P12-6 (Comprehensive Intangible Assets) Montana Matt's Golf Inc. was formed on July 1, 2009, when Matt Magilke purchased the Old Master Golf Company. Old Master provides video golf instruction at kiosks in shopping malls. Magilke plans to integrate the instruction business into his golf equipment and accessory stores. Magilke paid $770,000 cash for Old Master. At the time Old Master's balance sheet reported assets of $650,000 and liabilities of $200,000 (thus owners' equity was $450,000). The fair value of Old Master's assets is estimated to be $800,000. Included in the assets is the Old Master trade name with a fair value of $10,000 and a copyright on some instructional books with a fair value of $24,000. The trade name has a remaining life of 5 years and can be renewed at nominal cost indefinitely. The copyright has a remaining life of 40 years. Instructions (a) Prepare the intangible assets section of Montana Matt's Golf Inc. at December 31, 2009. How much amortization expense is included in Montana Matt's income for the year ended December 31, 2009? Show all supporting computations. (b) Prepare the journal entry to record amortization expense for 2010. Prepare the intangible assets section of Montana Matt's Golf Inc. at December 31, 2010. (No impairments are required to be recorded in 2010.) (c) At the end of 2011, is evaluating the results of the instructional business. Due to fierce competition from online and television (e.g., the Golf Channel), the Old Master reporting unit has been losing money. Its book value is now $500,000. The fair value of the Old Master reporting unit is $420,000. The implied value of goodwill is $90,000. Magilke has collected the following information related to the company's intangible assets. Intangible Asset Exp.Cash Flows Fair Values Trade name $ 9,000 $ 3,000 Copyright $ 30,000 $ 25,000 Prepare the journal entries required, if any, to record impairments on Montana Matt's intangible assets. (Assume that any amortization for 2011 has been recorded.) Show supporting computations.

