News from The Chubb Corporation

The Chubb Corporation 15 Mountain View Road • P.O. Box 1615 Warren, New Jersey 07061-1615 Telephone: 908-903-2000

FOR IMMEDIATE RELEASE

Chubb Third Quarter Earnings Per Share Are $1.04; Premiums Are Up 10.1%

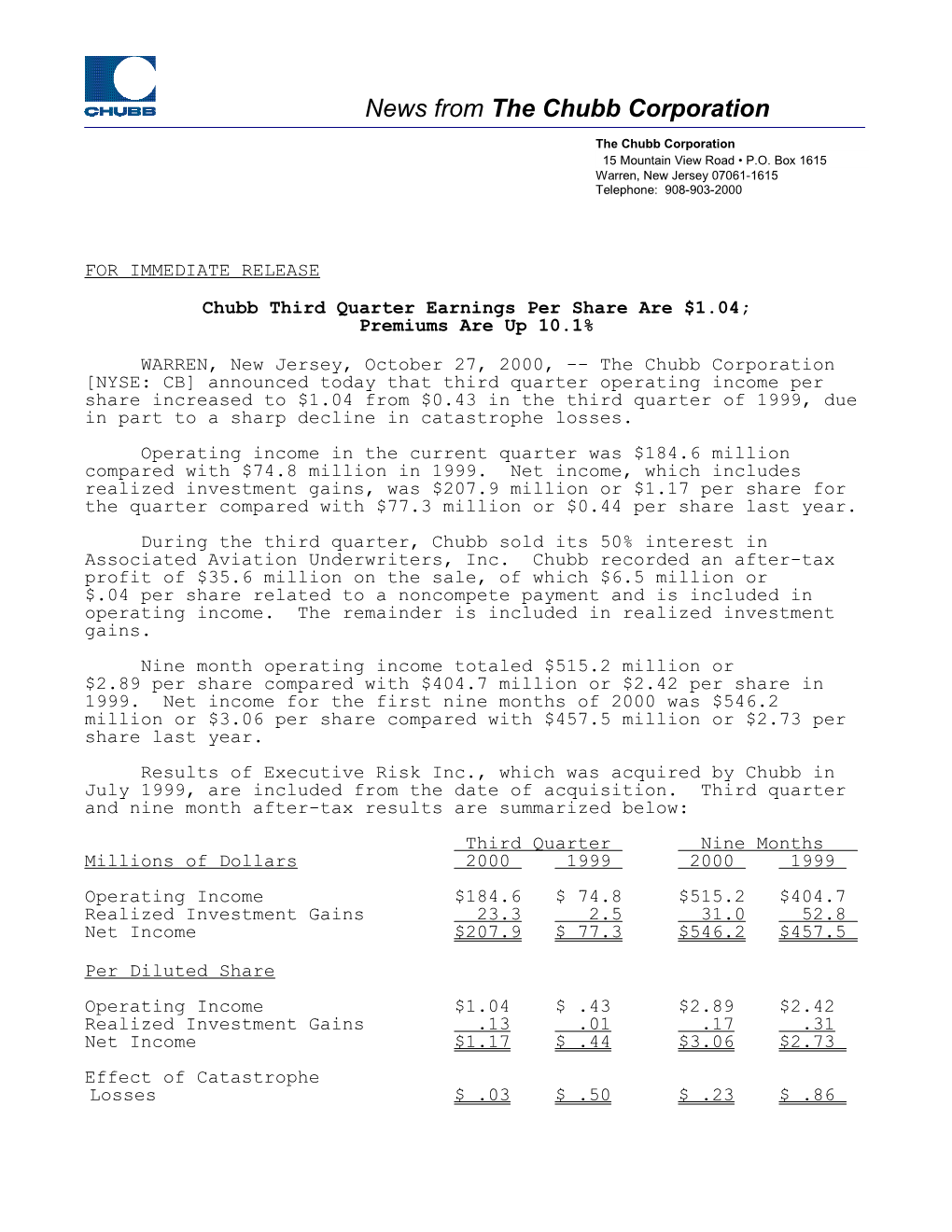

WARREN, New Jersey, October 27, 2000, -- The Chubb Corporation [NYSE: CB] announced today that third quarter operating income per share increased to $1.04 from $0.43 in the third quarter of 1999, due in part to a sharp decline in catastrophe losses. Operating income in the current quarter was $184.6 million compared with $74.8 million in 1999. Net income, which includes realized investment gains, was $207.9 million or $1.17 per share for the quarter compared with $77.3 million or $0.44 per share last year. During the third quarter, Chubb sold its 50% interest in Associated Aviation Underwriters, Inc. Chubb recorded an after-tax profit of $35.6 million on the sale, of which $6.5 million or $.04 per share related to a noncompete payment and is included in operating income. The remainder is included in realized investment gains. Nine month operating income totaled $515.2 million or $2.89 per share compared with $404.7 million or $2.42 per share in 1999. Net income for the first nine months of 2000 was $546.2 million or $3.06 per share compared with $457.5 million or $2.73 per share last year. Results of Executive Risk Inc., which was acquired by Chubb in July 1999, are included from the date of acquisition. Third quarter and nine month after-tax results are summarized below: Third Quarter Nine Months Millions of Dollars 2000 1999 2000 1999 Operating Income $184.6 $ 74.8 $515.2 $404.7 Realized Investment Gains 23.3 2.5 31.0 52.8 Net Income $207.9 $ 77.3 $546.2 $457.5

Per Diluted Share Operating Income $1.04 $ .43 $2.89 $2.42 Realized Investment Gains .13 .01 .17 .31 Net Income $1.17 $ .44 $3.06 $2.73 Effect of Catastrophe Losses $ .03 $ .50 $ .23 $ .86 2

For the third quarter, net property and casualty premiums written increased 10.1% to $1.6 billion. Premium growth in the U.S. was 11%. Reported premiums outside the U.S. were up 6%; in local currencies, they were up 19%. "Overall premium growth was outstanding, reflecting both new business and higher rates," said Dean R. O'Hare, chairman and chief executive officer. "We see the industry environment continuing to favor rate increases, and that bodes well for continued premium growth." The combined