ECON 202: APPLIED INTERNATIONAL MACROECONOMICS Professors Osler, Munsell Brandeis International Business School, Spring 2017 Mondays and Wednesdays, 11:00-12:20 and 12:30-1:50, Lee Hall ****************************************************************************** [email protected] [email protected] Osler: http://people.brandeis.edu/~cosler Tuesdays, 11:30 - 12:30 pm Drop by or schedule an appointment Next to the Ph.D. computer cluster Sachar 205 (third floor) Your Teaching Assistants Layla Zhang Yaoxi Ding Yibo Wu [email protected] [email protected] [email protected] ******************************************************************************O VERVIEW In this course you will learn how to analyze economies around the world. That is, you will learn important conceptual frameworks and practice applying them: What can Europe do to rejuvenate its economy? Why worry about Europe’s deflation? Why is China allowing its exchange rate to move more flexibly and restructuring its economy? What is quantitative easing and why do countries use it? Why aren’t resource-rich economies like Nigeria better off? The course differs from standard macroeconomics courses in at least four ways. First, it views economics as an activity, not just a set of concepts. You will practice applying economic principles to real-world situations in problem sets, exams, and in memos focused on a specific country of your choice. Everything you learn in class will be accompanied by real-world examples. Second, you will discuss countries from every continent and at every stage of development and you’ll be thinking throughout about how they’re linked internationally. Third, you’ll learn about how macroeconomic stability is influenced by banks and financial markets and how financial regulation can promote macroeconomic stability. Fourth, you’ll learn important skills used by practicing economists for analyzing and presenting data, writing clearly, and team management.

OUTLINE OF LEARNING GOALS (specific goals on pages 10-11) 1. Understand long-run interactions among inflation, money, exchange rates, international competitiveness, and government finances 2. Understand how financial markets influence economic health and how government regulation of financial markets can either promote or undermine financial stability 3. Understand the forces driving business cycles and how governments influence them 4. Understand how countries manage their exchange rates 5. Understand international capital flows and the balance of payments 6. Worldwide macroeconomic history since WWII 6. Skills for analyzing and presenting data 8. Teamwork skills EVALUATION Grading weights