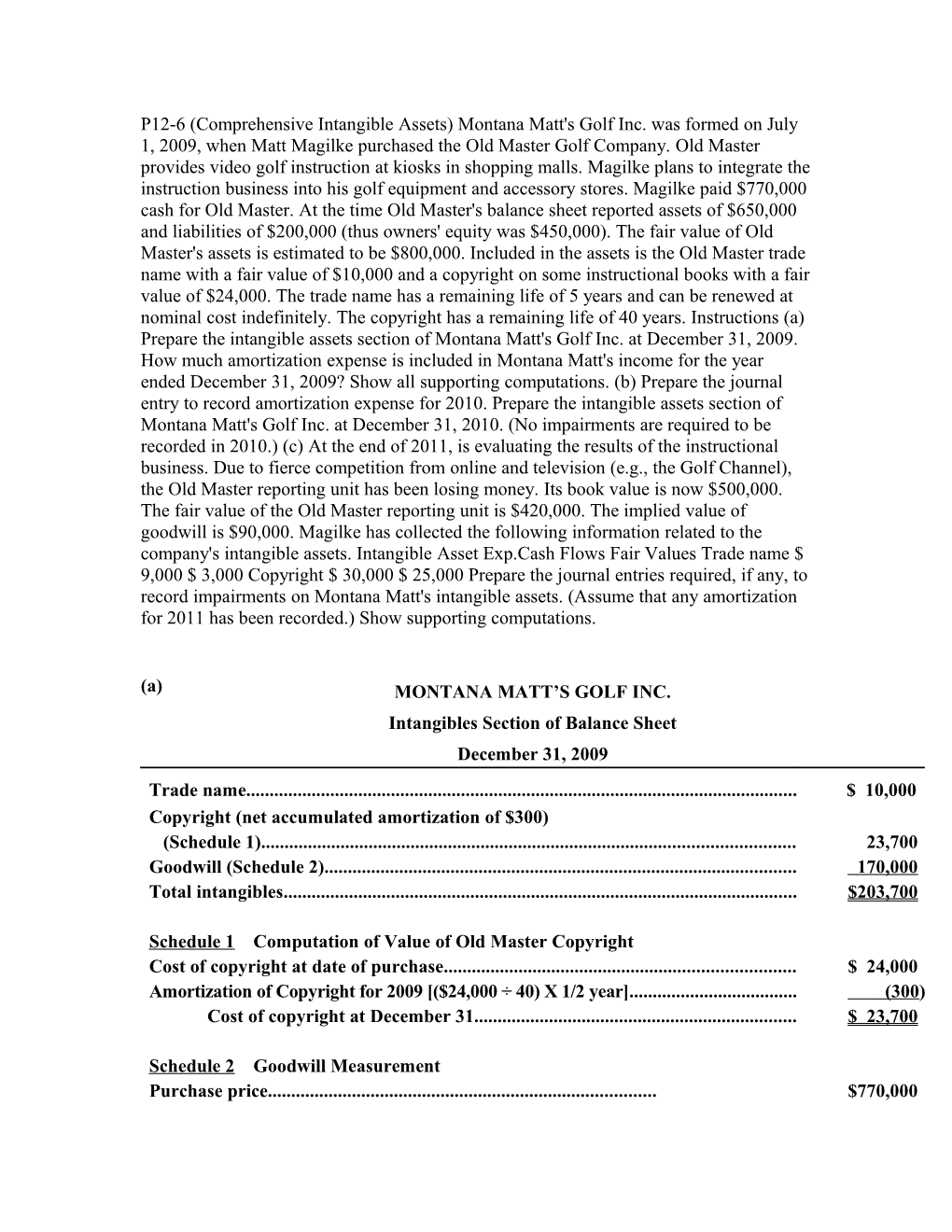

(a) MONTANA MATT’S GOLF INC. Intangibles Section of Balance Sheet December 31, 2009 Trade name...... $ 10,000 Copyright (net accumulated amortization of $300) (Schedule 1)...... 23,700 Goodwill (Schedule 2)...... 170,000 Total intangibles...... $203,700

Schedule 1 Computation of Value of Old Master Copyright Cost of copyright at date of purchase...... $ 24,000 Amortization of Copyright for 2009 [($24,000 ÷ 40) X 1/2 year]...... (300) Cost of copyright at December 31...... $ 23,700

Schedule 2 Goodwill Measurement Purchase price...... $770,000 Fair value of assets...... $800,000 Fair value of liabilities...... (200,000) Fair value of net assets...... 600,000 Value assigned to goodwill...... $170,000

Amortization expense for 2009 is $300 (see Schedule 1). There is no amortization for the goodwill or the trade name, both of which are considered indefinite life intangible assets.

(b) Copyright Amortization Expense...... 600 Copyright ($24,000 ÷ 40)...... 600

There is a full year of amortization on the Copyright. There is no amortization for the goodwill or the trade name, which is considered an indefinite life intangible.

MONTANA MATT’S GOLF INC. Intangibles Section of Balance Sheet December 31, 2010

Trade name...... $ 10,000 Copyright (net accumulated amortization of $900) (Schedule 1)...... 23,100 Goodwill...... 170,000 Total intangibles...... $203,100

Schedule 1 Computation of Value of Old Master Copyright Cost of Copyright at date of purchase...... $ 24,000 Amortization of Copyright for 2009, 2010 [($24,000 ÷ 40) X 1.5 years]...... (900) Cost of copyright at December 31...... $ 23,100

(c) Loss on Impairment...... 87,000 Goodwill ($170,000 – $90,000*)...... 80,000 Trade name ($10,000 – $3,000)...... 7,000

*Fair value of Old Master reporting unit...... $420,000 Net identifiable assets (excluding goodwill) ($500,000 – $170,000)...... (330,000) Implied value of goodwill...... $ 90,000

The Goodwill is considered impaired because the fair value of the business unit ($420,000) is less than its carrying value ($500,000). The copyright is not considered impaired because the expected net future cash flows ($30,000) exceed the carrying amount ($24,000).

QUESTION # 2 BE12-1 Celine Dion Corporation purchases a patent from Salmon Company on January 1, 2010, for $54,000. The patent has a remaining legal life of 16 years. Celine Dion feels the patent will be useful for 10 years. Prepare Celine Dion's journal entries to record the purchase of the patent and 2010 amortization. a)Account/Description Patents Debit? Cash Credit? (To record purchase of patent.) b)Account/Description? Patent amortization Expense Debit? Patents Credit? (To record amortization.)

