Pump and Dump Part I

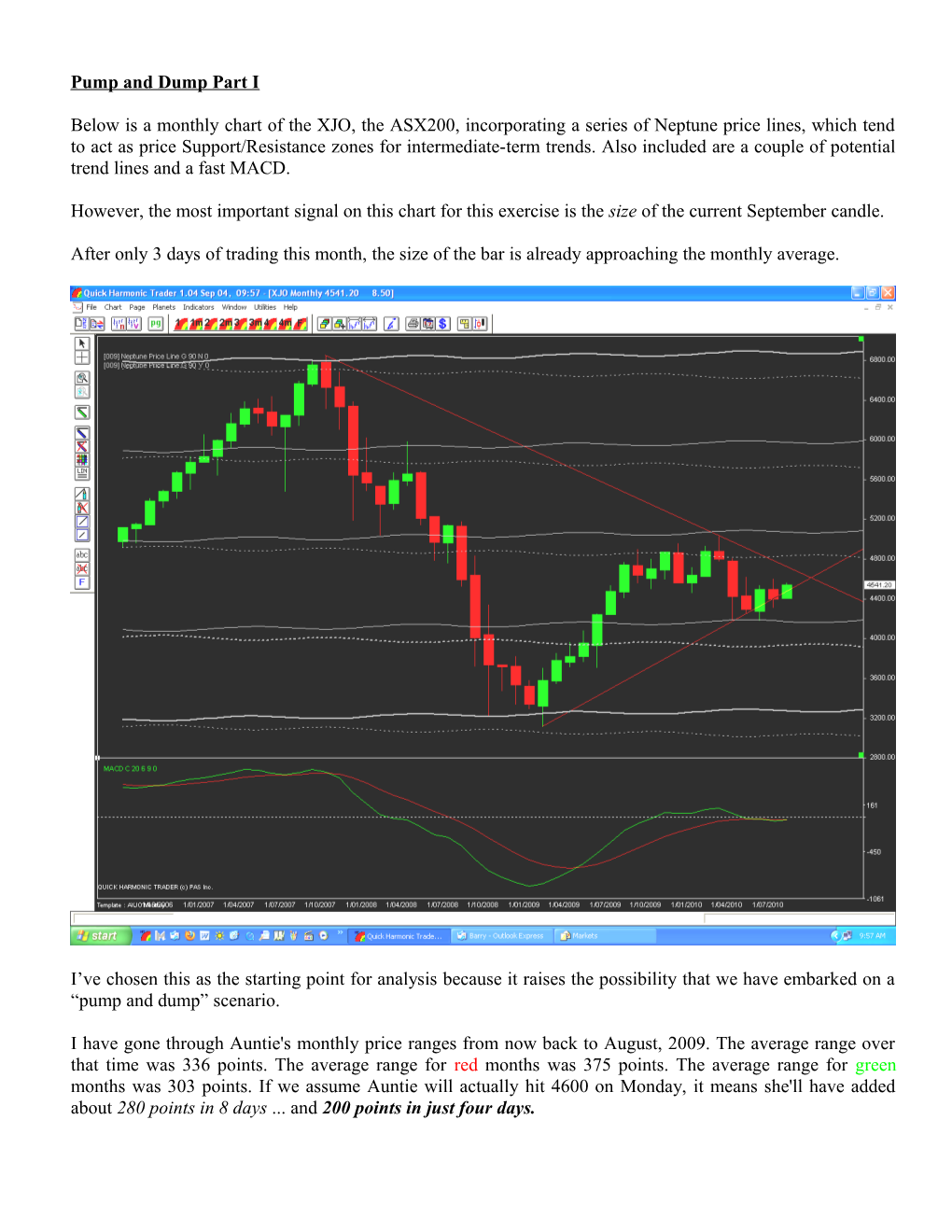

Below is a monthly chart of the XJO, the ASX200, incorporating a series of Neptune price lines, which tend to act as price Support/Resistance zones for intermediate-term trends. Also included are a couple of potential trend lines and a fast MACD.

However, the most important signal on this chart for this exercise is the size of the current September candle.

After only 3 days of trading this month, the size of the bar is already approaching the monthly average.

I’ve chosen this as the starting point for analysis because it raises the possibility that we have embarked on a “pump and dump” scenario.

I have gone through Auntie's monthly price ranges from now back to August, 2009. The average range over that time was 336 points. The average range for red months was 375 points. The average range for green months was 303 points. If we assume Auntie will actually hit 4600 on Monday, it means she'll have added about 280 points in 8 days ... and 200 points in just four days.

Effectively, what it means is that Auntie will have travelled a huge chunk of her average monthly range in just four days. It suggests she will have to backtrack, or go sideways, for a large chunk of the rest of September ... even if she is going higher.

It short, it's a classic case of too far, too fast. Even if she is in genuine rally mode, a short and fast rally of 280 points will need considerable consolidation very soon now.

The two best green months since August 09 were 357 points last September and 349 in July this year. All other rally months were under 300 points ... or, in other words, almost exactly where she will be come Monday.

So, even IF markets are in rally mode, the probability is that the rally has already made the great bulk of the "normal" monthly gains for a green month.

Now there is, of course, the possibility markets have entered an exhaustion rally which could carry prices much higher. It would not fit what has been the “normal” pattern of monthly rally ranges over the past year … it would be against the “normal” trend for markets to decline during the September/October period … it would conflict with a number of Elliott Wave counts.

And it would conflict with some astrological indications. However, for the moment, let’s give serious attention to the possibility.

You’ll have to excuse the huge amount of white space, but I prefer to keep the charts as large as possible to aid clarity. In Rudy’s EWW room recently, I posted a “cat amongst the pigeons” chart … and it’s this, using the SP500 as the example: -

This is the opposite of what almost everybody has been looking at and expecting. It means the Bear is actually dead and we are already embarked upon Wave 3 of a new Bull.

Last week’s rally has brought the 50 CCI back to the Zero line.

Now, this is NOT the preferred current scenario of any one of the 4M. However, markets don’t always do what we believe they will do and it’s necessary to consider the unexpected (and have a plan for it), as well as the expected. My preferred scenario has been the same for many weeks – until the past few days.

There is an extreme probability this scenario will be invalidated right from Monday’s Open on the ASX – and it became extremely unlikely from Monday of last week when price came too close to what I had marked out as my “line in the sand”.

The preferred scenario now becomes Rudy’s complex ABCDE “B” wave, in which Monday will bring us very close to the E point of the B-triangle and setting us up for, potentially, a rapid reversal south. Rudy has gone over this count at considerable length over the past couple of weeks as both of us became more and more concerned about the likely depth of the plunge into the late-August reversal.

So, we have gone through two scenarios here – one very Bullish and the alternative quite Bearish. Because of size constraints, I will go into further detail in Pump and Dump Part II … giving some price targets for the initial move in either direction as well as a couple of dates that are likely to be significant. It may not be posted until Sunday morning.