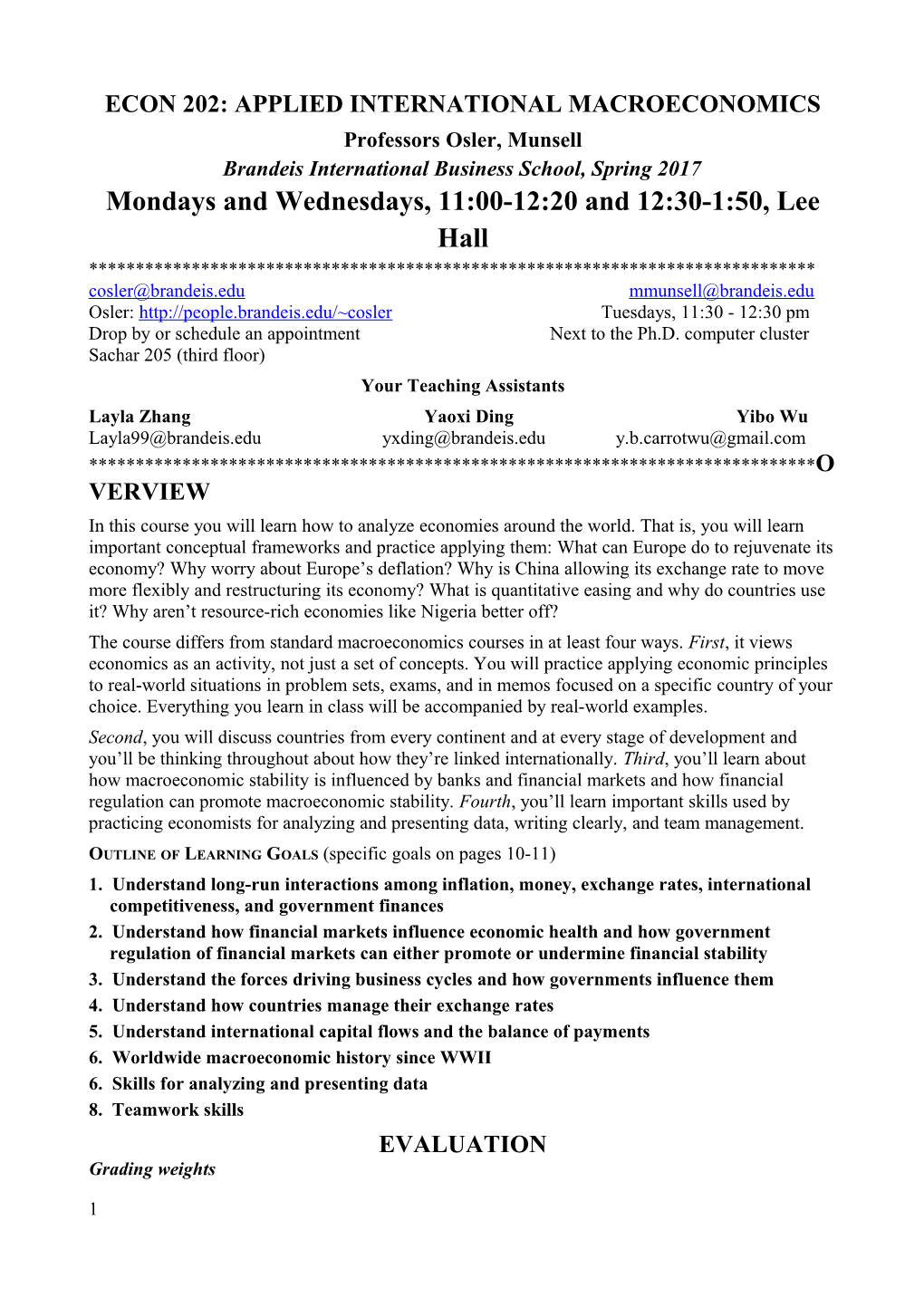

1 Country Analysis 20% Practice Problems 25% Of which Draft Final Peer Editing Midterm exam 20% Memo 1 4% 5% 1% Final exam 25% Memo 2 4% 5% 1% Class participation 5% Teamwork 5% Note: B- is the highest possible grade for “social loafers” or score below 50% on the final exam.

1. Country Analysis: You and three other students will analyze a country of your choice. You will write 2 memos for a professional portfolio manager. You will provide editing help to a partner team. Memos are graded equally on style as well as substance.