Patents...... 54,000 Cash...... 54,000

Patent Amortization Expense...... 5,400 Patents ($54,000 X 1/10 = $5,400)...... 5,400

QUESTION # 3 BE12-12 Nieland Industries had one patent recorded on its books as of January 1, 2010. This patent had a book value of $288,000 and a remaining useful life of 8 years. During 2010, Nieland incurred research and development costs of $96,000 and brought a patent infringement suit against a competitor. On December 1, 2010, Nieland received the good news that its patent was valid and that its competitor could not use the process Nieland had patented. The company incurred $85,000 to defend this patent. At what amount should patent(s) be reported on the December 31, 2010, balance sheet, assuming monthly amortization of patents? $ ?

Carrying Life in Amortization Per Months Amount Months Month Amortization Patent (1/1/10) $288,000 96 $3,000 12 Legal costs (12/1/10) 85,000 85 $1,000 1 $373,000

Carrying amount...... $373,000 Less: Amortization of patent (12 X $3,000)...... (36,000) Legal costs amortization (1 X $1,000)...... (1,000) Carrying amount 12/31/10...... $336,000

QUESTION # 4 (Accounting for Patents) During 2007, Thompson Corporation spent $170,000 in research and development costs. As a result, a new product called the New Age Piano was patented. The patent was obtained on October 1, 2007, and had a legal life of 20 years and a useful life of 10 years. Legal costs of $24,000 related to the patent were incurred as of October 1, 2007. (a)Prepare all journal entries required in 2007 and 2008 as a result of the transactions above. Date Account/Description 2007 Research & Development Expense Debit? Cash Credit? (To record research and development costs) Account /Description Patents Debit? Cash Credit? ^(To record the patent) Account/Description Patent Amortization Expense Debit? Patents Credit? ^(To record amortization) 2008 Account/Description Patent amortization Expense Debit? Patents Credit? (b) On June 1, 2009, Thompson spent $12,400 to successfully prosecute a patent infringement. As a result, the estimate of useful life was extended to 12 years from June 1, 2009. Prepare all journal entries required in 2009 and 2010. (Round amounts to 0 decimal places, e.g. 2,510.) Date Account/Description 2009 Patents Debit? Cash Credit? (To record prosecution of patent infringement) Account/Description Patent Amortization Expense Debit? Patents Credit? (To record amortization) 2010 Patent Amortization Expense Debit? Patents Credit? (c) In 2011, Thompson determined that a competitor's product would make the New Age Piano obsolete and the patent worthless by December 31, 2012. Prepare all journal entries required in 2011 and 2012. (Round amounts to 0 decimal places, e.g. 2,510.) Date Account/Description 2011 and 2012 Patent Amorization Expense Debit? Patents Credits?

E12-10)

(a) 2007 Research and Development Expense...... 170,000 Cash...... 170,000

Patents...... 24,000 Cash...... 24,000

Patent Amortization Expense...... 600 Patents [($24,000 ÷ 10) X 3/12]...... 600

2008 Patent Amortization Expense...... 2,400 Patents ($24,000 ÷ 10)...... 2,400

(b) 2009 Patents...... 12,400 Cash...... 12,400

Patent Amortization Expense...... 2,575 Patents ($1,000 + $1,575)...... 2,575 [Jan. 1–June 1: ($24,000 ÷ 10) X 5/12 = $1,000 June 1–Dec. 31: ($24,000 – $600 – $2,400 – $1,000 + $12,400) = $32,400; ($32,400 ÷ 12) X 7/12 = $1,575]

2010 Patent Amortization Expense...... 2,700 Patents ($32,400 ÷ 12)...... 2,700

(c) 2011 and 2012 Patent Amortization Expense...... 14,063 Patents ($28,125 ÷ 2)...... 14,063 ($32,400 – $1,575 – $2,700) = $28,125