ratio of 99.4% for the third quarter compares with 110.4% last year. Catastrophe losses were $8.0 million, adding one half of one percentage point to the combined ratio. In the third quarter of 1999, catastrophe losses were $135.0 million, representing 9.4 percentage points of the combined ratio. For the first nine months, net premiums written in 2000 increased 10.0% to $4.7 billion. Excluding the effect of the acquisition of Executive Risk, premiums grew about 6% in the first nine months. The combined ratio was 99.9% in 2000 and 103.4% in 1999. Catastrophe losses in 2000 were $62.6 million, adding 1.4 percentage points to the combined ratio. In the comparable period of 1999, catastrophe losses were $221.9 million or 5.3 percentage points of the combined ratio. "Personal Lines and Specialty Commercial Lines turned in excellent premium growth and underwriting profits in the third quarter," said Mr. O’Hare. "Standard Commercial Lines results also improved over the third quarter of last year. Average rate increases on renewals continued to climb, and the company’s sharpened underwriting selectivity showed evidence of progress in the drive to regain profitability in this segment. Comparisons with last year’s third quarter were helped substantially by the near-total absence of catastrophe losses this year compared with heavy catastrophe losses last year, mostly related to claims from Hurricane Floyd," he said. "Personal Lines turned in a particularly outstanding quarter, with premium growth of 14.0% and a combined ratio of 88.6%," said Mr. O'Hare. For the first nine months, Personal Lines had premium growth of 12.9% and a combined ratio of 93.3%. "By focusing our efforts on the affluent market, we have been able to build an enviable franchise in the fastest-growing and highest-margin segment of the personal property and casualty insurance business," said Mr. O’Hare. "No one understands this market as well as we do, and as a result we have been able to provide products and services –- particularly claims service -- that best meet the needs of our agents and brokers’ most important customers." Specialty Commercial Lines grew 15.4% in the third quarter, reflecting growth in Executive Protection, Financial Institutions and Chubb Re, and had a combined ratio of 93.9%. Executive Protection, which accounted for 47% of Chubb’s Specialty Commercial business, had a combined ratio of 89.8%, compared with 84.9% in the third quarter of 1999. 3