2. Practice Problems: Macroeconomic concepts are often harder to apply than you’d guess from the lecture. Practice problems help bridge that gap. The weakest 2 are dropped in calculating your final grade. Problem sets are due at the beginning of class. Late arrival to class is not an excuse. You must explain it in your own words, make your own charts, and create your own tables. If not, you get a zero. You may work with others to understand the problems or to learn Excel techniques. 3. In-class midterm exam: Monday, March 13. YOU MUST BE THERE. NO EXCEPTIONS except medical emergencies. You will analyze a specific country using a chart package distributed one day in advance. You can enhance your mid-term grade by submitting a glossary of ORIGINAL definitions for 100 vocabulary words. Up to 15 extra points. 4. Final exam: Comprehensive, closed book. You will analyze a specific country using a chart package distributed one day in advance. DO NOT MAKE TRAVEL PLANS UNTIL THE TIME IS FINALIZED BY THE REGISTRAR 5. Class participation: Depends on attendance, effort to answer pre-class questions, and contributions to Thoughts and Questions. Attendance: You may miss at most 2 classes without adverse consequences. Please explain absences in advance if possible. Pre-class questions: Take them seriously, they’re there to help you learn Contributions to class discussion: PLEASE ask for clarification, share relevant experiences, pose constructive questions, or explain why you disagree (politely). Thoughts and Questions: WHAT DO YOU THINK?! Tell it like it is. Roughly every other class you will be asked for your questions about the material covered in class and your reflections on the material. This is your opportunity to shape the course to your needs and preferences – Go for it! 6. Teamwork: You will be graded on your contributions to the country project team, based on evaluations from your teammates AND on your peer editing contributions. Details below and in “Managing Team Performance.” ****************************************************************************** DUE DATES (PS = Problem Set) W. Jan. 18: Resumé W. Jan. 25: Team performance plan, M. Jan 23: PS 1, Team country choice planning grid 2 M. Jan. 30: PS 2 M. Mar. 20: PS 9 W. Feb. 1: PS 3 W. Mar. 22: PS 10 M. Feb. 6: PS 4 M. Mar. 27: PS 11 W. Feb. 8: Nothing due (Begin editing W. Mar. 29: PS 12 Memo 1 by now) M. Apr. 3: PS 13 M. Feb. 13: PS 5 W. Feb. 15: PS 6 W. Apr. 5: Nothing due (Begin editing M. Feb. 27: PS 7 Memo 2 by now) W. Apr. 19: PS 14 W. Mar. 1: Nothing M. Mar. 6: PS 8 M. Apr. 24: Memo 2 to peer editing W. Mar. 8: Country Charts + W. Apr. 26: PS 15 Memo 1 to peer editing M. May 1: PS 16 M. Mar. 13: MID-TERM EXAM W. May 3: Memo 2 final W. Mar. 15: Country Charts + Memo 1 final By Mon. May 8: Teammate evaluations, Team performance review “MT” = Midterm. Mon Wed Mon Wed Mon Wed Mon Wed Mon Wed Jan. 18 23 25 30 Feb. 1 6 8 13 15 27 March 1 6 8 13-MT 15 20 22 27 29 April 3 5 19 24 26 May 1 3 8 ****************************************************************************** WORKLOAD: Success in this four- credit course is based on the expectation that students will spend a minimum of 9 hours per week studying the lecture notes, completing assignments, preparing for exams, etc. DISABILITIES: If you are a student with a documented disability on record at Brandeis and wish to have a reasonable accommodation made for you in this class, please see me immediately. ACADEMIC INTEGRITY: You are expected to be honest in all of your academic work. Instances of alleged dishonesty will be forwarded to the Academic Review Committee. Potential sanctions include failure in the course and suspension from the University. The University’s policies on academic integrity are here: ttp://www.brandeis.edu/studentlife/sdje/ai/. ****************************************************************************** ****************************************************************************** COUNTRY ANALYSIS: DETAILS

2 Memos: You will analyze a country of your choice with three other students. Details online. 1. An actively-managed mutual fund is considering investing in the country you are studying. As such, it recognizes the need to forecast your country’s exchange rate vis-à-vis the US dollar over its investment horizon of 1 to 3 years. a. What economic factors should the investment committee consider when making these forecasts? b. How strongly can the investment committee rely on these forecasts?

3 2. The university’s endowment fund takes a 10-year perspective on returns and risk. It is deciding whether to invest in the country you are studying. The investment committee needs to know a. Is the economy well-managed and stable? a.i. Are the fiscal and monetary authorities doing a good job? a.ii. Is there potential for financial excess and associated macro instability over the next decade. Is this country’s banking system well-regulated? b. Is output growth likely to be low or high, on average? What are the country’s structural advantages and structural obstacles to growth?

Peer editing: Teams will help each other edit. Your team will submit its first drafts to a partner team, which will submit its first drafts to your team. Each member of your team will evaluate one of four dimensions of the other team’s memo. These dimensions are described in “Guidelines for Country Memos” on Latte. NOTE: EVERYTHING you submit must be your own words. No quotes are allowed in Applied International Macroeconomics. Copied text is extremely easy to identify.

