $80 per share. The value of the stock one year from today will either be $60 or $100. Suppose that a European call option is currently selling for $3. The call option has an exercise price of $90 and expires one year from today. If the appropriate annual discount rate for this call option is 10%, what is probability that this stock will be $100 one year from now? (You can assume that individuals are risk neutral for this problem, meaning that they are trying to maximize the expected value of their investment.) 5. The cost of capital for an all-equity firm is 10%, while the cost of debt for the same firm is 5%. Assume this company currently has 60% of its value in bonds and 40% in stocks. (Note: Make the same relevant assumptions as in the Modigliani and Miller propositions.)

(a) (5 points) What is the current cost of equity?

(b) (4 points) What is the weighted average cost of capital for this firm? 6. (8 points) Sebastian just purchased $50,000 to open his new business, Baby Blabber Depot. He charged these purchases on his Gurgle Express credit card, which charges an 18% stated annual interest rate, compounded monthly. When Sebastian got home, he found an offer for a Disembark credit card. He could transfer the balance later today and pay off the Disembark credit card, but there is a 5% transfer fee for doing so. The Disembark credit card charges a 12% stated annual interest rate, compounded monthly. If Sebastian makes a $2,000 payment every month until one of the credit cards is paid off, should he pay off the Gurgle Express credit card, or transfer the balance to the Disembark credit card and pay that credit card off? Please completely justify your answer. 7. Answer each of the following:

(a) (4 points) Today is March 19, 2014. A zero-coupon bond will mature on September 19, 2021. The face value of this bond is $500. What is the effective annual discount rate of this bond if the bond is currently selling for $250?

(b) (5 points) A stock will pay a $5 dividend later today. The annual dividend will grow by 25% each year for the next 4 years. After that the stock will pay a constant dividend every year, forever. If the effective annual interest rate for this stock is 30%, what is the present value of the stock?