Standard Commercial Lines recorded a combined ratio of 118.0% in the third quarter of 2000, compared with 130.4% in the corresponding year-earlier quarter. Reported net written premiums declined 1%, primarily due to the effect of the strength of the U.S. dollar. In the U.S., premiums increased 1%, reflecting price increases and the fact that the company’s program to nonrenew its most loss-prone business is nearing completion. Chubb’s pricing initiative continued to progress, as the average price increase on policies renewed in each month of the third quarter of 2000 exceeded the average price increase of the previous month. As a result of two rounds of annual increases, average rates on renewals in the third quarter were 19% higher than two years ago; including exposure increases, average prices on renewals were 25% higher.

Property and casualty investment income after taxes increased 3.2% to $184.7 million or $1.04 per share in the third quarter from $179.0 million or $1.02 per share last year. For the first nine months, investment income increased 7.6% to $546.8 million or $3.07 per share from $508.4 million or $3.04 per share in 1999. Chubb repurchased approximately 762,000 shares of its common stock in the open market in the third quarter, bringing total stock purchases for the first nine months to 3.1 million shares.

For further information contact: Gail E. Devlin (908) 903-3245

Glenn A. Montgomery (908) 903-2365

FORWARD LOOKING INFORMATION

Certain statements in this communication may be considered to be "forward looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995 such as statements that include words or phrases "will result", "is expected to", "will continue", "is anticipated", or similar expressions. Such statements are subject to certain risks and uncertainties. The factors which could cause actual results to differ materially from those suggested by any such statements include but are not limited to those discussed or identified from time to time in the Corporation's public filings with the Securities & Exchange Commission, and more generally to: general economic conditions including changes in interest rates and the performance of the financial markets, changes in domestic and foreign laws, regulations and taxes, changes in competition and pricing environments, regional or general changes in asset valuations, the occurrence of significant natural disasters or other weather-related events, the inability to reinsure certain risks economically, the adequacy of loss reserves, as well as general market conditions, competition, pricing and restructurings. 4

THE CHUBB CORPORATION

SUPPLEMENTARY FINANCIAL DATA (Unaudited)

Periods Ended September 30 Third Quarter Nine Months 2000 1999 2000 1999 (in millions)

PROPERTY AND CASUALTY INSURANCE Underwriting Net Premiums Written...... $1,607.8 $1,459.7 $4,727.7 $4,299.4 Increase in Unearned Premiums.. (57.7) (7.6) (165.8) (90.0) Premiums Earned...... 1,550.1 1,452.1 4,561.9 4,209.4 Claims and Claim Expenses...... 1,032.6 1,125.2 3,056.8 2,957.5 Operating Costs and Expenses... 520.4 467.6 1,536.8 1,392.0 Decrease (Increase) in Deferred Policy Acquisition Costs...... (14.4) 3.4 (46.5) (14.2) Dividends to Policyholders..... 6.6 11.3 19.9 31.9

Underwriting Income (Loss)..... 4.9 (155.4) (5.1) (157.8)

Investments Investment Income Before Expenses...... 223.7 214.9 662.7 610.2 Investment Expenses...... 2.9 2.7 9.8 9.6

Investment Income...... 220.8 212.2 652.9 600.6

Amortization of Goodwill and Other Charges...... (14.7) (5.3) (39.5) (7.6)

Property and Casualty Income.... 211.0 51.5 608.3 435.2

CORPORATE AND OTHER...... 10.3 (.9) (.6) .5

CONSOLIDATED OPERATING INCOME BEFORE INCOME TAX...... 221.3 50.6 607.7 435.7

Federal and Foreign Income Tax (Credit)...... 36.7 (24.2) 92.5 31.0

CONSOLIDATED OPERATING INCOME.... 184.6 74.8 515.2 404.7

REALIZED INVESTMENT GAINS AFTER INCOME TAX...... 23.3 2.5 31.0 52.8

CONSOLIDATED NET INCOME...... $ 207.9 $ 77.3 $ 546.2 $ 457.5

PROPERTY AND CASUALTY INVESTMENT INCOME AFTER INCOME TAX...... $ 184.7 $ 179.0 $ 546.8 $ 508.4 5

Periods Ended September 30 Third Quarter Nine Months 2000 1999 2000 1999

OUTSTANDING SHARE DATA (in millions) Average Common and Potentially Dilutive Shares...... 177.9 175.1 178.1 167.4 Actual Common Shares...... 174.6 176.3 174.6 176.3