Country Analysis Timeline I. Meet your team Thursday or Friday, January 19-20. Schedule a meeting or two over the next few days to begin developing a performance plan and a detailed planning grid. Consult “Managing Team Performance” and the country analysis material on Latte to learn what is expected. BE SURE TO INCORPORATE MULTIPLE DAYS FOR EDITING BEFORE ANY SUBMISSION DEADLINE.

II. Tell Professor Osler your country choice by Monday, January 23 More than one group can study the same country, but the following countries are NOT available in 2017: Argentina Indonesia New Zealand Singapore Canada Iran Panama Switzerland China Japan Peru Turkey France Malaysia Saudi Arabia U.S.

III. Submit detailed performance plan and planning grid by Wednesday, January 25.

IV. Memo 1 Wednesday, February 8: By now you should have combined any independent work on Memo 1 and be working together to synthesize the ideas into a coherent, polished essay Wednesday March 8: Exchange draft of Memo 1 and complete set of professional-quality country charts with peer-editing partner. See “Guidelines for Country Memos” on Latte. Wednesday March 15: Submit final version of Memo 1 to Professor Osler.

V. Memo 2 Wednesday, April 5: By now you should have combined any independent work on Memo 2 and be working together to synthesize the ideas into a coherent, polished essay Monday, April 24: Exchange draft of Memo 2 with peer-editing partner. Wednesday, May 3: Submit final Memo 2 to Professor Osler.

4 VII. Monday, May 8: Evaluate teammates and submit “Process Review Sheet” (p. 20 of Managing Team Performance) ****************************************************************************** TEAMWORK When you leave IBS, you will work in teams. This course helps you develop essential teamwork skills. It also teaches norms of professional behavior. Your team will participate in a structured program of meetings and team activities. Managing Team Performance gives step-by-step instructions and advice for each critical teamwork skill. Equity is often a concern in teamwork. You must make substantial direct contributions to the memos; you must also contribute substantially to team activities like the performance plan. If you do not contribute equitably, the rest of your team can dismiss you, in which case you become your own team. Your grade depends on your performance as a teammate, which your teammates will evaluate using criteria listed in Managing Team Performance. If your teammates agree that you have not contributed equitably, your grade for the course cannot exceed “B-.”

****************************************************************************** COURSE OUTLINE AND OPTIONAL READINGS The course lecture notes are your primary readings: There is no textbook These lecture notes are available on Latte. Last year’s notes are available from the beginning of the semester. BUT: The order in which material is presented has changed drastically and in any case the lecture notes are almost always revised before class. Excellent resources are listed below for concepts you might find challenging (“Reference”) or concepts you might want to investigate a greater depth (“Depth”). “FD” refers to Finance and Development, a glossy magazine with short articles from the IMF / World Bank. ****************************************************************************** I. SUSTAINED INFLATION I.A. Sustained Inflation: Origins and Propagation Reference Osler: Chapter 2, Inflation Gets Going; Chapter 3, Inflation Takes Off Depth Dugger, “In Zimbabwe, Survival Lies in Scavenging,” December 22, 2008 http://www.nytimes.com/2008/12/22/world/africa/22iht-22zimbabwe.18857774.html Dugger, “Life in Zimbabwe: Waiting for Useless Money,” NYT October 2, 2008 http://www.nytimes.com/2008/10/02/world/africa/02zimbabwe.html?pagewanted=all Wines, “How Bad is Inflation in Zimbabwe?” NYTimes, May 2, 2006. http://www.nytimes.com/2006/05/02/world/africa/02zimbabwe.html Gupta, “Price controls and scarcity for Venezuelans to turn to the black market for milk and toilet paper,” The Guardian April 15, 2015 http://www.theguardian.com/global-development-professionals-network/2015/apr/16/venezuela- economy-black-market-milk-and-toilet-paper The nature of money: Large stones under water? http://www.thisamericanlife.org/radio-archives/episode/423/the-invention-of-money?act=0

5 I.B. Money, Government Deficits, and High Sustained Inflation Depth The Fed's interpretation: “Fedpoints: Reserve Requirements” (Latte) Indonesia - Sabirin supported by Indonesia Central Bank 02, Latte Bruce Bartlett, “Supply Side Economics to Go,” NYT 4/6/07. On Latte. An arch-conservative identifies fatal flaws in tax-cut logic.

