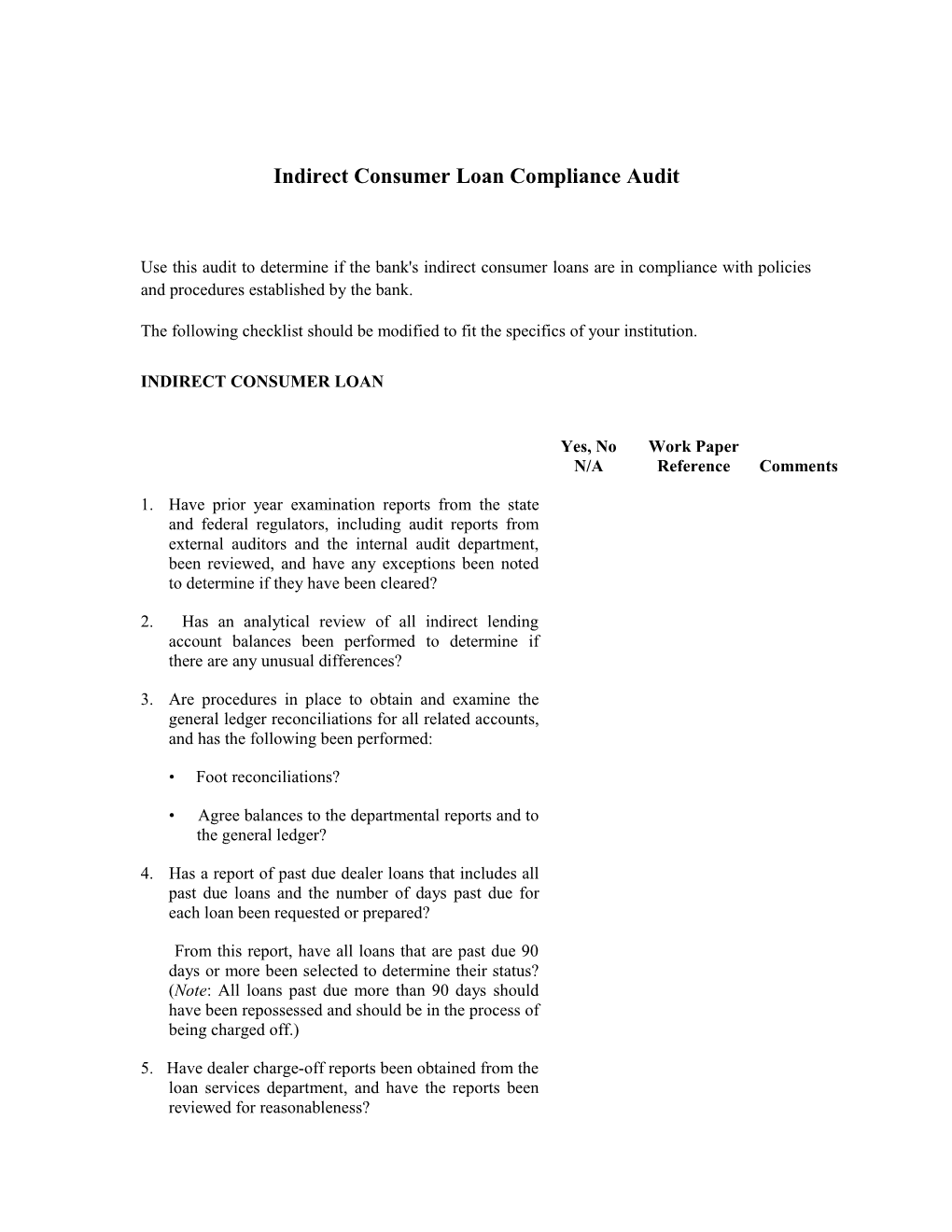

Indirect Consumer Loan Compliance Audit

Use this audit to determine if the bank's indirect consumer loans are in compliance with policies and procedures established by the bank.

The following checklist should be modified to fit the specifics of your institution.

INDIRECT CONSUMER LOAN

Yes, No Work Paper

N/A Reference Comments

1. Have prior year examination reports from the state and federal regulators, including audit reports from external auditors and the internal audit department, been reviewed, and have any exceptions been noted to determine if they have been cleared?

2. Has an analytical review of all indirect lending account balances been performed to determine if there are any unusual differences?

3. Are procedures in place to obtain and examine the general ledger reconciliations for all related accounts, and has the following been performed:

• Foot reconciliations?

• Agree balances to the departmental reports and to the general ledger?

4. Has a report of past due dealer loans that includes all past due loans and the number of days past due for each loan been requested or prepared?

From this report, have all loans that are past due 90 days or more been selected to determine their status? (Note: All loans past due more than 90 days should have been repossessed and should be in the process of being charged off.)

5. Have dealer charge-off reports been obtained from the loan services department, and have the reports been reviewed for reasonableness? 6. Has a sample of charged off loans since the last audit been selected to determine if the reasons for charge- off were reasonable and within bank policy?

7. Have the loan-to-value (LTV) ratios and procedures for loans made since the last audit been reviewed, and have the LTV ratios been computed by dividing the purchase price by the National Automobile Dealers Association (NADA) value?

Have the ratios been analyzed to determine if there are any trends at loan origination that are not in compliance with the bank’s policies?

8. Have the controls over drafts and checks used to fund dealer loans been reviewed?

9. Has the loan review department staff been interviewed to determine if the following is in compliance with bank policies and procedures:

• The method used for reviewing and grading dealer loans?

• The method used for reserving funds for dealer loan losses?

10. Have the internal controls over the collection and repossession process been reviewed, and has a sample of _____ loans been selected to verify the following:

• That the loan services department is monitoring delinquent dealer loans?

• That collection letters are generated and sent to all signers on the loan (borrower, co-borrower(s), and co-signer(s), when appropriate)? (Note: Each signer on the loan should have a separate installment loan name/address screen for notification purposes.)

• That the only name on the installment loan account inquiry screen is that of the borrower?

• That the loan services department contacts a repossession agency in a timely manner and that a repossession file is maintained for each customer.

• That all repossessed loans are reviewed to determine if the customer purchased any warranties or insurance? If so, determine if you need to send a written request to the dealer for the rebate amount.

• That the loan services department files for a title to the vehicle at the time of repossession.

• That the vehicle is sent to an auto auction and bids made on the vehicle at the auto auction are reviewed and accepted or rejected by an appropriate bank employee? (Note: Your collection/repossession procedures may be different. You should adjust these questions to your specific procedures.)

11. Are procedures in place to review the due diligence and risk assessment conducted for each dealer to determine if it is thorough and in compliance with the bank’s policies and procedures?

12. Have all dealer contracts from the indirect lending department been obtained to:

• Review and summarize the terms of the dealer contracts?

• Verify that all dealers have a contract and that all contracts are properly signed and dated?