DILUTED EARNINGS PER SHARE DATA Operating Income...... $1.04 $ .43 $2.89 $2.42 Realized Investment Gains...... 13 .01 .17 .31 Net Income...... $1.17 $ .44 $3.06 $2.73

Effect of Catastrophe Losses... $ .03 $ .50 $ .23 $ .86

Sept. 30 Dec. 31 2000 1999

BOOK VALUE PER COMMON SHARE...... $38.39 $35.74

BOOK VALUE PER COMMON SHARE, Excluding Effects of SFAS No. 115 on Shareholders' Equity...... 38.16 36.58

PROPERTY AND CASUALTY UNDERWRITING RATIOS PERIODS ENDED SEPTEMBER 30

Third Quarter Nine Months 2000 1999 2000 1999

Losses to Premiums Earned...... 66.9% 78.1% 67.3% 70.8% Expenses to Net Premiums Written...... 32.5 32.3 32.6 32.6

Combined Loss and Expense Ratio...... 99.4% 110.4% 99.9% 103.4%

PROPERTY AND CASUALTY CLAIMS AND CLAIM EXPENSE COMPONENTS PERIODS ENDED SEPTEMBER 30

Third Quarter Nine Months 2000 1999 2000 1999 (in millions)

Paid Claims and Claim Expenses...... $1,011.2 $ 842.3 $2,828.8 $2,379.0 Increase in Unpaid Claims and Claim Expenses...... 21.4 282.9 228.0 578.5

Total Claims and Claim Expenses...... $1,032.6 $1,125.2 $3,056.8 $2,957.5 6

PROPERTY AND CASUALTY PRODUCT MIX

NINE MONTHS ENDED SEPTEMBER 30

Net Premiums Combined Loss and Written Expense Ratios 2000 1999 2000 1999 (in millions)

Personal Insurance Automobile...... $ 297.9 $ 257.5 94.8% 90.1% Homeowners...... 696.4 620.5 102.0 103.5 Other...... 297.7 266.2 71.6 69.2 Total Personal 1,292.0 1,144.2 93.3 92.5

Commercial Insurance Multiple Peril...... 502.9 537.3 115.2 134.3 Casualty...... 584.0 631.1 117.5 116.4 Workers' Compensation...... 239.4 221.4 103.6 112.7 Total Standard Commercial 1,326.3 1,389.8 114.3 122.9

Property and Marine...... 375.6 389.5 110.3 111.8 Executive Protection...... 987.3 792.6 86.5 84.3 Financial Institutions...... 385.2 298.4 90.4 95.2 Other...... 361.3 284.9 103.3 90.6 Total Specialty Commercial 2,109.4 1,765.4 94.3 93.5

Total Commercial 3,435.7 3,155.2 102.3 107.2

Total $4,727.7 $4,299.4 99.9% 103.4%

THREE MONTHS ENDED SEPTEMBER 30

Net Premiums Combined Loss and Written Expense Ratios 2000 1999 2000 1999 (in millions)

Personal Insurance Automobile...... $ 105.9 $ 91.0 94.7% 97.8% Homeowners...... 253.1 223.8 93.8 120.5 Other...... 101.3 89.0 70.1 69.1 Total Personal 460.3 403.8 88.6 103.4

Commercial Insurance Multiple Peril...... 167.5 171.3 122.9 149.7 Casualty...... 190.1 199.4 119.5 119.3 Workers' Compensation...... 73.7 64.6 101.7 111.6 Total Standard Commercial 431.3 435.3 118.0 130.4

Property and Marine...... 121.4 128.0 98.8 130.2 Executive Protection...... 337.9 301.8 89.8 84.9 Financial Institutions...... 128.7 85.6 95.3 107.1 Other...... 128.2 105.2 99.3 88.6 Total Specialty Commercial 716.2 620.6 93.9 98.9

Total Commercial 1,147.5 1,055.9 103.3 112.8

Total $1,607.8 $1,459.7 99.4% 110.4%