I.C. Nominal Anchors to Control Inflation Reference Husted/Melvin International Economics Chapter 14 (PPP) Husted/Melvin International Economics Chapter 19 ONLY through “Floating Exchange Rates: Since 1973” (International monetary history including the gold standard) Husted/Melvin International Economics Chapter 13 ONLY sections on “Exchange Rate Supply and Demand and Intervention” and “Black Markets and Parallel Exchange Rates” Taylor (2004). “Global Finance: Past and Present. Policymakers in Two Eras Faced the Same Trilemma of Difficult Policy Trade-Offs,” Finance and Development, March 2004: http://www.imf.org/external/pubs/ft/fandd/2004/03/pdf/taylor.pdf “Introduction to Currency Boards” http://users.erols.com/kurrency/intro.htm Reem Heakal: “What is a currency board?” http://www.investopedia.com/articles/03/051503.asp Jahan, Sarwat (2012). “Inflation Targeting: Holding the Line. “ Finance and Development (March 28, 2012). http://www.imf.org/external/pubs/ft/fandd/basics/target.htm Depth Clement Manirabarusha (2016). “Burundi faces foreign exchange shortage as aid dries up, crisis grinds on.” Reuters, Jul 22, 2016. http://www.reuters.com/article/us-burundi-economy- idUSKCN1021JZ Czech National Bank: “Objective of Monetary Policy” http://www.cnb.cz/en/monetary_policy/objective.html Current consensus on state-of-the-art monetary policy making “A Primer on Central Bank Independence,” Cecchetti and Schoenholtz http://www.e-axes.com/content/primer-central-bank-independence “Why the Fed Focuses on Core Inflation.” Joshua Zumbrun, Bloomberg, March 30, 2011. http://www.bloomberg.com/news/2011-03-30/bernanke-backed-by-history- betting-volatility-variable-won-t-hurt-economy.html

II. FINANCIAL CRISES II.A. International Debt Crises Reference Husted/Melvin International Economics Chapter 12 (Balance of Payments Accounting) Husted/Melvin International Economics Chapter 15, ONLY “Interest Parity” material Reem Heakal, “What is the balance of payments?” http://www.investopedia.com/articles/03/060403.asp Kahn Academy on the balance of payments (Note: Uses “capital account” instead of “financial account”) https://www.khanacademy.org/economics-finance-domain/macroeconomics/forex-trade-topic/current- capital-account/v/balance-of-payments-current-account https://www.khanacademy.org/economics-finance-domain/macroeconomics/forex-trade-topic/current- capital-account/v/balance-of-payments-capital-account

6 https://www.khanacademy.org/economics-finance-domain/macroeconomics/forex-trade-topic/current- capital-account/v/why-current-and-capital-accounts-net-out ECB. “Carry Trades and Exchange Rates” https://www.ecb.europa.eu/pub/pdf/other/mb201003_focus10.en.pdf Depth Illustration: Expected monetary policy affects current exchange rates. “Exchange rates and anticipated monetary policy,” RBS, Latte. Accominotti, Olivier , and Barry Eichengreen (14 September 2013). “The mother of all sudden stops: Capital flows and reversals in Europe, 1919-1932.” http://voxeu.org/article/mother-all-sudden-stops Feldstein, Martin, “Avoiding Currency Crises,” http://www.nber.org/feldstein/kcfed99.2.pdf Ghosh and Ramakrishnan, Current Account Deficits: Is There a Problem? FD, no date http://www.imf.org/external/pubs/ft/fandd/basics/current.htm “Coping with Capital Inflows,” FD September 2010 http://www.imf.org/external/pubs/ft/fandd/2010/09/dataspot.htm

II.B. Banking Crises Reference Kindleberger-Aliber, Manias, Panics, Crises: Chapters 1, 2, & 3 (beginning at “Speculation often develops in two stages”). Colombo, Jesse (June 4th, 2012) . “Japan’s Bubble Economy of the 1980s.” http://www.thebubblebubble.com/japan-bubble/ Spriha Svivastava (15 Sep. 2016). “On this day 8 years ago, Lehman Brothers collapsed: Have we learned anything? CNBC. http://www.cnbc.com/2016/09/15/on-this-day-8-years-ago- lehman-brothers-collapsed-have-we-learned-anything.html Depth Old-style crisis: Iceland, Chapter 2: “Summary of the Report’s Main Conclusions” regarding the causes of the collapse of the Icelandic banks.” (18 pages) New-style crisis: UK. Gorton: “Question and Answers about the Financial Crisis,” Latte. Husock, “Housing Goals We Can’t Afford,” NYT, December 11, 2008. http://www.nytimes.com/2008/12/11/opinion/11husock.html Reinhardt, “An Economist’s Mea Culpa,” NYT January 9, 2009. http://economix.blogs.nytimes.com/2009/01/09/an-economists-mea-culpa/

II.C. Promoting Financial Stability Depth Shin,Hyun Song (January 31, 2009). “It is time for a reappraisal of the basic principles of financial regulation.” http://voxeu.org/article/financial-regulation-built-sand-today-s-microprudential- regulation-rules-need-macroprudential-complements Many economists: Letter published in the Financial Timeson November 9, 2010. “Healthy Banking System is the Goal, not Profitable Banks.” https://www.gsb.stanford.edu/faculty- research/excessive-leverage/healthy-banking-system-goal Er, Ricki Tigert (March 1999). “What Deposit Insurance Can and Cannot Do.” Finance and Development Volume 36. http://www.imf.org/external/pubs/ft/fandd/1999/03/tigert.htm

7 IV. RECESSIONS, UNEMPLOYMENT, AND DEFLATION A. What happens to business, employment, and inflation in recessions? Depth Social, psychological, and health costs of unemployment: http://www.theatlantic.com/magazine/archive/2010/03/how-a-new-jobless-era-will- transform-america/7919/ “Deflation: Why Europe’s Problem is Everyone’s Problem” Knowledge@Wharton 2/4/15 knowledge.wharton.upenn.edu/article/europes-deflation-problem-is-everyones-problem/ Bartlett, “The Harsh Impact On Consumption Of Lost Home Equity.” Forbes, 2/6/09 http://www.forbes.com/2009/02/05/spending-housing-equity-opinions- columnists_0206_bruce_bartlett.html?partner=daily_newsletter Economist: “Statistics in Argentina: Fishy Figures” Sept. 17, 2014 http://www.economist.com/blogs/americasview/2014/09/statistics-argentina

B. Strategies to address unemployment and deflation: Fiscal policy There has been a ton of research in recent years on the size of fiscal multipliers. You will read and summarize 1 of the following 4 papers for a homework assignment. PAPER: Multipliers. Sahm, Shapiro, Slemrod: Household Response to the 2008 Tax Rebates: Survey Evidence and Aggregate Implications.” On Latte. Intro. only! PAPER: “Assessing the Short-Term Effect on Output of Changes in Fiscal Policies,” Reichling and Whalen, CBO Working paper May 2012. Latte. PAPER: “Fiscal Multipliers and the State of the Economy,” Baum, Poplawski, Weber, IMF Working Paper December 2012. PAPER: “The Household Effects of Government Spending,” Giavazzi, McMahon, Working Paper February, 2012. Latte. Depth Central Bank of Turkey, “Disinflation Program 2000 short” Latte Turkey explains why less is sometimes more in government spending Osler, “Greece illustrates the importance of staying within limits” http://blogs.lse.ac.uk/europpblog/2015/09/01/greece-illustrates-the-importance-of-staying-within- economic-limits/ Congressional Budget Office: “Long-term Budget Outlook in 26 Slides.” http://www.cbo.gov/publication/45527?utm_source=feedblitz&utm_medium=FeedBlitzEmail&utm _content=812526&utm_campaign=Hourly_2014-07-16%2014%3a00 IMF, “Fiscal Rules,” pages 1-14. On Latte. Lastrapes, “Explainer: What’s the debt ceiling and why it’s an obsolete way to control spending.” The Conversation, October 27, 2015. http://theconversation.com/explainer-whats-the-debt-ceiling-and-why-its-an-obsolete-way-to-control- spending-49633 Mourmouras, Financial Times, “The price of austerity for indebted Greece,” January 16, 2012 http://www.ft.com/intl/cms/s/0/02af6316-4034-11e1-82f6-00144feab49a.html#axzz1jinARbVd Pollin, Robert, “Austerity is Not a Solution: Why the Deficit Hawks Are Wrong,” Challenge (Magazine), November/December 2010. http://www.peri.umass.edu/fileadmin/pdf/working_papers/working_papers_201-250/WP235.pdf

C. Strategies to address unemployment and deflation: Monetary policy Reference What is quantitative easing? The Economist Explains, May 9, 2015 http://www.economist.com/blogs/economist-explains/2015/03/economist-explains-5 Depth 8 Vinals, “A marriage made in heaven or in hell: Monetary and financial stability,” Latte. 2 pages. Coppola, 2014. “QE has (nearly) ended. But how will the Fed unwind it?” Forbes 10/8. http://www.forbes.com/sites/francescoppola/2014/10/08/qe-has-nearly-ended-but-how-will-the-fed- unwind-it/ “Policy Duration Commitments: Part I, Categorisation” RBS, July 29, 2013. Latte Instability in US money demand persisits:”The Money Supply,” Federal Reserve Bank of New York FedPoint. (2 pages) http://www.newyorkfed.org/aboutthefed/fedpoint/fed49.html “Why Draghi was Right to Cut Rates” Wolf, Financial Times, Nov 12, 2013 Trehan & Zorrilla, “The Financial Crisis and Inflation Expectations,” Federal Reserve Bank of San Francisco Economic Letter, Sept. 24, 2012. http://www.frbsf.org/publications/economics/letter/2012/el2012-29.html

D. Strategies to address unemployment and deflation: Exchange rate management Krugman, Paul (Jun 24, 2012). Revenge of the Optimum Currency Area. http://krugman.blogs.nytimes.com/2012/06/24/revenge-of-the-optimum-currency-area/?_r=0 Stone, Anderson, Veyrune, “Exchange-Rate Regimes: Fix or Float?” http://www.imf.org/external/pubs/ft/fandd/2008/03/pdf/basics.pdf Masson and Patillo, “A Single Currency for Africa?” http://www.imf.org/external/pubs/ft/fandd/2004/12/pdf/masson.pdf Vostroknutova, Brahmbhatt, Canuto, “Dealing with Dutch Disease,” Vox EU 21 June 2010 http://www.voxeu.org/article/dealing-dutch-disease Economist on Dutch Disease, “Gas discoveries in east Africa: Making the most of a good situation.” Feb 7, 2013. http://www.economist.com/blogs/baobab/2013/02/gas-discoveries-east-africa Nier, Sedik, Mondino, “Gross Private Capital Flows to Emerging Markets: Can the Global Financial Cycle Be Tamed?” IMF working paper October 2014. ONLY introduction and conclusion! https://www.imf.org/external/pubs/ft/wp/2014/wp14196.pdf “South Korea's currency controls,” Economist June 16, 2010. Latte. “Latvia’s Internal Devaluation: Success?” Weisbrot & Ray, OECD, 12/2011. Latte

E. Strategies to address unemployment: Structural reform Depth “What Structural Reform Is and Why It Is Important,” Economist Magazine Dec. 9, 2014 http://www.economist.com/blogs/economist-explains/2014/12/economist-explains-5 “What’s Broken in Greece? Ask an Entrepreneur,” Thomas, NYT 1/31/11 http://www.nytimes.com/2011/01/30/business/30greek.html?src=me&ref=business

****************************************************************************** ****************************************************************************** LEARNING GOALS IN DETAIL

1. Understand long-run interactions among inflation, money, exchange rates, international competitiveness, and government finances * Inflation and hyperinflation: Understand how the money supply is related to inflation and how the relation is influenced by velocity. * Competitiveness and PPP: Understand how and why competitiveness is mostly stable in the long run. Understand what this implies for the relation between inflation differentials across countries and long-run exchange-rate changes and the role of “goods-market arbitrage.” * Money supply process: Understand how central banks influence money growth through their control over the money base. Understand how banks and the public affect money growth. 9 * Understand why high, sustained inflation has always reflected the monetization of high government deficits, and why this process, when taken to an extreme, ends with governments that cannot provide for their people (inflation-tax Laffer curve).

2. Understand how financial markets influence macroeconomic health * How financial intermediaries and financial markets are needed to promote long-run capital formation and wealth due to imperfect information. * How inappropriate regulation can undermine the proper functioning of the financial system: Financial repression; how deregulation or poor regulation has historically often been accompanied by financial excess that leads to crisis, e.g., 2001-2008. * Imperative for financial regulation; current best practices. * Open issues in financial regulation: CEO pay? Capital-adequacy standards to vary over the business cycle? Consumer financial protection? Proprietary trading? Too big to fail? Loan-to-value ratios as policy tool?

3. Understand forces driving unemployment and recessions * How exchange rates and interest rates are related through uncovered interest parity. * Components of aggregate demand and how they tend to behave over the business cycle * How central banks influence aggregate demand through the real short-term interest rate. * Expectations-augmented Phillips curve: How short-run inflation is influenced by expected inflation and the state of the business cycle. * Inflation targeting and, more generally, the monetary policy reaction function: What drives central banks in setting the short-run real interest rate? * Sustainability of government deficits and debt; why sustainability becomes harder to achieve the longer a country waits to achieve it. * Zero lower bound; why it is essential to avoid deflation; what central banks do to stimulate the economy once short-term nominal interest rates hit zero.

4. Understand how countries manage their exchange rates * How central banks control exchange rates and the fact that a fixed exchange rate leaves the central bank largely unable to pursue any other monetary policy goals. * Difference between sterilized and unsterilized exchange rate intervention; different ways to sterilize; the motivation for sterilization; and the extent to which sterilized intervention actually works. Which countries tend to intervene and to sterilize today. * Differences across the following exchange rate regimes and their permutations: Common currency, dollarization, currency board, peg, band, crawling peg, crawling band, managed exchange rate, dirty float, free float. * New and old attitudes towards capital controls; why they need to be temporary.

5. Understand international capital flows and the balance of payments * 4 major components of the balance of payments: Current account, financial account, capital account, net errors & omissions. * Relationship between national savings, national investment and the current account. * Subcomponents of national savings: Personal, corporate, government. What drives each. Why measured personal savings rates tend to fall when asset prices rise rapidly. * A country’s net international investment position (NIIP) and the relation of NIIP to past and future current account balances, including net income from capital.

6. Worldwide macroeconomic history since WWII: Most significant elements 10 * Emerging markets stressed equally with developed countries

7. Skills for analyzing and presenting data * Ways to calculate growth rates and when each one is appropriate * Different ways to graph macroeconomic data and when each one is appropriate * Familiarity with different sorts of data and when to use each type * Professional-quality charts * Executive memo-writing * Editing text for clarity, conciseness, organization, flow, and tone.

8. Teamwork skills * Performance plan, planning grid, process review, peer editing, performance evaluation

11